In this technical blog we’re going to take a quick look at the Elliott Wave charts of ZS_F (Soybean futures) published in members area of the website. As our members knew, we’ve been favoring the short side in ZS_F (Soybean futures) due to incomplete bearish sequence down from June 9, 2022 peak against July 29, 2022 peak. ZS_F cycle from July 29, 2022 peak ended at 1390 on August 3, 2022 as an impulse Elliott wave structure and then it started bouncing. This pull back took the form of Elliott Wave Zig Zag pattern and members knew it was nothing more than another selling opportunity. In the remainder of the article, we are going to explain the Elliott Wave Pattern and talk about the blue box selling area.

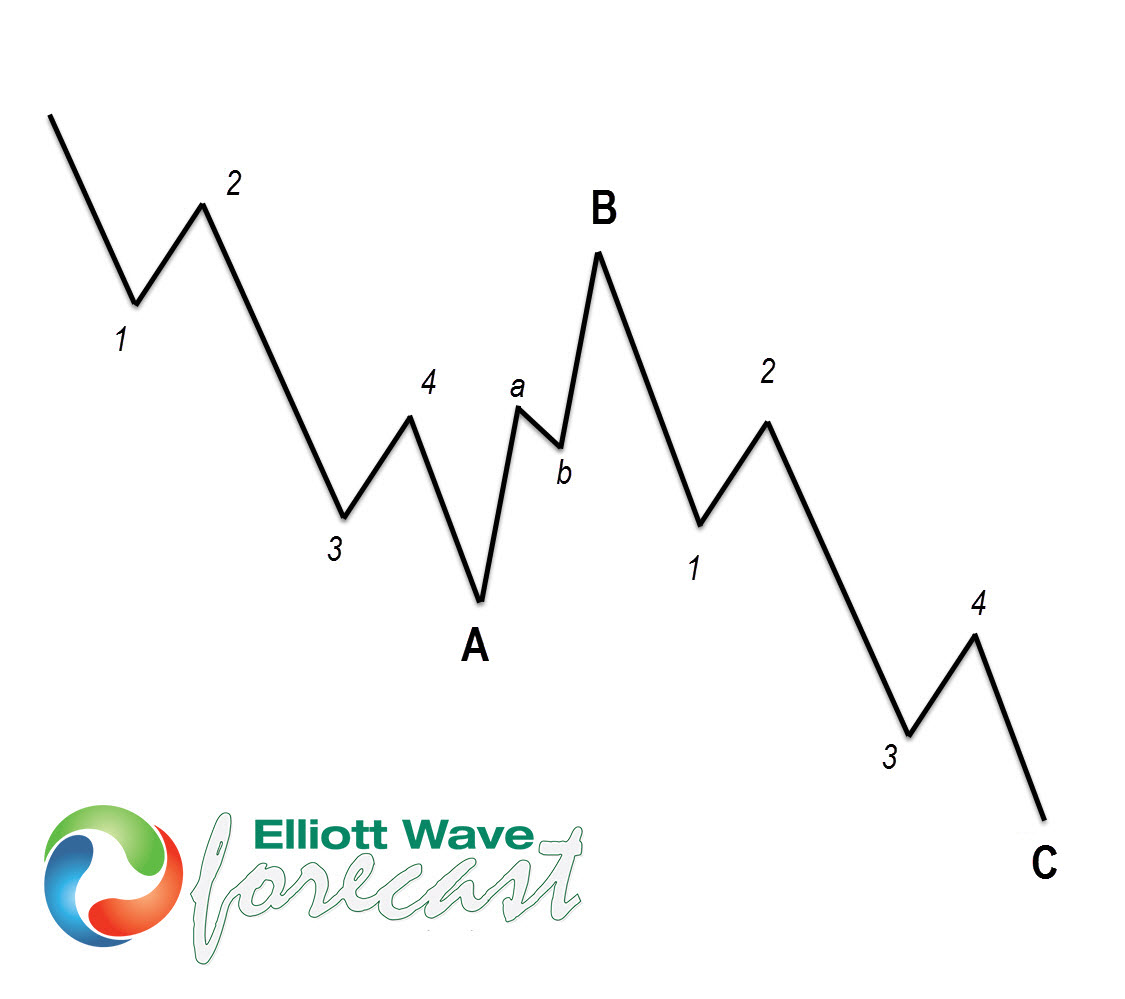

Before we take a look at the real market example, let’s explain Elliott Wave Zigzag.

Elliott Wave Zigzag is the most popular corrective pattern in Elliott Wave theory . It’s made of 3 swings and is sub-divided as 5-3-5. Inner swings are labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C can be either impulsive waves or diagonals. (Leading Diagonal in case of wave A or Ending in case of wave C) . Waves A and C must meet all conditions of being 5 wave structure, such as: having RSI divergence between wave subdivisions, ideal Fibonacci extensions and ideal retracements etc. Wave B could be a triangle, FLAT, Zigzag or a double three structure.

