NFP is done and this week we are going to add more setups as we’re still on stronger dollar bias. USDCHF just hit the demand area, expecting to be going higher after. Just need to zoom in to confirm.

More confirmation is needed on USDCAD as price is in the middle of lower run towards this demand area. Our aim is to go higher than previous week’s high.

EURJPY is seen to be moving lower as price just left a supply area. Price is expected to retrace and hit this area to continue the lower price movement.

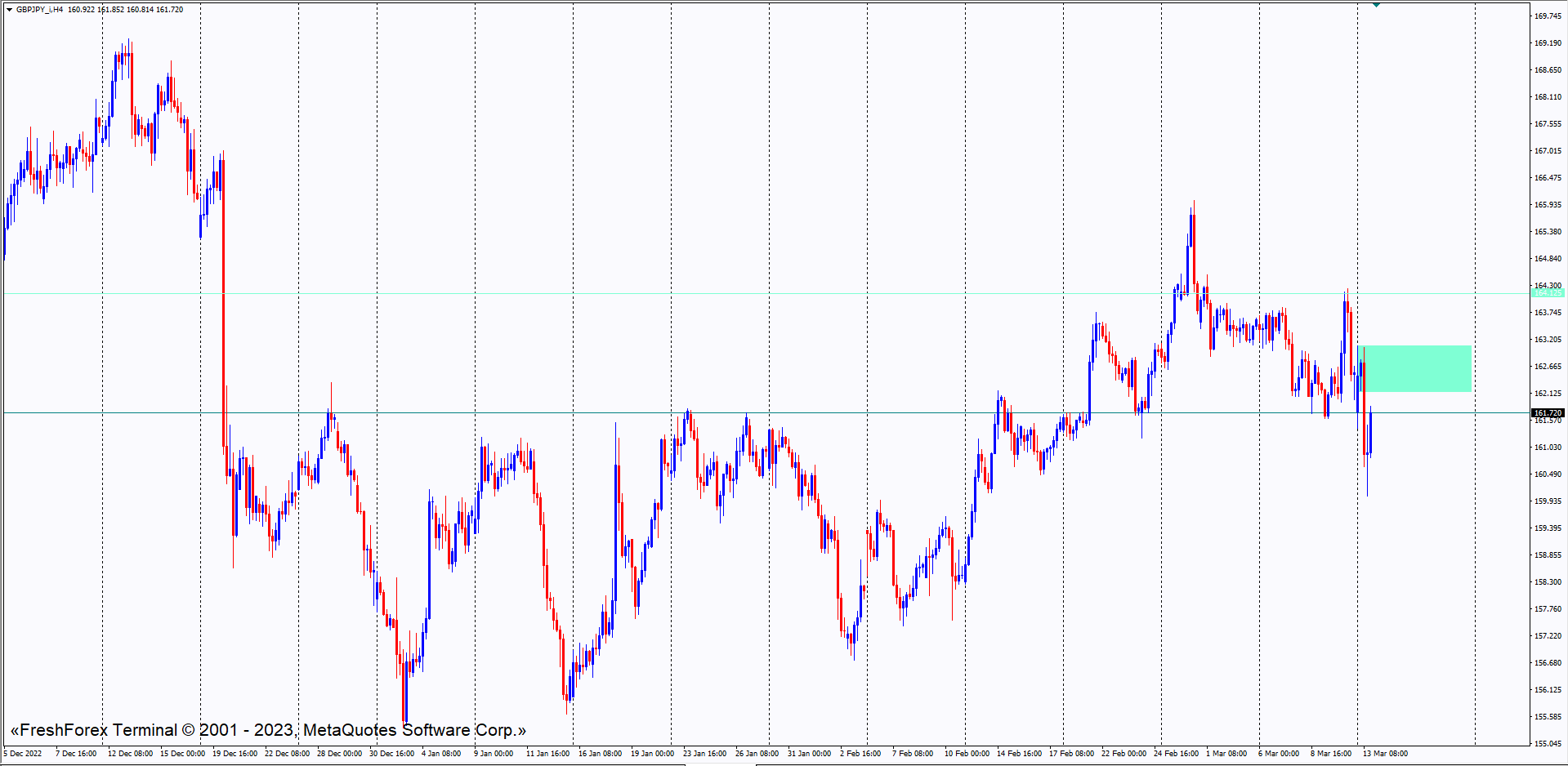

Also wait and see for GBPJPY to also retrace and hit this area for continuing the bearish trend the pair just created.

This week’s webinar will discuss market movement after NFP and how we are going to face 2023 after a long break since December. Don’t miss out in FreshForex’s website.

A bit unpredictable month as EURUSD went higher after touching the demand area a couple of times and expecting to hit this supply area before FOMC this week.

