Markets may not have to wait until well into 2024 for the Bank of Japan (BOJ) to tighten monetary policy with Governor Kazuo Ueda confirming over the weekend that he could have enough data by year-end to determine whether to increase rates, sending the USD/JPY sharply lower in early trade on Monday.

“Once we’re convinced Japan will see sustained rises in inflation accompanied by wage growth, there are various options we can take,” Ueda told the Yomiuri newspaper in an interview conducted last week. "If we judge that Japan can achieve its inflation target even after ending negative rates, we’ll do so.

Despite the moderately hawkish language, Ueda pored cold water on hopes for a near-term policy shift, reaffirming the bank will persist with ultra-easy monetary policy until it’s convinced inflation will remain around 2%, the BOJ’s official target.

“While Japan is showing budding positive signs, achievement of our target isn’t in sight yet,” he said, adding one of the key factors will be whether Japanese wage rises continue next year given the linkages to services inflation.

USD/JPY may decline further on narrowing yield differentials

Taken at face value, it suggests the BOJ’s next policy move may not to be to end yield-curve control (YCC), the practice of the bank purchasing large-scale volumes of Japanese government debt to suppress benchmark 10-year yields around 0%. Instead, it may be the abandonment of setting its overnight policy rate at -0.1% which has been in place since before the GFC.

While that may help reduce the yield deficit Japanese debt has to other advanced nations such as the United States at the extreme front-end of the interest rates curve, it’s likely that negative yield differential will have to narrow for longer timeframes, such as 10 years, to lead to a sustained downtrend in the USD/JPY.

Even though Ueda’s remarks on ending negative rates do not imply that will happen unless it’s driven by a recalibration of the expected US interest rate path, having recently tweaked YCC to allow for greater flexibility in the range 10-year Japanese yields are allowed to move, the BOJ could permit yields to rise to as high as 100 basis points, more than 30 basis points higher than where they currently sit.

Therefore, any data suggesting Japanese inflationary pressures are becoming more sustainable could see longer-date Japanese yields drift higher, potentially helping to narrow the differential to the US without a meaningful reduction in US yields.

USD/JPY down sharply on Ueda’s remarks

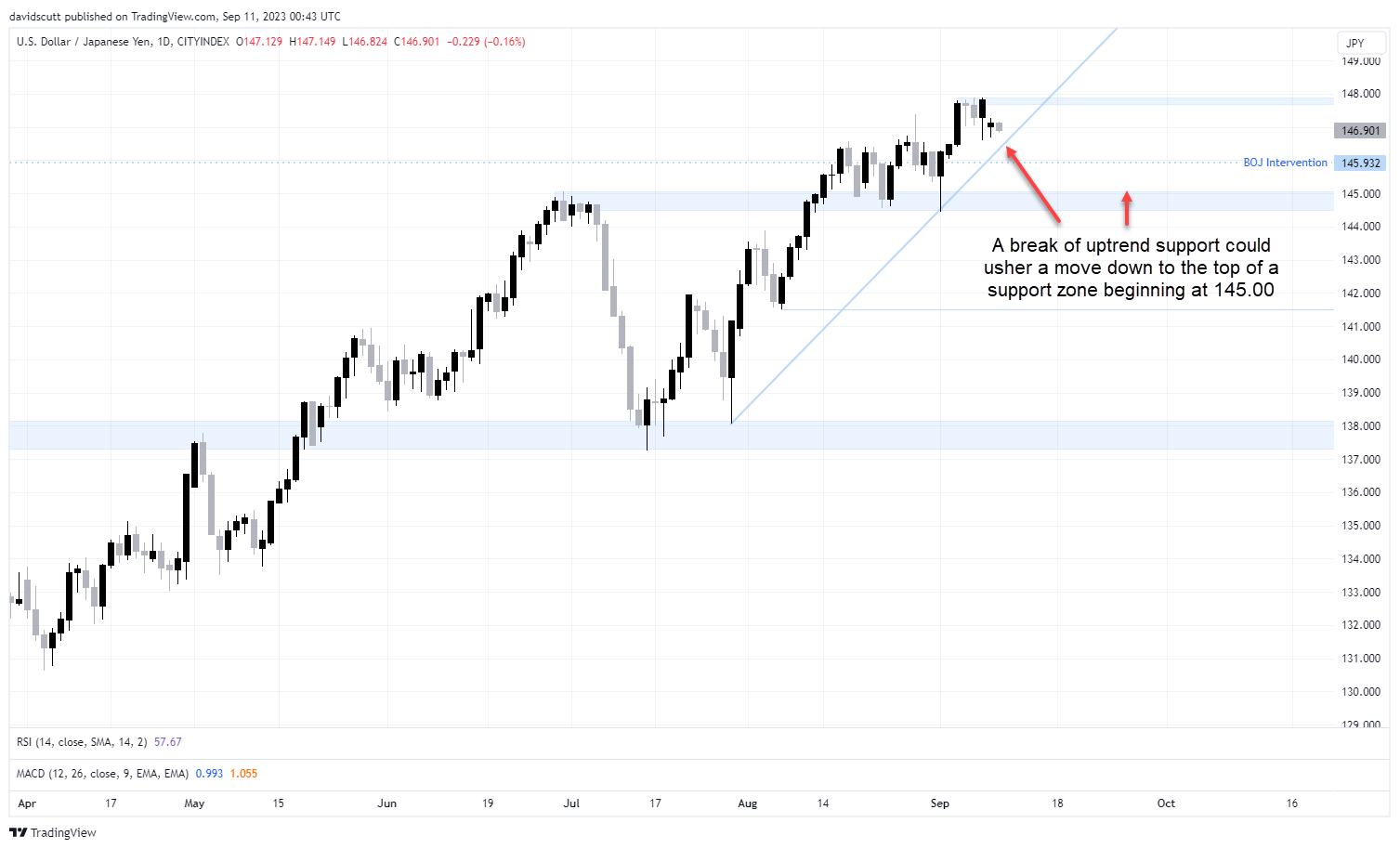

Ueda’s remarks had an instant impact once made public, pushing USD/JPY down more than a big figure from Friday’s close at one stage to as low as 146.64. The pair has bounced a little since but remains under pressure, adding to the case for near-term downside after trying unsuccessfully to break above 148 on several occasions last week. The US dollar index rally is also looking [tired after eight weeks of consecutive gains, pointing to the possibility for profit-taking ahead of key market events.

On the downside, the uptrend that began in late July is the next level to watch around 146.50. A break of that would open the door for the pair to move back towards a support zone starting at 145.00. On the topside, sellers are likely to emerge on probes above 147.70.

Macro events that could prevent further USD/JPY downside

When it comes to macro events that could reverse the selloff, a watering down of hawkish rhetoric from the ECB – regardless of whether it hikes rates later this week – along with a hotter-than-expected US CPI report for August would result in renewed US dollar strength. With the Federal Reserve’s FOMC Committee meeting held next week, we will not hear from any Fed officials until the policy decision is made due to the media blackout.