USD/JPY in focus for BOJ meeting and US inflation report: The Week Ahead

We’re intrigued to see if US indices can continue to defy gravity and follow their seasonal tendency to post strong gains in the second half of December. But given the strength of the rally leading into their highs, bulls may want to be cautious of this Santa’s rally. The two key events next week are the BOJ meeting and US PCE inflation report, puts USD/JPY firmly in the sights of currency traders.

The week that was:

- The final FOMC meeting of the year was the clear highlight, as the Fed effectively announced a dovish pivot by showing a full 75bp of cuts by the end of 2024 with the median Fed funds projection

- Bond yields tanked, the 10-year fell beneath 4% for the first time in four months and the 2-year fell to its lowest yield in six months

- US CPI came in roughly in line with expectations ahead of the FOMC meeting, although the uptick of inflation at 0.1% m/m and core CPI at 0.3% saw traders initially scale back bets for a dovish Fed pivot in Q1 2024

- The Fed’s dovish pivot boosted hopes that the ECB and BOE would follow suit, but both central banks were quick to push back against those hopes – which made their meetings more hawkish than expected

- GBP/USD and EUR/USD posted their best day’s gains in a month as they took advantage of the weaker US dollar

- The Dow Jones reached a record high ahead of the Nasdaq 100 and S&P 500m with the latter two very close to testing their milestone levels

- Soft inflation data from China continues to point to sluggish growth for the world’s second largest economy

- Oil prices continued to weaken with concerns of oversupply alongside a weaker demand outlook, although posted a two-day rally from their cycle lows after the FOC meeting

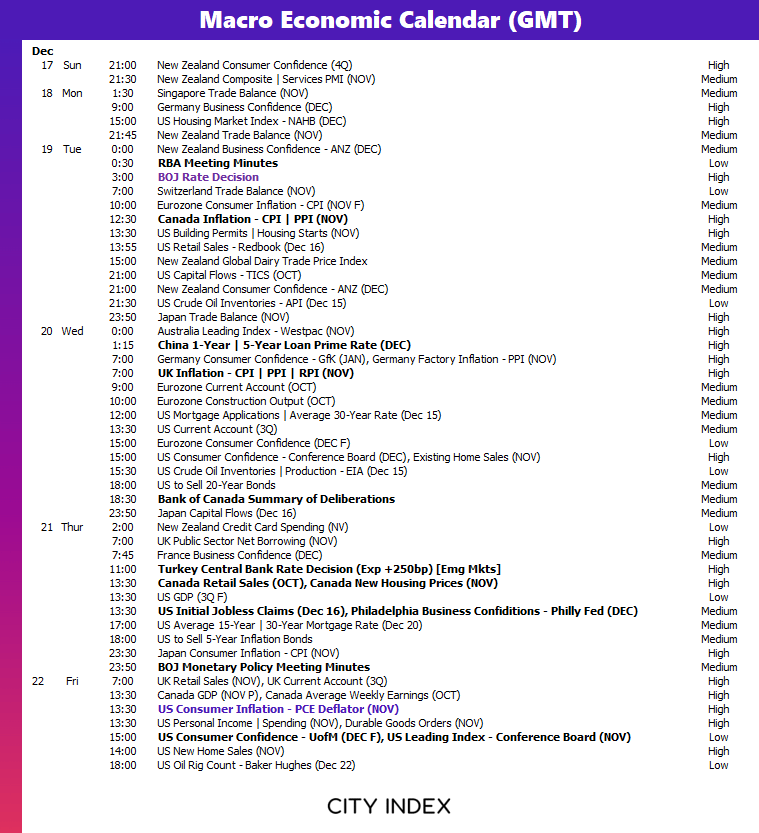

The week ahead (calendar):

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- Santa’s rally

- US consumer inflation – PCE deflator

- BOJ rate decision, policy meeting minutes

- RBA minutes

- US consumer confidence

Santa’s rally

I noted the tendency for the S&P 500 (and Wall Stret in general) to post strong gains in the second half of December. With the Fed pivot and seasonality on its side, it certainly builds a case for further gains. However, traders should also take into consideration that we have already seen strong gains in the first half of December, which is not the norm. Therefore, if US indices extend their rallies they may want to be a little more conservative with upside potential for the likes of the Dow Jones, S&P 500 and Nasdaq 100.

