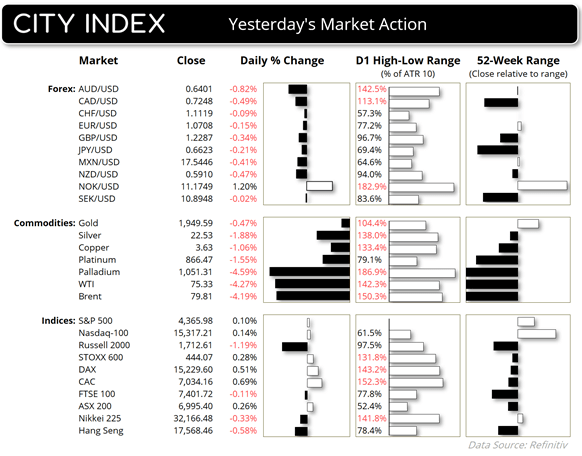

Market Summary:

- Joe Biden and Xi Jinping are set to meet in San Francisco next week for summit talks, which would make it their second meeting in three years. Although it has since been reported that Janet Yellen is set to meet China’s Vice Premier ahead of the APEC summit.

- The new Republican House Speaker, Mike Johnson, is to reveal his plan over the next couple of days of how to avoid a government shutdown (current funding expires 17 November)

- Not that US stock markets seem too bothered, with the Nasdaq 100 effective trading flat for the day. Although its minor loss means it snapped its 7-day winning streak with the October high acting as resistance

- Oil demand concerns for the US and China continued to weigh on oil prices and sent WTI crude down to my $75 target. With no immediate signs of a trough, the potential for a move to $70 remains on the cards.

- “Some” BOC members saw the need for further interest rate hikes according to their minutes of the meeting, although the majority clearly got their way by holding rates at 5%. However, a recent survey of market participants lists higher interest rates as the main risk to the economy.

- The US dollar index rose for a third day, but only just with a modest gain of 0.05%. But the bearish hammer candle respected the March high and reinforces my bias that another leg lower may be due for the US dollar.

- Jerome Powell did not make any remarks on monetary policy when he spoke at a central bank statistics conference on Wednesday

- AUD/USD was the weakest FX major for a second day after the RBA hiked without a commitment to further hikes. The Aussie posted a minor retracement higher before falling back to 64c, a level it is considering breaking now. Due to technical levels nearby, happy to remain flat until a better opportunity arrives.

