- Markets are pricing more than 100 basis points of cuts from the Fed next year

- Bond markets have responded by sending yields sharply lower

- Narrowing yield differentials between the US and Japan could lead to downside for USD/JPY

- A stronger JPY may create headwinds for Japan’s Nikkei 225

If you believe the Federal Reserve is done hiking rates and will be forced to ease policy aggressively next year as a new US economic downturn begins, it’s hard to be bullish USD/JPY or the Nikkei 225 given the role yield differentials and FX fluctuations have played in underpinning both this year.

Base case scenario is no more Fed hikes, plenty of cuts next year, according to markets

The scenario detailed above is, except for uncertainty about the trajectory for the US economy, now the accepted base case scenario based on recent market movements. In the wake of the Federal Reserve’s November interest rates decision, softer ISM services and nonfarm payrolls reports, markets are pricing in over 100 basis points of cuts next year, nearly 50 basis points more than what was priced in following the Fed’s last meeting six weeks ago.

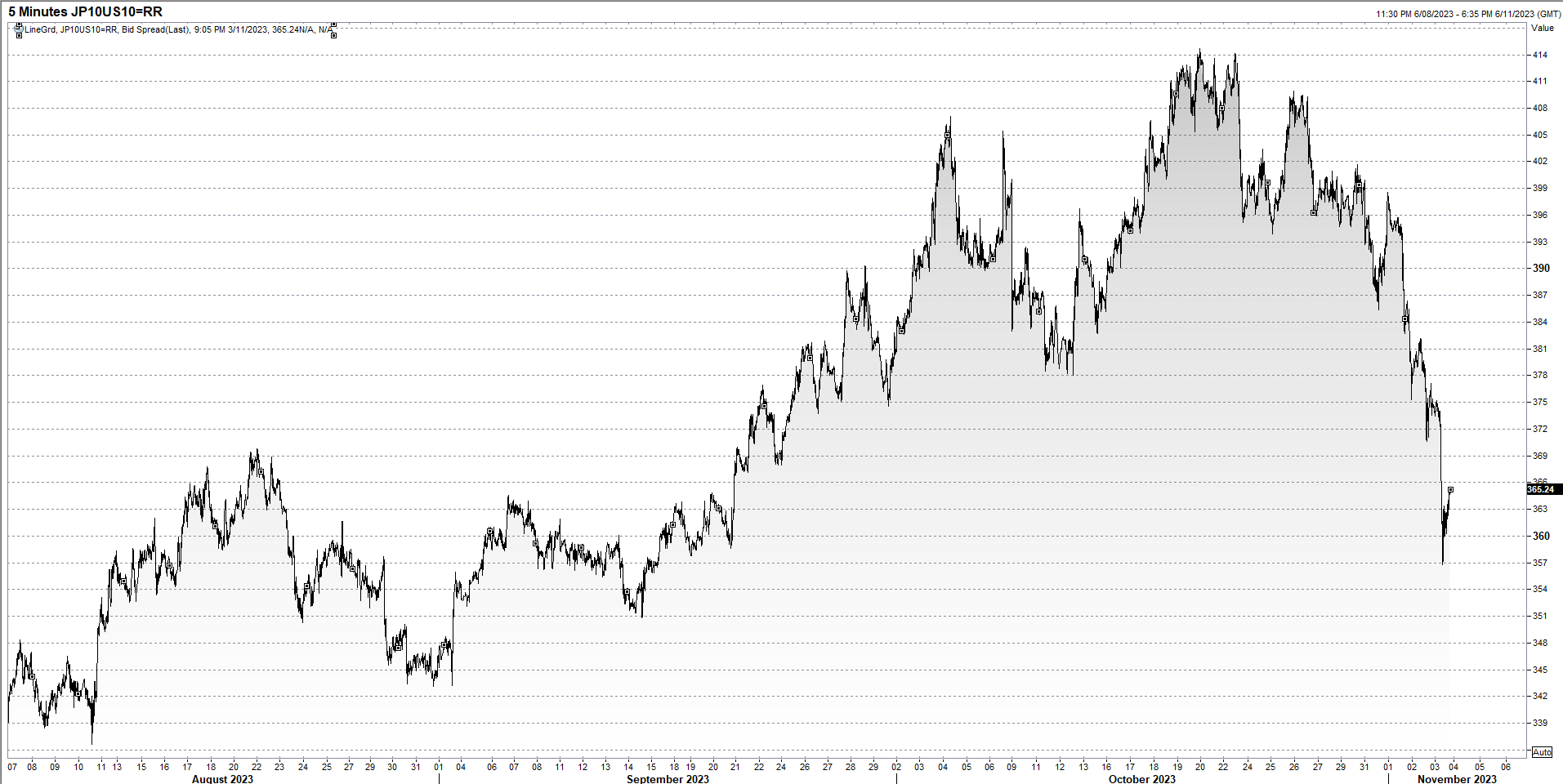

US yield curve sees unusually large bull flattening

With the short-end of the US interest rate curve moving lower rapidly, it’s combined with improved sentiment towards longer-dated bonds to send US yields five year and out cascading lower. From the cyclical highs, five-year yields have fallen 50 basis points. For benchmark 10-year debt, it’s over 46 basis points. 30-years are off 42 basis points. It’s been a massive move, only really seen in the past in times of extreme market turbulence.

That’s what make this move unusual; it’s not been caused by something breaking in financial markets or the real economy, at least not yet. It’s occurred when markets have been in a near euphoric mood as short covering helped fuel one of the largest weekly gains in risker assets in years.

While there may be grounds for near-term consolidation or a partial reversal of last week’s moves given how quickly the move occurred, at face value, evidence is building to suggest the highs for US yields may be in. It would be wrong to dismiss the move, arriving in a week that was laden with major risk events. It appears meaningful.

