I find oil and gas trading easier and less stressful than Forex, and a lot less frustrating than trying to trade manipulated Gold and Silver markets.

From a fundamentals point of view, data is readily available, and narrow in nature. What I mean by this is best explained with a couple of examples.

Forex - economic performance analysis, geopolitical factors, and in the case of the AUD, NZD, and CAD, commodity prices for oil, Gold and Silver, must be factored into the analysis. There is a wide band of fundamental information to be captured and analysed, but does it really help if you’re trading shorter time-frames?

Gold and Silver - you would think that simple analysis of supply and demand factors would be enough to provide the necessary insight to trade successfully, but that’s not the case. If it were, Gold and Silver prices would be substantially higher than at present. Demand for Silver, for instance, is exploding right now, and yet prices remain stubbornly low. And is it any wonder, when market giants (you know who they are!) flood the market with short positions whenever prices begin to rise. It’s a joke!

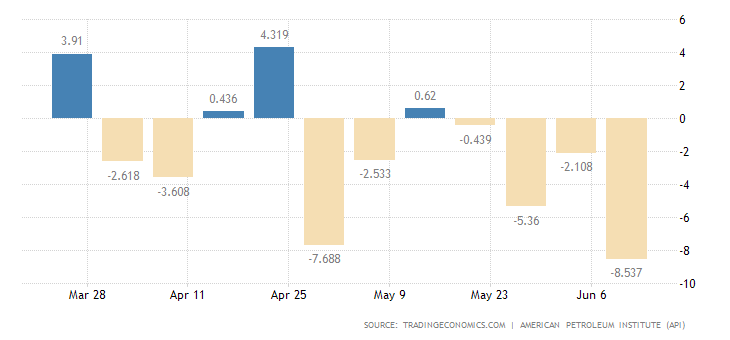

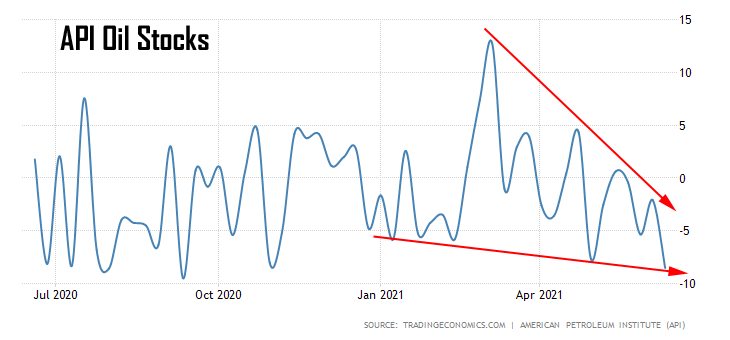

Oil and Gas - regular weekly reports from the American Petroleum Institute, Baker Hughes, and the Energy Information Administration, tell us the number of rigs in operation, as well as oil and gas stocks on hand. If the rig count increases, prices are likely to fall, and vice versa. Likewise, if stocks and inventories begin to pile-up, demand is falling and prices will follow suit soon. It really doesn’t have to be any more complex than this. Information is timely, easy to absorb and interpret, and most important of all, helps determine likely price direction over the next week or so. Clean and simple.

Turning to technical analysis, both oil and gas lend themselves well to price chart analysis. A moving average and oscillator are all I need to trade successfully. See the attached charts, for example.

I will be posting my trading results here every Tuesday, Thursday, and Saturday, and hope you find it interesting.