View related analysis:

S&P 500 forecast: A closer look at ‘Santa’s rally’

Dow theory put to the test as DJIA breakout leads S&P 500, Nasdaq 100

US consumer inflation – PCE deflator

US inflation data is next week’s standout economic event, although it is debatable as to how much of an impact it could have on sentiment unless it comes in hot. Traders have been presented with the dovish pivot they so desperately wanted, so a softer set of PCE inflation would likely be the frosting on Santa’s rally.

But for the Fed to be so quick to reverse their dovish pivot would likely take a much higher-than expected PCE data set. And as the data is low volatility at the best of times, it seems more likely to come in around consensus estimates and not rock the boat.

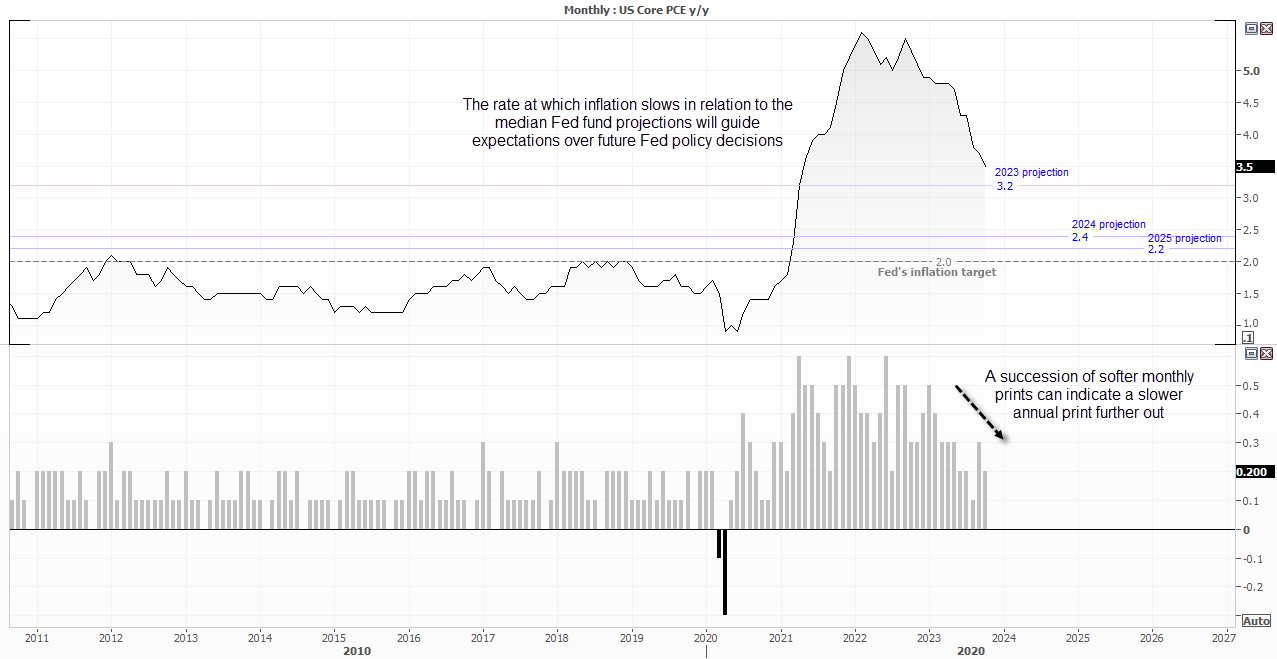

The core PCE chart below shows the annual rate alongside the Fed’s median estimates for it through to 2025, and the lower panel displays core PCE m/m. Whilst traders tend to focus on the annual print, the monthly can be a good guide as to where the annual print will be further out – so we like to see soft prints on the monthly to retain the relatively dovish bias gifted by the Fed.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

