i see it, good luck. be careful in this half hour into equity open, can be fakeout central.

Lost another 20 pips. Wow, it’s going terrible at the moment. lol

I don’t understand. The pattern seemed very solid with several X’s pointing to the same direction, and just as it was about to complete we had bullish unemployment claims news for the USD, but it continued to tank…

Why are you using a 20 pip stop? What made you come up with that number? Do you use it across all timeframes? It doesn’t make a lot of sense to me?

Also, I have found it’s better to wait for the equity floor to open before entering the market. This takes discipline, but it generally pays.

Modo: I don’t understand what you’re saying by waiting for the equity floor to open, could you explain?

I don’t use a 20pip loss in all timeframes, I use a visual stoploss. The sensible stoploss point was the next fib, but that is 50 pips away and I can’t afford to lose that much.

By equity floor I mean the stockmarket. In the period leading up to that I believe there is less liquidity and more likelyhood of stops getting run.

Are you trading the minimum size? If not can you reduce size to accomodate an appropriate stop?

That’s the thing - I started with a $300 account and was able to trade lots smaller than 10K. But now for some reason when I try to enter a smaller number, it says it should be higher than 10k.

Obviously a 20 dollar or 50 dollar loss isn’t a big one, but I am very novice and can’t risk a lot of money into my trades.

Not sure about FX but with spreadbetting some new accounts allow you to bet less than 1 euro in the beginning but this is removed after a few trades and you have to bet a minimum of 1 euro.

I had the same problem as you when I went live first with 1,000 euro. A few trades went wrong for 50 pips and then it was down to 800. Popped up some and then down again. After a month it was down to 600 so called it quits as it’s a death spiral where the % being risked was constantly going up and the % I had to earn just to get back to breakeven was now at 66%. I couldn’t practice proper money management so I’ll be demoing until I’ve saved up 5,000 quid and can have a proper go.

Hmm, maybe you should talk to your broker and find out what’s going on. Don’t meant to bust your balls, I just hate to see you losing like that. If you had a better stop you would still be in that trade. Everybody is different, I’m not saying the next XA fib is the only solution, but it’s hard enough finding turning points, let alone to within 20-30 pips on 4h or daily patterns. Maybe if you are a little undercapitalised you could wait for a long term pattern to hit, then move down in timeframe where the stop requirements are smaller. I do that a lot myself because the stops on larger patterns can be huge in terms of next XA fibs. I’m really no expert, but i’m just trying to talk it through. I thought you were using an arbitrary 20 pips stop which you are not, so maybe i’m making too big a deal of it.

I went for 300 dollars because this is the amount I wouldn’t mind completely losing. But if I use stoplosses of more than 20-30 pips that means, because I can’t use lots smaller than 10k, I can go completely bust essentially in 10 trades. And then I would always have second thoughts about putting more money into this business.

And live trading is SO different from demo’ing. I think the “demo xx months before you go live” is not as accurate as it might seem, because the live $50 money you lose can teach you MUCH more than the thousands you lose in demo.

Heh, yeah live is quite a bit different. I learned more in that month than I did in the previous 7 or 8 months. Had to unlearn quite a few things too - bad habits I’d picked up in demo trading.

If you have $300 that means you should only be risking like 6$ at most on a trade while being able to keep reasonable stops. If that’s not possible I’d advise pulling your money out now and keep working away at your system until you’ve got a bit more to invest and can feel (somewhat) comfortable that you can make a decent go of it.

That’s the path that I’m taking anyway. Means I’ll have to be patient for a year maybe but I figure I can learn a lot in that year now that I know from live trading what my faults are and what things I should do to correct them on top of just learning more about forex in general.

You’re right. Trading is 90% psycology, and demo won’t teach you a thing about that. But I also respect Pipbandits desire to be adequately capitalised. Otherwise it can be like taking a knife to a gunfight. But aren’t there brokers out there where you can trade like 10 cents per pip. Just a token amount to practice with that is not demo.

