Abercrombie & Fitch Co., (ANF) operates as a specialty retailer in the United States, Europe, Middle East, Asia & Asia-Pacific & Internationally. The company operates though two segments, Hollister & Abercrombie, which operates through its stores, various wholesale, franchise, licensing arrangements & e-commerce platforms. It comes under “Consumer Cyclical” sector under Apparel Retail & trades at NYSE as “ANF” ticker.

ANF is trading at all time high since 1996 & expect upside in short term impulse against May-2023 low. It favors upside in (3) of ((3)) of III & remain supported in 3, 7 or 11 swings pullback at extreme areas.

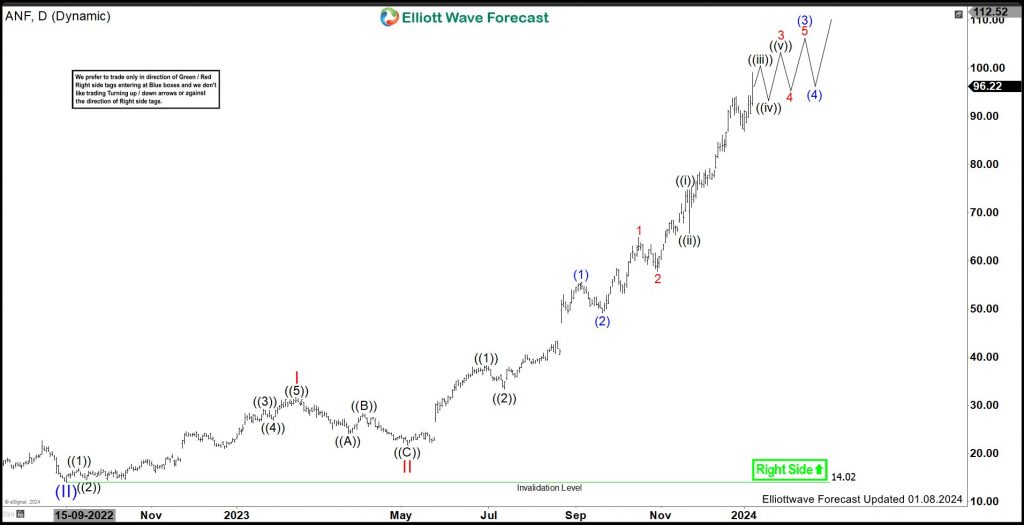

ANF - Elliott Wave Latest Daily View:

It placed ((I)) at $85.77 high in October-2007 & ((II)) ended at $7.42 low in March-2020 low. Above there, it favors upside in ((III)) as it broke above ((I)) high. It placed (II) of ((III)) at $14.02 low in September-2022 low & favors upside in (III), which expects further upside to continue.

It placed I of (III) at $31.69 high & II at $21.73 low as 0.618 Fibonacci retracement. Later, it resumes higher as extended wave with nesting in 3 of (3) of ((3)) of III. Within III red, it placed ((1)) at $38.20 high & ((2)) as shallow pullback at $33.38 low. Within ((3)), it placed (1) at $55.52 high & (2) at $49.24 low. The pullback within the sequence are of almost having equal frequency with shallow correction, which indicates the nesting in progress.

Currently, it favors upside in ((iii)) of 3 of (3), while placed 2 at $57.78 low & ((ii)) at $65.60 low & expects short term upside, which soon correct lower in ((iv)) of 3. It expects to remain supported in 3, 7 or 11 swings pullback at extreme areas to resumes upside & extend ((3)) of III of (III) sequence.