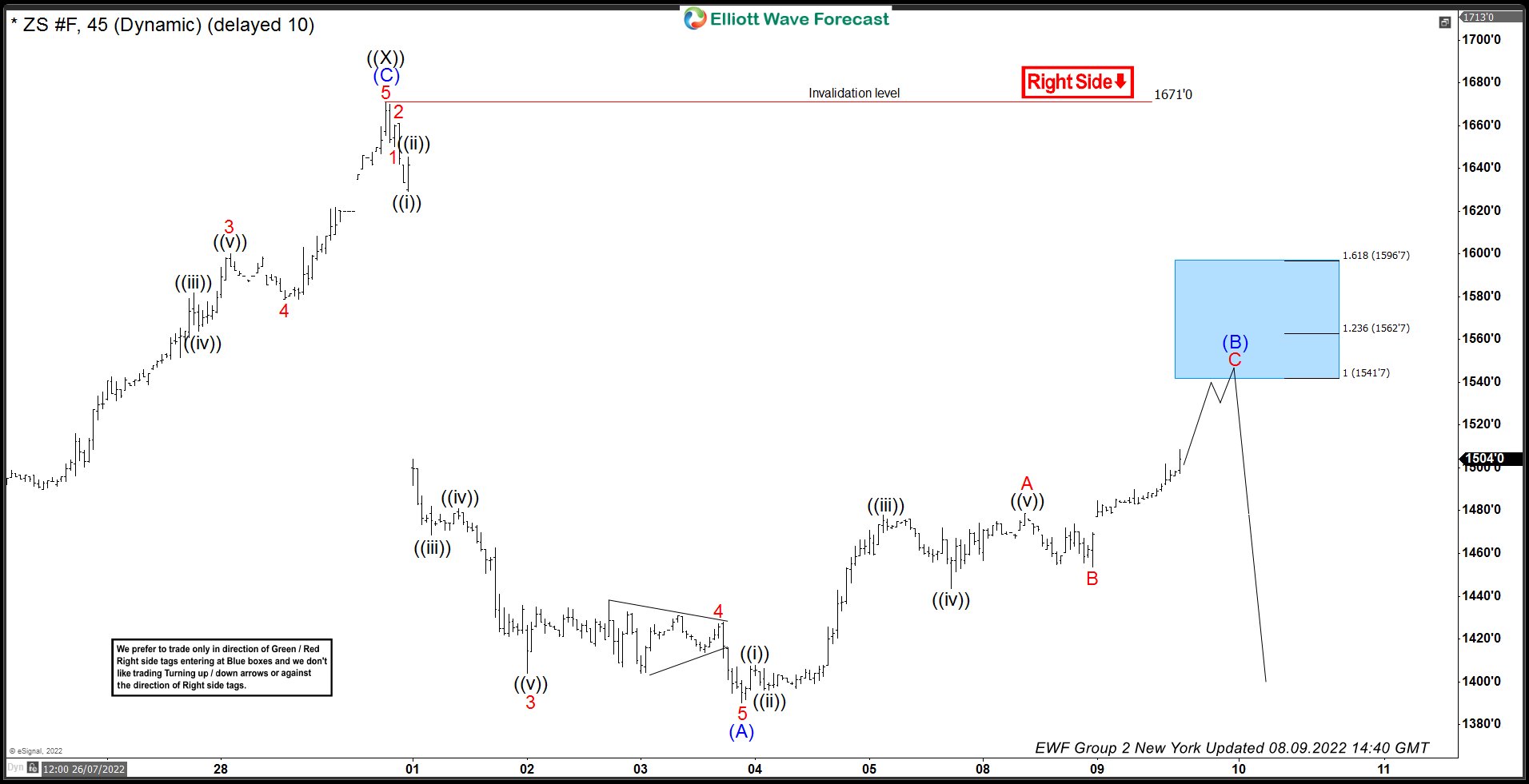

ZS_F (Soybean Futures) 9 August 2022, 1 Hour Elliott Wave Update

Current view suggests ZS_F is bounce to correct the decline from July 29, 2022 peak (1671’3). First leg from the low was in 5 waves which has been labelled as wave A. Pull back was corrective and completed wave B. We have already seen a new high above wave A which makes it an incomplete sequence against August 8, 2022 low. Current view suggests C leg is in progress toward 1541’7 - 1596’7 area (highlighted with a blue box).

We don’t recommend buying the instruments against the bearish sequence and bearish trend. Strategy is waiting for the price to reached marked blue box zone, before selling the instrument. As the cycle is bearish against July 29, 2022 peak, we expect sellers to appear at the blue box for 3 waves reaction lower at least. Once reaction lower reaches 50 Fibs against red B low, we will make short position risk free by either moving stop loss to entry position or taking partial profits and putting stop on remaining position above the high within the blue box. Invalidation for the trade would be break of marked 1.618 Fib extension level at 1596’7. As our members know, blue boxes are no enemy areas , giving us around 80% or a higher chance to get 3 waves reaction lower at least from the blue box area.

