Interesting as I found this one on the 4H chart.

So your bullish gartley might lead up to the bearish on the 4h… time will tell =)

Interesting as I found this one on the 4H chart.

So your bullish gartley might lead up to the bearish on the 4h… time will tell =)

Yeah, but what you have is a butterfly and not a gartley.

Maybe both will work out, let’s watch and see. You gonna trade it?

Yeah I know its a butterfly

Will see how price plays out, might trade none, 1 or both

How’s it going guys!

Diablo, feeling better already? I’m liking the GBPJPY setup you have there. If it reaches there today I probably won’t trade it because I’m out in a few minutes, but next week, most likely

Hey man!

Well not exactly better, but good enough to be able to sit in front of the computer at home starring at the charts with a few sleeping brakes in between…

It was close touching it already and then shot up again. We’ll see if it gets back there again or we need to look for another setup.

This setup resulted in a fake out of 10 pips. Price stopped a bit below the resistance and then continued down. Guess trend was too strong and time of day for a trade was bad too. :56:

It was the NFP that sent it shooting down, but it didn’t touch so pattern should still be valid… Hoping for it

That’s interesting. I just re-drew the pattern myself since it wasn’t reproducible by so many. Indeed, it did not come out as a perfect convergence this time. I’m on Oanda’s MT4 demo for that chart, and so cannot switch between bid and ask. Since I’ve redrawn it the convergence has been shown to not be perfect, however it is significantly less than the 30 pips you say it is. I get a convergence less than 11 pips apart.

Considering the amount of time this pattern has taken to form that still seems like a reasonable convergence for a solid entry, especially considering that the pair already went right past the convergence at the .50 level.

There are two more convergences that appear on my chart, at the .786 and .886. The .786 is actually a better convergence than the .618, but the .618 is the level with which this pair reacts most often and most violently.

Hi tmoneybags,

Thanks for sharing your trades.A great way for all of us here to learn and grow.Is there a particular process you follow before you start trading your system?Like for example,before you start trading this system that you are trading now,do you have some kind of backtesting results to build your conviction on it before trading it live?Or do you just trade it straightaway based on conviction of the logic behind the edge that the trading system has?

Your comments and others opinions would help.

To bad it didn’t work out. Like i wrote in my edit in the post above. Strong trend in combination with wrong time of day = fake out. Well well, there are many other patterns out there.

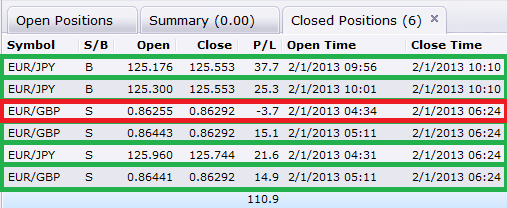

Did a few quick scalps today (testing the waters) :). Have a great weekend guys!

Haha, nice TMB. Looks like mine just the other way around!

Now i know who’s taking the opposite side of my trades…

Btw, for all you out there. I’m testing a sweet little indicator that calculates and draws harmonic patterns automatically in MT4. I’m not suggesting you should use it as a tool to place trades, more to use it to help you spot patterns and maybe redraw it yourself. Or to help you confirm the ones you’ve found on your own. It’s very editable (don’t ask me how to do though).

The indicator can be found here and it’s free: TradingArsenal.com - Successful Forex Trading with harmonic patterns

If you need help to install it into MT4 just google it, there are many guides for that out there.

Here’s a screenshot of the patterns it draws. I’m testing it on a demo account atm.

Well done, as usual. I 'm most impressed by the EUR/JPY short, cause I can’t see any harmonics leading up to that. Was that just a hunch based on the double top at some fibonacci line in a leg of another harmonic?

Both shorts are from weekly/daily harmonic patterns that have developed and my entries are based on 30/60 min patterns triggering them. I’ll post the graphs when I get home, chilling in downtown vienna and enjoying the weekend  take care!

take care!

Have a nice weekend everyone! Myself, i have a lot of analyzing of my trades to do since everything around forex that i touch goes against me! See you next week!

no, I don’t use eas, I draw it by hand. the zz i use is just to add a subjective point of view. This way im able to make a more reliable manual backtest.

I would be lying if I say now that im getting great profits. I tend to forget rules and take too much mediocre setups, however since i have the placard I have reduced a bit this problem. Yes, it sounds stupid, but it works!

Looking the numbers from 2012 I would say im just a small step above breakeven.

Yes, I put fibo between C and the point its suposed to become D, and then i have a table of patterns i developed from backtesting and forward testing differents pairs and timeframes, wich tell me the fibo lvl I should set sl and tp. The idea is to keep a general ratio of max. average deviation the CD leg of a specific pattern can suffer before reversing.

this last was a gartley, so I put the sl at -27.2 (127.2), tp at 38.2, 78.6 and 127.2, smaller lot size because it didn’t accomplish all requeriments ( the 127.2 fibo from BC was too far from the entry). However most of them i put sl at -13.0 (113), this way when i get a “homerun” means a 1:8 or even higher risk:reward, the best i catched was a 1:12. This seems great in theory but in practice i have had a max drawdown of 18 losing trades in a row. will see if this year i can move another step forward and be able to trade only the high quality setups and reduce a bit this dd, so i would be able to increase the lot size.

Yes, they differ for 35 pips, However, looking at weekly chart is not that much. Is like trading a 1 hour chart with and XA of 290 pips and a 3,5 pips difference. And there is the 224 fibo from bc that converges on this same zone too… the butterfly ends 45 pips above. so there is an interesting zone of 70-80 pips. Maybe we will be able to find any pattern at the top of this zone on a lower tf and let the profits run for some weeks.

have you all a good weekend!

Ah, of course. Take your time, man. Enjoy your weekend. Still working hours for me so let’s see if I can track it down for the audience. Cheers!

EDIT: Ok, this is actually pretty difficult. I feel weird going back a year to find an X, and I think it may not even be the right one.

Is this the Bearish Butterfly you based the 1 hr pattern from?

Things are horrible, I already got stop out because of the wick was too long. The set up was done correctly. (Set sell at the highest green line) But most of my order got stop out because of the wick. i wish I can do the visual stop. But that is out of my reach to me because I have work during the day

How many pip do you guys often set for your SL? Is it 20-30 pips stop lost for 30 pips profit good enough?

I wouldn’t look at that as a stop loss issue. The wick pretty much hit the next fib level, so the convergence did not go where you expected it. I feel that for 30/60 min, I’ve gotten slightly more wins with tight stops that cover the full range of divergence along the fib point I expect the D point. I take 2:1 or higher R:R ratios, and then use the freedom to place a backup entry at a backup convergence point in case the first one fails. In pairs that are respecting Fibs, it’s not unlikely for both sets to hit.

for this trade you could have put a larger target for atleast 100 pips (B point) or even 200 (78.6 retracement from CD). So i think that a sl of 30-35 pips in 4h tf is reasonable, and even more in a fast pair like gbpaud.

I did not take this one because i had already taken and closed the trade at 1.27 of BC, but i dont agree with merper, I think you entered at the lvl or at least the zone price reacted to:

(H4 tf)

I prefer larger R:R, a 1:1 risk:reward with pending orders seems me a bit unlikely to work, but who knows…

Thanks, look like I shouldnt stick hard to the limit 30 pips. And adjust to how big the pattern is to set stop lost and profit