So here is my weekly update (sorry its a day or so late).

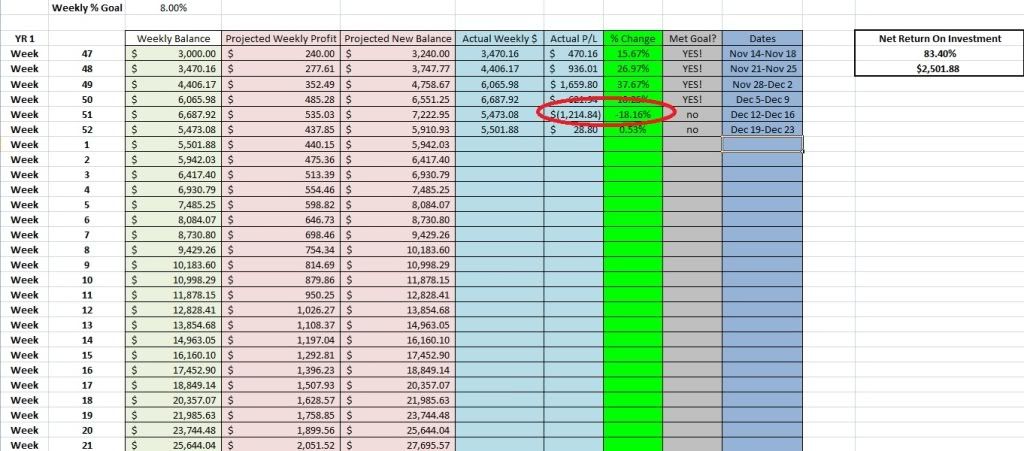

This past week was BY FAR my worst week in forex since I’ve gone live. I had by far exceeded my weekly goals for the first 4 weeks of my live trading adventures and was on top of the world. A small (or large) part of me was already counting my millions. And then Monday of last week came. I lost 3% on my first trade after not managing it appropriately, and quickly revenge traded cause I was mad at the market/myself and lost 4% more. I told myself to be done for the day, and that I probably shouldn’t trade anymore for the week. Well, I quickly learned a lot about myself and the lack of discipline I have, and how FAR I have to go to get to the point where I am a psychologically, emotionally stable trader.

I was hesitant to post my results for last week, embarrassed, even had thoughts of fudging the numbers…but where would that have gotten me. I am trying my absolute hardest to take some good from the week and learn from it, and hopefully help others out there who may have similar feelings in a similar situation.

So…on Tuesday, I woke up with the intention to not trade, but as I looked at my spreadsheet and saw again how far my account had dropped in one day, I got angry/sad/frustrated and I felt like I just HAD to get my balance back to where I started the week. I over-traded, over-leveraged, and was taking trades on a whim. Well, “shockingly” I kept losing. I had a 25% overall draw down in my account by Wednesday. I should’ve stopped then (well, I should stopped even sooner…), but I made a few successful/lucky trades on Thursday/Friday and got my account up to an 18% loss for the week. 36 TRADES - 20 LOSERS. Shameful.

So after a weekend of not being able to trade I was trying to look deep down and figure out what was at the center of my thought process during the week, and how I could avoid ever having another week like this…

Here’s what I came up with:

-

I ABSOLUTELY NEED MORE RULES!

I have some basic rules written down, but the majority of my trade strategy is in my head. I’ve told myself that I’ve learned a lot of ICTs principles and I will follow them, but that I also need to let my self have an added element of discretion that I can apply to take trades that “feel right.” Well, that cannot be the case for me right now. Maybe when I have years of experience, like Michael, I can take trades off of instinct/experience/etc, but not now. I need to write down ALL my rules and stick to them. Gotta get emotion and gut feeling outta this right now!

-

I AM NOT ENTITLED TO ANY SPECIFIC $ AMOUNT IN MY ACCOUNT

When I lost 7% on Monday, my account had dropped from $6687 to $6218. Now, all I could focus on were those two numbers. I had such a microscopic view of that day and my net loss for the week. I was not focusing on the fact that at that time I was still up over 100% in a little more than 5 weeks! Looking back now, I can’t believe I was sitting there upset with myself with results like that. But no, I couldn’t see the big picture at all. I just felt so upset that I was moving the opposite way of reaching my WEEKLY goal that I couldn’t see ‘the forest for the trees.’ I’m thinking that this is going to be a key part in my development and my ability to handle losses. I need to focus on the big picture, not the day to day profits/losses. When I started forex, I was WELL AWARE that I would have LOSSES. It’s just inevitable. Yet, I was somehow shocked and angry and couldn’t handle that I would actually lose money! I couldn’t mentally handle having a losing week I guess. I think subconsciously my brain was telling me that something was wrong that my account was now smaller than it was last week, when in fact, I know that fluctuations in my account WILL HAPPEN. And I need to learn to deal with it, and need to have set rules in place for when I do have losing trades (see point #1 above).

-

I MUST MANAGE EVERY TRADE THE SAME AND NOT LOOK AT THE BIG PICTURE

Wait, didn’t I just ramble on and on about how I need to look at the big picture more? What I mean by this is that even though in order to take the sting out of losses I need to focus on the macro picture, WHILE IM IN A TRADE, I can’t be trying to get my account to a certain “magic number” or be trying to make up for losses. I simply need to try to manage that trade in an isolated fashion, only focusing on making that trade profitable and adjusting S/L and T/P appropriately. When I was doing so well my first few weeks I had no problem banking 20 or 30 pips and happily closing a trade…just adding more $$$ to the pile. BUT, when I was sitting there down 7%,10%,15%,20%, my approach was entirely different. As soon as I would enter a trade, I would draw some fib extensions or look to a far off area of support or resistance and say "Okay, if i can just hold the whole thing for 70, 80, or 100 pips, I’ll get X% back of my losses. And sure enough, even when I was right in my trade, I would see it go 40 or 50 pips in my favor and then change direction, and I’d end up losing money on the trade or finally closing at BE. Basically terrible trade management, plain and simple. Again, back to point #1, I need to have written down, established trade management rules that I will adhere to regardless of where my account is at any given time.

So, those are my thoughts. I need to be patient, disciplined, follow my rules, take emotion out of trading and focus on the big picture. Groundbreaking concepts, I know  But I just felt writing down my thoughts would help me out, and hopefully someone else out there got some value out of reading them.

But I just felt writing down my thoughts would help me out, and hopefully someone else out there got some value out of reading them.

And so far this week I took a small trade this morning, for the right reasons, didn’t over-leverage (actually risked a lot less than I normally do), and closed it out for 15 pips and was HAPPY!

Merry Christmas and Happy Trading all!

Matty

Keep up the good work!

Keep up the good work! But I just felt writing down my thoughts would help me out, and hopefully someone else out there got some value out of reading them.

But I just felt writing down my thoughts would help me out, and hopefully someone else out there got some value out of reading them.