taking partial profit and letting it run past 20-30 pips is best when setting the stop at break even.

dang, I almost qualified fot the government part too

but amm you say is what everybody else says and it rings true with me, keep it up man

you do help ppl management fund? by under our own account or under your account? any further detail might email me.

These two patterns seem to be pretty much the same one, the only difference is that one is the EUR/JPY and the other the EUR/GBP

The reversal zone for the EUR/JPY is at 100.52

For the EUR/GBP the reversal zone should be at .8020

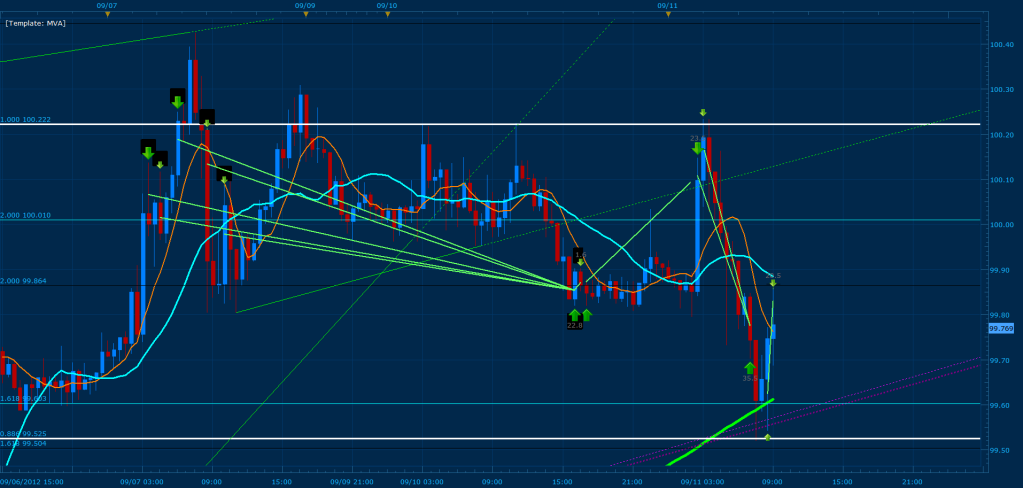

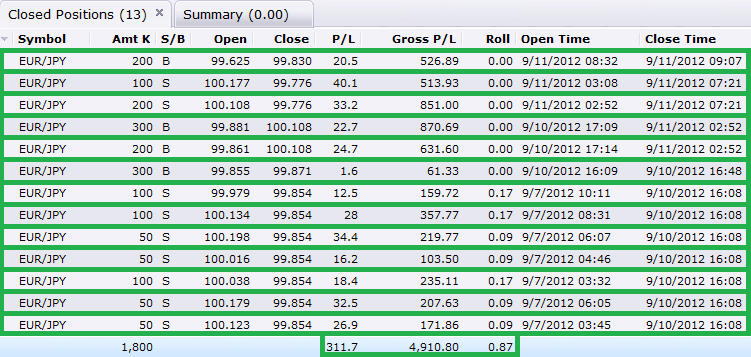

I spent Friday predicting a sell on the EJ that should have nailed me 70+ pips in profit “easily”. The reality of it is that I am not God and I can not predict the future and I must humble my self and “Trade What I see”. To clarify, a few hours before the market was closing I was “given” the opportunity by the market quite a few times… to close with a decent profit of 1500 for the day which was equivalent to 30-35 pips; at the same time price had tested the bottom of a channel and given us a pattern with a potential of reaching another 30 pips before the days close… My instincts told me to take profit and enter the trade, but the greed and pride in me wanted to see price complete itself to the predicted point. The result was a day without any profit and watching price do exactly as my instincts and the markets showed. At that moment I remembered that the entire reason for this whole 30 pip system was to eliminate these emotions we feel which prevent us from achieving consistency in the account and decided not to let go of such opportunities again… for they are devastating both financially and emotionally (building stress upon stress). The reality is that 30+30 = 60 pips and it’s a lot more secure of achieving then holding onto a trade for 60+ pips… Bellow are the results after humbling my self:

When you guys find a pattern what exactly do you guys use to more or less filter bad ones from the good ones besides symmetry and avoiding news days?

Eddittheguy patterns don’t work and never work. All you need to do to become a successful trader is have only 45% of your trades be winners, and have your winners be 1.5-2 times as large (on average) as your losers.

So a 45% win rate, and a "risk-to-reward of 1.5:1 or 2:1.

If you can execute this perfectly, you will be a multimillionaire in just a couple of years. The toughtest part is executing this. It’s very easy to become emotional and distracted in a losing trade. Don’t worry about each trade, just focus on the big picture.

I recommend checking out Ninjatrader and becoming familiar with the trading software-it will allow you to practice a trading day in just a couple of minutes because of it’s market replay feature. This feature will let you fastforward an entire trading day. You can then practice your 45% win rate and 1.5:1 risk to reward. Do not attempt automated trading-people call this searching for the holy grail, and it is impossible for individuals to accomplish this. Only firms with multipule people can do this. It only takes a few weeks to become a good “descretionary” trader.

We use multiple convergence zones, candle stick patterns, price action, trend lines, moving averages, previous price history (major support resistance zones), top down analysis of the market; Basic patterns such as Triangles and H&S along with their apex measurements once triggered, etc… In essence, a combination of the basic tools traders use every single day combined with Harmonic patterns in order to pin point the correct converging zones. You can read more about this throughout the thread and reference our techniques visually with the hundreds of patterns I’ve linked on this thread.