BOJ rate decision

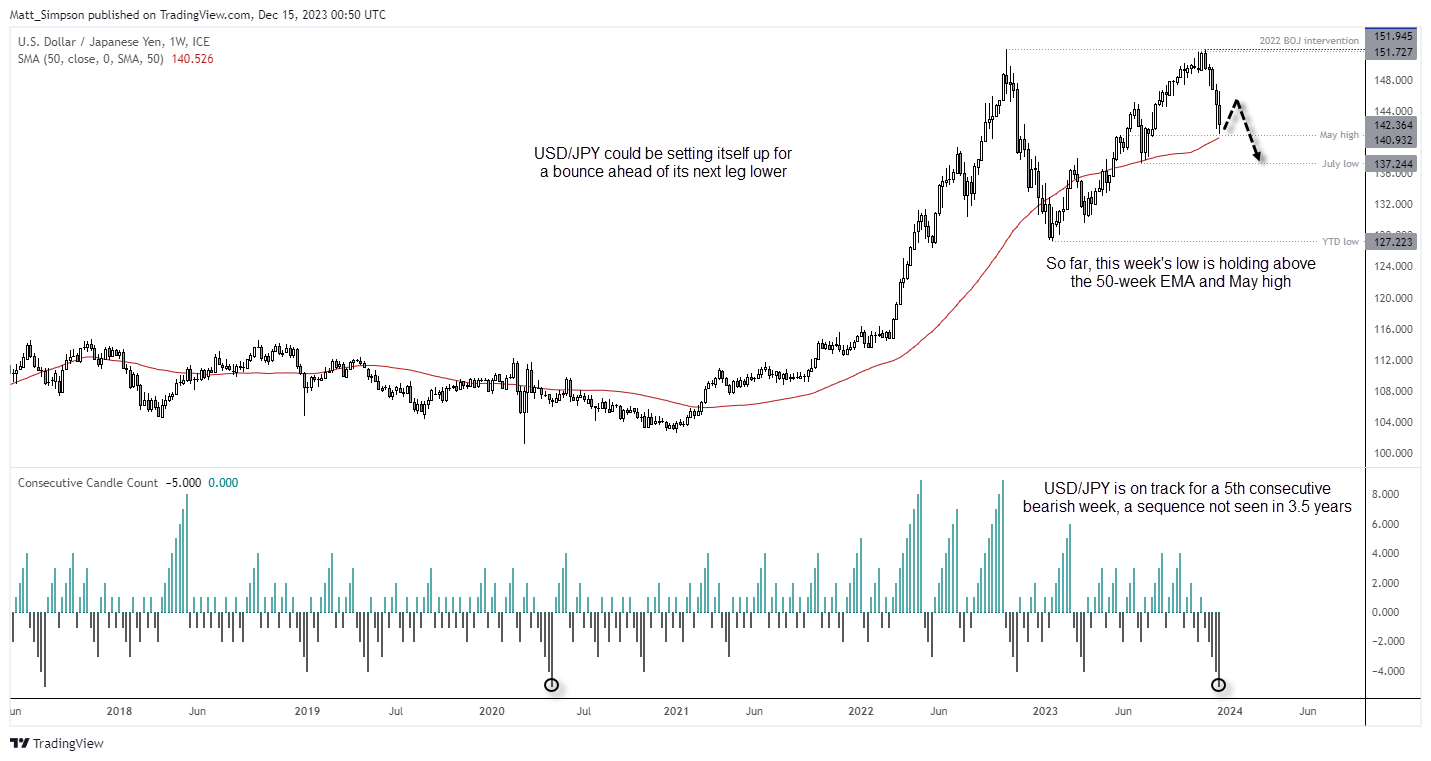

The Bank of Japan (BOJ) is the central bank you dare not move your eyes from, at the risk of enduring lots of ‘nothing burger meetings’ just in case they do act. We have seen lots of hype of over a live BOJ meeting over the past year, only to be disappointed with a couple of tweaks to their YCC policy along the way. Yet swap markets were suggesting a 45% chance of a BOJ hike next week following hawkish comments from Ueda which sent USD/JPY briefly below 143. Economists continue to favour the BOJ will end negative rates in Q1 next year, and whilst that may turn out to be the case it is worth being prepared for a live MOG meeting next week. Just in case.

