yeah i wasnt too keen on the idea,

thankfully there is babypips.com

Hello members,

I am a new user of abcd/butterfly.gartley pattrens just learning it can somebody please tell me what should be our first target for profit?

So, I’ve found a few - any additional analysis would be helpful. I they look pretty good, but I am still quite new at this so I could very well be wrong!

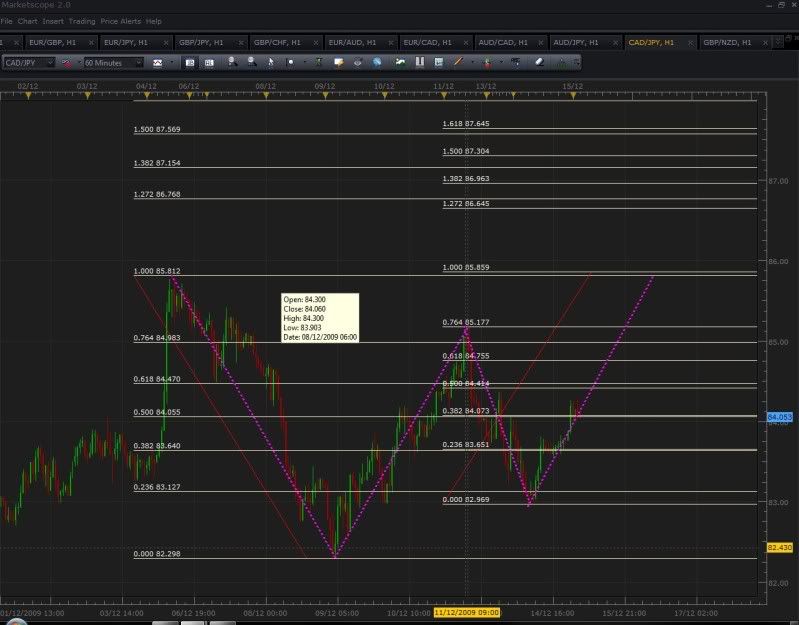

First one: on the 1 hour CAD/JPY. It looks like there’s going to be some really nice convergence on the 100% fib of the XA and the D.

Second one: This one looks pretty volatile to me; if it hits my target anything could happen - big profit, no profit, losses, etc. I’m definitely wary about this one. It’s on the GBP/AUD 1 hour.

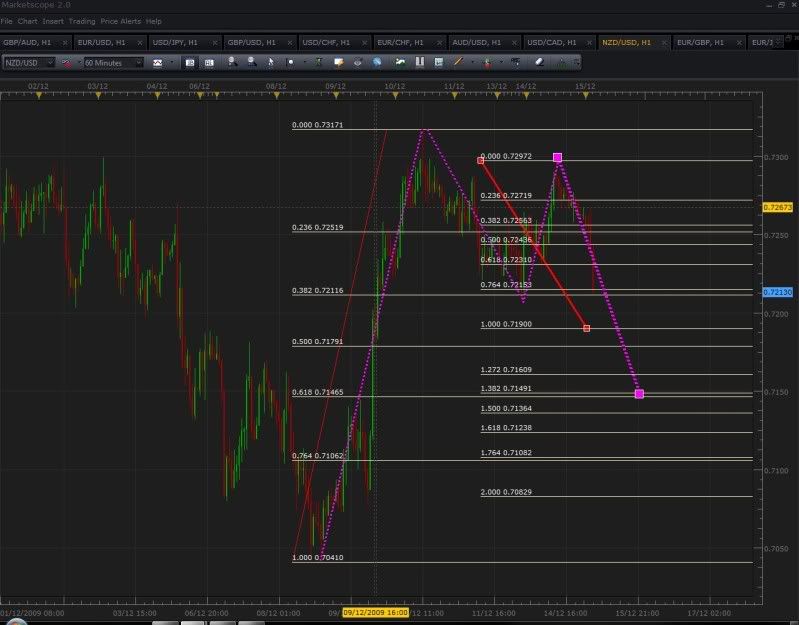

Third one: on the NZD/USD 1 hour- I’m liking the symmetry of this one. Not quite perfect, but still pretty nice. As I type this, it is flying towards the goal, so I think it looks pretty promising. We’ll have to see, it might even reach the 76.4% of XA.

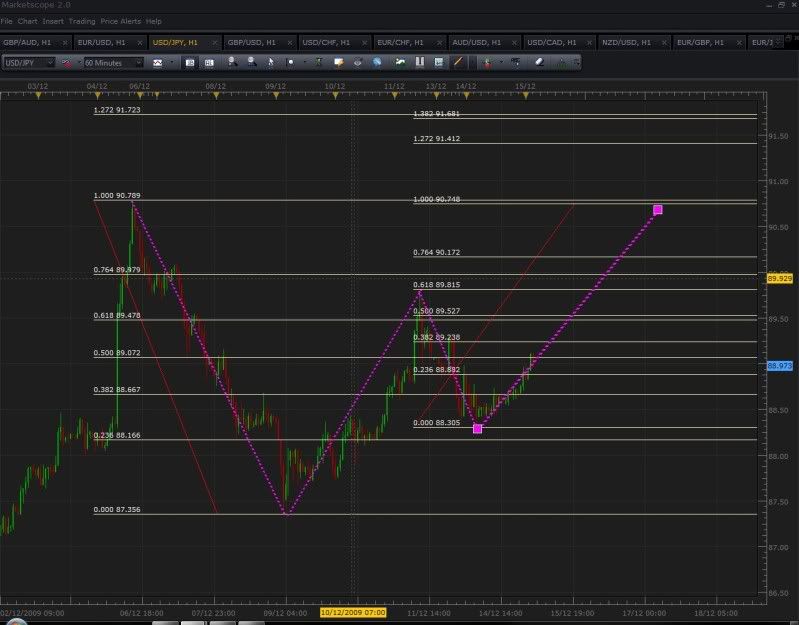

Fourth one: This one I also like. It looks like it’s behaving really, really well, and the convergence is on the 100% of XA, so I’ll definitely be keeping my eye on this one. It’s on the USD/JPY 1 hour.

