USD, yields retrace further, RBA meeting could be live: The Week Ahead

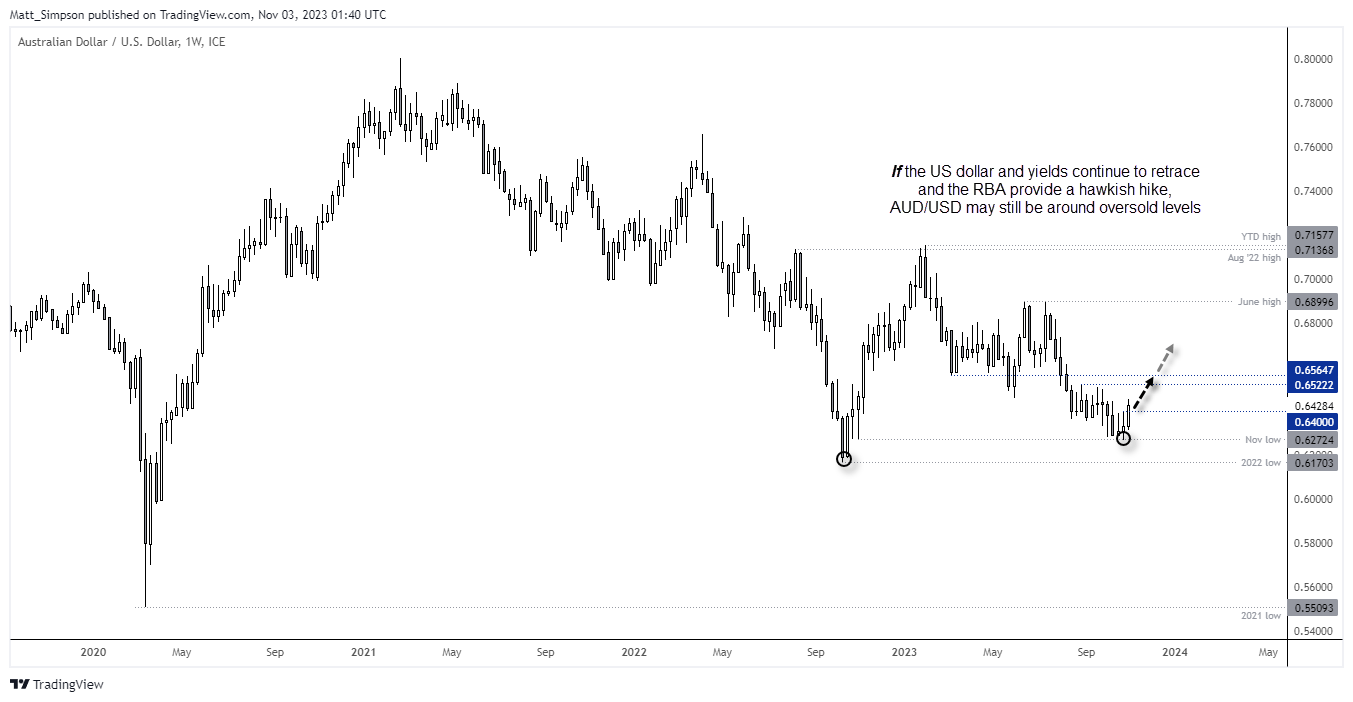

Bond yields continue to retrace for a second week with the US dollar, which has allowed risk assets to bounce from their lows. Whilst it has been a nice reprieve from negative sentiment, it remains debatable as to whether the supposed short-covering rally can switch to a risk-on phase. Tuesday’s RBA meeting is more than likely to be live, and that could help AUD/USD move higher from oversold levels.

The week that was:

- FOMC members voted unanimously to hold rates at 5.25 – 5.5% for a second consecutive meeting. Whilst they left the door open for another hike, Powell’s press-conference comments on rising yields and financial conditions means the Fed may not have to hike again.

