I usually do the opposite when Stolper make a call, and i’m doing well  But he may be right once of ten

But he may be right once of ten  I think he is right on long EURAUD, we will see.

I think he is right on long EURAUD, we will see.

Thanks for the info I will have to keep an eye on that in the future. But a small loss never hurt anyone. I will be shorting the Aussie soon

hi team! I was out from the fx for a while, tonight I’m eager to see the Fed talks-beige booklet combo, and then I’m expecting to jump in the trade with ya all. GG, thanks for the reading!! at Eur/aud I 'd like to see at least a double top, then I would be shorting, from about 1.275, but till then I’m on the sidelines. Actionforex sees it going to 1.23xx then turning north again…I dunno.

At Aud/Us I’m waiting the Fed today.

Welcome back I think I am with you on waiting for the fed I am also waiting to see what the technicals might say

1.0223…was a resistance, (1.0202 too) and the Fed is here to say… i also will long for my earning. good luck. waiting for heading back at a top, thinking bout 1.03ish

it’s hard to see that they are playing with currencies but they always do. eur/usd is also at their game. in for a long at it, also waiting to form a top.

and am seeing a stair-case rhythm at eur-aud…currently

he was right on the past, and some long can come, but the 2/3 of the trade of the year is … - I think - … over. they always say what is actually at least halfway done.

what a still water

Yes, very quiet, they said nothing interesting in this beige book, only canned and useless things, this is why the market did not react.

More important will be the AUD Employment Change (SEP) and AUD Unemployment Rate (SEP) tonight (00:30 GMT), the Aussie usually make big moves on these numbers. Important chinese economy release 30 minutes before AUD. The night will be hot !

See you and good luck all !

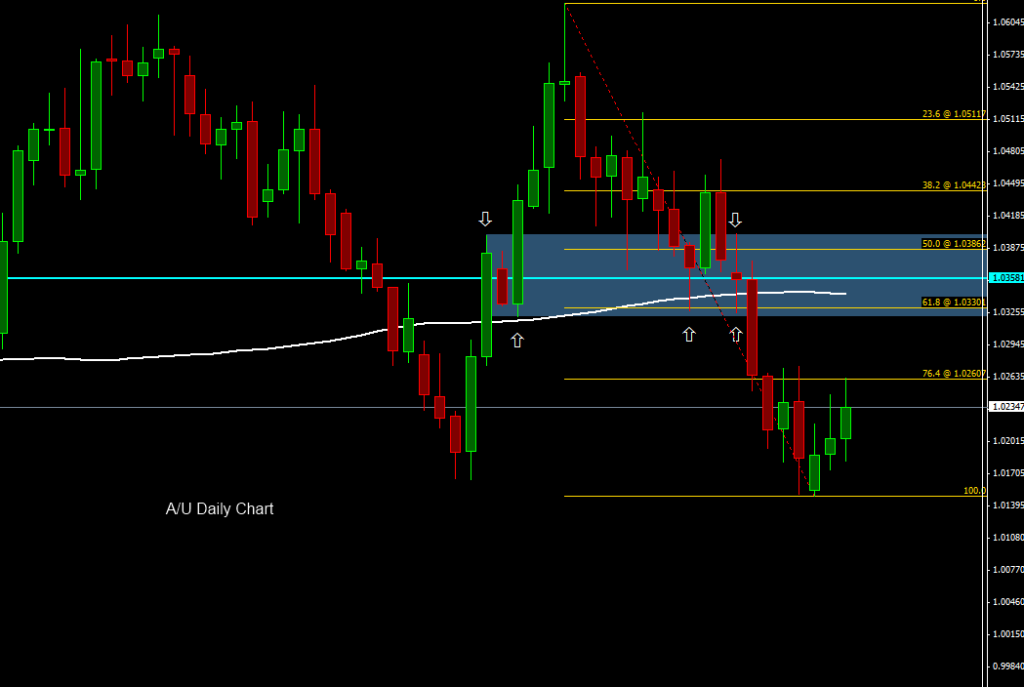

You know that I prefer to play the extremes in this pair… but if I get a good PA in the blue area then I will go short

http://i1086.photobucket.com/albums/j449/yunny11/eurusd149.png

Forex Flash: Short AUD/JPY best trade to express view on fiscal cliff - HSBC

cooking and stirring!

why haven’t they advised it when it was higher? … it’s ugly

the pair is at it’s daily resistance.

have an idea: short the usd/jpy till the BOJ interferes. is it about 76.5?

I was in short yesterday morning, thinking jobs data was yesterday. I then exited seeking to get in later last night. However, the 30min, 1hr, and 4hr chart were showing a clear pennant formation. I set a long and short trade upon breakout to catch whichever way it went and surprisingly my long was filled! I still think the AUD is overvalued and will come down in medium term

last night I wouldn’t have thought that eur/aud buy can worth, now am thinking about buyin some. crazy.

and that is the direction that verifies for me a short in aud/us

(usd/cad trade ? I see it longish. last day tried it was good for that day. ok, was just a joke. maybe tomorrow)

Well good thing I decided to go fishing last night instead of looking at the charts. Well lets see what it does today currently on the side lines awaiting a chance to short

Hello all,

Interesting comment i wanted to share with you:

[I][B]RBA’s Stevens says RBA has monetary policy ammunition, says GDP growth is softening.

12 Oct 11h41[/B][/I]

Happy trading all and have a nice day.

Hey Bob-

What I am doing here is I think your style of trading. Or in other words I am trying it for the first time.

