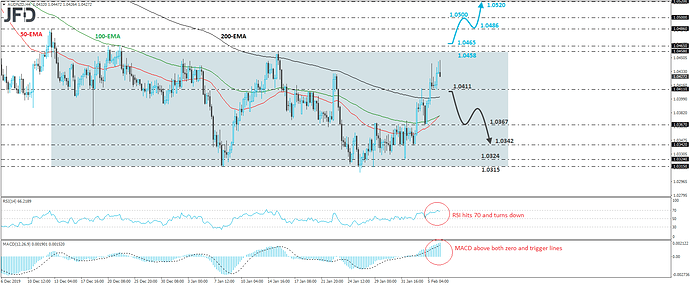

AUD/NZD edged north today, after hitting support near the 1.0411 barrier, marked by Tuesday’s inside swing high. The rate has been in a recovery mode since February 2nd, when it hit support near the lower end of a sideways range that’s been containing most of the price action since December 13th, between 1.0315 and 1.0458. As long as the pair continues to trade within those boundaries, we would consider the near-term picture to be flat.

Although the rate is trading closer to the upper end of range, we would like to see a decisive break, not only above 1.0458, but also above 1.0465, before we start examining whether the outlook has become brighter. Such a move may encourage the bulls to stay in charge and perhaps aim for the 1.0486 zone, marked by the high of December 12th. Another break, above 1.0486, could extend the rally towards the psychological zone of 1.1500. If the bulls are not willing to stop there either, a breach of the 1.1500 area may allow them to put the 1.0520 hurdle on their radars. That hurdle is fractionally below the lows of November 28th and 29th, and marginally above the peak of December 3rd.

Shifting attention to our short-term momentum studies, we see that the RSI hit its 70 line and turned down, while the MACD lies above both its zero and trigger lines. Both indicators detect strong upside speed, but the fact that the RSI turned down make us cautious that a small setback may be in the works before the next leg north, perhaps for the rate to test once again the 1.0411 level.

Nevertheless, we would like to see a decisive dip below that obstacle before we can start assessing whether traders want to keep AUD/NZD range-bound for a while more. Such a dip may pave the way towards the 1.0367 zone, near yesterday’s low, the break of which may carry more declines, perhaps towards the low of February 2nd, at around 1.0342.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.