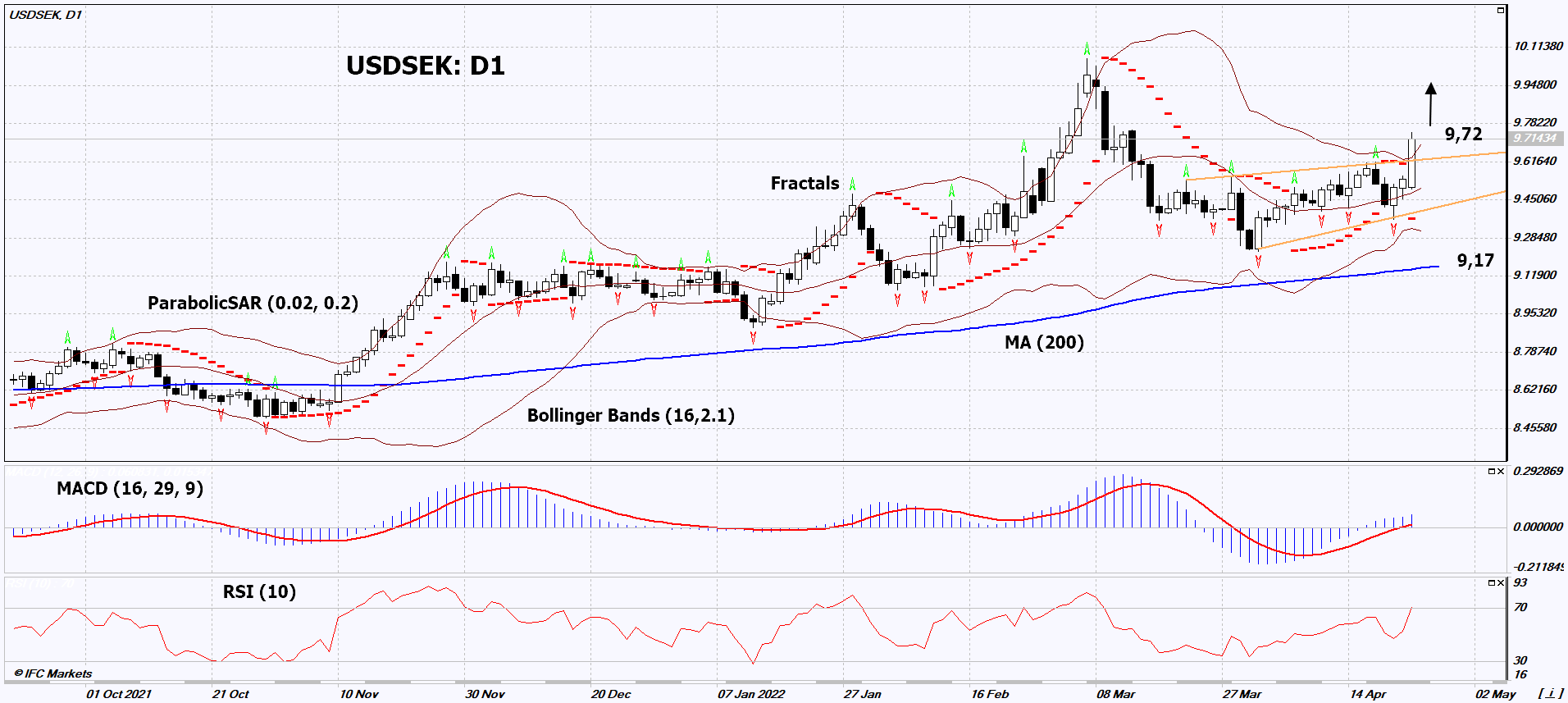

USD/SEK Technical Analysis Summary

Buy Stop։ Above 9,72

Stop Loss: Below 9,17

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

USD/SEK Chart Analysis

USD/SEK Technical Analysis

On the daily timeframe, USDSEK: D1 is in a long-term uptrend and has come out of the wedge. Some indicators of technical analysis have formed signals for a further increase. We do not rule out a bullish movement if USDSEK: D1 rises above the last high of 9.72. This level can be used as an entry point. Initial risk cap is possible below the Parabolic signal, the last four down fractals, the lower Bollinger band and the 200-day moving average line: 9.17. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (9.17) without activating the order (9.72), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - USD/SEK

Investors may be disappointed by the outcome of the meeting of the Central Bank of Sweden. Will the USDSEK quotes continue to rise?

The next meeting of Sveriges Riksbank (Central Bank of Sweden) will be held on April 28. Most likely he will keep the rate at 0%. Investors do not exclude its increase at the next meeting on June 30. Meanwhile, inflation in Sweden reached 6% in March. In April, its further growth to 6.8% is expected. New data for April will be published on May 12. In addition to the Riksbank meeting, significant statistics are expected to be released this week in Sweden. On April 27, data on unemployment, the producer price index and the balance of foreign trade in goods will be released. Retail sales, GDP for the 1st quarter of 2022 (Sweden Gross Domestic Product) and a number of other economic indicators will be released on April 28. An additional negative for the Swedish krona could be an increase in political risks against the backdrop of the planned entry of Sweden into NATO.