With the recent failure in Silicon Valley Bank and First Republic Bank, we will take a look at the U.S. banking sectors. In this article, we will update the long term outlook of Wells Fargo & Company (WFC). Wells Fargo is a diversified financial services company which provides banking, investment, mortgage, consumer & commercial finance products & services in the US & internationally. It is based in San Francisco, CA, comes under Financial services sector & trades as “WFC” ticker at NYSE.

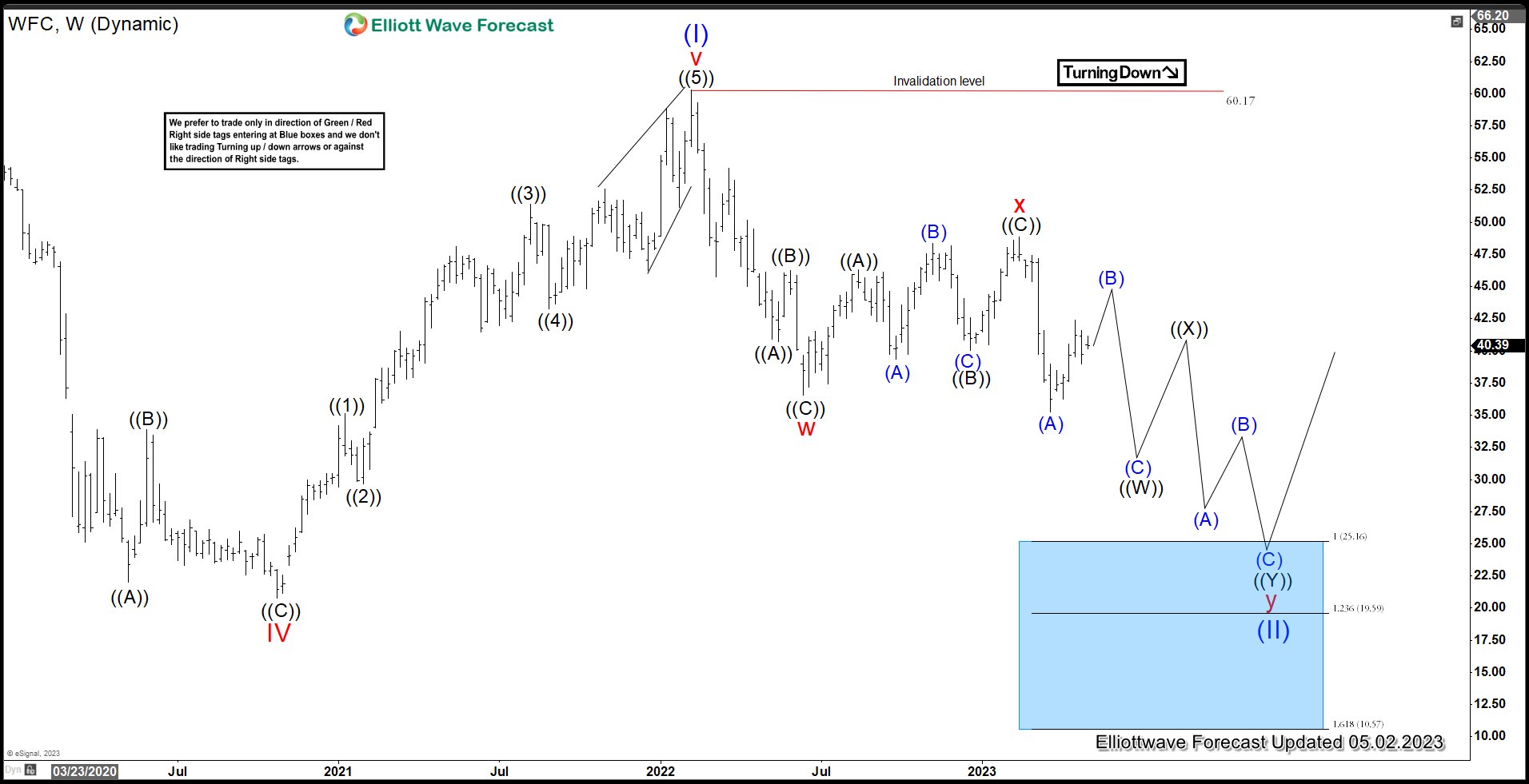

Wells Fargo & Company (WFC) Weekly Elliott Wave

Wells Fargo & Company ended Super Cycle wave (I) at 69.17 and the stock is now doing correction to the all-time low within Super Cycle wave (II). Internal subdivision of wave (II) is unfolding as a double three Elliott Wave structure. Down from wave (I), wave w ended at 36.54 and rally in wave x ended at 48.84. The stock has resumed lower and broken below wave w at 36.54 suggesting the next leg lower has started. Target for wave y lower is 100% - 161.8% Fibonacci extension of wave w at 10.57 - 25.16. This area, if reached, should be major low and provides good long term buying opportunity.

