13 April 2023 0600HR SGT

Alphahavoc Currency Strength Ranking

|

Wed |

12.04.2023 |

|

|

Tues |

11.04.2023 |

|

|

Mon |

10.04.2023 |

|

|

Fri |

07.04.2023 |

|

| Rank |

Currency |

Strength |

|

Rank |

Currency |

Strength |

|

Rank |

Currency |

Strength |

|

Rank |

Currency |

Strength |

|

| 1 |

EUR |

5.53 |

|

1 |

CHF |

6.53 |

|

1 |

CAD |

6.54 |

|

1 |

NZD |

6.03 |

|

| 2 |

GBP |

5.50 |

|

2 |

CAD |

6.01 |

|

2 |

GBP |

4.51 |

|

2 |

CHF |

5.01 |

|

| 3 |

CHF |

4.03 |

|

3 |

EUR |

5.53 |

|

3 |

USD |

4.03 |

|

3 |

USD |

4.01 |

|

| 4 |

JPY |

3.99 |

|

4 |

GBP |

3.51 |

|

4 |

AUD |

4.01 |

|

4 |

AUD |

3.00 |

|

| 5 |

AUD |

3.01 |

|

5 |

USD |

2.98 |

|

5 |

EUR |

3.00 |

|

5 |

CAD |

2.99 |

|

| 6 |

CAD |

2.98 |

|

6 |

AUD |

2.51 |

|

6 |

NZD |

2.99 |

|

6 |

EUR |

2.49 |

|

| 7 |

NZD |

1.49 |

|

7 |

JPY |

0.47 |

|

7 |

CHF |

2.98 |

|

7 |

GBP |

2.49 |

|

| 8 |

USD |

1.46 |

|

8 |

NZD |

0.45 |

|

8 |

JPY |

-0.06 |

|

8 |

JPY |

1.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

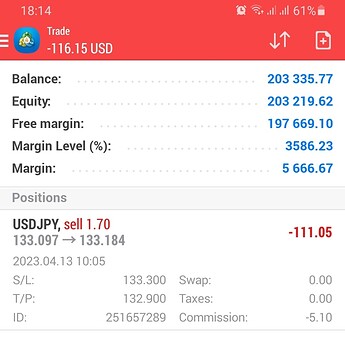

According to my currency strength ranking, USDJPY directional bias seems to have a reversal of fortune. Although the stochastic oscillator is oscillating back and forth between 20% and 80%, indicating that USDJPY is moving sideways, it still has a bearish bias. The bearish sentiment was largely due to the release of inflation data last night that was higher than expected. As such, I have entered a short position, but I am trying to contain my urge to increase my position size for the remaining trading days of the week.

Last night, there were no emergency activations from my hospital, and I was able to get a good six-hour sleep from midnight until 0600HR SGT…

However, contradictory to that, I am starting to feel unwell with some mild sore throat and a bit of a runny nose. Nevertheless, I will not allow myself to get sick and have taken paracetamol, antihistamines, lozenges, and a bun. I do remember that one should not take paracetamol on an empty stomach

A morning selfie with two of my boys.

FIGHTING!!

0900HR SGT

Ealier than usual Brunch

1 otah, 1 fishball, 1 sunny egg, i popcorn chicken & 1 pandan flavoured rice.

I feel like I might be getting sick soon. It would be a good idea to consume more food for additional energy to help combat the illness.

CPI comes in weaker than expected, it means that inflation is lower than what was anticipated by the market or the central bank. This could reduce the pressure on the central bank to raise interest rates as higher rates are a policy response to cool down inflation. However, if inflation is still above the central bank’s target or there are other factors that warrant a tighter monetary policy, the central bank may still decide to raise interest rates despite a weaker CPI.

Professor Steve Hanke from Johns Hopkins University uses the quantity theory of money to predict inflation trends, which states that changes in the money supply lead to changes in asset prices, economic activity, and inflation. Shrinking money supply for the past 11 months led to lower inflation rates, and Henke predicts that inflation will continue to decrease to 2-5% by the end of the year. Inflation is a monetary phenomenon resulting from changes in the money supply, not from higher interest rates or cost-push theories. The discussion also covers the recent increase in gold prices and its relationship with a possible recession, as well as the potential impact of de-dollarization on the US economy. The definition of hyperinflation is also clarified, and the importance of custom and practice in economic definitions is discussed.

It appears that the expectation for a rate hike by the Fed has decreased.

Fed signaled that it expects to raise rates 3 more times in 2023. The upcoming Fed decision in May is becoming increasingly uncertain in terms of what actions will be taken.

1500HR SGT

Early Dinner at Sanpoutei

1800HR SGT

Alright, I got home early and had an hour of good sleep. However, the sick sinusitis feeling isn’t going away. Additionally, the price movements seem fickle, as trading hasn’t been going well today. Regardless, I’m quite fed up now.

I’m giving my final trade position an ultimatum: either USD/JPY goes down to hit my target or I’m cutting my losses at 133.300. I’m sticking to the directional bias of my currency strength ranking.

I hope I won’t get an emergency activation. I will go back to sleep now.

2100HR SGT

Once again, I missed the boat. I was activated for an emergency at 1945HR SGT. I had correctly predicted the direction, but sadly, I got stopped out. I just completed the emergency case and am now getting ready to head home now.