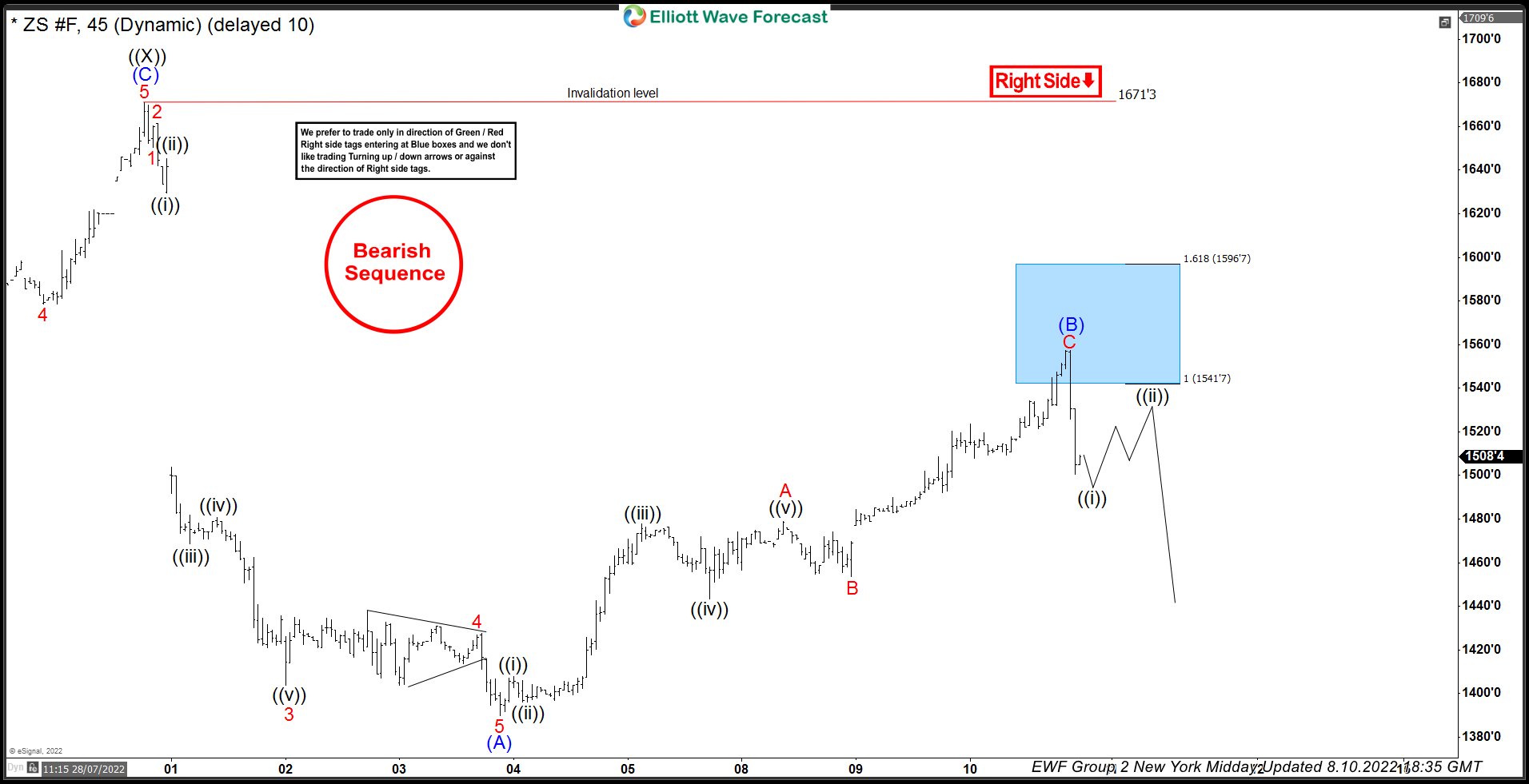

ZS_F (Soybean Futures) 10 August 2022, 1 Hour Elliott Wave Update

Chart below shows ZS_F (Soybean Futures) made the push higher toward the blue box area as expected. The instrument has found sellers at the Blue Box area and we are getting good reaction from there. Bounce completed at 1557’2 as a Zig Zag pattern. The reaction lower from the blue box reached 50 fibs against the red B connector. Consequently, members who have taken the short trades at the blue box are now enjoying profits in risk free trades. Now we would need to see break of August 3, 2022 (1390’0) low in order to confirm next leg lower is in progress. Once the instruments breaks below August 3, 2022 low, the instruments will become bearish against August 10, 2022 high and might offer some new selling opportunities in the short-term bounces in 3, 7 or 11 swings against 1557’2 high. Until August 3, 2022 low doesn’t break, a double correction high still can’t be ruled out in which case we would highlight the next blue box buying area for the members.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site