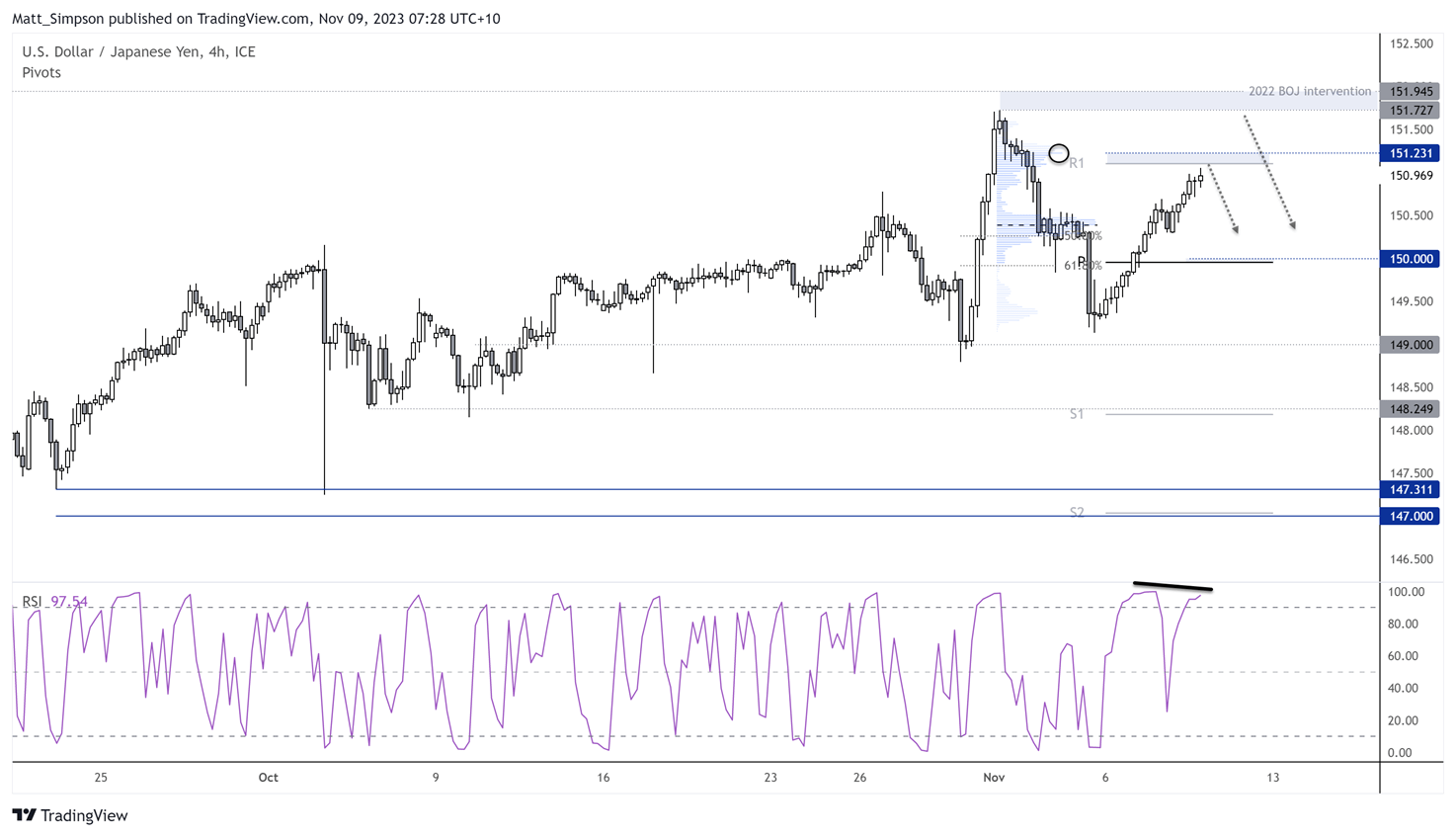

- The Japanese yen continued to weaken against USD, EUR and GBP, which saw EUR/JPY rise to its highest level since August 2008.

- USD/JPY rose for a third day and is just -67 pips beneath its October high, or -89 pips beneath the October 2022 high (when the BOJ last intervened)

Events in focus (AEDT):

- 08:45 – New Zealand retail sales

- 10:50 – BOJ summary of opinions, bank lending, current account

- 12:30 – China CPI, PPI

- 19:30 – BOE MPC member Pill speaks

- 01:15 – Fed Chair Powell speaks

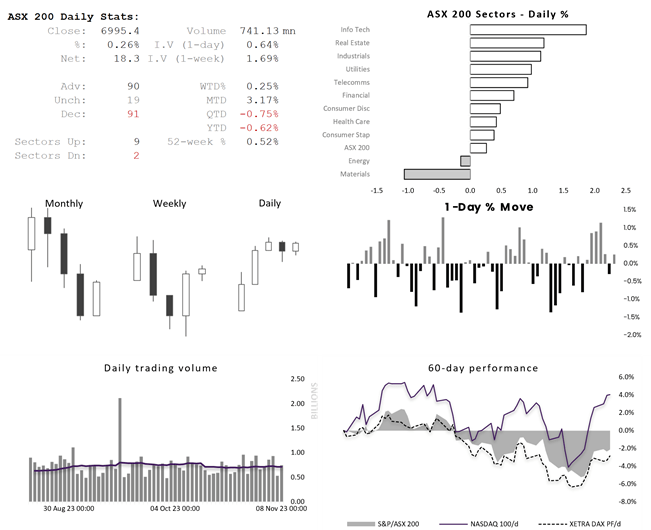

ASX 200 at a glance:

- The ASX 200 printed a small bullish inside day beneath 7000 resistance on Wednesday

- However, with SPI 200 futures up ~0.5% the ASX cash market is expected to open above 7,000 today

- If bulls can maintain control today, 7062 and 7100 are resistance levels for them to target whilst 7,000 and 6952 are likely levels of support

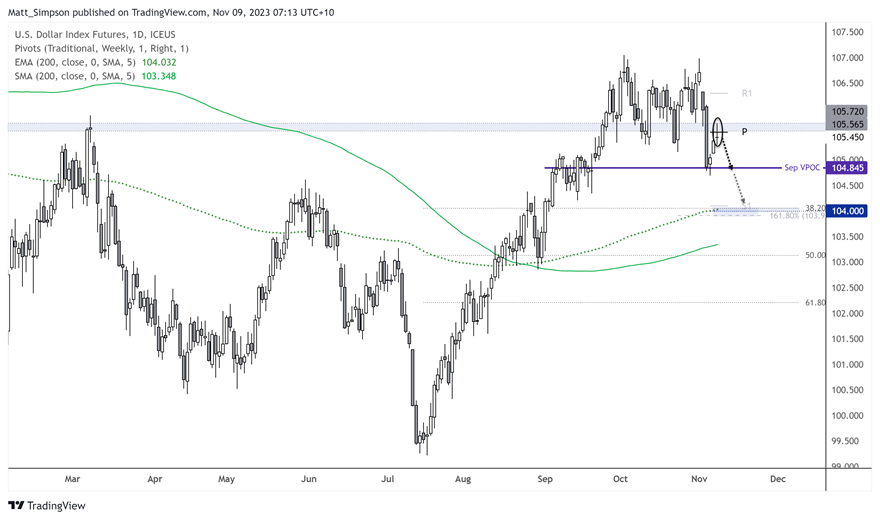

USD index technical analysis (DXY chart):

I outlined a near-term bearish bias for the US dollar index in yesterday’s article, so this is merely a minor update. The market has formed a 1-bar reversal and its high perfectly respected the resistance zone, and the day closed back beneath the weekly pivot point. Bears could either seek to enter with a break of Wednesday’s low, or fade into low volatility retracements within Wednesday’s range. The initial target is 105 / VPOC, a break beneath which opens up a ruin for 104 near the 200day EMA.

USD/JPY technical analysis

The weaker yen has allowed USD/JPY to creep higher despite a soft performance for the US dollar elsewhere and lower bond yields. Yet USD/JPY is fast approaching key levels which may tempt bears into near-term short trades. Yesterday’s high stopped just short of the weekly R1 pivot point, and 151.21 marks a high-volume node from the prior decline – which provides a potential zone of resistance for bears play with. Should prices instead break higher, then the next obvious zone of resistance is the October and October 2022 high (when the BOJ last intervened).

View the full economic calendar

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.