- Market pricing continues to suspect they have reached their terminal rate with odds of a December or January hike falling from already low levels

- Expectations of a less-hawkish Fed, improved earnings and less fear of an escalation of the Middle East conflict saw a likely short squeeze for risk assets and less demand for the US dollar

- Wall Street is on track for its best week of the year with the S&P 500 up 4.9% ahead of Friday’s open, and the Nasdaq 100 up 5.2%

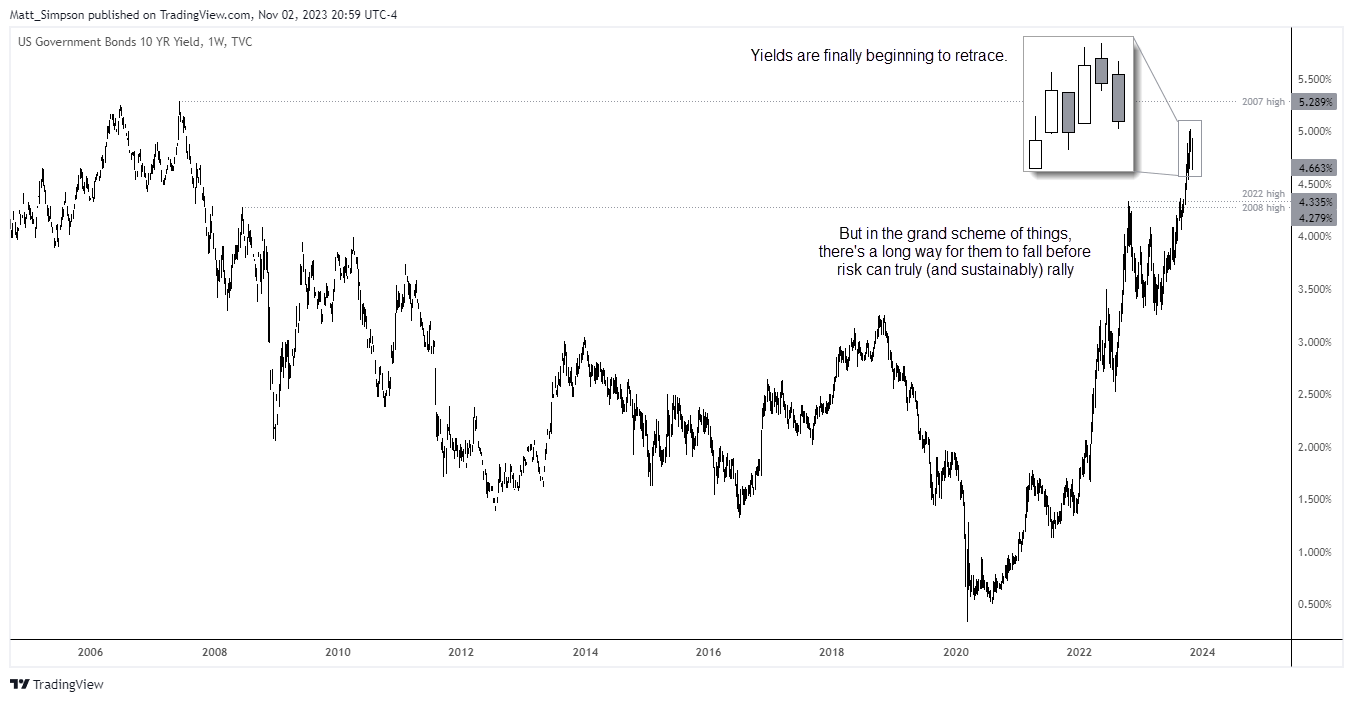

- Bond yields eased for a second week as bears covered and investor snapped up bargain which saw the 10, 20 and 30-year yields post their second largest declines of the year (in basis points)

- The bank of Japan eased their grip on YCC further but it came as a disappointment to many who were expected the YCC bands to be widened or abandoned and sent UD/JPY surging above 151

- Whilst the BOJ are yet to intervene, they role out the obligatory warning shots to markets with currency diplomat Kanda speaking of speculative moves

- Reuters ‘sources’ suggest the BOJ may look to exit negative rates in Spring next year following an interview with six people ‘familiar with the BOJ’s thinking’

