Asian Indices:

- Australia’s ASX 200 index fell by -60.9 points (-0.85%) and currently trades at 7,146.00

- Japan’s Nikkei 225 index has fallen by -137.62 points (-0.42%) and currently trades at 32,638.75

- Hong Kong’s Hang Seng index has fallen by -37.79 points (-0.21%) and currently trades at 17,988.10

- China’s A50 Index has fallen by -85.42 points (-0.68%) and currently trades at 12,525.80

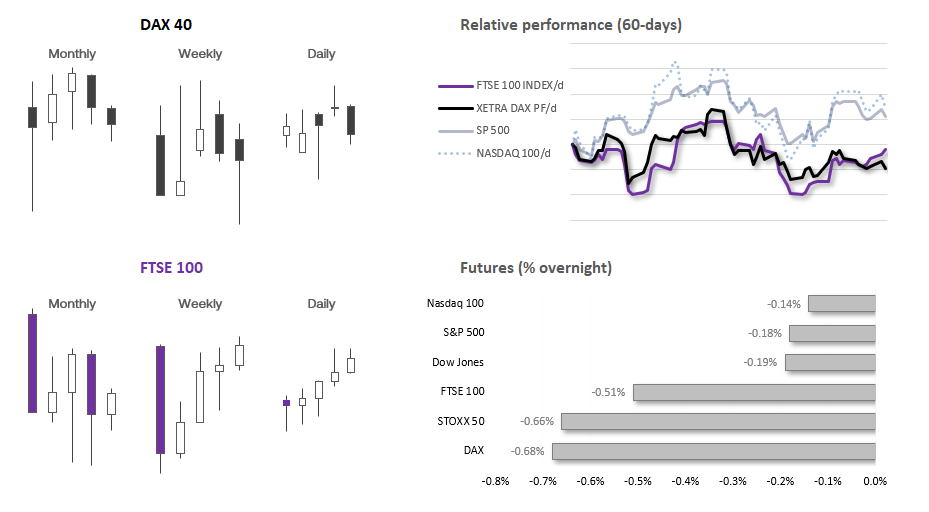

UK and Europe:

- UK’s FTSE 100 futures are currently down -38 points (-0.5%), the cash market is currently estimated to open at 7,489.53

- Euro STOXX 50 futures are currently down -28 points (-0.66%), the cash market is currently estimated to open at 4,214.27

- Germany’s DAX futures are currently down -107 points (-0.68%), the cash market is currently estimated to open at 15,608.53

US Futures:

- DJI futures are currently down -67 points (-0.19%)

- S&P 500 futures are currently down -7.75 points (-0.17%)

- Nasdaq 100 futures are currently down -19 points (-0.12%)