Let us know how it turns out for you mate  and which ones you went with, if not all or none, Demo or live?

and which ones you went with, if not all or none, Demo or live?

Demo for now, probably going to go live in a month or two, depending on how comfortable I am with the system/my overall level of knowledge.

There are a few different options for take profit with this method:

Tmoneybags used a 30 pip goal. He also mentioned that, if you want to play it safe, you can set your take profit at the 23.6% fib from A to D, as price almost always hits at least that level.

If you are more adventurous, you can set your TPs at higher levels; the 50%, 100%, etc. Wherever you want, so long as you are confident that the price will reach that level - perhaps it’s a major resistance line that you feel the price will head towards. Keep in mind that the further away you set your goal, the less frequently you will hit that goal. He was also quite an advocate for rigid stop losses and take profits - a “set it and forget it” attitude which is a very, very good idea; particularly if you can be a nervous trader.

Personally, I’m going to start testing out a system where I aim for the 23.6% fib level, or the 30 pip target - whichever is lower - and once price crosses that line, set a trailing stop 10-15 pips behind that, and then let the market go where it wants to. I’ll definitely let you guys know how it works once I’ve tried it a few times.

What Aarnog just said is right, TmoneyBags suggests a 30 pips profit, no matter what conditions, which is a very achievable one.

Good retracements are supposed to go to the 50% AD retracement, so that being said, we have 23.6 and 38.2 level in between, which are good for set a target profit.

Personally, I usually target the 23.6% AD retracement as target profit, as long as it is 30 pips or more.

Most of the time, when we have a fake out, price will hit the 23,6% and then resume its original trend.

Try it yourself and see what works better for you, 30 pips or fib levels.

Hope that helps

HI ALL !!! i am the newest noob around and i want to say HIIIII !!!

i am reading the whole story here and it starts to clear…very slowly/becouse english is not my 1st language i have some difficulties…please someone post the rule of the trade.pdf…the actual rule of the trade t money bags created…i cant find it…thanks and bye for now…have 190 pages more to read…

TMobeyBags thank you for sharing all this…to all members…thank you for supporting noobs like me…DA THREAD IS ROCKIN !

this is what i found interesting in another book by Larry Pesavento

/attached/

Hit my stop loss on the GBP/AUD after sitting around in profit for a while - never quite retraced to my 23.6% target. This was the pair I was most nervous about trading, too. Goes to show that sometimes your gut feeling can be your best friend.

I’ll definitely do some research to see why the pattern failed once I’m finished studying. For now, back to the books!

Problem discovered: I didn’t go back far enough when checking for other X’s. There was a larger, much more significant X located further back. You can see that there is perfect convergence with the 161.8% fib, and the 76.4% fib. This convergence is significantly higher than the one I was aiming for. Whoops!

I also found another decent looking pattern on the GBP/NZD. While the convergence is very good, it’s generally a pretty nasty pair to trade; and the spread can get absolutely ridiculous so I’ll probably avoid it. Anyone else who wants to check it out can, however:

There is also a larger daily pattern than hasn’t reached it’s D, but is well on its way towards it on the GBP/AUD, indicating that I may well have been trading in the wrong direction entirely - as the D is above the one I was aiming for in the hourly chart.

Lessons learned: Do more research on the daily and hourly charts before entering into a trade.

Hi sweet…may ask where did you find this indicator and is it any good at all…thanks

Just a quick heads up Aarnog, it looks like you don’t have the proper Fib levels set, TMB posted them in the first few pages of this thread. Your GBD/AUD was a good pattern but your fib levels didn’t show you convergence at the .886 of XA and 2.00 of CD, which is right where it did a Uturn.

Fib levels are on page 2

Hiebz - thanks! I didn’t even think to check my fib levels when I switched from GFT to FXCM, I just selected all the fib levels and assumed everything would be good. This is my big problem during finals - I am pretty haphazard with most of the things I do, because I’m only concerned with studying for finals.

Actually, I just realized (because Dealbook didn’t have this option) - are we supposed to use the bid or the ask price for patterns?

I just noticed that convergence is much better along the .886 using the ask price than the bid price (where there is only 15 pips of convergence - weak at best)

Yep TMB recomends using Ask for a bullish pattern and Bid for a bearish pattern

I thought I read that somewhere, but I couldn’t for the life of me find it. I’m going to throw that into the word file I made regarding this method (same place I had the fibs, actually. I just need to remember to check it more regularly, apparently)

Hi guys,

I’m watching this aj 4h.

Take care as there is also a daily pattern with D well below at 77.29.

Thankyou modo

I’m seeing a few Bullish butterflys developing on the 4h and daily chart for Eur/Jpy