Higher TF TT showing that price is in buy zone moving toward fair value. I was looking for buys today based on that and some SMT divergence in the asian session. I did not take a trade b/c I was not feeling where price was on pivot points, but just an idea of where price might be going.

Was about to post a pic but saw sladhaFX’s post below yours. Got it sorted, thanks guys.

Recording up. Long boring and unorganized. Perfect waste of three hours.

:0)

haha you say about 5 times in the beginning it will not be recorded, but waste of 3 hrs… never.

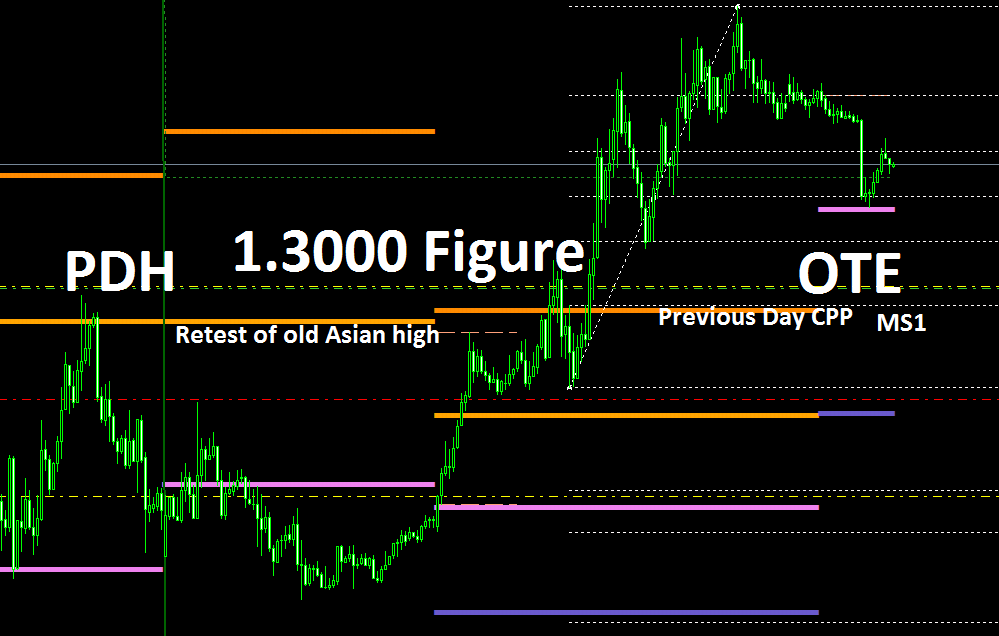

So just demoing still til next week, but here’s my analysis going into LO…

4h MF up

Market structure bullish

Looking for longs

Would like to see price trade down to the figure coming out of asian session…TONS of confluences there for a nice Judas swing

Pending order long for 1.3000…we shall see how this plays out. Thoughts?

Matty

Time to sit with a cuppa this morning and catch up!

both, Fiber and Cable are oversold on too many tools, I got a pending sell on the Cable… we shall see… as I type this, Cable forming Judas going into london…

Hi All,

Following from my post yesterday about starting from page 1, I have scanned the first 40 or so pages and come up with the following timetable I will be following, just thought it may help other newbies like me just starting. I have put together the videos with the thread pages and a timescale I will be following.

Video | Thread Pages | Thread Time | My timetable

A,B,C | 1-3 | 6 wk | To Jan 29

1 | 4-7 | 1 half wk

2 | 8-9 | 3 wk

3 | 10-17 | 3 days

3.1 | 18-19 | 2 wk

3.2 | 20-22 | 1 wk | All to Mar 4

4 | 23-25 | 1 wk

4.1 | 26-29 | 1 wk

4.2 | 30-34 | 1 wk

4.3 | 35-42 | 1 wk | All to Mar 31

I hope my posts aren’t clogging the thread, Michael, please let me know and I will refrain. I just thought it may help newbies like me begin learning with a timescale similar to how the thread started, to enable the material to be properly absorbed.

Regards

John

Hey guys

Does anyone have an MT4 indicator that displays the current price in the corner, but like in a much bigger font?

although I wanted to wait until next monday to start demo trading, I could not resist and have a look today.

Im looking at the cable, and as a complete newbie, I would appreciate it immensely if one of you, more experienced traders could help me.

First I need to admit that I did not look at the COT, as Im still trying to find good sources in the internet to have this nice overlay of commercials, vs dumb money, vs large investors, like ICTs Esignal… but free;) hahaha (any suggestions?)

SMT (daily) the way I understand the SMT tool (and today is the first time I try to incorporate it into my analysis!) it seems to me that there is a bearish cable/fiber divergence. I was looking at the daily charts and I noticed, what I believe to be a divergence, on the open bar (or is it only valid once the bar has closed?)

If this is correct, it would mean a Bearish move.

USDX divergence (with the inaccurate forex ltd feed) seems to be in line as usdx does higher lows and fiber lower highs (again: on the forex ltd, daily chart) - I don’t see a crack in market symmetry here.