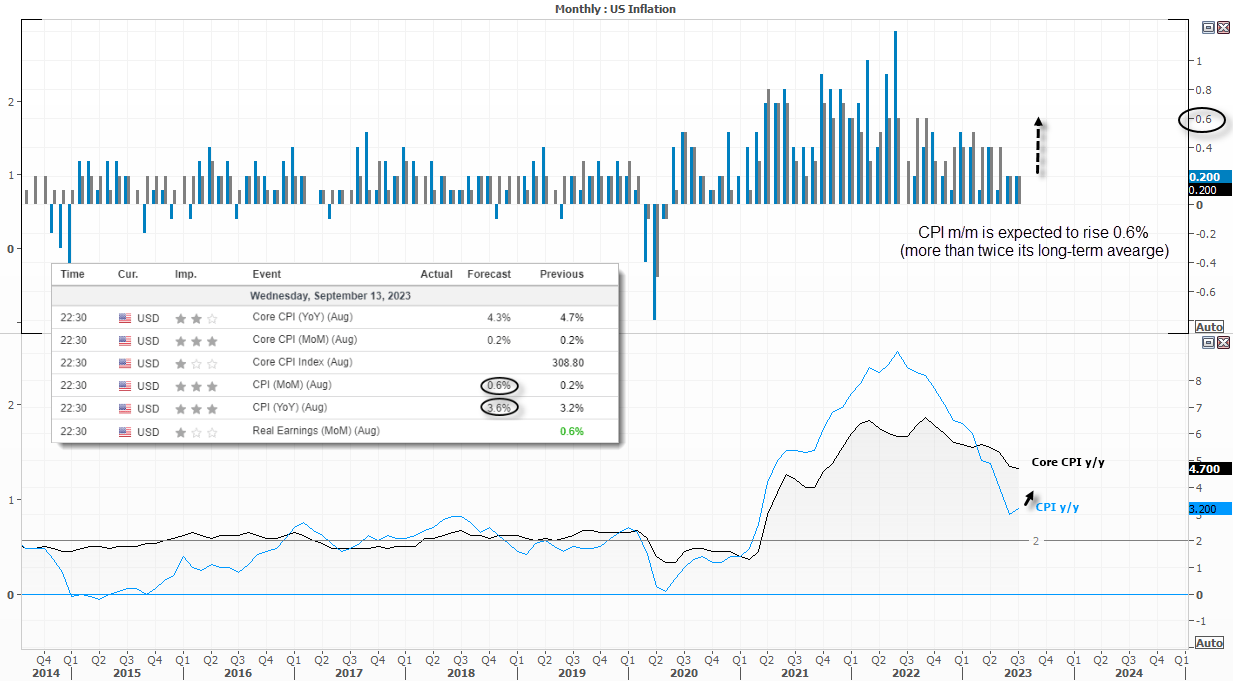

US inflation data is here once again, although CPI is expected to rise by 0.6% m/m, which would be its highest monthly print since June 2022 and twice its long-term average of 2.9%. CPI is also expected to rise to 3.6% y/y, which firmly places the theme of disinflation has made its way into the rear-view mirror.

And that means inflation prints going forward really serve to either reignite fears of another Fed hike, or simply elongate the time rates could remain ‘higher for longer’ as Jerome Powell suggested at the Jackson Hole symposium.

A significant majority pf economists expect the Fed to hold interest rates in September, which aligns them with money markets who have been pricing in a hold for weeks. However, if CPI rises 0.6% m/m or higher, markets could quickly shift their probabilities towards a hike.

Rising commodity prices are beginning to work their way back up the supply chain. The Baltic dry index (which measures the cost of shipping goods) is not expected to get much cheaper, leaving it vulnerable to upside surprises. Import costs and PMI “prices paid” are also ticking higher, which increases the risk of another round of inflation China’s CPI only managed one deflationary print before expanding again, which further supports this view.

With traders expecting a hot inflation report, the market response may be muted if the report is not as hot as feared. However, it is difficult to imagine an inflation report that would be considered “dovish” enough to trigger expectations of a Fed rate cut. This is because such a report would need to show a surprise drop in core CPI and a less-than-expected rise in overall CPI. And with inflationary pressures building, this seems unlikely.

Events in focus (GMT+1):

- 07:00 – UK GDP, construction/manufacturing/industrial output, index of services, trade balance

