Remembered a little earlier today that my TV has a YouTube app on it. Anyway that has helped knock down about 3 hours of Pro Trade Review videos so far

This is how I’ve always thought of it.

I recommend the following site to get your bearings straight.

Forex Clock | Forex Session Times | Forex4Noobs

I’ve never seen it make a mistake yet, no matter how many DST adjustments the world makes! It’s very visual and easy on the brain, and should serve some confused people well until they’ve got the times memorized :64:

I am there.

Will it be possible to have a few days notice prior to the webinar? I want to make sure that I setup my agenda in accordance.

Regards,

I’d love to attend if I can make it.

Thanks ICT. Great News, Please count me in

Thank for sharing. Clearly I want to learn from many people especially experienced traders so I can be a consistent trader and even making profit time after time.

I agree AK, that is a very good resource. It also seems that we can now agree on the opening times and closing times, which were my original settings and were in line with what you and Clint are suggesting. My NY Open kill zone doesn’t start until 08:30 NY purely because I don’t want to factor in the news at that time, but I can agree that the actual open is at 08:00 NY time. With regard to London Close, I set my buffer two hours before the close and one after and that has always served me well.

The thing that was confusing is the degree to which these kill zones are flexible, and Clint seems to have cleared that up by posting his correspondence with Michael. I now recognize that my London Open ‘one hour before, one hour after’ rule was fine, but I need more flexibility around that main zone.

Well, thanks for everyone’s input. Let’s put this thing to bed!

I took a demo trade today using the ICT tools. I went short on Fiber at 1.4117. This was optimal entry from fibs drawn at a low of 1.4081 and a high of 1.41329 in the NY evening session.

Although it was just a demo trade, I played by the money management rules. I took 30% off at 30 pips. 30% off at the 127% extension, and closed the trade at central pivot (which ended up being just 4 pips from the low of the day) Once price reached the 127% extension, I placed a stop at the 100% extension. Once it reached the 162% extension, moved the stop to the 127% line. It then reached the central pivot and bounced, price action gave me a second chance to get out there and I took it.

That’s 30% at 30 pips, 30% at 50 pips, and 40% at 80 pips!

The hardest part of this is going to be to keep up with the demo trading and not risking real money until I am completely comfortable with the setups. I want to keep away from the live account for at least a month from this point.

Thanks to ICT for the excellent tools, and thanks to all of the other active people in the thread for answering my constant questions!

Like most folks here, I assume, my aim is to build a career in trading. I want to make the transition from working at my job F/T to trading at home F/T. and while I’m willing to be patient, I believe have some time-based goals could be helpful as well.

Attempting to strike a balance between patience and confidence in my abilities, I came up with the figure of 4 years. I tried to factor in the known variables, like my Starting balance and the Balance I’m striving to achieve within that 4 year span.

Starting balance will be ~$5,000 and my target balance is $60,000. The $60,000 will be split between 2 years of living expenses (as ICT suggests) and the actual capital used for trading. My split is $30,000 for living expenses, and $30,000 for the trading account. This will give me 2 years to compound that $30,000 into a bigger account with the potential to live off its profits. I would like to triple this starter account in those 2 years of trading, keeping in mind that I won’t need to withdraw any money for living expenses

What’s left in this equation is the actual % gains on the account that will allow me to reach that $60k mark in the 4 year timespan. I’ve called this value my “minimal acceptable performance” and I’ve read that similar benchmarks are placed on professional traders in the banking industry.

Since I’m sure you’re wondering, the value works out to be ~5% per month. That is factoring in some deposits I’ll be able to make from my surplus income from my job (figured to be about $2000/year). It’s not much but Excel shows me that it can really expediate the compounding process.

So, is this achievable for me? It’s really hard to say, but 3 months of live trading results have so far shown that it is very possible using ICT’s tools. Knowing what value will tangibly get me to my goal helps me ground my expectations for pip profits. If I know I can be where I want to be with 35pips in a week, I can feel really good about closing up shop for the week with a 50pip gain. To me, having that modest mindset has really provided a solid foundation for my week-to-week consistency

and that’s all I have to say about that. as is usual with my posts, I’m mostly thinking out loud, with the hopes that others will find something usable in their own trading adventure!

good luck and goodnight!

Good link, Aaron.

That sounds like a plan, AK.

I guess the advantage I have over you is that I am ten years older and therefore I am already at the stage, financially speaking, where I could go F/T. The danger though is that I rush the education, and as a consequence start trading with a sizeable account before I have the skills to do so. That is the reason why I am also laying down a structured time plan.

What I aim to do is continue my day job for the next 15 months, because there are various things that prevent me from leaving my current situation right away (emmigrating to a new country takes time!) In the mean time I will work on three kill zones, allocating 6 months to each. The first one is obviously the London Close, and I am currently 3 months into my 6 month education with that. I will slowly increase the stakes, but at a very conservative pace. Around September I hope to start looking at the Asian session more, and I will be allocating a further 6 months to learning that. After the Asian session comes the NY Open - 6 months more. It won’t be until I go F/T that I can fully concentrate on the London Open. I have tried these past few weeks, but it just isn’t happening.

