Hello Ladies and Gents,

I paper traded yesterday, being a bit busy at the moment, I wanted to see if I can quickly determine a daily directional bias every day b4 LO and if so just set up a mark on the charts where I would enter and see each evening if I called it right. So far… so good…

This penny may have dropped for you all ages ago, but hear me out…

I consider determining the daily directional bias as the basis of all that ICT’s taught us and when you can nail that, the rest of his tools work so effectively. Before this became apparent, I would look at the 15M chart at LO, and say, OK, Market Flow on the Daily and 1H is up, we’re in a buy zone - below central pivot, lets go long, and then we’d have a large range bear day. Crapola.

Focusing on the daily chart, WAITING (“Patience patience patience!” - ICT, 2011) for:

- range contraction,

- candlesticks showing a reversal (pin bar or 2 bar reversal, or final move in a counter-longer-term-trend retracement

- either of the above at significant S/R, higher TF fib level.

- an extended run of a series of candles in the same direction, indicating a pullback is imminent, but only looking for pullbacks that go with the longer term trend.

If I don’t have a daily set up like the above, then I can’t call the direction of the day with a high probability, then… dum dum daaah… I don’t trade that day… or… I wait until NY open to see if the intra-day data has provided me with a high-prob set up. But deciding not to trade because of what the daily chart tells me, has been, at least this week & end of last week a highly efficient filter and feels like this is an “edge.”

So twice this week there was, on the daily charts, what I would consider (and I’m just learning this, so my analysis will be slightly limited) situations telling me there is a high prob that the coming day will move in one direction.

For example: on the GU, on Monday there was a large range bull day. Preceding that, to me, there was nothing to predict that move. But already, I know: "large range, short range day, large range day, etc " ICT, 2011.

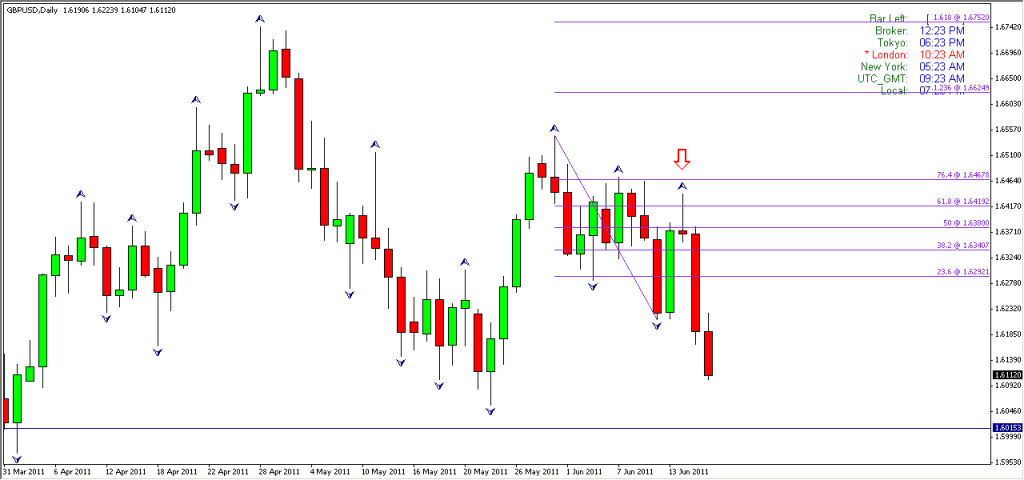

So i wait… and I am waiting for a pullback into, what looks to me like a longer term bear move, as we have lower highs since that high in early May. So I don;t really want to trade counter-long-term trend, so I wait for a large range bear day set up.

Tuesday prints a pin bar/inverted hammer, whose nose/wick hits and slightly transects my weekly fib i’ve got drawn on that has acted as S/R in the recent past. This suggests a strong rejection of this level. My ADR(1) shows range has contracted albeit a little, but now, I am expecting a strong move down with expansion, which would be in the direction of the longer term trend. I know the weekly & monthly MF are still up - but i figure it will take a little while before those fractals are broken. So I’m looking at the down trend based on the daily market structure.

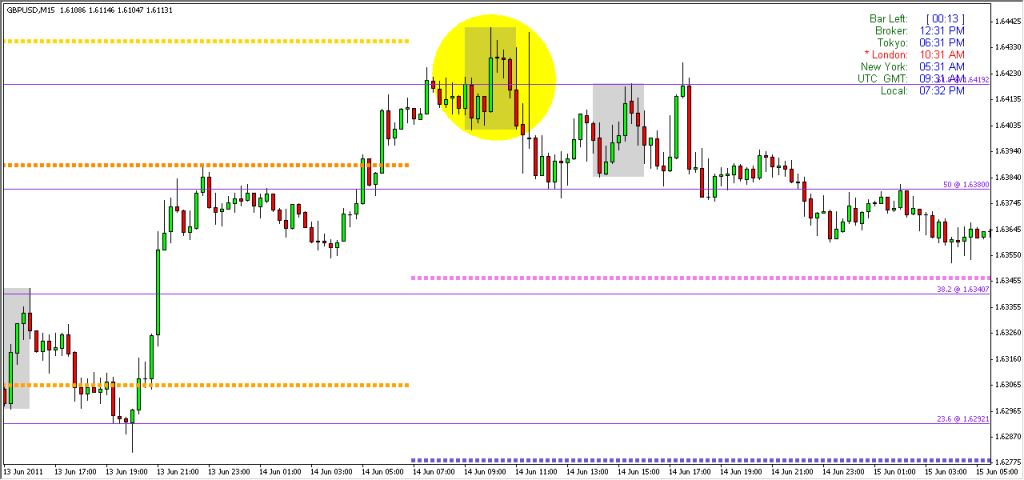

Wed morning, LO, price opens near CPP, so here i was a little hesitant, so I would prob reduce my risk to maybe 0.5%, I figure I want ALL the ICT tools to line up for me to risk EVERYTHING!! which = 1% ha ha!

There was a move down, so i draw my fibs, put my paper trade on and SL (30 pips from entry).

Staggered exits as per ICTs method would of closed out 2/3s of the trade 2 hours later. And, this may of been different if I had a live trade open, but I could of let the final 1/3 run until LC - as ICT mentioned once… if so… with ICTs top down analysis and tools yesterday the trade would of caught pretty much all the large range bear candle, = 165 pips.

That’s an R:R of 1: 5.5.

And I’m off to play golf with my lawyer buddies for the rest of the week.*

I thought to myself, I could of played the break of the pin bar on the daily… but by going down to lower TFs and waiting for the move in the london session, that allows you to place your SL closer to entry (otherwise R:R on daily chart would of been about… 1:2) and also, there’s that extra weight of probability when price starts moving as anticipated by the higher TF analysis, when you’re watching it in LO. I use SMT here too for further confirmation.

Cheers ICT, its clicking into place over here!

*just for full disclosure, i don’t have any lawyer buddies nor do i play golf.