Over the past three trading sessions, the USD/MXN pair had posted gains of over 4.5% in favor of the U.S. dollar. However, in recent hours, the Mexican peso has recovered nearly 2%.

By : Julian Pineda, CFA, Market Analyst

Over the past three trading sessions, the USD/MXN pair had posted gains of over 4.5% in favor of the U.S. dollar. However, in recent hours, the Mexican peso has recovered nearly 2%. This renewed strength is largely due to recent comments from President Trump, suggesting a possible short-term pause in tariff pressures.

Click the website link below to read our exclusive Guide to USD/MXN and USD/CAD trading in Q2 2025

https://www.cityindex.com/en-au/market-outlooks-2025/q2-usdcad-usdmxn-outlook/

Mexico Temporarily Spared

The trade war has escalated in recent sessions. After President Donald Trump announced plans for additional tariffs on China, it was initially expected that China would give in to pressure from the White House and seek a deal. However, the outcome was different. China stated it would not allow interference in its sovereignty or development and responded with 84% tariffs on all U.S. imports, set to take effect on April 10.

The story does not end there, as today it was also revealed that the White House has decided to raise the proposed tariffs on China to 125%, while simultaneously pausing the implementation of tariffs on other countries for 90 days—a decision that, in this case, has benefited Mexico.

As a result, Mexico has temporarily fallen out of focus. While the country initially drew significant attention, negotiations proposed by the Mexican government failed to materialize, leaving Mexico at risk of facing 25% tariffs on products outside the USMCA framework. However, the newly announced tariff pause has significantly eased market concerns about the peso, contributing to its recent rebound during the latest trading hours.

This temporary confidence boost may help stabilize downward pressure on USD/MXN over the next sessions. That said, it’s worth noting that, as of 2024, more than 80% of Mexican exports go to the United States—highlighting a high degree of trade dependency.

As concerns over potential tariff reimplementation arise following this grace period, investor confidence in the peso may once again erode. For this reason, it will be crucial to monitor how both governments handle negotiations going forward. Should new negative comments targeting Mexico emerge, the recent gains in peso confidence could quickly disappear.

How Are Central Banks Responding?

Currently, Banxico’s interest rate stands at 9%, though the institution has repeatedly hinted that its easing cycle could continue in upcoming meetings. Some comments have suggested that the economic impact of tariffs could justify additional rate cuts of up to 50 basis points in the near term, reinforcing a dovish outlook.

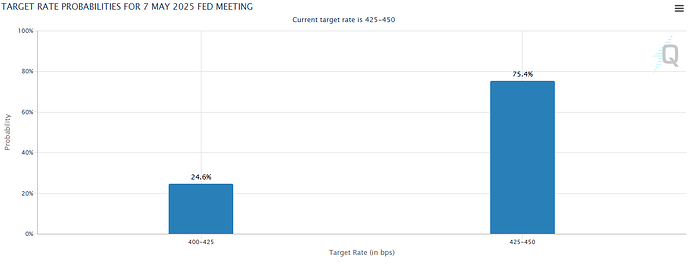

In contrast, the Federal Reserve maintains a different stance. In recent weeks, Jerome Powell has noted that the trade war could exert inflationary pressure on the U.S. economy, justifying a stable and restrictive monetary policy, with interest rates holding around 4.5%.

This is reflected in the CME Group’s FedWatch tool, which currently shows a 75.4% probability that the Fed will keep rates between 4.25% and 4.5% at its upcoming May 7 meeting.

Source: CMEGroup

While Banxico’s rate (9%) is higher than that of the Federal Reserve (4.5%), the dovish bias from Mexico’s central bank contrasts with the Fed’s more hawkish position, which has started to influence the behavior of both currencies.

As the U.S. maintains an attractive and stable rate, demand for U.S. Treasuries—viewed as one of the safest assets globally—continues to rise. In contrast, while Mexican bonds offer higher yields, they also involve greater risk. If the market continues to favor Treasuries as the more secure and profitable option, demand for the U.S. dollar could keep growing, reinforcing bullish pressure on USD/MXN in the medium to long term.

USD/MXN Technical Outlook

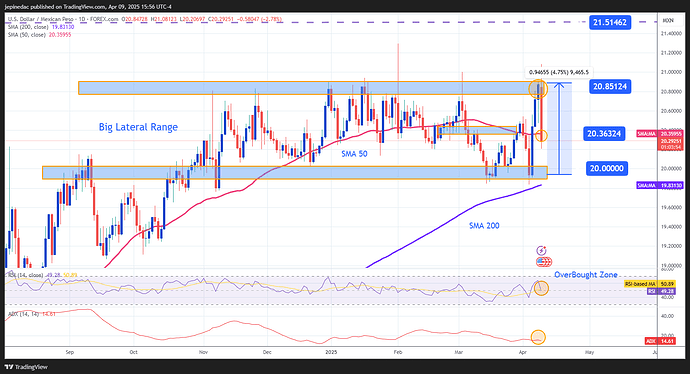

Source: StoneX, Tradingview

- Sideways Range Holds Firm: Over the past two months, price action has remained within a sideways range, with resistance near 20.85 pesos per dollar and support around 20.00 pesos. Recently, upward pressure pushed the price toward the top of the channel, but it quickly reversed to the mid-range, preventing a meaningful breakout. For now, this sideways channel remains the dominant technical structure to monitor.

- RSI: The RSI has returned to the neutral 50 zone, reflecting strong indecision in the market. If the line continues to fall, the recent bearish momentum could gain strength. However, levels near 30, which mark oversold territory, should also be monitored closely.

- ADX: The ADX line remains below the neutral threshold of 20, signaling a lack of strength in recent price movements. As long as it stays low, it’s reasonable to assume there is no clear trend in USD/MXN at this time.

Key Levels:

- 20.85 – Key Resistance: This level marks the upper boundary of the range. Price action near this zone could reignite bullish strength and reestablish upward bias.

- 20.36 – Current Barrier: Located at the center of the range, aligned with the 50-period moving average. Continued trading near this level may reinforce neutrality and extend the sideways channel.

- 20.00 – Major Support: This level marks the bottom of the range. A strong bearish break below this level could end the current neutrality and trigger a more pronounced downtrend.

Written by Julian Pineda, CFA – Market Analyst

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.