London Close: Week 3 results (The third ‘full’ week that I have monitored from Mon-Fri)

Trades taken: 0

Percentage profit/loss: 0% (of course!)

What is the point of a write-up? Well those figures don’t tell the whole story. This week has been abundant with learning opportunities, and I really feel that I am further down the road than I was this time last week.

Monday: Nothing set-up up on my charts even though I waited patiently through the full 3 hour kill zone.

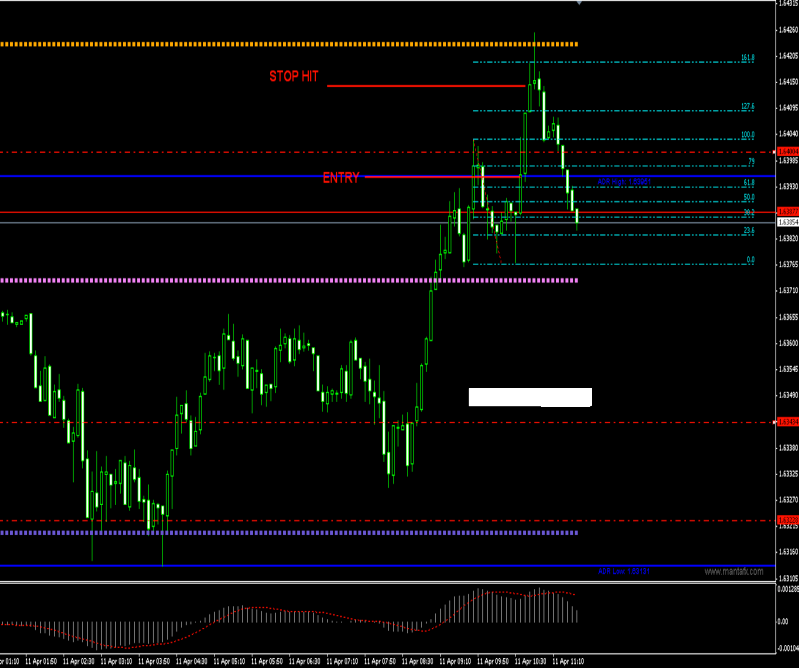

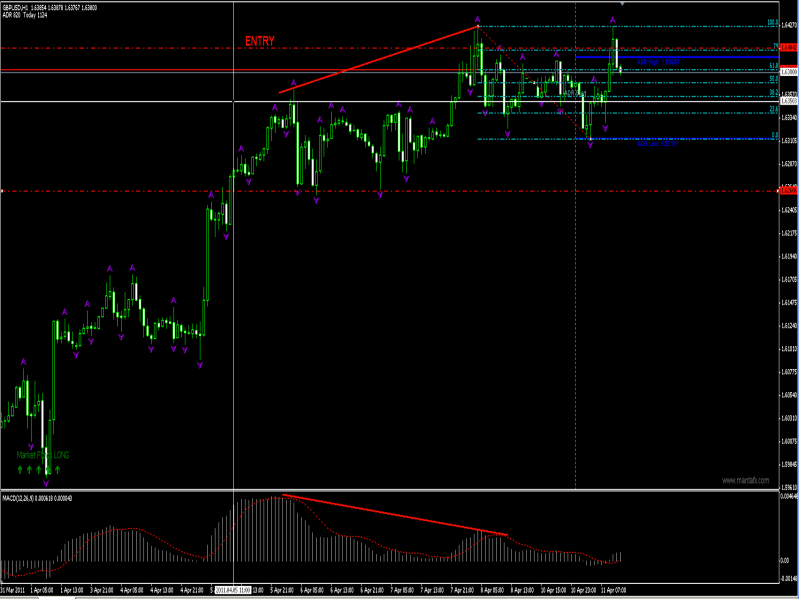

Tuesday: Those that were outside of the ADR were way outside of the range, and as my write-up on Tuesday suggests, I was reluctant to trade at these levels. The Tuesday Cable set-up that I was monitoring was an excellent learning opportunity for me in terms of self-control. If I see this same set-up again, and I am confident that I will, I will know a third time around that I don’t want to trade it. This time I was unsure, next time I will definitely let it pass. On a positive note, it is great for confidence to see something that you have seen before, recall your past experience, and see it play out again in the same way.

Wednesday: After 2 sessions and 6 hours of seeing nothing, I am beginning to get a little restless. I think this is the feeling ICT wants us to experience, and wants us to overcome. It is at these times that you tend to jump on trades that aren’t really A+.

Luckily USDCAD sets-up, and I put in my Limit order only to see it get missed by a fraction of a pip, put in railroad tracks, and shoot up to my TP within 10 minutes.

Thursday: It is now getting towards the end of the week and I have seen only 1 positive set-up. The previous 2 weeks that I have monitored from Mon-Fri, 15:00GMT to 18:00GMT saw much more action than this, and I am beginning to question my ADR and the LC. I toggle the ADR between different starts, compare ADR levels with others, and am generally restless. Just as I toggle back to my original ADR settings, I notice I have missed 3 set-ups! I was monitoring these pairs as potentials that hadn’t quite met their ADRs, and I think if they had not played out so quickly I probably would have caught them. The fact is, they retraced 20% and came back to OTE all within 10 minutes. All three were JPY crosses which is no surprise given the current events and the way the Yen has been trading.

Friday: By final day I am resigned to the fact that this is a ‘learning’ week, and I am just happy to have witnessed 4 potential set-ups. I note Fiber as a potential, but word on the street is that things are going down in Washington, and I am happy to leave the week flat.

I netted 5.5% in my first two weeks of trading the LC, and if I am still at that level after 4 full weeks then I will be happy. No, it is not what other traders might be easily pulling in, but it is enough for me to make a living. If and when I leave the day job, I will have enough capital to support my family with monthly returns of 5% or over. In that respect, consistency is my major objective, and self-control is the holy grail.

Have a great weekend folks. I will be enjoying the annual cherry blossom party, which is always a license for debauchery, but will be more so this year given the fact that the Japanese will undoubtedly want to escape current reality.