Hey Guys…Just wanted to call attention to the divergence and a pattern on a higher TF chart similarities on the Cable back in 2010.

First Chart…Shows divergence on the EU and GU using Week of Nov 20, 2011 as a reference point. EU has gone pretty far below that level. GU still has yet to close below that level even this will be the 4th consecutive week of the EU closing below that level. This was a ITL for both pairs established in the same week. EU has been below it for a month. GU has not closed below that weeks level yet.

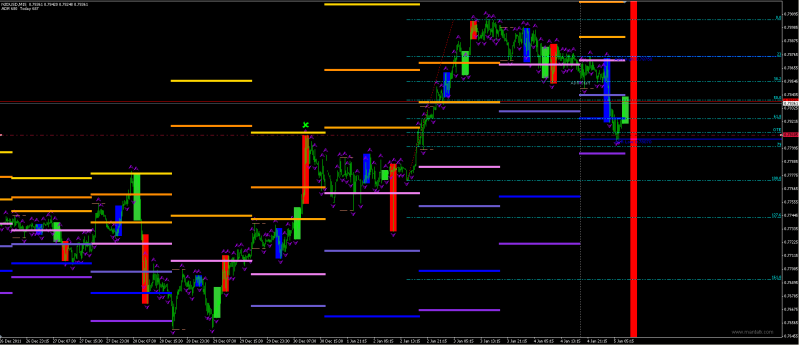

Second chart. Shows divergence on a daily chart using closer reference points. Today is set to close below the Dec 29, 2011 EU low, while the GU is not. Another bullish divergence.

Now…we don’t use the presence of divergence to initiate a trade, rather confirmation. I just watched the reversal market profile video (about 9 minute silent video). This 3rd chart highlights the GU weekly. The first blue rectangle…note that we established a swing point low on the weekly chart the week of Sep 5, 2010. Price went up, retraced, but didn’t break this 1.5490 level, then went up to 1.6744…a 1400 pip move up established April 2011 which is out LTH reference point on the Cable.

If you were to drill down to an hourly chart, you would see October 4th was a ‘reversal market profile’ day where it looked like a sell day, then LC/late NYO price reversed and went higher through the NY, LO, and Asian highs, consolidating around 1900 GMT. Then on 10/6/11, there was another late in the day rally (although didn’t blow through the NY/LO/Asia highs as the move down was aggressive).

We saw price reverse using the reversal market profiles at this key weekly level before. We’ve seen 2 significant bounces off this level since Sep 2010. Careful trading if your looking for sell days. We could have a reversal coming up again at this key support level.

The chart in 2010 established this level, then price went up, retraced, but didn’t quite reach it, the launch higher. We could be in the retracement phased repeating the pattern from before.

The market seems primed to potentilly move higher…COT data pointing to commercials being long. very key long term support level in our sights, and buillish divergence forming on higher timeframes.

GLGT