Rather than hijack @Jerome32 and his trade journal thread anymore, I’m starting a thread to keep track of the EA I created based on @Trendswithbenefits description in that thread.

The strategy is as follows:

Stochastic indicator set to 8 3 3

When stochastic crosses above 85% short, below 15% buy

Position closes when opposite signal is made, or when long and stochastic is above 50 and turns down or vice versa for short.

I have 2 versions of this trading, one on the weekly time frame and one on the daily time frame. I’ll post some back test results for each later and then add whatever trades get taken by the EA

2 Likes

Your EA deserves its own thread, and you’ve answered my query

regarding Entry/Exit criteria which isn’t what I thought TWB was

saying, I thought he recommends cross of DiNapoli over MA

Be sure he will clarify that if necessary

However, your criteria is paying off, so good luck with your

ongoing analysis.

2 Likes

@Jerome32, Point me to the post where I included an MA Cross in the strategy???

Did you read any of my posts or just made it up as you went along…??

I’ll leave this thread to @chesterjohn, who has grasped the concept and strategy and will develop it further.

I think you’re getting confused by the terminology of the indicator itself. A stochastic is made up of 2 parts, K and D. K is the oscillator and D is the 3 day MA of the oscillator. So when the oscillator crosses the 3 day SMA of itself, that is a signal that it’s changing direction (in this strategy, obviously it’s configurable).

You seem to be thinking of a MA regarding price, but that doesn’t make sense, because a stochastic is scaled from 0 to 100.

yes that is exactly where I was getting confused, assuming MA of price

not MA of oscillator. Thanks for that clarification

These are the equity curves for the backtesting. I’ve had a little tweak of a few numbers to change the entry points slightly and will show the difference between both.

For the weekly chart:

Original settings

Adjusted entry points

That last one is showing almost £14000 profit on a £5000 starting account in 2.5 years. Seems too good to be true, we will see

The daily charts are not quite so impressive.

Original settings:

Adjusted entry points:

So we’re still seeing an overall gain, but it’s much less accurate and has some huge drawdowns. I can see that one of the big problems on the daily chart is when the signal lines sort of hug each other and we see lots of entries close together when price is going to wrong way. I’ll try and think of a way to filter these out, but I still think the overall method combined with me manually intervening where necessary has potential

I will be highly surprised if this works. Good job it is demo. Good luck.

Me too, but I’ve never had such a simple strategy show anywhere near this win rate on backtesting before. We’ll see what happens, but no chance I’d put my money on the line for something that I have no idea if it works

The first trade has been taken as GBPNZD long with a cross on the weekly stochastic. Needless to say, it’s not had a good day. Not a trade I would have manually taken given the rhetoric over Brexit, but the system doesn’t know the news…

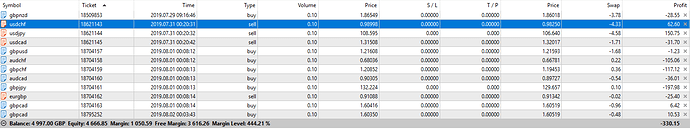

3 more trades taken last night on the daily time frame.

USDCHF short

USDJPY short

USDCAD short

This is a problem I see with strategies applied across the board, they often have multiple trades of the same currency getting a signal at the same time. Great if it goes for you, not so good if it goes against. We’ll see what happens, probably going to get some volatility in 2 hours when the fed decision is made. I guess that will make or break these trades.

I’ve noticed a flaw in my EA. It only checks the market once within the first hour of the daily opening. The problem is that it is checking the current candle against the previous one, although the current candle is only just starting. This has seen a couple of trades taken that hadn’t actually crossed because when the candle finished it looked different. I think I’ll change it to trade from completed candles.

This week isn’t looking great, the safe havens taking a huge rally on Thursday and Friday along with the GBP retracement before collapsing has triggered a few losers. Fingers crossed they turn around before blowing the account.

Not much time to put many details in here today, but progress so far is positive. 3 trades closed, 2 positive and equity is up.

I’ll put more details next week when I have more time.