Great read on something that is gaining steam and a topic you’ll hear more about in the future. There are some really interesting products and services being developed within this area.

In simpler terms, it’s financial software built on the blockchain that can be pieced together like Money Legos.

Project/protocol listing

1 Like

Hi,

This is indeed an interesting topic. It makes Forex look like a snail by comparison with the “hares” of the crypto-currency world. Before 1May2020 I knew absolutely nothing about crypto, but had some time on my hands to start learning. Three months later I am invested in eight crypto-currencies, the (very small) portfolio gain is something I find hard to believe, beginner’s luck, and I am now committed to creating a crypto investment portfolio ten times the size of the initial undertaking, and at a later stage when I know enough about it, to add a component of “crypto trading” to that investment account.

Crypto (and more specifically DeFi) is also referred to as “Internet 3.0”. As someone who has spent a good 20 years of my life in telecommunications networking, and more specifically in inter-networking protocol, it was like a huge light bulb moment for me after the first hour of “Youtube education” and I have not looked back. There are already over 50 “sectors” identified for DeFi, and just one of those sectors - interbank currency payments - has about 20 trillion dollars tied up in funds waiting up to 3 days to clear transactions, that DeFi could reduce to just billions by only tying up funds for the time it takes to add a block to the blockchain (minutes).

One other sector (yes, just one) is the Internet of Things, where the “things” will outnumber human beings very shortly. Trust between parties will be a thing of the past (decentralized voting models) and interoperability protocols will grow faster than we can imagine (re CRO, LINK, TRX, etc) and on top of those interoperability protocols will evolve end to end “apps” just like the OSI seven layer network model is today.

I don’t think you have to know anything about how it all works under the bonnet, but for me it sure helps to know a little of what’s going on.

1 Like

It seems to me that DeFi is just another marketing term for Ethereum’s Smart Contracts. Am I wrong?

Vitalik is a brilliant technologist but he may not have a good grasp of what is required to butt heads with Bitcoin. I read the following article some time back and it resonated with me. ETH, good try but no cigar.

https://hackernoon.com/the-fundamental-problems-with-ethereum-408c420849f0

Hi QuadPip,

404 error. Article has been removed. I am by no means an expert on crypto, more a kindergarten learner. However, what I do recognize is that there are commercial issues with Bitcoin (that they themselves have plans to mitigate) that Ethereum and other Alt Coins are designed to fix. I see the whole Crypto thing as the Wild West and like the California gold rush, it seems there are thousands of bucket and shovel sellers trying to attract investors or speculative traders to their shops (YouTube videos). To name a few, in order to enable the DeFi brands to create a real world useful end to end product, certain “Alts” have “interoperability” projects that promise to allow a system on a Bitcoin network talk to a system on an Ethereum network, or to create their own networking protocols that can make use of either or both. Whilst I believe many Alts represent possible trading gains, I am more focussed right now on the interoperability tokens.

Sorry - I have to run away and sell some LINK coins that have doubled since 10 days ago. LOL. The Wild West, for sure.

The crypto watchdog CipherTrace has exposed new DeFi exchanges as having contributed to 21% of the total volume of cryptocurrency related crime in 2020 – the staggering $99.2 million worth of assets have been stolen or laundered. According to the organization, this is due to their substantial presence on the crypto markets as well as the lack of anti money-laundering measures on such exchanges.

It will certainly have a lot of teething problems as any new tech tends to have but it appears to be something the banking world are resigned to accepting in some capacity moving forward as they risk being outcompeted in some aspects of finance such as interest rates and loans. The biggest issue with it will inevitably be that of tightening the security of it to try and limit the many scammers taking advantage of the hype surrounding the new technology.

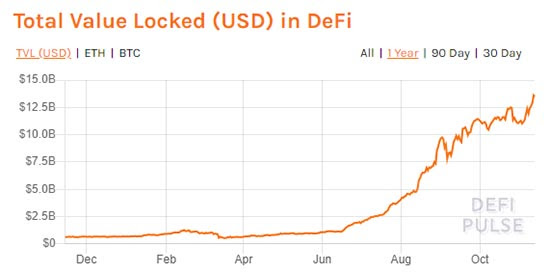

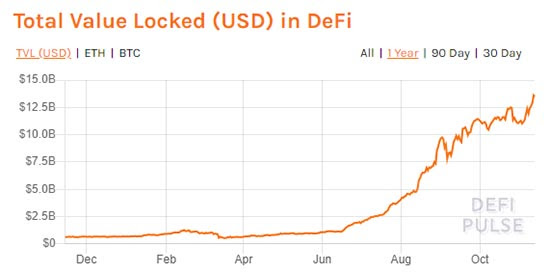

In December of 2019, the total value of assets tied up in DeFi projects was less than $700 million. Then, in February 2020, that value reached $1 billion. Now, in November 2020, the total value of assets tied up in DeFi projects has reached $13.62 billion, according to Coindesk and DeFi Pulse .

That’s an increase of over 1,845% and a clear indication that DeFi, is an idea whose time has come over this past year. This kind of explosive growth is evidence that interest in this particular use case is strong.

This graph from DeFi Pulse demonstrates just how stark this trend has been. More broadly, it can be taken as evidence that disruptive trends within the cryptocurrency sector are capable of producing explosive gains of 1,000% or more in just a few months.

1 Like

I really hope this will happen soon because the current statistics are concerning, I think.

1 Like

Interesting thread and some good links.

I’ve only just started looking into this, found a good thread on another forum ( I’m not a member there, just lurking for now) and there’s some excellent opportunities

Yet another example how risky Defi can be - over 30 million USD were reported to have been stolen from the decentralized finance (DeFi) protocol Grim Finance, after hackers have exploited a vulnerability in the platform.

The attack happens a week after [the Singapore- based Crypto Exchange AscendEX was hacked for some 77 million USD.

Did this issue of loss at Grim stem from a risk associated with it being a DeFi provider, or just the sheer speed at which some new tokens come to the market without sufficient testing, in particular penetration testing? I have not looked deeply into the Grim matter, but I have a recent strong interest in trying to follow how new tokens come about and come to market. I have joined half a dozen Discord sites to follow their development. As an experienced network, hardware, software and protocol test manager of past, I am very concerned that the backend system testing seems woefully inadequate. But I am assuming this with one hand tied behind my back as an outside observer, and not an inside participant.

I do not yet have an opinion about what method of governance may be most appropriate, and that may be different for new cryptos, especially those that offer new capabilities like DeFi. By nature of decentralization (i.e., to avoid central control by a corporate body) I think the governance models, in particular in the development lifecycle from initiation to maturity, need a lot more attention from the potential investor than has been given media space to comment so far in the short history. No doubt it will follow.

A decentralized autonomous organization (DAO) is a fully democratized corporation without a chief executive officer or a chief financial offer. DAOs execute all their transactions publicly. These blockchain-powered platforms include decentralized finance DeFi projects, crypto trading platforms, and fundraising projects. Crypto investors can interact with DAO using its native tokens. Every decentralized enterprise has its unique code, which works over the blockchain network.

[Edited for a Forums Violation]