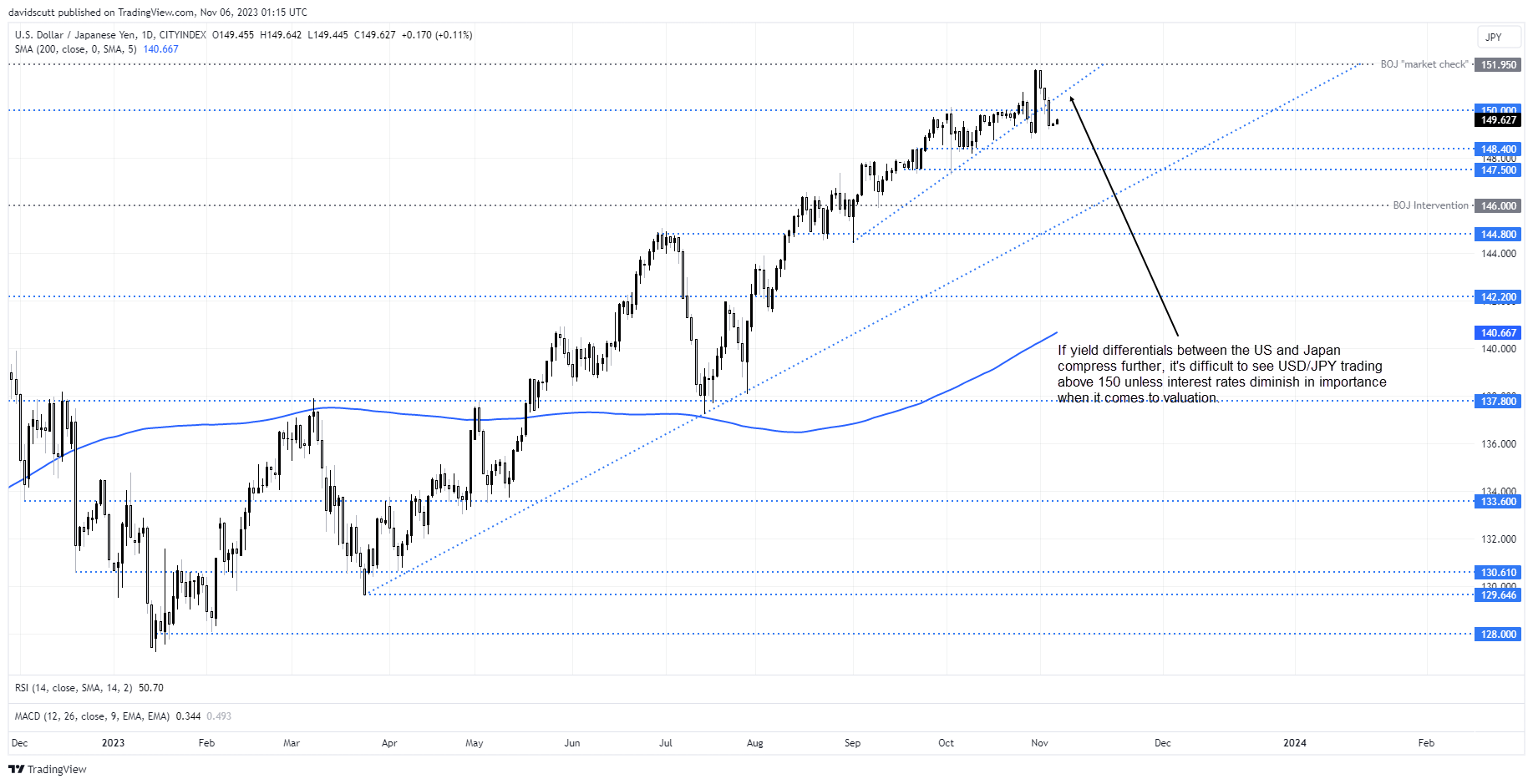

USD/JPY vulnerable to lower US yields

For a FX pair such as USD/JPY, beholden to shifts in rate differentials with the US, the implications may also be meaningful. Relative to where it was sitting in late October, the yield differential for 10-year debt has narrowed by around 50 basis points, leaving it levels last seen in late September. As seen in the daily chart below, USD/JPY was trading below 148 around then, not 149.60 where it trades today.

Source: Refinitiv

While there are numerous considerations that go into FX valuations, purely from a rate differentials perspective, risks appear to be building on the downside. And given the proximity to the recent highs, unless the drivers of USD/JPY switch away from interest rates, it’s not difficult to see the pair trading lower.

For those who expect yields will continue to dictate direction with differentials with the US likely to narrow further, you could consider initiating a short position below 150 with a stop loss order above for protection. Outside last week, the pair has had little success above the figure this cycle even when rate differentials meaningfully higher than what they are today. On the downside, the 50-day moving average looms as the first big technical test given it’s been respected on multiple occasions over the past few years. Below that, 148.50 and 147.50 are the next levels to watch with more meaningful support likely to kick in around 144.80.

