Nice OTE entry on the EUR/USD right at London open today! I’m pretty sad I missed the entry, but an evening out with the lady is worth more than a few pips I think!

That must be some lady to rather be with her than trading! haha. There will always be more opportunities, besides it’s just Tuesday. The week is young

I missed the OTE entry too… similar situation to you just i wasnt out with a lady… i was watching ICT’s latest video… lmao… only saw the entry after finishing the video… oh well… there are a lot more sessions and opportunities…

Aw… looks like today is those once in a while sweet setup for the fiber…

Entry confluent of daily TF money flow, london S2, ADR Low, 1.4380 int level and OTE.

And no major resistance till confluent of the 2 pivots R1, ADR high and yesterday’s daily high…

Anyone got on the ride of at least 80-90 pips???

I was watching ICT’s latest video so missed it T_T…

Yes, I took it long off the Hourly chart, made some nice pips, it was breakfast time here so easy catch at that time. I also took AUD/USD long off the Hourly at the same time, not sure many of you trade that on this thread but I could not resist that low test into the 200ema/S2. Around 2% on each, nice start to the day, makes up for a small backward step yesterday!

Updated the indicator again , the main change is the lines will only be drawn for the last 2 days so when you zoom out you will not have lines extending across the screen; makes for cleaner charts.

i-HighLow_customizable(v5).zip (14.1 KB)

Took 3 trades tonight (Fiber, EURGBP, USDCHF) netting +47 pips or 1.87%.

Fiber: +39 pips

EURGBP: -17 pips (got really unlucky with the SL on this one, and this is the one I fancied the most!)

USDCHF: +25 pips

I have remained patient these last few days, and I am now looking at +7.37% with 3 sessions left in my initial 4 week trial period trading the London Close.

Very nice trades Alishijo!

Those are some nice LC scalps, schools a bit more flexible once again, I will be starting to focus on LC scalps. =)

Regards,

Clark.

Hello guys, just a quick question. I downloaded the pivot macro for the mt4 program. Does anyone know how to configure it so that the pivots show on your OANDA mt4 platform?

Very helpful thread. Thanks!!

Ended up sitting on my hands for quite a while :mad:

I always think of this one thing ICT told me in the chatroom, that we are either motivated by Fear or Greed. and this week I feel like my pendulum is swinging too far into the Fear side. No trades yet this week. I passed on a few setups (which went positive) and just felt like I was making excuses not to enter. Anyways, I think the problem is that I’m trying to be more involved than I really have time for. I do have a fulltime job and trying to catch setups in even 2 outta 3 sessions is taxing on my brain and health.

So to help my confidence, I’m going to focus exclusively on London Open setups. The window is nice and predictable, shouldn’t take more than 2-3 hours at the charts, and I think that is a reasonable time commitment considering my other obligations. I plan on doing this at least until I no longer need my FT job, or perhaps if the results are adequate, I might just end up dedicating my career to it! I feel that the london open trades pack the most punch (especially on the cable) so I really think this will be a positive move overall.

This post is mostly me thinking out loud, so feel free to not care haha. Good luck everyone, I’m really happy there is a group of people here that are really sticking to it for the long haul and catching some nice wins in the meantime!

I think that is a very perceptive comment. It is a case of finding the balance between overtrading and undertrading, and that is one area that I don’t believe can be taught. I guess it comes with experience, and a finely tuned ability to control those emotions. I have to say that I didn’t realize there would be so much psychology involved in trading, and I am now beginning to see where the difference lies between a good trader and a bad one.

On a personal level, I could feel the fear start to creep in after sitting on my hands for a week. After not actively taking a set-up would I still know how to do it? I found out that this is where the rules that you abide by, your trading plan, have to be tight enough and strong enough to withstand the emotions. All good golfers know that if they practice long and hard enough, their swing will hold up under even the most intense of competitive pressures. That is not to say that we should be out there practicing all the time, and that it should become robotic, just that as time goes by you learn to trust, and this trust can only be built on firm foundations.

Continuing in a similar vein, and this is now a question directed towards ICT, I think people might be interested to know how long you have been seeing these tools work for you? We know that you have been trading for around 18 years, but how long have you been seeing the Optimal Trade Entry and other concepts like daily pivot range averages?

The OTE and Pivots are essentially my S&P 500 day trading method I used from the 1997-2001 era… the Kill Zones were a recent addition to my trading after learning a few things from Chris Lori’s work on Forex. The OTE is my spin on a very generic concept called commonly a “1,2,3” top or bottom. However, much like most textbook examples or writeups on concepts… they merely highlight hindsight crystal clear examples but how to quantify, qualify and zero in on “when to anticipate” them to occur was never explained to my liking. So I worked in a few things I learned about Fibs and Gann and other concepts I haven’t shared yet here… the OTE was born. If I was to point to a specific time it started working for me… I’d say fall of 1997. I used it to trade Spoos [S&P 500 futures] and even T Bond Futures.

I would monitor the Dow, SPX, Naz at the stock market open… when the initial drop in the averages would occur… I would monitor a Pivot Support level and previous hourly support level… nothing more… and the averages would diverge bullish like the ICT SMT does and I would wait for the bounce… after the bounce I would look for the 62-79% retracement into the low made at the bounce… then hold for the 2pm hour EST or the Stock market close… assuming the Treasury market closed steady at 3pm… that’s the origin of the OTE… Pivots… and I used a tool called the Target Shooter by Larry Williams for my objectives… it was like wizardry. So much so I became something of a AOL {America Online} celebrity in 1998 when I publicly ran a 5k account to over 90k in three month… the good ole days lol.