Risking 6$ per trade requires no more than 6 pip stop losses… that makes everything “untradeable”

unfortunaltely you have to make mistakes to learn, and in this business making mistakes means losing money. you might as well accept that you will lose some money along the way…think of it as tuition.

if you have only 300 in your account i think it’s reasonable to risk more than the usual 1,2 or 3%. focus on trying to find the best trades you can, then go at it hard…with the right stop. let your default setting be not to trade, and only take a trade when it’s so compelling that you simply can’t let it pass. when you have done all your homework, i think you should feel comfortable with risking say $40 or $50, and be happy regardless of the outcome because you had traded with discipline. but take your time, hasten slowly. as long as you are not wildly speculating and have some kind of circuit breaker like stop trading after the first loss of the day, then i think you will be fine and learn a lot.

Good points by Modo. I didn’t follow them when I went live with a semi-adequately capitalised account and paid the penalty. Good lessons in the end though I have to admit. I now demo like I should have traded live. If you lose your $300 don’t sweat it too much. Chalk it up as an education and carry on. Learning to do anything decent takes time and money usually.

Thanks Modo and PipBandit, really appreciated your words. My morale is very low, because trades that seemed good didn’t even flinch while they broke my fib levels, lol. In the end I lost 50 dollars, which I don’t really care about when you think about it, but today has really been a blow for me. I need to go out and clear my head before I continue trading.

Sorry to hear that, but try use it to your advantage. This game is full of disapointment and learning how to deal with it is a skill. Use this opportunity to practice getting over it as quickly as possible, similar to how an athlete would recover after hard training. Time yourslef if needs be. See how long it takes to normalise your frame of mind. It shouldn’t take long when you consider that one day, one week, even one month’s performance is meaningless when you are playing with odds and probabilities.

Take it easy, I’m off to bed. Just booked partial profit on that long eurgpb trade of 270 pips wohoo. But I missed re-entry into the short aussie so i’m dealing with some disapointment of my own. Time to practice what i preach…goodnight.

That NZD USD was a beauty but it missed my entry by 3 pips!!! Heartbreaker, it would have given me +50 in a hurry.

Exactly the same for me too. Had an order at 0.7105. Ah well… on to the next pattern.

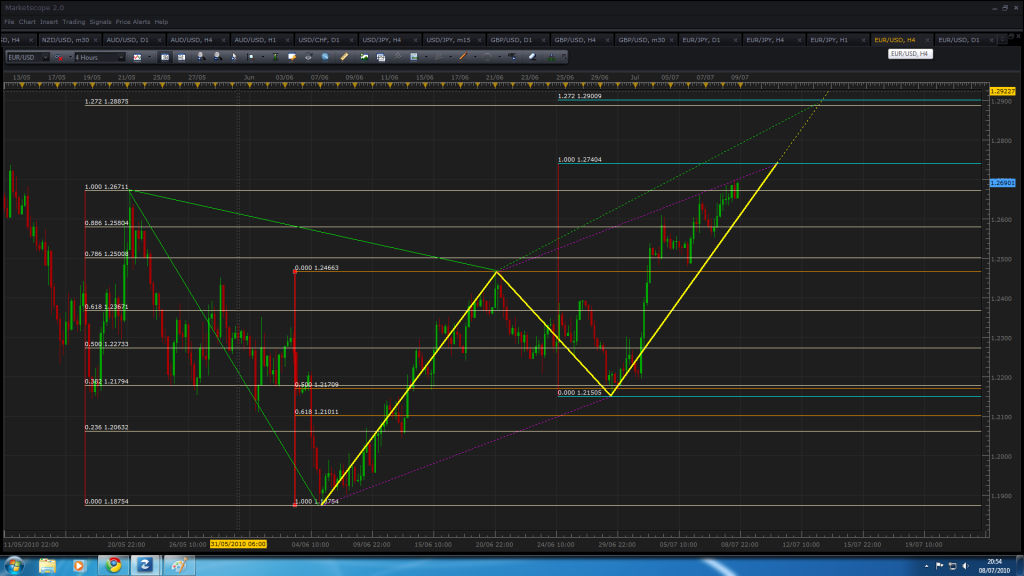

Speaking of which the main two I’m watching at the moment are EUR/USD and EUR/JPY. Pretty much complementary of each other I guess. Both contain an ABCD pattern which completes a reasonable bit before a Butterfly and a Gartley.

Wouldn’t be too confident about the ABCD pattern - would have preferred a bit more of a retracement in both to their C points. If anything that’s giving me a bit more confidence in the other patterns’ potentials. We’ll see how things go I guess.

EUR/USD 4 Hour Chart:

EUR/JPY 1 Hour Chart: