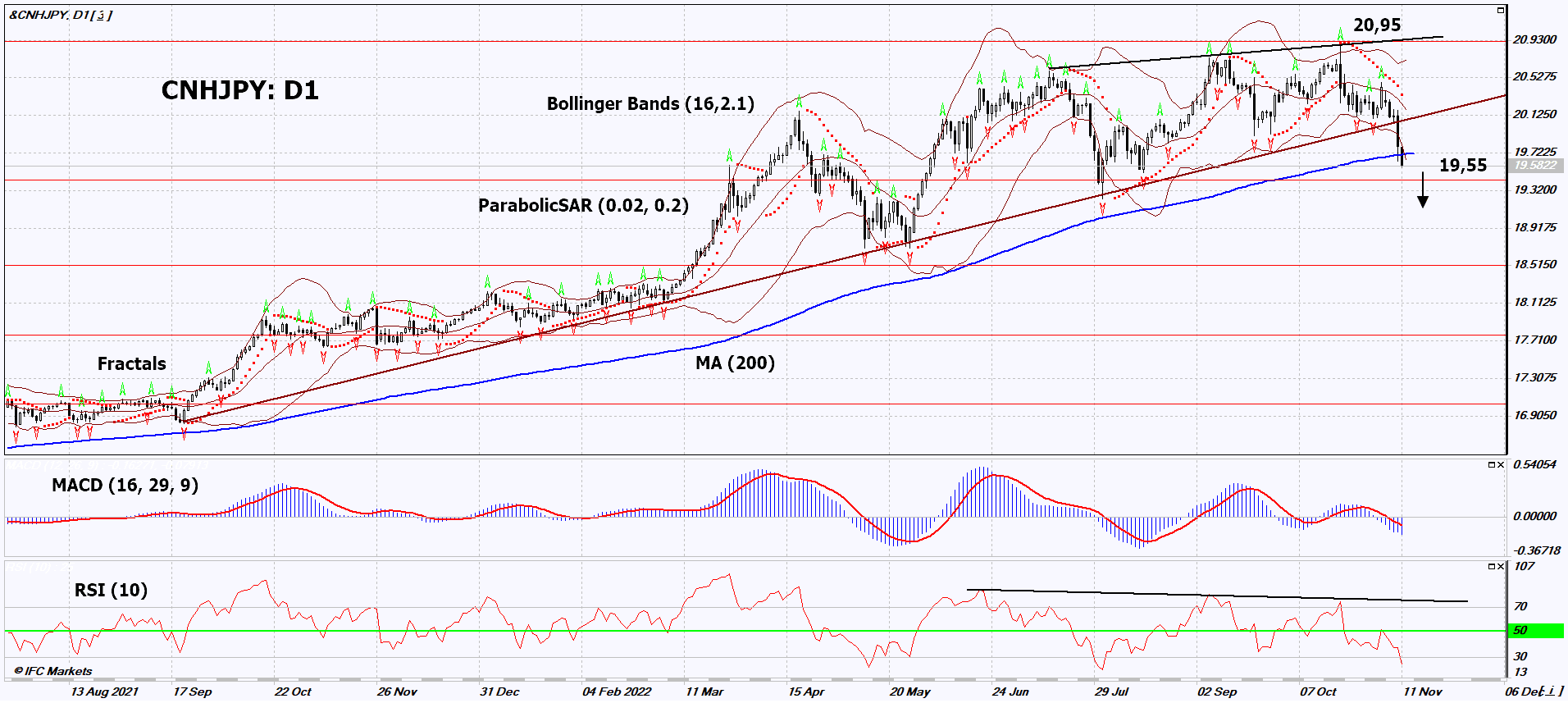

CNH JPY Technical Analysis Summary

Below 20,95

Sell Stop

Above 19,55

Stop Loss

| Indicator | Signal |

|---|---|

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Sell |

CNH JPY Chart Analysis

CNH JPY Technical Analysis

On the daily timeframe, CNHJPY: D1 broke down the support line of the long-term uptrend, as well as the 200-day moving average. A number of technical analysis indicators formed signals for further decline. We do not rule out a bearish movement if CNHJPY: D1 falls below the latest low of 19.55. This level can be used as an entry point. Initial risk cap possible above all-time high, last 3 upper fractals, upper Bollinger band, Parabolic signal and 200-day moving average line: 20.95. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal high. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a trade, can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (20.95) without activating the order (19.55), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of PCI - CNH JPY

China and Japan are expected to publish important economic data. Will CNHJPY quotes continue to decline?

In this review, we propose to consider the personal composite instrument (PCI) Chinese Yuan/Japanese Yen. It declines when the yuan weakens against the yen. On November 15th will be published preliminary Japan GDP for the 3rd quarter, on November 17 - Trade Balance for October and on November 18 - inflation also for October. These data may help investors refine their forecast for a possible tightening of the monetary policy of the Bank of Japan (-0.1% current rate) at a meeting on December 20th. This week in China, some economic indicators for October will be released only on December 15: Industrial Production, Retail Sales, Unemployment Rate, Fixed Asset Investment. Preliminary forecasts of these data look moderately negative.