If Wall Street futures cannot fully roll over on bad news, it may not take much god news to help them rally. And that could bode well for the ASX 200 over the near term.

By : Matt Simpson, Market Analyst

President Trump has granted a delay to the European Union’s 50% tariffs to July, a pattern we’re now becoming all too familiar with. It allowed risk to regain its footing during quiet trade in Asia on Monday, with Wall Street futures printing small but bullish engulfing candles.

View related analysis:

- Nasdaq 100 Breaks Out Into Bull Market, Tops Wall Street Rally

- US Dollar Shorts Trimmed, Gold Bulls Return: COT report

- AUD/USD Weekly Outlook: CPI, RBNZ, PCE - Key Data Ahead

- Gold Rally Stalls Below Monthly High: Is a Deeper Pullback Brewing?

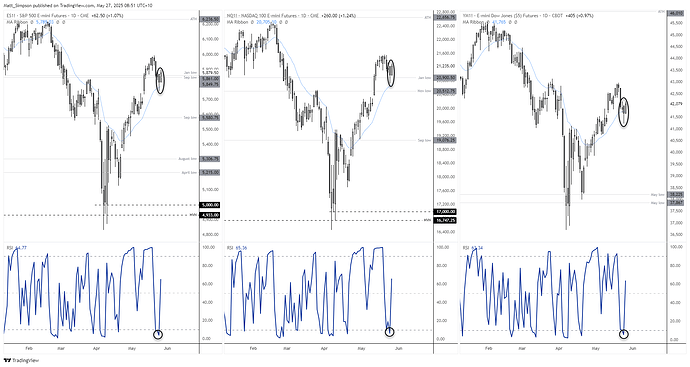

S&P 500, Nasdaq 100, Dow Jones Technical Outlook: Wall Street Futures in Focus

The daily RSI (2) moved from oversold and rose above 50 for all three Wall Street futures. The S&P 500 found support at the 20-day EMA on Friday and closed back above its September and January lows on Monday. The Nasdaq 100 held above the January low despite a false break of it on Friday while the Dow Jones closed back above its 20-day EMA.

I’m not anticipating large moves to the upside, but if Wall Street futures didn’t; fall on bad news then it makes them more susceptible to a rally on marginally good news. And that could bode well for ASX 200 bulls over the near term.

Click the website link below to read our exclusive Guide to index trading in Q2 2025

https://www.forex.com/en-us/market-outlooks-2025/q2-indices-outlook/

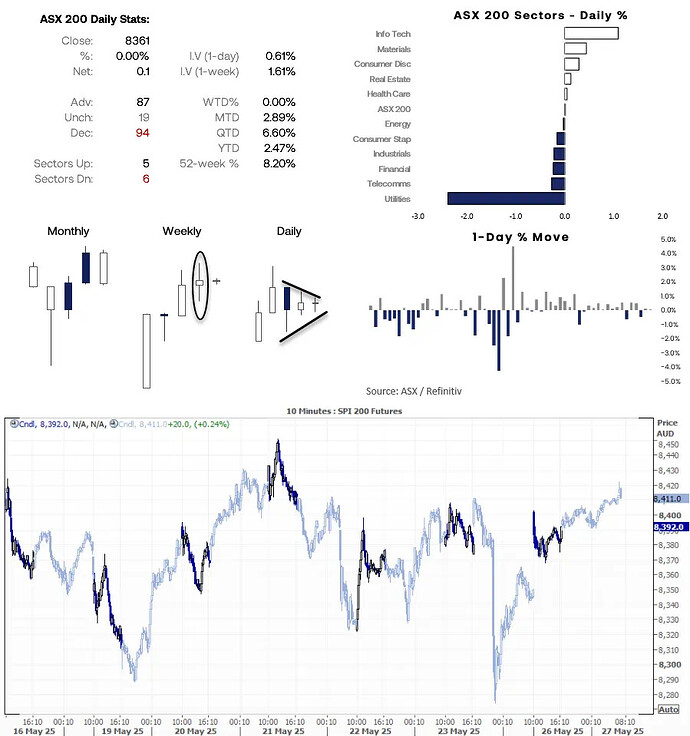

ASX 200 (Australian 200 Index) at a Glance

- It was a mixed performance for the ASX 200 on Monday, with five sectors rising and six declining

- Utilities led the way lower, info tech and materials were leaders

- 87 ASX 200 stacks advanced, 4 declined, 19 were flat

- The ASX 200 cash market shows prices are compressing on the daily chart, which suggests it could be approaching a period of volatility

- ASX 200 futures (SPI 200) rose 20 points overnight (0.24%)

ASX 200 Futures (SPI 200) Technical Outlook

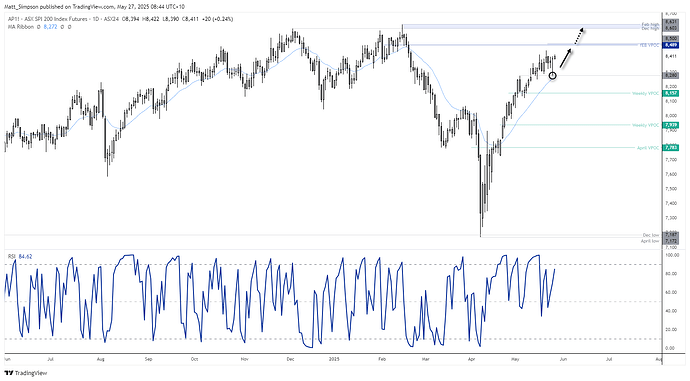

The ASX 200 has continued to defy the doomsayers, rising nearly 18% from its April low to last week’s high. It hasn’t seen much of a pullback, though prices have been moving more or less sideways over the past couple of weeks.

A bullish pinbar formed on Monday, and its daily low held above the 20-day EMA, 8280 high and 8300 handle. The setup is simple; bulls could consider dips within yesterday’s range in anticipation of a break above last week’s high, for a move to 8500 or the highs around 8600.

Economic Events in Focus (AEST / GMT+10)

- 09:01 – UK Shop Price Index

- 09:50 – Japanese Corporate Services Price Index

- 11:30 – Chinese Industrial Profits YTD

- 15:00 – Japanese Core CPI (Bank of Japan)

- 16:00 – German Consumer Climate (GfK)

- 18:00 – BoE Hauser Speaks

- 18:00 - FOMC Member Kashkari Speaks

- 19:00 – European Sentiment Index, Consumer Price Inflation Expectations

- 22:30 – Core Durable Goods Orders (MoM) (Apr)

- 01:00 – CB Consumer Confidence (May)

- 01:30 – Atlanta Fed GDPNow (Q2)

– Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.