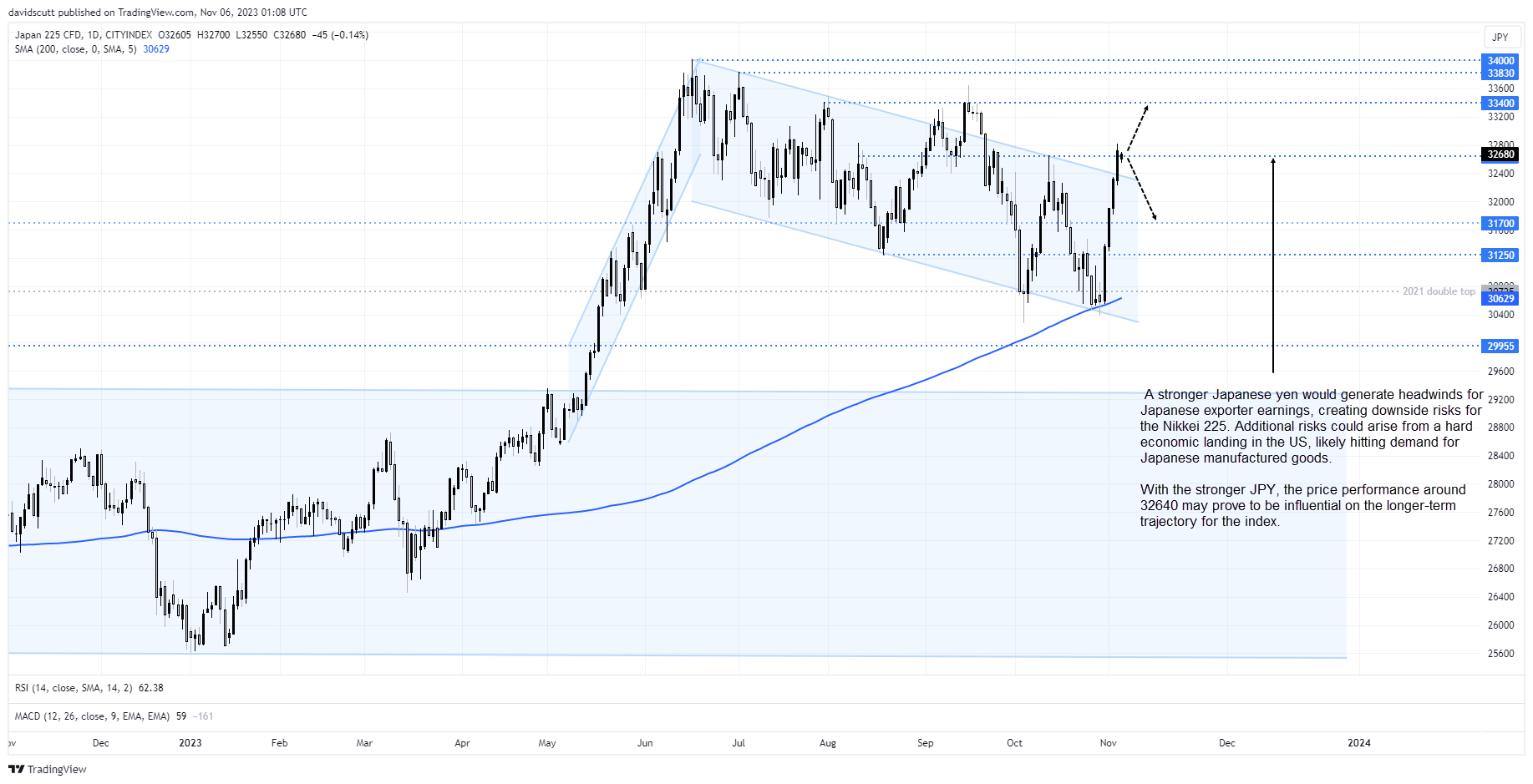

Stronger JPY unlikely to help Nikkei 225

Should USD/JPY start to move lower, it would also lessen earnings tailwinds for Japanese exporters from the weaker yen, likely weighing on the Nikkei 225 given the mix of its constituents. Other risks are the potential for the US economy to experience a hard economic landing, creating an environment where demand for Japanese manufactured good would likely soften.

Looking at the Nikkei 225 daily, the bounce off the intersection of the 200-day moving average and 2021 double top support has been powerful, seeing the index punch through numerous resistance layers before stalling around 32640. The index has done a lot of work either side of this level, meaning what happens near-term may be influential for the longer-term trajectory.

Should the index fail to extend its rally, traders could initiate shorts with a stop placed between 32800 and 33,000, depending on the entry level. Former channel resistance just below 32400, 31700 and 31250 are the initial downside levels to watch.

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.