On GBPUSD, we can also see a supply area to be hit later and wait for a reaction on FOMC this week. Just wait and see for now or look for a buying setup before Wednesday.

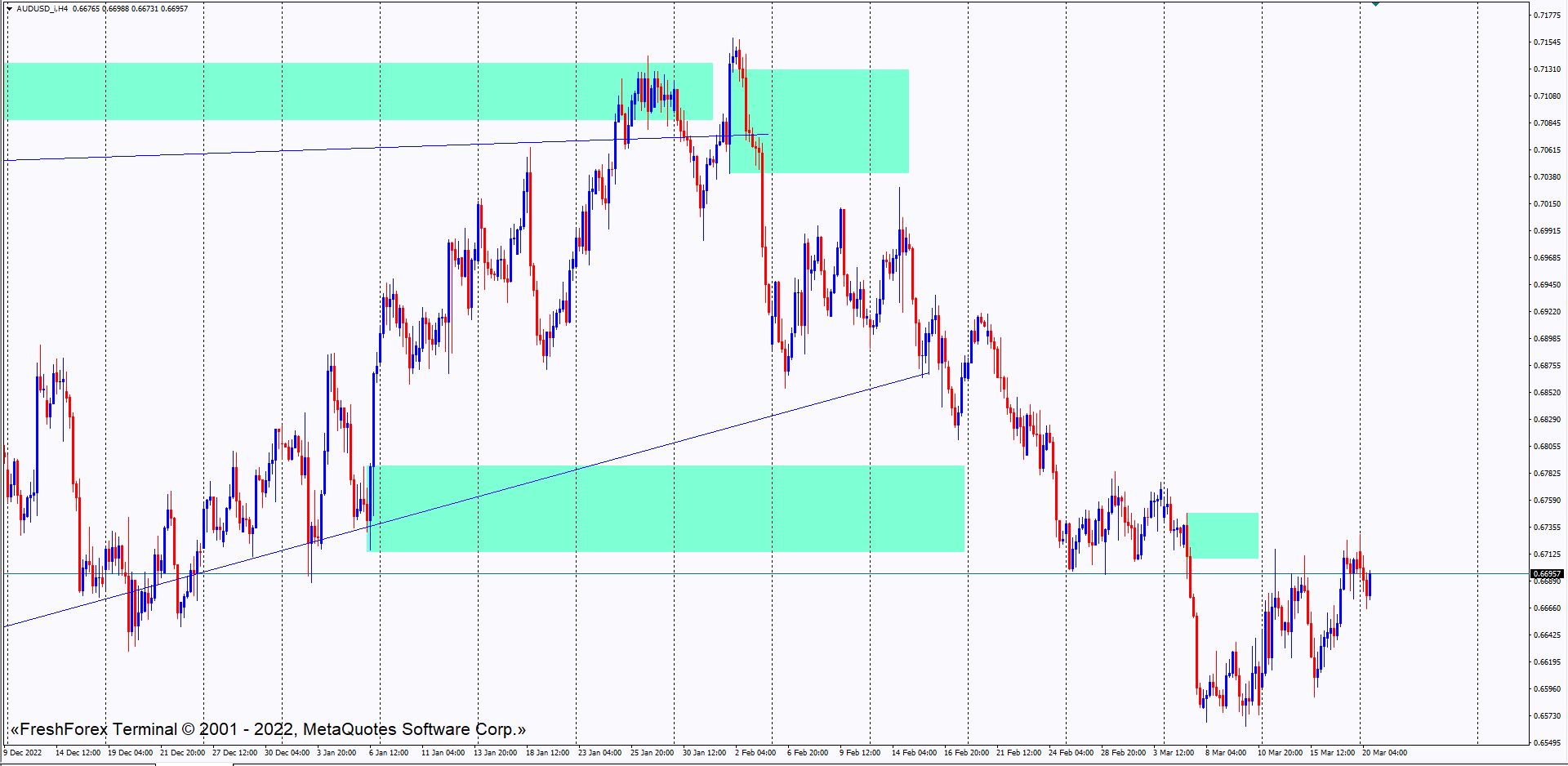

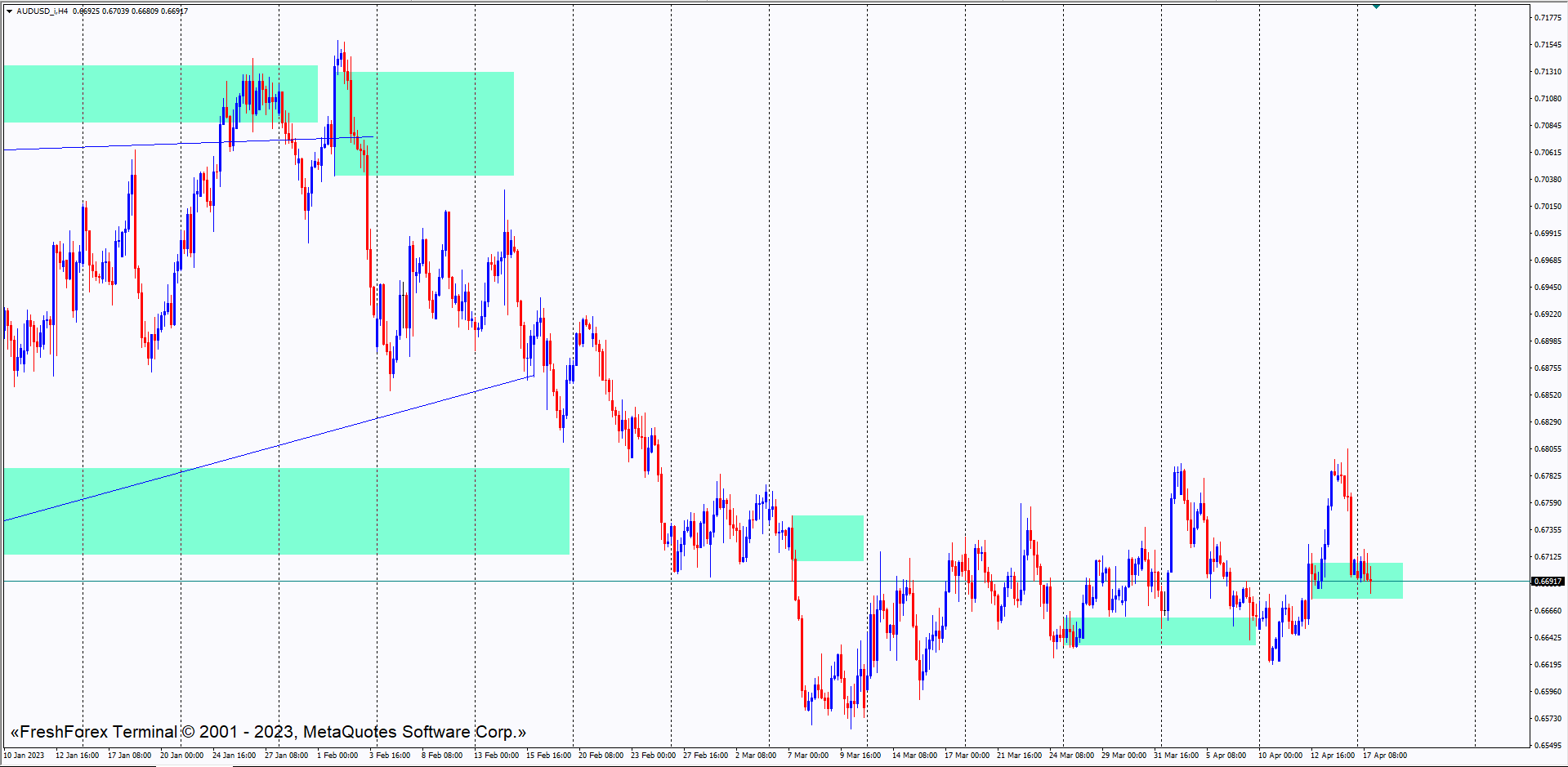

AUDUSD, on the other hand, is creating a ranging price action and a short term trend can be expected later after FOMC. Currently waiting for a reaction around this supply area.

Gold is going pretty fast in terms of price movement and ignored the previous area mentioned. Still managed to grab 120 pips but we are expecting price to react at this area on higher timeframe.

A sell can be done this week on EURUSD where you can try it after the retracement around this area. Just be sure to do it on smaller timeframe as the price already reacted on the higher timeframe supply area.

A little cautious on selling GBPUSD as price is struggling to react on this supply area. Smaller timeframe confirmation can signal the sell later this week.

After a breach in the supply area, we will see any continuation of GBPUSD. NFP week so we only see how the price reacts to it today.

A good reaction from NZDUSD from this demand area, a buy setup may come across after so we will see.

Another high for the year on Gold. We’re also going to observe the rally after hitting this demand area.

Be looking for new opportunities. Starting from EURUSD where we can expect retracement to this area so we can start buying later.

We can also see on GBPUSD where price is currently on the same area we mentioned last week. Just wait and see for another buying.

As for AUDUSD, we can also see a new high was created, this can be an indication of higher price later. Just wait for any confirmation around this area.

Gold is doing great so far with the new high created and even touched the buying target we aimed earlier. Just wait and see the retracement to this area and look for another buying confirmation.