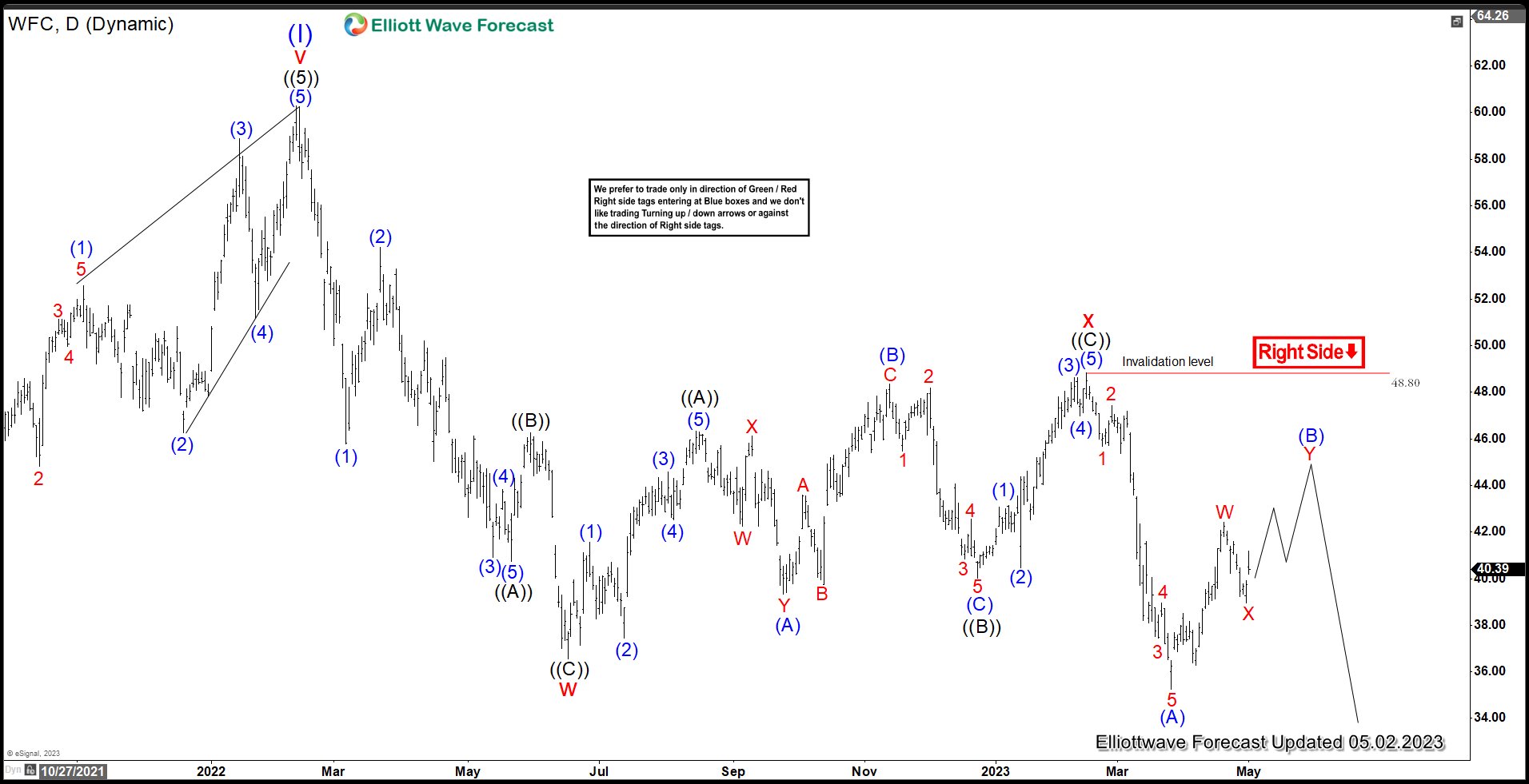

WFC Daily Elliott Wave

Daily Elliott Wave Chart of Wells Fargo & Company above shows the stock has 5 swing bearish sequence from wave (I) high, favoring further downside. The stock is now rallying to correct cycle from 2.14.2023 high within wave (B). Rally should fail in 3, 7, or 11 swing before the decline resumes. As far as pivot at 48.8 stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Target for wave Y of (B) rally is 100% Fibonacci extension of wave W at 46.1.