- 13:30 – US inflation

- 14:15 – BOE deputy governor Mann speaks

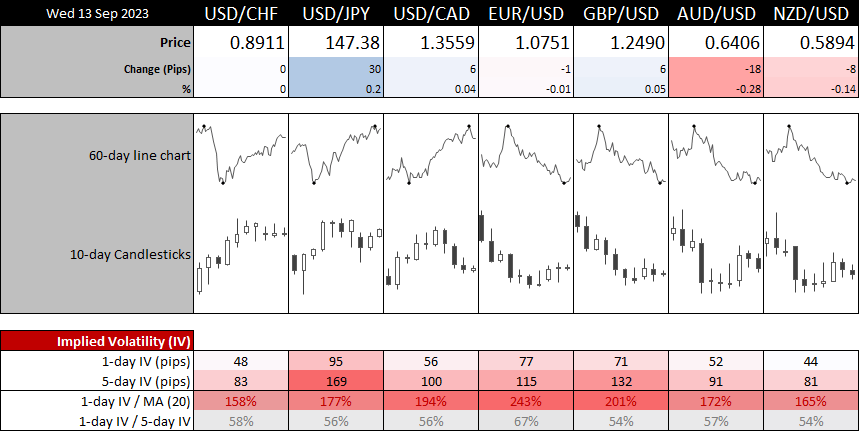

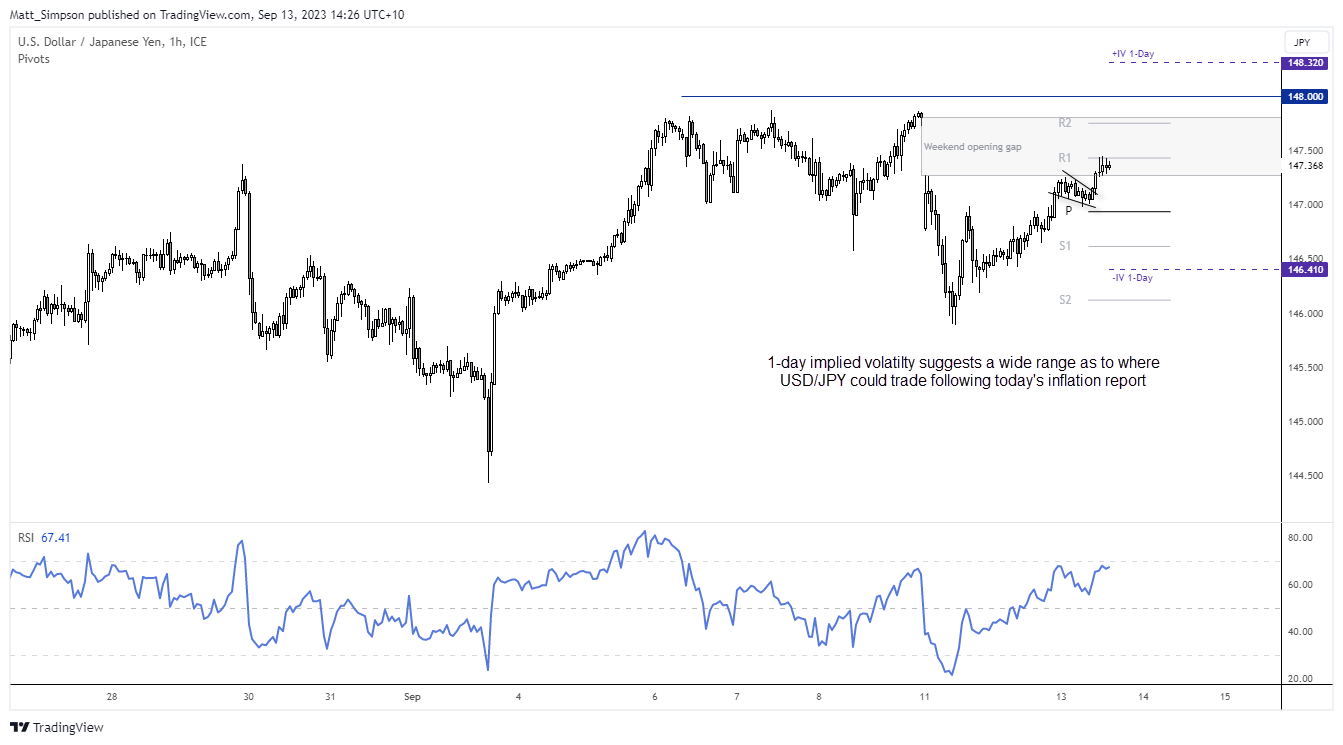

USD/JPY technical analysis (1-hour chart):

A nice clean trend has developed on the USD/JPY 1-hour chart, which saw the pair break out of a bull flag early in the Asian session. It is seemingly trying to close the large weekend opening gap which was created following relatively hawkish comments from Ueda on Saturday. Although momentum has since receded and resistance met around the daily R1.