Given the US dollar has had quite the bearish week and yen pears have been strengthening on increased hopes that the BOJ will act sooner than later, we may find that inaction from the BOJ next week could help USD/JPY post a corrective bounce.

If so, I suspect it will be a pair to fade into next year as the path of least resistance seems lower in Q1 given the Fed’s pivot and the BOJ’s desire to dismantle Kuroda’s policies. Of course, a cheeky hike by the BOJ coupled with sifter PCE inflation data form the US could send USD/JPY markedly lower.

And should the meeting be a nothing burger their minutes which are released on Thursday may reveal clues or any discussions over policy change in Q1.

Trader’s watchlist: USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nikkei 225

UK inflation:

We know the BOE have pushed back on being dovish too soon, and next week’s inflation report could either reaffirm the BOE’s ‘higher for longer stance’ or reconsider and push the British pound around accordingly.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

RBA minutes:

The RBA delivered a third dovish statement in a row under the new RBA governor Michele Bullock. Yet the first two were followed up with relatively hawkish minutes. SO keep an eye on next week’s minutes to see if the trend continues to support AUD/USD, or back up the dovishness of the December statement to weigh upon it. Given there will not be a meeting until February and the RBA will by then have the robust quarterly inflation report data, I doubt the minutes will be too dovish.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

US consumer confidence:

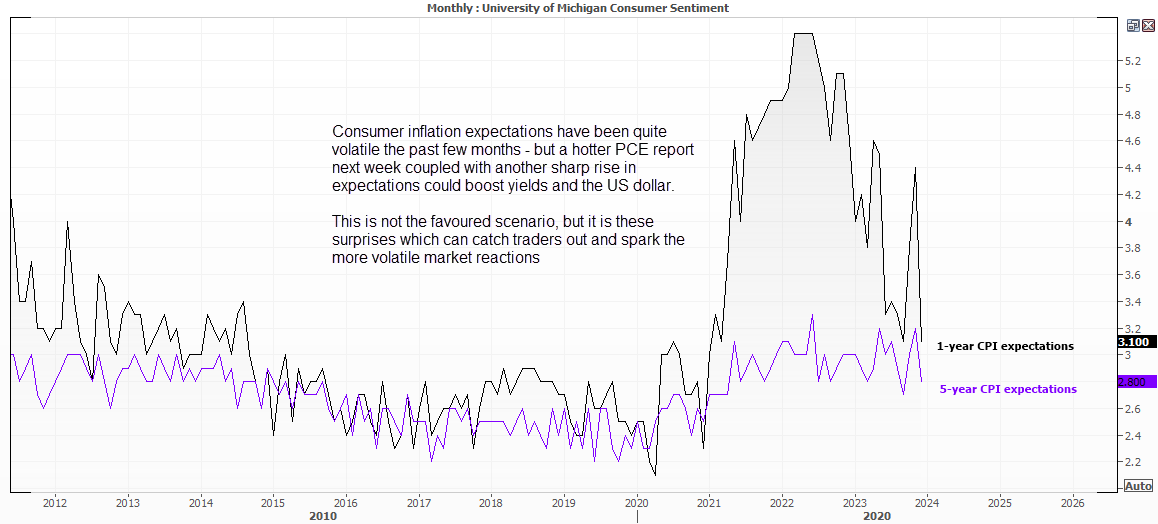

The University of Michigan consumer sentiment survey also includes inflation expectations. And the importance of them CPI expectations are likely down to how well the PCE inflation data set comes in. For example, a hot PCE inflation report would mean that a rise in consumer expectations in the Michigan survey would be taken a lot more seriously, and likely send yields and the US dollar higher. I suspect this scenario to be lower probability, but it is these scenarios which can catch traders off guard and provide the bigger reactions.

Trader’s watchlist: USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nikkei 225

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

For more analysis by Matt Simpson visit Matt’s profile

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.