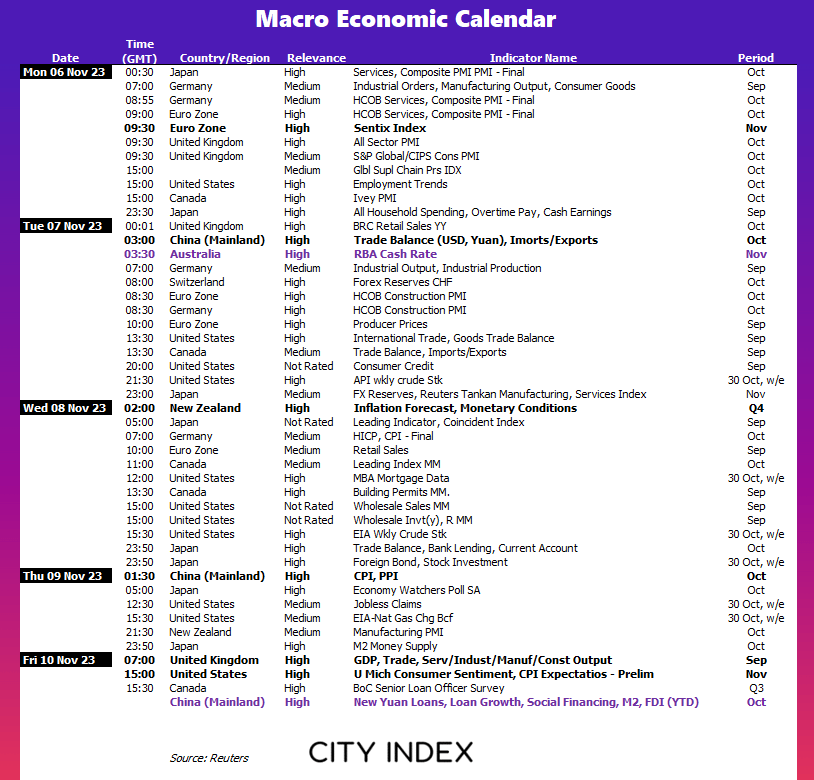

The week ahead (calendar):

This content will only appear on City Index websites!

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- Can yields and the US dollar to loosen their grip in sentiment?

- RBA cash rate meeting

- BOJ intervention

- China data (CPI, PPI, loan growth, trade balance)

Can yields and the US dollar to loosen their grip in sentiment?