1-day implied volatility suggests a relatively large range where USD/JPY could trade following CPI, so volatility is clearly expected. But if the US dollar maintains strength in the first half of the European session, perhaps we can see it break higher as it tries to close that gap ahead of CPI/ At which point it may be vulnerable to whipsaws of volatility. A hot report could see markets either reprice the potential for a Fed hike and support the US dollar accordingly. Yet if prices are rising into the report and CPI comes in softer than expected, bears may be tempted to pounce once the initial spikey moves are out of the way.

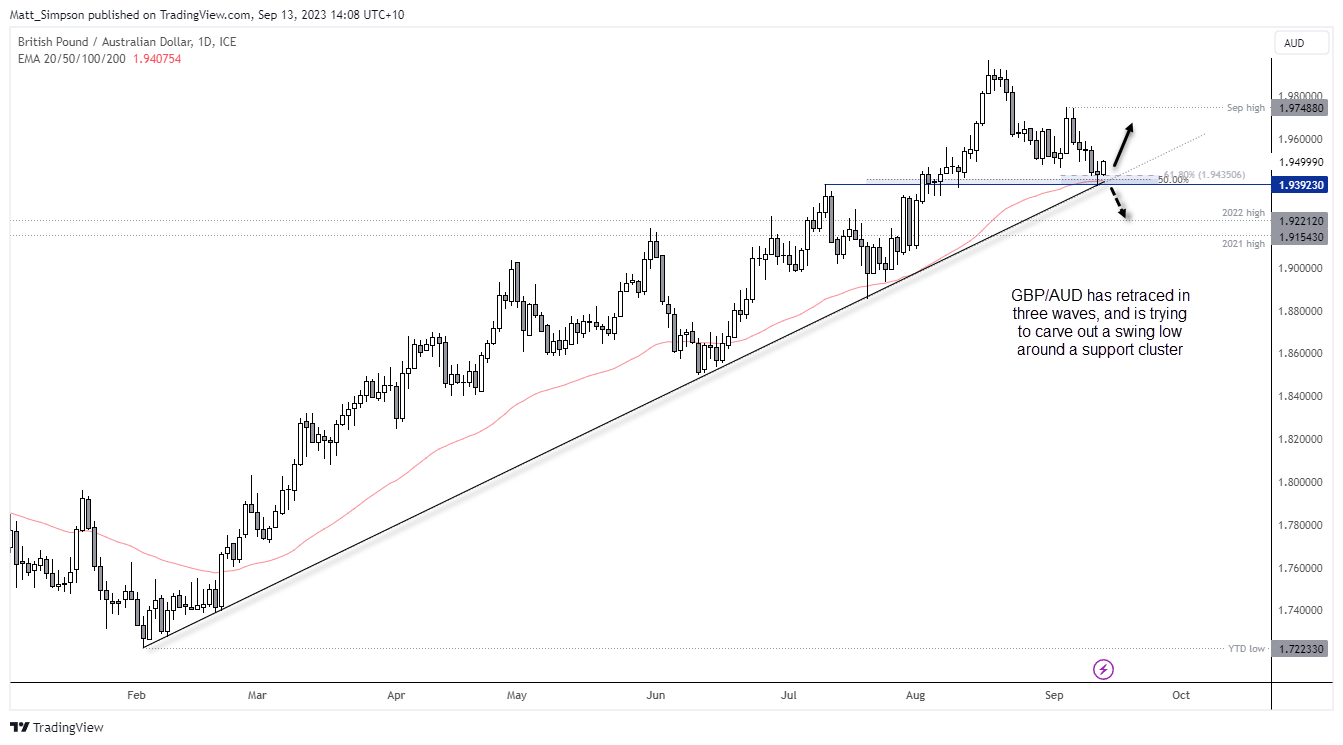

GBP/AUD technical analysis (daily chart):

There comes a point where so many technical levels come together, fundamentals take a bit of a step back. We may be there with GBP/AUD. A doji formed on Monday at a cluster of support levels including the February trendline, 50-day EMA, historical high, 50% retracement level and 61.8% Fibonacci expansion level.