lol,thanx for saying yes.This means you wont be leaving soon.hahaha

Hi Rel did i read that your now trading fulltime? congrats thats a real bold move hope some day i can trade fulltime too but am in no hurry i did what u suggested sometimes back opening a small live account and maintain it without blowing it yes i agree preservation of capital is key

ok on second reading this is what i understand.MFx is pointing out lack of clarity in classical TA about trend start point and end point.He suggests we only need to find the point where trend reverses and this is what he calls FZR.For trend reversal he requires two FZRs in opposite direction and this confirms a new trend.

Have i got it right?..lol.

any ever seen a chart with intersecting channel lines like these (H1 and M15 of EUR/USD)?

i know they’re not actually channels, but i was drawing lines in my chart and noticed an interesting coincidence that there was a lot of consolidated candles in the small square section created by the intersecting channel lines. wondering if it is familiar to any other chart patterns or strategies that anyone’s seen before.

Ok. I spend a good hour or so preparing this week’s projection and trading plan for EURUSD.

Copy & pasting the conclusion part only "Watch for retracement down to 1.3433 or 1.3414 area and look to go long with S/L @ 1.3389, T/P @ 1.3492."

I’m amazed how accurate this was! The day’s low was 1.3412 and the day’s high was 1.3495.

I’m just sad that I didn’t have 100% faith in my analysis and got whipsawed a little and ended up opening silly positions out of fear. This is something I need to really work on and to work out beforehand what price action would invalidate my projection and make me go back to the drawing board.

I loaded up on long today and took about 15% of my account size as profit.

I do however have short position with running loss (still up for the day)

I’m projecting that we will see a retracement down to 1.3455 level so I should hope to recoup these running losses.

All in all everything went well this week apart from my trading management and managing my emotions, which does get a little bit tougher when I load up on the position also.

Relativity,

My stats for D4 waves are somehow very different to yours. Mine doesn’t seem correct because it’s all over the shop with no particular ratio sticking out as a common ratio. I’ve also tried doing time ratio between swings and was able to spot some patterns but not as good as the price ratio.

Rel,

Please have a look and tell if i am reading correctly?Black line i have only drawn to get the idea of the direction of the previous wave.

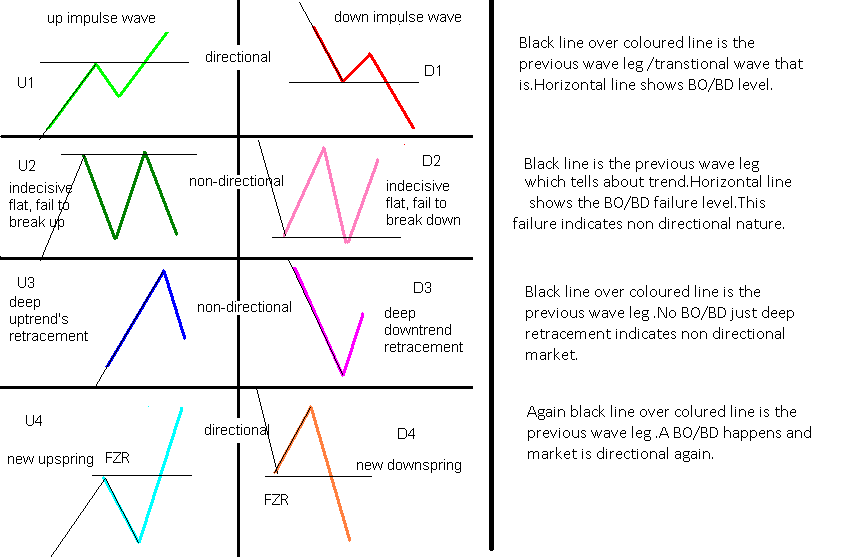

Well i havn’t seen the video yet but from what you are telling i am getting confused about wave 3 and 4.They both look like ‘V’.To me the difference is that wave 3 represent inside range retracement action while while wave 4 is the one giving reversal signal as it includes a breakout in the opposite direction.so wave 1 is about successful BO in trend direction ,wave 4 is about successful breakout in opposite direction to the trend,wave 2 is about failed BO in trend direction and wave 3 is just no breakout day.

It seems wave leg 2 and wave leg 1 ratio should be used to determine what kinda wave structure is possible…also time element tells if a third leg is possible or not.I guess i am finally getting this stuff.lol.

I have a tendency to try to make things more complicated instead of sticking to the simple things and learning to do them correctly. It’s been my undoing in everything from woodworking, to golf, to poker. FPS (fancy play syndrome)

I realized after reading your reply and a couple other posts that its all based on supply and demand anyway, so why not just use the support and resistance lines on the chart by itself (with perhaps a fib retracement, SMA, a trend strength indicator, and a price action oscillator). Seems simple enough: support and resistance on the chart with a SMA and a fib retracement showing possible short term supports. Trend strength to help confirm a trend is still in place and something else to help confirm the price action candlestick patterns I think I can see.

Rel please give some details on how you do the archiving stuff.

stuff = all the study material pdfs webpages articles etc etc.managing organising record keeping etc etc…like u say often… gonna achived this for later study.

Also you say often u have only shared only a part of your reseach in this thread and some part is still hidden.Can u tell how much reseach you have shared so far …quantity wise and quality wise …in percentage terms.Please exclude coding work from the calculation.

It is often said a good trader maintains good records.Your this week discovery

is a good example of studying ones own trade log to improve ones trading.I hope i am not wrong in assuming that you made this discovery while going through your past trades.

I have got basicpriceaction indicator working but now the problem is its only showing graph and not the frequency tables.lol

Hi rel,

where are the posts you were talking about in 1 amd 2?

Relativity, when is the next weekly forex review video be available?

With the data collection engine working well now, I am able to easily start looking at some harmonics where before it was a terrible process.

Just as an initial working of the idea, you can see the green arrows, and the “loose” harmonic that precedes that arrow. This is only one harmonic, and I haven’t applied specific lengths to any legs yet(just using Highs and Lows of prior swing for testing). But you can kinda see the idea.

Hi Pelt1

When you write harmonics is that as in harmonic patterns?

Yes. I want to do some more exploration of course, but yes, the patterns you see in the ss above are just gartley 222s.

Still doing work.

But just for testing, put in some simple 222s and Butterflies. These things seem to happen very rarely, even with the 10% tolerance I built in for all values. Adding in a bat and crab may be a way to find more harmonics.

I’m guessing, that the way my zz works, is based on a length. SO I would think that there will be many patterns one could find that wouldn’t show up on a given chart… so maybe stacking many tfs(with regard to range) on top of each other might be the way to see more.

After all this, to prove decent data collection (which I think I have), I’ll be looking more into some patterns with regards to each up and down movement, with regards to its characteristics, i.e. how a swing down/up, up/down may influence the proceeding swing. Not sure totally, but something along those lines.

Mind sharing the script?

not to advertise but i think, if u post i in the “30pips a day keeps your money at bay” thread u would get more feed back as the posters there mostly trade using harmonics.