Hey traders

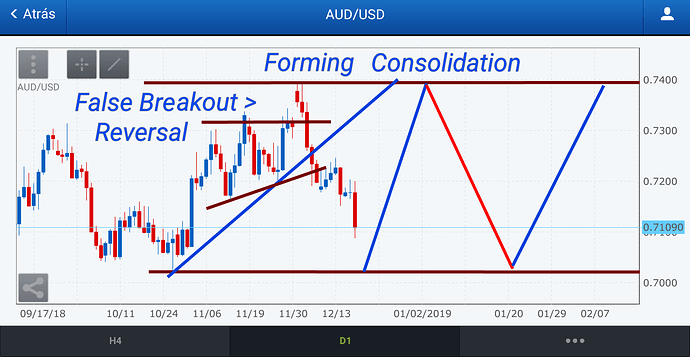

Check out another trade made on the AUD USD last week as we took advantage of the False Consolidation Breakout on the Daily Chart of this Pair. (Video to follow).

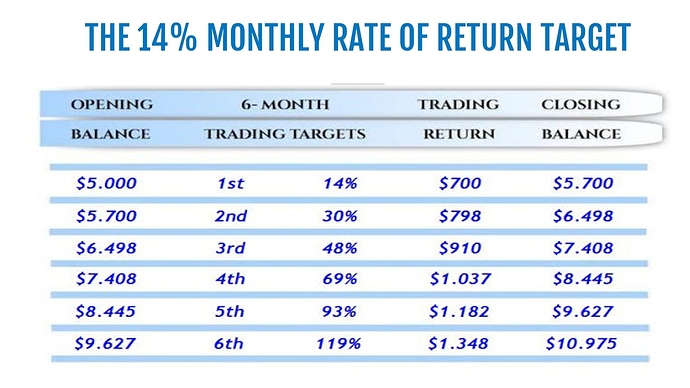

This reprensented a Rate of Return of 3.82% on my Live Account and depending on the level of Risk that the traders I help use, it would have represented a Return of between 2% and 5% on their trading accounts.

This trade also followed the CAD JPY trade we captured of 50 Pips that we got earlier that week, which represented an even larger 4.98% Return on my Account.

These are the types of Return Targets Per Trade that you should aim for as they will allow you to achieve significant Return Targets over both the Short-Term and Long-Term…

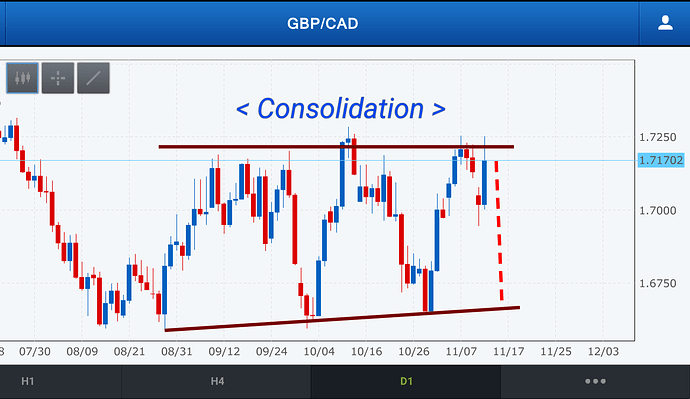

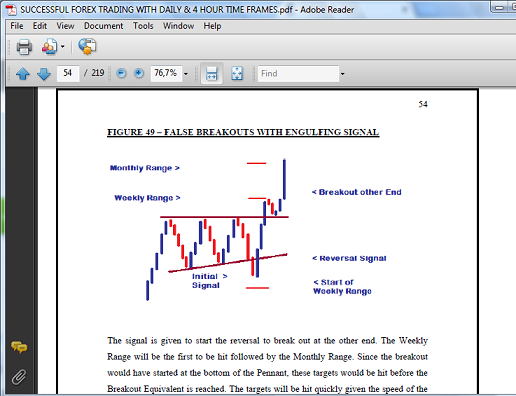

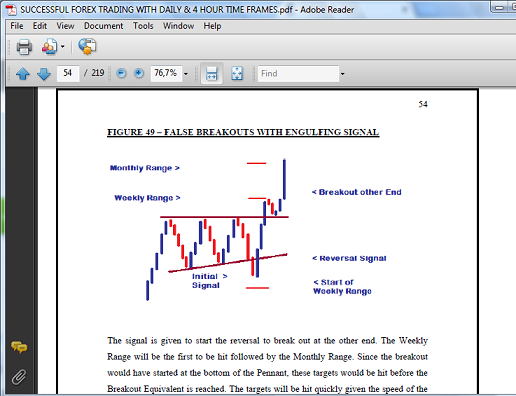

What we did was to trade the Pair Short at the Bearish Engulfing Candlestick Formation on the Daily Chart as it continued the False Consolidation Breakout Reversal that was taking place. This Downtrend was projected to be part of the formation of a large Pennant Consolidation Setup.

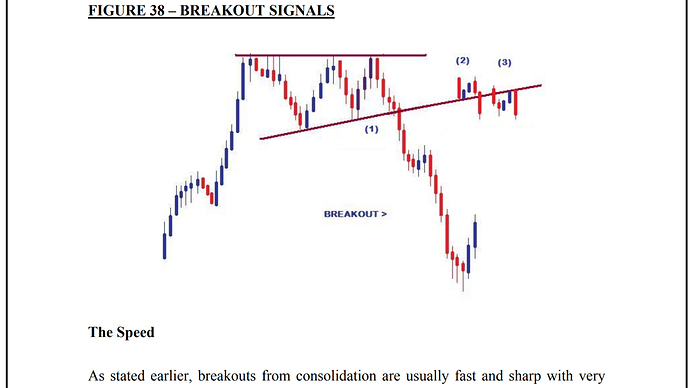

False Breakouts are one of several setups and Chart Patterns that start trends and usually move quickly. The breakout will fail at one end (in this case Resistance) and then start the breakout at the other end. Signals such as Bearish Engulfing Candlestick Signals allow us to take advantage of these trends.

Once this was seen, an Entry Setup was opened using the 4 Hour Chart. The Stop Loss was placed above the Downtrendline to protect the trade with the target set for an area just above the 0.7020 Support Price.

After 48 Hours, I decided/recommended to adjust the Take Profit Order to exit the trade at 0.7037 instead of 0.7025. This gave us 70 Pips instead of the 83 Pips originally targeted.

As you can see…the Stop Loss was not affected by the temporary pullback that took place. This was because it was placed far enough away from entry and above the Downtrend Line - an area that usually protects your trades once it is strong enough and on the Larger Time Frames…

So this was another example of how False Breakouts can be traded. Once it is clear and the Signals and Setups supporting them are strong and clear enough, they can be traded for strong gains every time.

It was also another example of the Aggressive Strategy now being used. Most trades are 50 to 70 Pips over 24 Hours…but sometimes 48 Hours are used to capture larger targets.

Duane

DRFXTRADING