The methods moved from S&P trading and T Bond trading to Futures contracts on Swiss Franc, Yen, Mark, Pound, Can $, Aussie you name it I traded it… even pork bellies! Then I got into Forex and with the 24 hour liquidity… I got so attracted to the “all you can make” mentality. I would run up nice gains and then slide into losses going in too many times and at the wrong times of the the day. I never had a fear of losing money… I feared being wrong… and the multiple accounts I dusted and kung fu’d are a testimony to that truth.

It wasn’t until the last three years I really approached Forex specifically with a discipline and respect for how the game is played and how the players run the table… you have to know when to hold them, know when to fold them and mostly know when to sit at the table or walk away all together.

:57:

That was fascinating, thank-you for sharing.

Thank you for those insights. Its very aspiring for new traders.

Hi guys… looks like fiber having some strong support confluent today.

Confluent of buy zone, 2 pivots S1, yesterday daily low, ADR low and 1.44 int level. Looks like a potential sweet entry but the price is currently a distance away from that level so i guess will need to have patience and wait for it.

Anyone spotted other potential sweet entry which i missed?? ( High chance for a newbie like me )

That’s the kinda career bio I was always curious about but I wasn’t sure if that’s something you’d want to share. Glad you spilled the beans haha. I too am somehow drawn to FX and it’s astronomical liquidity.

Although the only other market experience I have is from trading NASDAQ’s OTCBB. Now that is the wild fu**in west, and I got a huge payoff and a huge burn that dragged on for years as the POS kept reverse-splitting and took my investment to a 99.9999% loss. That’s right I walked away with a penny from a $15,000 “investment”. I got robbed by my own gullibility and inexperience, and I had to deal with that while doing fulltime University with a P/T job, and I think that’s why I lost so much money in my first years of FX. I was just numb to the feeling of losing money and just like ICT, the only thing I was scared of was being wrong! I thought “this isn’t really that much money” because I was already exposed to those huge losses, but it was huge because I couldn’t raise that kind of money again working P/T and being in school (which I hated btw).

I think that’s why having an almost $15,000 net loss in FX really “woke me up” to the reality of how poorly I am doing overall. I’ve finally reached the number that goes beyond that numbness to loss and really makes me want to change my trading. So if anyone was scared off my by huge overall drawdown, just know that it was due to bizarre circumstances early in my trading career and I’m dealing with it the best I can! wow what a rant, back to trading…

And thank you for sharing akeakamai. There’s a theory in poker called “The threshold of pain” where you stop feeling your losses and go numb. It takes huge self awareness to recognise this at the time and walk away, but the pain will be felt in hindsight.

ICTs tools and insight are priceless but as noobie, for me at least, until I felt the sting of a significant drawdown I found it hard to incorporate proper risk management into my trading. Another theory (which I only partially ascribe to) is the quickest way to permanently affect behavoir is through trauma, and when you are breathing, eating and sleeping trading (like many over enthusiastic noobs) a big loss is really traumatic.

But I hope some of you guys can achieve consistency without the pain, believe us it’s real:49::49:

Wednesday London open trade, off reservation with an AudUsd.

Sell zone, 4 hour MF down, OTE, 1.050 and R1 resistance levels. Just noticed my fib was badly drawn but trade is still valid.

Huh, took profit at 1.0480 for 20 pips. Doing this a bit lately and fear is stopping me let my trades run.

Sometimes I get in that mindset too. You can ease your way out of that mindset if need be by letting small amounts of the trade run. Imagine if you just left 10% of your position open, there’s no significant loss if the trade goes against you, but it’ll build your confidence by rewarding you with real $ for leaving something on. Then you can work up to 30%, 50%, and finally the 70%. I think it’s really advanced stuff to have the confidence to leave 70% on past 30pips, and if you aren’t ready yet, I don’t think that’s all that bad!

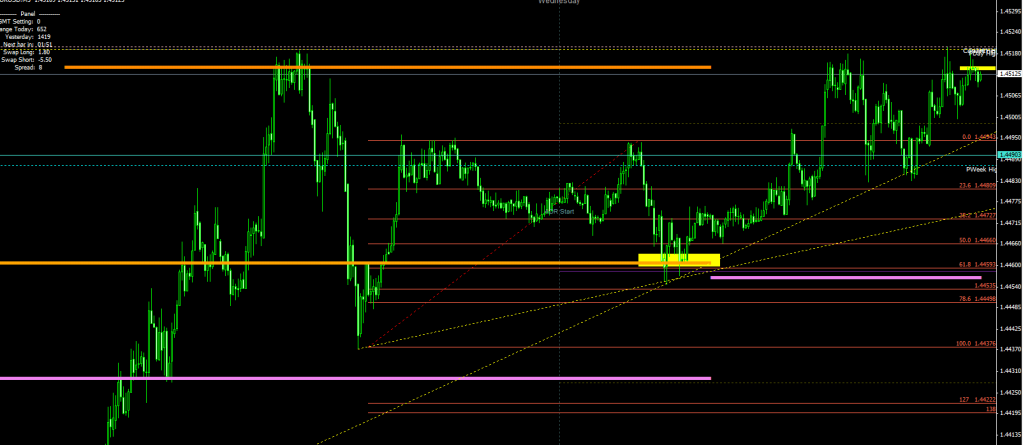

Eu trade today +50.

EU trending up and long term bias is up. Entered on the yellow box ITC entry. I did enter long in a sell zone, however given the EU strong trend and likely trend up I am okay with this. Confluence here is R1 as support and 60m key s/r (not drawn). PA tired breach the 60m support but failed, the second test of the 60m s/r barely touched it. Took profit in the 2nd yellow box because PA was bouncing against the previous day high and major news due out soon (why give back).