Bond yields (stockcharts.com) seem to be going up together nicely (is there a way to zoom in? to see weekly or daily moves?)

looking at the higher time frames I have a bearish bias, while 1H and 4 H seem to be bullish.

Daily Pivots are in overbought. Trinity is in sell Area. Williams %R is overbought.

18/40 EMAs are bullish in 1H and 4H but bearish in higher TF.

at the daily chart, a fractal low has formed on dec 29th, that would have offered a lovely long entry yesterday (and many of you have taken it, as I noticed in the thread… but I just started my demo today…)

My bias is bearish in the long term, but I remember ICT saying that we should look at the 4H bias + 1 (either H1 or D1).

this would mean a bullish trend? Which ones of the mentioned signals are stronger?This is really confusing me;)

Price moved out above the asian range, heading to yesterdays high (and I assume also to the stops there)

Below Asian Range I see a nice confluence of Support levels at around 1.5580, which in it self is a nice round number, but its also yesterdays asian high AND the 50% level between Decembers High and Low. A bit further down we obviously have the 1.56 level which confluences with the weekly TT sell button.

now I know that I should not try to bend what I see to what I want to see…

anyways I expect to see a judas swing:

eating the stops above yesterdays high (which should happen soon I guess) and then slam down to one of the above mentioned confluencing S+R levels.

Im posting this with a huge question mark! wait for it… ??? (there it is)

I need a reality check. As I am really just starting out right now, I would really appreciate hints, advice and feedbacks on how my analysis today is holding up… Price will show me later today, how far off I am, but what interests me is how to improve my analyzing process and thought process.

Ive been sucking in all of ICTs material for the past few weeks, and I learned such an incredible amount in such a short time. But it still seems to be a far road from understanding my notes to implementing it on demo.

Have a great trading day

and feel free to drop any comments or advice

Sincerely

Fredy

Pretty Awesome when you anticipate it and BOOM, Did you get filled?

…I’ll stop pulling my hair out for a minute to answer your question: nope, missed it for 2.7 pips! My order was at 1.5671… this is real pain, but I’m glad I stud to the rules and did NOT chase the price… always next time! lets see what NYO brings…

cant really believe, they did not ‘‘kiss’’ the stops above yesterdays high (less than 2 pips on cable and less than 4 on fiber) before push it down!?! ‘‘turtle soup’’ was my entry pattern of choice, if it was an OTE I would’ve gotten on the train… oh well…

what about you?..

very well, Im not the only one who anticipating a reach for yesterdays high;)

(this is comforting as my analysis might not be all that bad, but not comforting to see you pulling out your hair! haha

who knows, maybe this was just a nice 35 pip fakeout, and in a perfect world it would go up to OTE and then slam down all the way to the line of the ICT_ADR indicator (this is one indicator I seriously don’t understand;))

yeah, my analysis was pretty similar to yours (not saying we are both right, lol)… probably the low liquidity still is the reason that things not going to plan, for example: not obvious Judas yesterday, no stop run today, etc. ICT is not trading until next week for a reason… markets still ‘‘warming up’’ I guess

ADR is simply anticipated Daily pip Range, based on the last five days action… definitely not 100% accurate, also ICT recommends not to use it first half of the day (before NYO)…

GLGT! :41:

hello guys

i am in the opposite side of your trades many thing in my view looking to go bearish on cable

- TT

- pivots

- Judas swing

- the market flow to the down side

- SMT to the down side

- OTE to the down side from the judas swing

lol it’s exiting that’s although we have the same teacher we have different view that’s makes the learning more strong.

lol, read todays posts again… you’re actually on ‘‘our side’’

thanks for the ADR info… still haven’t managed to read through the whole thread (I might be able to do so once ICT closed down this one… but there are more new posts everyday than I can read hahaha)

very useful info about ADR only after NYO!

Price actually went up to my anticipated OTE… But I will not trade yet (need to stick to my own rules: no trading until second week of January;)) But I just wanted to turn my notes into reality and do some analysis today. I hope by Summertime I feel more comfortable with all the tools, and hopefully the charts will be talking to me rather than confusing me;)

Are going to enter short or have you entered short when it was in the sweat spot just around 30 minutes ago? (wa staking a shower that time, missed it;))

hhhhh lol yes i didn’t read it will put still there is someone think it’s going the opposite way i think i read it in the previous pages

one of my rules (well ICT rule) states: do not trade outside the kill zones! so I’ll stick to it and wait for NYO to give me an entry, but yes it was good opportunity to get in on the retracement… but saying that, it starts to look as a z-day more and more (particularly on the cable), I was expecting it tomorrow before the NFP on friday?..

yes i agree with you Kubio it’s forming a Z day because SMT now in bullish between cable and fiber and USDX

i am in the trade right now looking for 30 pip then keep the rest at BE

the market already paid me the 30 pip now i am not loosing in fact that what ICT refer to it last night you can be profitable even if you are wrong if you understand the higher time frame analysis. i am not saying that i am perfect in this but that’s how we can learn.