Kind of mixed up if you think of the order ICT is teaching it, right? But I can’t allocate the time I need to the London Open because of my other work. Hopefully I will have enough with LC, Asian session, and NY Open to give me a conservative first year of F/T trading, and then London Open will slowly build on that. It is my hope that I will have learned enough skills after 3 years to replace the income that my current business is earning. It’s an exciting prospect, but I constantly need to remind myself to stay grounded. Over exhuberance could kill my dreams.

GLGT!

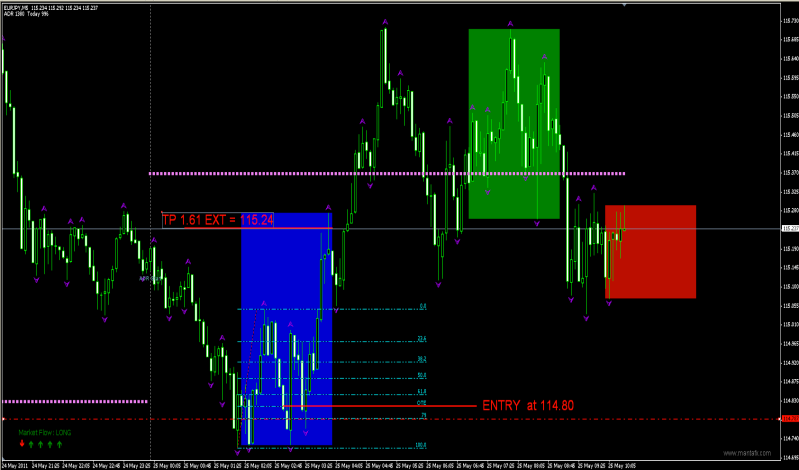

London Open Trade

EUR/JPY

Daily TF - Up

4 Hour TF - Up

1 Hour TF - Down

Price opened the day in the buy zone, below the central pivot.

Price bounced off of previous support and institutional level 114.80.

5 inside bars before breaking a mother candle to the upside, lending weight to the bulls.

OTE present during kill zone.

Entry was long at 114.80 and my TP was set just below the 1.61 ext at 115.24.

My trading is done for the week.

2 trades, a LC scalp yesterday and the LO today.

1R was 1.5% of the account, gain was 2.9 R or 4.33% for the week

:35: Awesome… sweet… sweet… supa’ sweet!!!

Handsomely done WTG

[B]GLGT[/B] :57:

Thanks for sharing. Your thinking loud helps others too. I remember last month when i was thinking of a goal of 100 pips a week but after our chat i reduced it to 50 pips a week and now i feel that was a good decision. Thanks AK and GLGT

Just got home from work and checking over my charts to see the action from today. There was a lot of divergence on the Smart Money Indicator (I’ll refer to it as SMI) showing the cable running much stronger than fiber today. I thought that generally if one pair was making new highs while the other was making new lows towards the top of their daily price action that it was an indication that price action may reverse lower. Anyone watching their charts right now will see that the opposite happened as fiber shot up compared to only marginal gains by cable.

Was I viewing the SMI correctly, or was this price jump in line with what the indicator was showing?

It’s always interesting to hear others plans & hopes, as I’m thinking along similar lines of trading for living & it’s hard to know what are realistic expectations. Reading your thoughts helps me compare my plans & I hope it helps me make sensible decisions.

Where I am at this point;

Almost 18 months reading & demoing, This thread has been by far the most helpful (Thanks ITC!)

My main problem is trying to work a job that’s 60+ hrs a week & studying while I’m tired…

I’m the sort of person that has to put everything else aside to concerntrate properly on one thing at a time to get the best result. I also like to learn in a small group environment, or just one other person (in real life, not on line) just to bounce questions off, you know the saying “Two heads are better then one”

I am also in the process of emmigrating, been trotting back & forth to Europe since 07 & this summer am thinking of taking the plunge on a one way ticket, I have a network of friends over there & a part time low paying job, but also a VERY low cost of living where I am based in Europe, so I would have much more time to study but much lower income / expenditure.

I have to make my mind up on this in the next week! Scary!! I do have the finances to support me for a good year or 2 but really don’t want to exhaust those if I can help it, also highly probable I will get my job back here in NZ if It all goes down the drain… Like you akeakamai, just thinking out loud…

Problems posting again:32:

I think if anyone can do it, it would be you Ali! Your discipline is exemplary. But honestly, I wouldn’t expect anything less from a guy living in Japan haha. I still get those “gunslinger” moments where I’m loaded up to the hilt, and take some big hits. But nowadays, loaded up to the hilt is just 2% lol, so it’s not like ‘before’ when a bad week had me down -10%. It sounds ridiculous, but that’s what overtrading can do. The kill zones are an automatic edge, just due to the fact that you are limited to a few setups a day. Get to that point and have the discretion to choose the best setup and your gains will increase exponentially, as ICT says.

Feels good at 6AM (my time) when you see those stars and stripes light up, and you know the greatest free nation in the world is ready for financial war. Haha