Super, your on topic posts are bang on (you must start some threads though on the ‘off topics’ stuff, I’m sure they would lead to some great discussions)

Well, have a look at your charts…fiber got booted to 1.3651…minor swing lo 10am EST, yesterday is resistance

Present support is major swing hi’s 1.3626/25/22.

1.3640 is 61.8% fib level current week lo to current week hi.

Present 1h candle shape similar to last Fri.

Offers above 1.3650.

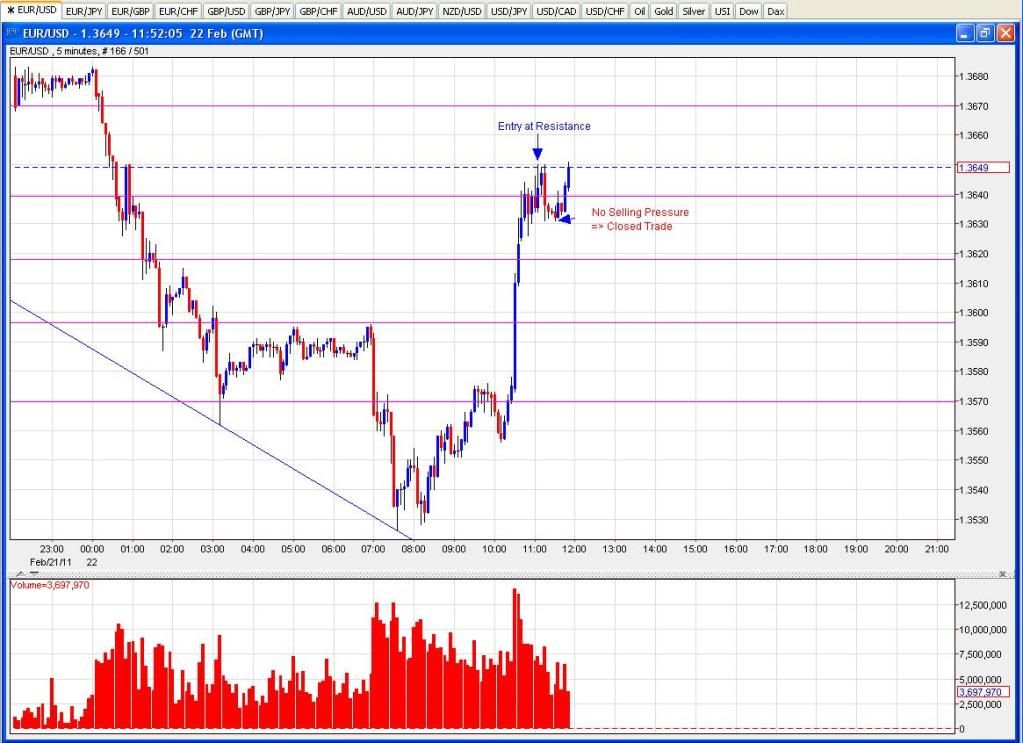

And an example of volume letting me take a little profit after I entered that short at the test of the Feb 21 low. After price went +15 pips there clearly wasn’t any selling pressure evident in the volumes so closed out at 1.3634. The candles were probably a clue too but volume helped to clearly identify this.

Now I just need to be quicker about thinking to go long in such cases. And also need to start leaving portions of a position open. Missed some good profit opportunities today despite making 1%. The education goes on!

Sorry but I can’t resist - if you didn’t think too much about worldy stuff - you’d be there!

Heh, yeah I was waiting for that one

Anyway, here’s one from a different pair showing that VSA works nicely elsewhere too. Entered a long GBP/CHF trade after the volume seemed to be saying to me that price had based out for the moment. Closed out the trade at the recent high from earlier in the afternoon.

Edit to add: 1.5175 was also the 62% retracement from the Jan 25th to Feb 15th swing up which added some support no doubt.

Click on the attachments and download the Master the Market PDF. Have a read through that and then read through this thread to see forex examples put into practice. I’d also advise reading through the Technical Templates thread to get a view of how some prop traders trades - in particular about S&R zones. It won’t be wasted time in the end.

I went long today. 2 times. And way too early. Got stopped from both. First bad day for me in long time. After those I went to sleep. And now I’m back and see that nice move up. lol

Today -3%. Have to lose sometimes, right?

Well… Sorry if I’m harsh. But if you say reading 155 pages is way too much, then you are in wrong business. 'cause you need to read alot. And one time is not enough. You need to read couple of times at least.

But if you said that 'cause you don’t know if this is worth it… I can say it is totally worth it. This thread is my bible.

I agree, might as well give up now, 155 pages is nothing on this learning curve, a mere drop in the ocean.

Did you pay attention to reality this time ?

Cable entered it’s zone.

Did I read this right? saw alot of stopping volume on down move with with alot of large lower wicks. Went long on the first candle that closed above those 4 pins.

Or was I just lucky?

*image not showing for some reason

Looks like a valid trade to me. You’ve got volume spikes occurring but no new lows accompanying them and the candles have quite wicky ends. Think a few others here took the same trade more or less today.

I think you need 50 posts before you can post images - so throw your two cents in everywhere for a while.

His link is not straight link for image. It’s link for image and for some random stuff. 5 posts needed, not 50.

Correct link: http://img193.imageshack.us/img193/518/eurusd1.png

Hey guys, VSA really seems like an interesting concept or arrangements of concepts, but I have an [U]honest, not-intending-to-offend[/U] question.

If Forex is an over-the-counter; ie. decentralized exchange, what Volumes are you using for your analysis? Is it the volume aggregrated from all users of MT4 across all brokers? Or is dependent on the broker? I just hope it is not [U]retail[/U] trader volume, seeing the proportion of the forex market they represent…

+1 guys, +1.

Regards,

xXTrizzleXx

I’m short. I was short like hour ago and got stopped… Pfft… This week really going badly. Let’s just watch how I get stopped out from this one too.  haha This can be little too early to trade again… But there is alot volume.

haha This can be little too early to trade again… But there is alot volume.

Read through this thread you will find the answers.

You’re going against the prevailing trend, and trading without any Fibs or S/R in sight, stick them on and you will be consistent again, if maybe placing less trades, but that can be a good thing.

Yeah it’s tough to be short right now with all the interest rate expectations fueling the Euro lately. Normally with a bloodbath like yesterday for Equities you’d have seen the Euro beaten down and stay down. But once some ECB folks started talking about interest rate rises to combat inflation whoosh up it goes again.

London pa shows me nothing but weakness. I am not afraid.