Over the past four trading sessions, USD/MXN has resumed a clear bearish bias, leading the exchange rate to depreciate by more than 1.5% in the short term, in favor of the Mexican peso.

By :Julian Pineda, CFA, Market Analyst

Over the past four trading sessions, USD/MXN has resumed a clear bearish bias , leading the exchange rate to depreciate by more than 1.5% in the short term, in favor of the Mexican peso. This recent strength in the Mexican currency has held firm just ahead of today’s official rate decision by the Bank of Mexico, where markets expect a new rate cut.

Click the website link below to read our exclusive Guide to USD/MXN and USD/CAD trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-usdcad-usdmxn-outlook/

What to Expect from Banxico

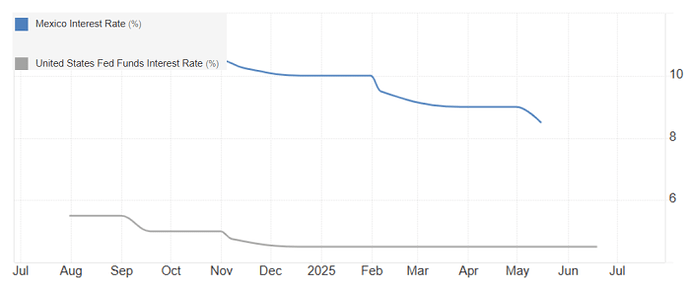

During today’s session (June 26), Banxico is set to announce its official interest rate decision. The consensus suggests the central bank will maintain a flexible monetary stance, possibly cutting the current rate of 8.5% by 50 basis points, bringing it down to around 8%.

This potential cut comes despite inflation remaining above the 3% target, signaling that Banxico is prioritizing economic growth over price control. A lower interest rate could offer relief to an economy still navigating through an environment of uncertainty. If the cut goes through, the rate would fall to its lowest level in the past three years, potentially boosting activity in certain productive sectors.

However, this continued trend of rate cuts may not be favorable for the peso in the short term. Compared to the Federal Reserve, which has kept its rate steady around 4.5%, there is a growing divergence in monetary policy between the two countries. While Banxico keeps lowering its rate, the Fed has opted for consistency. This difference could weaken the perceived attractiveness of the peso, prompting capital flows toward lower-risk assets like U.S. investments.

Source: TradingEconomics

Even though Mexico’s interest rate remains higher than the U.S. rate (8% vs. 4.5%), Banxico’s more relaxed monetary stance could gradually erode investor confidence if it continues over time. The Fed’s steady rate, despite being lower, has reinforced the perception of policy stability. As a result, investors may prefer U.S. fixed-income instruments, which could boost demand for the U.S. dollar against the peso. If Banxico continues signaling a dovish rate outlook, it could eventually weaken the peso’s gains this year and trigger a more persistent buying pressure on USD/MXN.

USD/MXN Technical Outlook

Source: StoneX, Tradingview

-

Downtrend remains in place: Since early April, the USD/MXN chart has maintained a clear downward trend, with no strong signs of reversal. Recent bullish corrections haven’t been enough to change the prevailing bearish structure. However, it’s worth noting that the pair has recently failed to reach new lows. If this continues, the strength of the downtrend could come into question, opening the door to short-term upside corrections. As long as the price remains below 19 pesos per dollar, the bearish setup remains the most relevant technical factor.

-

RSI: Although the RSI is still below the neutral 50 level, indicating that sellers remain dominant, it has started to show higher lows, while USD/MXN keeps forming new price lows. This has created a bullish divergence, suggesting that selling momentum may be losing strength. If this pattern continues, it could lead to short-term upward corrections.

-

ADX: The ADX has dropped below the neutral threshold of 20, signaling a loss of strength in the current trend. This lack of volatility and direction suggests that bearish pressure may be losing consistency, especially if the price fails to break the key support area.

Key Levels :

-

18.83 – Key support: This marks the recent lows and is the level where the price has found support against sustained bearish pressure. A break below this level could reinforce the downtrend and lead to a more extended decline.

-

19.16 – Nearby barrier: A consolidation zone aligned with the chart’s descending trendline. If a technical rebound occurs, this level could act as immediate resistance to any potential bullish correction.

-

19.40 – Final resistance: This level aligns with the 50-period simple moving average. A breakout above could signal the end of the current downtrend and pave the way for a more meaningful bullish bias in the short term.

Written by Julian Pineda, CFA – Market Analyst

Follow Him: @julianpineda25

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.