Personally, I still think your problem is due to you trading the “DcR” method! What is that, do I hear?

Think of how a dog chases a rabbit and what happens every time the dog gets near to the rabbit - the rabbit suddenly changes course. Seems from your screenshot that you are the “Dog” and you suddenly see the “Rabbit” running fast past you and you chase after it - but too late, the rabbit turns back on itself.

Here are three screenshots for you (I don’t have a 10sec chart but I think 1M is good enough to demonstrate):

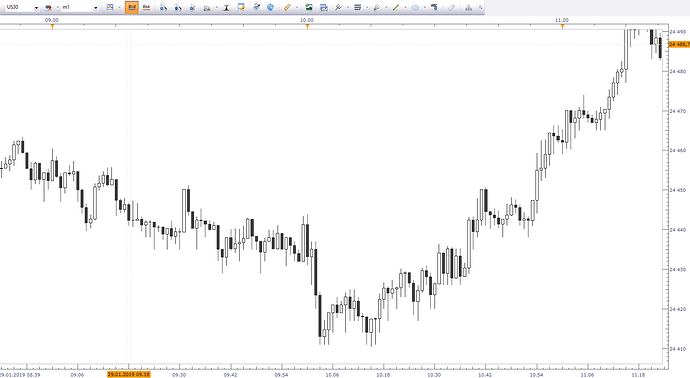

Broker I - this is one broker that I use showing the same spot and identical move as in your screenshot:

Broker 2 - this is another broker I use showing the same spot and identical move as in your screenshot:

Together with the screenshot from @bradley79 above, that is three brokers all showing the same move. So I think we can conclude the fault does not lie with your broker?

OK so what is the problem here? I cannot tell from only one trade here but I suspect you do not have a clear method here to determine your entries and exits.

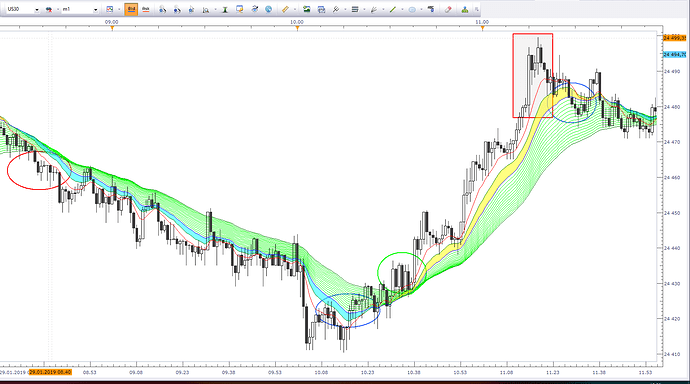

Here is that same 2nd broker with my own method placed over it. I am not for one sec (or even 10 sec!  ) suggesting you should use such an approach - this is purely an example to demonstrate that some kind of tangible strategy can change the way you are entering/exiting positions.

) suggesting you should use such an approach - this is purely an example to demonstrate that some kind of tangible strategy can change the way you are entering/exiting positions.

According to this approach, If I were trading this I would have sold in the first red circle and looking to buy back in the blue circle, (i.e. around your sell entry!). Then I would have bought in that green circle and again looked to exit at that last blue circle…

BUT NOTE!!!

Just prior to that last blue circle where the market is exiting, if you look at that rectangle, there is an IDENTICAL SET UP to the steep drop that you sold into but in the opposite direction!. One could imagine that you would have also bought into that fast rise for the same reasons that you sold when you did on that steep drop.

If that is so, then I really believe that all the evidence points to your entry/exit strategy. It is getting you into trades too late on this kind of timeframe.

I would suggest that you heed to what @Tommor has said and reconsider what TFs are most suitable for you and leave the DogchasingRabbit technique to nature!

) suggesting you should use such an approach - this is purely an example to demonstrate that some kind of tangible strategy can change the way you are entering/exiting positions.

) suggesting you should use such an approach - this is purely an example to demonstrate that some kind of tangible strategy can change the way you are entering/exiting positions.