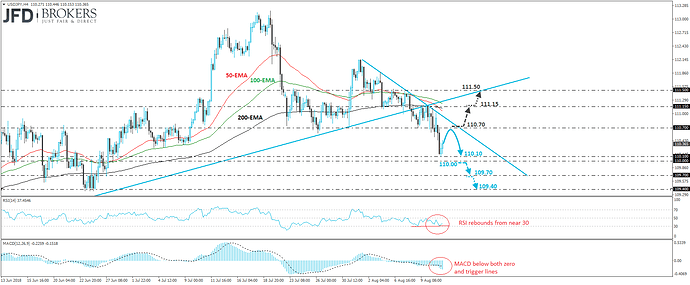

USD/JPY tumbled on Monday, falling below the 110.70 territory. However, the rate hit support at 110.10 and then it recovered somewhat. The pair continues to print lower peaks and lower troughs below the short-term downtrend line drawn from the peak of the 1st of August, and it is also trading below the prior medium-term upside support line taken from the low of the 29th of May. What’s more, the dip below 110.70 may have signaled the completion of a failure swing top formation on the daily chart, which combined with the aforementioned technical signs, suggests that the near-term outlook of the pair is to the downside.

If sellers are strong enough to jump back in from current levels, we would expect them to aim for another test near 110.10. That said, we would like to see a clear and decisive break below the psychological figure of 110.00 before we get confident on larger declines. Such a dip could initially pave the way for our next support of 109.70, marked by the low of the 27th of June. Another break below 109.70 could pave the way for the 109.40 territory.

Taking a look at our short-term oscillators, we see that the RSI rebounded from near its 30 line and it is now pointing up. The MACD lies below both its zero and trigger lines but shows signs that it could start bottoming. These indicators suggest that further recovery may be in the works before the bears decide to take the reins again, perhaps for a test near the 110.70 zone, or near the short-term downtrend line.

We prefer to wait for a clear break above that line before we abandon the bearish case and take the sidelines, at least in the short run. Such a move could open the path towards the 111.15 resistance, the break of which could set the stage for extensions towards the crossroads of the 111.50 barrier and the aforementioned medium-term upside line taken from the low of the 29th of May. In order to start examining whether the outlook has turned positive again, we would like to see a clear close above that crossroads.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.