The next entry in the theme of Corona Virus stocks is Waitr Holdings Inc ($WTRH). Biotech and software are not the only sectors benefitting greatly from the COVID-19 outbreak. The food delivery services are also making huge gains since the lows. Waitr has had an unbelievable run, let’s take a look at the history of the company:

“Waitr, Inc. was founded at McNeese State University as a project lead by Chris Meaux. It quickly spread throughout Louisiana and across the southern United States. In 2018, the company was acquired through a $308 million reverse takeover by Tilman Fertitta’s Lancadia holdings, which is part of the Fertitta Entertainment portfolio. Later that year, Waitr acquired Minneapolis-based Bite Squad for $321 million. In 2019, The company announced it would lay-off all of their employed drivers, and move to a contract-only model, similar to Grubhub and DoorDash.”

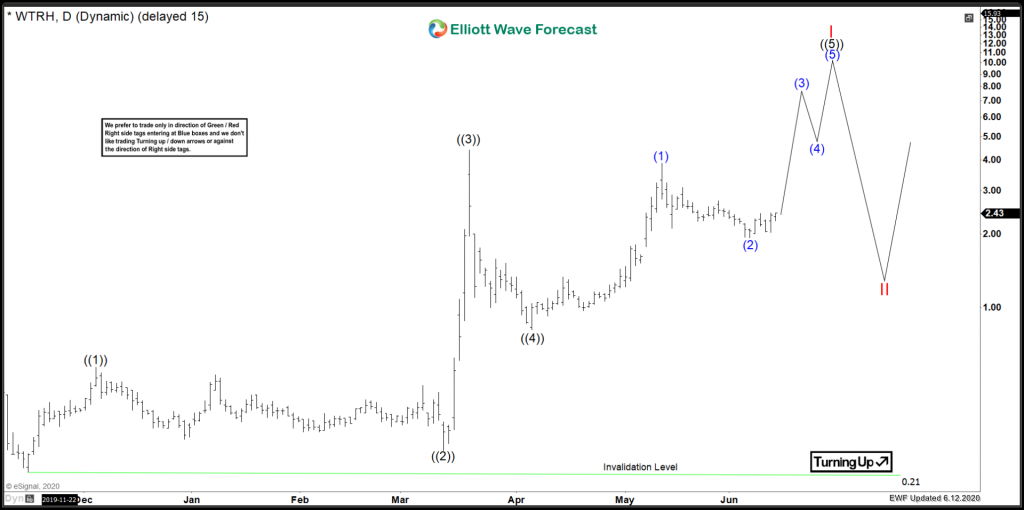

The Elliott wave count on Waitr is fairly clean, and points to more gains ahead. Lets take a look at the daily view.

Daily Elliott Wave View:

Medium term term view from 11/14/2019 lows of 0.21. Wave ((1)) was set at 0.57 on 12/4/2019 and wave ((2)) at 0.26 on 3/12/2020. After that, a sharp increase to Black ((3)) took place, which topped on 3/19/2020 at 4.40. This was an increase of 1600% in the span of 6 days. After that, Waitr has set a black ((4)) bottom, and is currently working on breakout out above previous ((3)) peak. Blue (1) of 5 is favoured to be set, with blue (2) also set. It is possible blue (2) can do a marginal new low, but the structure would remain the same, which is favouring a breakout above ((3)) to complete the sequence.

In conclusion, Waitr is favoured to advance in the final ((5)), with a breakout over the previous $4.40 peak expected to take place in the near to medium term future.