Thank you TMB and 21 club its just that I was mostly trading everything I found I know that in the long term that wasn’t going to be very successful or I might get lucky every now and then and since I have just started trading with a mini live account I wanted to adapt good habits before I execute a trade and know what to look for.

If you were not so arrogant and repulsive, you would become a better trader very soon. Yes this is how long it takes. I have been a very successful trader for awhile now, although I’m a total newbie when it comes to forex. Even though my life entirely depends on my trading career, I don’t go around flaunting any prowess. This is not a provocation, I’m just trying to enlightenen you. I will help you as much as you would like me to, just let me know. (Which by the way, don’t let me know any of your true or fantasy claims on your trading successes)

Trading is not difficult. Unfortunately most men (especially older ones) are very narcist and not as smart as their arrogance says, so they have an almost impossible time learning. Especially on their own.

Again let me know if I can help you in any way. I hope my response is constructive and positive.

Eddietheguy - I think forex is the best place to start, even if I am new to it (I am a futures and options trader). The reason is forex allows you to start with a little amount of money. With futures, your account will be eaten by comission and slippage (more slippage than forex for small traders). There are also large minimum trade sizes in futures - often over $1,000 per “lot” (contract). With forex, you can trade whatever amount you would like.

I recommend reading Mind Over Markets by James Dalton. It is a very easy read. I do not recommend most trading books. The only “indicators” you need on your trading screen are market profile and VWAP (volume weighted average price). These two will get you on the path quickly to a successful trading career. EURUSD is by far the largest forex pair.

So true and being negative makes life harder then it really should be.

thanks for the help and its funny because when i was completely knew trading I was looking in to trading futures but the minimum trade size was way to much for me and thats how I ended up in forex.

It would be much appreciated if from this point forward all posts placed on this thread are positive and constructive towards the community. In addition, please keep all comments strictly towards risk management and harmonics; it is what this thread is based on. As for bashing, boasting, advertising, or any other form of comment that does not pertain to this thread… please keep it out or think twice before submitting a post. I do not mind reading and answering novice questions nor the implementing of new techniques to the system I have been teaching here.

But placing comments such as:

[B]

1). “[I]…If you were not so arrogant and repulsive, you would become a better trader very soon…[/I]“

2).”[I]…patterns don’t work and never work…[/I]“

3).”[I]…Don’t worry about each trade, just focus on the big picture…[/I]“

4).”[I]…Bahahaha!!! You can become a good discretionary trader in a few weeks…??? “all you need to do is set reward risk to 1.5 - 2 and you will be golden” … Bahahaha… I hope your are kidding man…[/I]”[/B]

[B]1). No need to be fresh with anyone in this community no matter what comment has been said, use your private messages for this if you feel the need to.

2). Patterns work in probabilities and harmonics have a proven 70% chance of working since the 1930’s. In addition, just about every pattern out there in the market has a sole probability of working 30% of the time which can be adjusted to that of 85-95% with proper risk management. All in all, patterns in the market are based on human emotion, which is mainly fear and greed… Human emotion has been proven to be predictable, do not base your view on the success of this because of your own failure or of others you have seen.

3). Each and every trade that you take is important, neglecting a single trade can wipe out your account or reduce it significantly, managing it correctly can increase your balance significantly or allow you to recover from previous mistakes. Focusing on the big picture can lead towards illusions developing throughout your analysis and add towards bias judgement in any given moment. I suggest that you and all who do trade no matter what technique is used focus on the day to day trading events and not that of tomorrow, because you do not know what tomorrow will bring with 100% certainty… this is a huge mistake. Do not confuse me with being pessimistic here… it is important to maintain a positive attitude at all times and have goals, but i must stress the fact that when ones focuses on what they do not currently have they loose the means of achieving that “want” easily… Again, focus on the NOW, “Trade what you see” not what you want and consistency will take you there where ever there may be for you.

4). Refer to my first response 1).[/B]

TMB can you explain to me what all the green lines that intersect are? The origins from the left side seem so random in location on the different candlesticks. Thanks.

Was checking out my charts and noticed this possibly forming.

Strangely on all 3 of my different broker charts they are different. There are 2/3 candles that look completely different between each broker.

Edit: Wanted to add the original pattern I was following as reference.

Those green lines represent trades we entered and took profit from… The arrows next to the lines indicate the direction of the trades.

So are where the green lines originate in respect to the candlesticks where you entered? Obviously I can’t help but be curious as to the practical use of the information. Well looking at your chart again more than one of those entries provide a future support/resistance area. Interesting.

That’s because the entries are not random… lol their placed on fib points within the convergence zone for the sell we have been anticipating. Its part of various patterns developing on the daily, 8/4hour, 1hr/30mn, charts. If you look at my trade summary and trace back each open and close of the trade through its price location, you will get those lines we have drawn on the chart. In addition, the buy’s where 30 min patterns that developed on top of previous convergence zones from the higher time frames that where broken by price but still respected.

I’m entering a short now on the EJ since price has pushed back up to retest the sell convergence, place a horizontal line on 100.219 and the highest high ever made. I’ll post a full analysis on the pair to clarify things for everyone. Just give me a few mins