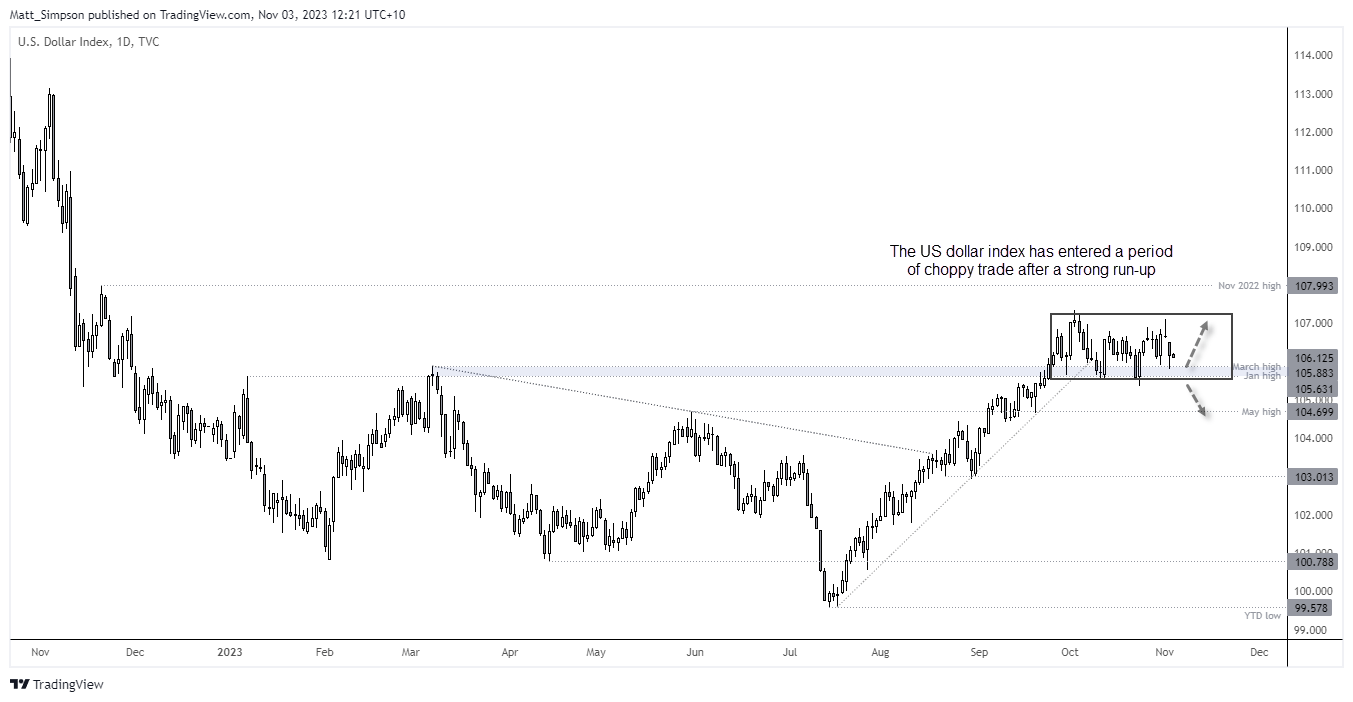

Rising bond yields have certainly earned their time in the spotlight in recent weeks, with fears that ‘something will break’ making the round through echo chambers and market sentiment. And that has seen the US dollar mostly move in tandem with rising yields, to the detriment of its forex major peers, stocks and commodities. Yet with yields getting choppy around their highs and pulling back, it is also weighing on the US dollar and providing some relief for battered markets. And the icing on the cake this week was the Fed once again conceding that rising yields may effectively do the Fed’s tightening for them – hence the call for no further hikes.

So we have now seemingly entered a corrective phase for the US dollar which has allowed AUD/USD to break above 0.64, GBP/USD head for 1.22 and USD/CAD fall back beneath the March high after a failed bid to crack 1.39. Technically it appears such markets are in need of a retracement and their potential depths likely rely on how bullish investors want to get on bond prices, which dictates how much lower yields and therefore the US dollar will go).

But as nice as it is to see yields retrace, there is a long way for them to drop before risk can truly and sustainably rally.

Market to watch: Gold, WTI Crude Oil, S&P 500, Nasdaq 100, Dow Jones, AUD/USD

US dollar technical analysis (daily chart):

The US dollar rallied nearly 8% in two and a half months with a clean runup, yet since October it has entered a period of choppy trade within a rough sideways channel. Whilst it holds above the 105.4 low, range-trading strategies are preferred. But it also suggests traders may want to think of their positions ‘at a day at a time’ as opposed to seeking multi-day swing trade – unless we get a fresh catalyst to drive global sentiment back into trending mode (one way or the other).

Market to watch: EUR/USD, GBP/USD, S&P 500, Nasdaq 100

RBA cash rate meeting

Tuesday’s RBA meeting certainly has the potential to be live, even if the surprisingly dovish Fed meeting may make some question if it let’s the RBA off the hook.

Australia’s quarterly and monthly inflation reports came in higher than expected, which provided the obvious queue for money markets and economists renew forecasts for a hike in November and even December. And whilst Governor Bullock seemingly tried to tone down her previous hawkish comments after the inflation report, by saying that the RBA are still deciding whether the numbers deviated away from their own forecasts to be deemed significant), I would be surprised if they don’t hike.

With that said, I doubt the RBA have the appetite to deliver 25bp hikes in November and December. Especially as they will switch to a new format of 8 meetings per year with press conferences. But a hike on Tuesday delivers the message that they do aim to contain inflation (whilst keep expectations anchored), and they can then make another call at the February of March meeting next year for further hikes.

Market to watch: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

China data (CPI, PPI, loan growth, trade balance)

For risk appetite to be truly revived, we need to see improved data from China. I can’t say I have high hopes, but a broad strengthening of data from the region is a must for global equity markets to sustain the rally we’ve seen over the past four days. The ideal scenario is to see a further pickup up of imports and loan growth to show China’s growth is being fuelled by domestic demand (as Beijing hope) whist a rise in exports would shows demand from the rest of the world – although it could be argued it provides more reasons for Western central banks to keep rates higher for longer. If China data is weak on aggregate, then AUD/USD and US indices may struggle to maintain the bullish momentum it has achieved so far this week.

Market to watch: USD/CNH, USD/JPY, S&P 500, Nasdaq 100, Dow Jones, VIX, AUD/JPY

From time to time, StoneX Financial Pty Ltd (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material.

As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed.