Market Summary:

- Canada’s inflation rose faster than expected which raises the odds of another BOC hike on 25 October

- Whilst deputy BOC governor Zokicki acknowledged that headline inflation was volatile, and supported by energy costs, underlying inflation is “well above” a level consistent with their 2% inflation target

- The Bank of Canada’s preferred measure of inflation also turned higher, with median CPI rising 4.1% y/y (3.7% expected, prior upgraded to 3.9%) and trimmed mean rising 3.9% y/y (3.5% expected, 3.6% prior). CPI rose 4% y/y (3.8% forecast, 3.3% prior) and 0.4% m/m (0.2% forecast, 0.6% prior).

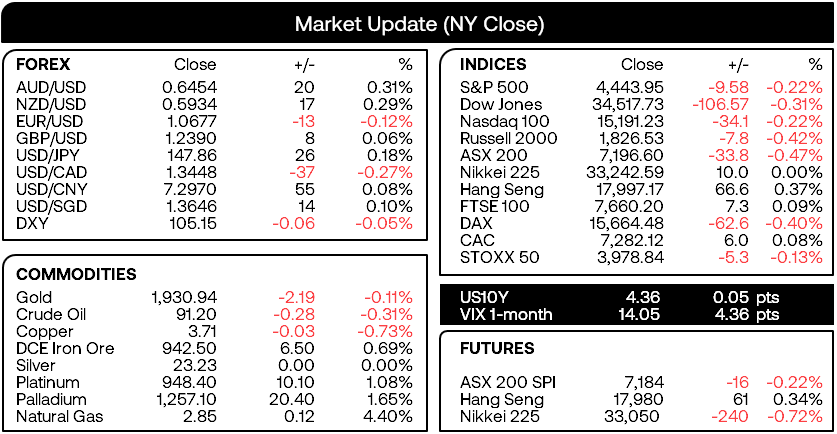

- The Canadian dollar was the strongest forex major, sending USD/CAD down to our lower target around the 200-day EMA and 50% retracement level before bouncing into the close. CAD/JPY probed the October high and GBP/CAD hit a 6-month low

- US bond yields continued to climb ahead of the FOMC meeting, with yields seemingly siding with the prospects of a more hawkish Fed meeting. It’s possible we’ll see an upgrade to their CPI forecast, although my immediate attention will be to see whether the dot plot edges higher for the 2023 or 2024 period, and prompt money markets to price in another potential hike and send they

- Wall Street was initially lower but the S&P 500 managed to hold above trend support projected from the 4 May low and closed just beneath the 50-day EMA

- EUR/USD rallied into the 61.8% Fibonacci level mentioned in yesterday’s report before reversing lower and forming a bearish hammer on the daily chart and closing back beneath 1.07

- USD/JPY continued to trade within a tight range, clearly awaiting the outcome of the FOMC meeting. 148 remains the clear barrier for bulls to break or bears to fade into over the near term. Big move coming, one way of the other

Events in focus (AEDT):

- 09:50 – Japan trade balance

- 11:30 – Australian leading index (Melbourne Institute)

- 11:15 – PBoC Loam Prime Rate (1yr, 5yr)

- 16:00 – UK inflation: With US and Canadian inflation now curling higher, it could set the scene for another undesirably hot inflation report from the UK today. And that could cement another rate hike from the BOE tomorrow

- 04:00 – FOMC meeting:

- 04:30 – FOMC press conference:

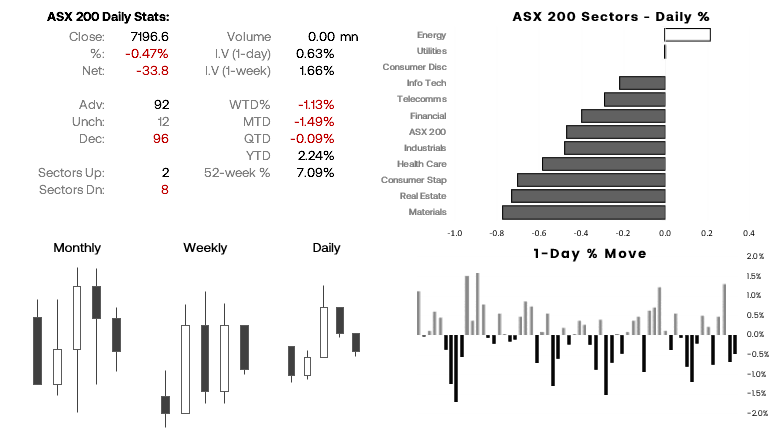

ASX 200 at a glance:

- The ASX 200 continued lower for a second day to erase most of Friday’s gains and closed beneath the 200-day EMA and 7200 level

- Wall Street and SPI also point to a weak open, which could make 7200 as a resistance level early in today’s session

- There’s a decent chance that volatility could be reduced in today’s Asian session due to the pending FOMC meeting, and to place a directional bet for the remainder of the week would be to take a punt on if the Fed are more hawkish than expected (likely bearish stocks) or less hawkish than expected (likely supportive of stocks)

- Otherwise, traders may want to step aside and see how the dust settles tomorrow, before choosing a bias

WTI crude oil technical analysis (daily chart):

We have all been watching oil prices climb alongside concerns of higher inflation. It’s rally barely paused for breath with a break above $90, although WTI crude oil has hinted at a potential retracement via a key reversal, with a bearish hammer on high volume and a bearish divergence with the RSI (2). That its high failed to retest the October and November highs adds to the case for a near-term reversal.

With the FOMC meeting looming and the potential for the Fed to deliver a more hawkish tone than the Fed Fund futures imply, a stronger USD and growth concerns could weigh on oil prices over the near term to finally trigger a retracement.

A break beneath $90 opening up a run for $87 – near the volume node of the preceding leg higher. Alternatively, bears could seek to fade into minor rallies with a stop above the hammer high or October / November highs in anticipation of a break below $90. An obvious risks to keep in mind is if the Fed are not as hawkish as I suspect, which could weigh on the US dollar and support appetite for risk and send oil prices higher.