Help me here in terms of how do you manage your trade/stop loss. What will make you get out of the trade manually.

I entered this trade on Wednesday night a little after the Australian unemployment report. AUD/USD didn’t look that clear to me. However this trade in EUR/AUD seemed clear enough and I had enough confidence that I went long on a solid Bear candle while it was happening. Price was falling right into what I thought is a solid support.

My stop loss here now is at 30 pips above my entry and the trade is around 125 pips. This trade for me is more about learning to ride the waves then making a huge profit only from this trade.

I am debating on a profit take on this trade between 1.2800(most recent swing high) or 1.2900 next resistance.

Not exactly how I trade but pretty close and nice entry. I would have waited for the next candle after the hammer to have retraced into the hammers wick. So on this trade I would have not gotten an entry.

As far as my stop I would have put it below the hammer or a nice swing point on a lower timeframe. Since you entered on the hammer (that is risky but excellent) you would of had no choice but to find S/R levels on lower timeframes to place a stop under.

Now for my TP I will say first off I usually will not set a hard TP unless I am going away and will not be able to manage my trade. In this case if that was to happen I would place it at the top of the previous high.

Typically I will trail my stop based on previous swings and let the market take me out. Now in the case of AU when price is in an area where there are no valid swings. I will look to get to fib levels such as the 128 fib and tighten up the stop pretty tight. This way if price decides to break this fib then great next target would be the 1618 fib. Again trying to trail the stop around any swings that may occur along the way. If price decides to retrace/reverse at the 128 fib then I have a tight stop and I consider that my TP.

Hope that helps

Well now that it has been 2 years on babypips I think its time to share what I have learned in my trading. I have been trading a little over 3 years in trading. My first (roughly) 18 months were not pretty. I had no plan and no idea what I was doing. Using decent money management did get me through and kept me alive. Because of that I can sit here today and say I have never blown an account be it live or demo. That is the first and foremost lesson a trader must learn. Its not about a strategy that gives you an edge. Its not about finding the holy grail (although I due consider risk management the holy grail). Its about staying afloat in deep shark infested waters and staying alive.

Thankfully a buddy of mine told me about this site and I have been hooked ever since. Although he is not on here much if he reads this THANKS. The info and the people on here are great. My stay here has been a experance I will never forget reguardless if I make it in forex or not.

In the past 2 years I have made a trading plan and I have learned somethings as my trading has progressed. My plan in honestly still under construction as I feel it will be for the rest of my career as a forex trader. Last year I made a killing but had a really bad win ratio. I did not over leverage my account nor did I risk to much. But deep down I just didnt see it lasting over the long term. Luck was on my side and luck is not something I will risk my future on. So I decided at the end of last year to go back a revamp my plan and tighten up loose ends. The result was not what I expected. This year I have had a really high (IMO) win ratio but my profits are not near as impressive as last year. Mostly because I now dont trade much and when I do I have kept risk so low the profits have taken a hit. I know slow and steady but even if you are moving in the right direction you can still get run over. I am not refering to other traders but life will run you over. You must move at a pace where you are progressing. This year has been a great year as I have learned so much my account does not show improvement as much as I expected. At this rate I will never trade full time. So I think I will finish out this year and go back to revamp the trading plan. I feel I went from one extreme to the other and I am still in search in the grey area in my plan.

To me the most important thing in trading is your trading plan. However as a newbie trader one must not concrete there plan and thats it. One must leave room for editing. As you progress as a trader you need to look at your plan and see if there is room for improvement. I am not saying revamp it everyday but more progress you plan as you progress. To me this is the single most important aspect to trading. IMO it is more important than properly manageing risk. Why? Because your plan will defiing how you manage risk. It is something that can keep your reality in check before the markets check it for you and it will every time.

Sadly enough your trading plan is the least talked about thing on babypips. That probably the reason for my post. I will not tell anyone how to setup there plan as you are not me and you will have to figure out what you like. I can give ideas for most of you. Lack of having a plan is the main reason why traders do not make it in trading. Not haveing a plan means you are just floating around aimlessly and if that is the case you will be carried away with the tides. Tides change in forex everyday so you must stay focused or your voyage is doomed from the start. Failure to plan is planning to fail. We have all herd it. Well I will say it again FAILURE TO PLAN IS PLANNING TO FAIL. Do you wander why so many people fail hmmmmm I wander.

When starting your trading plan remember to KEEP IT SIMPLE. One thing I have learned from building saltwater reef tanks and making my own filtration systems is. The easier it is to maintain the more likely you will be to maintain it over the long term. If you do not maintain it you WILL fail. Same thing in trading the more complicated your plan is the harder it will be to follow. the harder it is to follow the less likely you will be to follow it. This is critical. For help on building a trading plan go over to ICT’s thread and watch his trading plan development series vidoes. They are not done yet at the time of writing this but they should help you out.

Also please pay attention to price action. I am not say not to use indicators as you will see me use them from time to time. Just remember they are created from price and in order for you to profit you need price to act. Therefore does it not make sense to learn to read price action. If you do use indicators pick the ones you like learn them and stick to them. If later you decide there are not for you then fine pick another. Do not switch to a new indicator everyday as you will never learn what it is trying to tell you. That is why you hear so many say indicators do not work. Its (most of the time) because the user did not spend the time to learn the indicator. If you use the indicator because it has a cool name (and some of them do have cool names that make you feel smart when you use them) is it any wander that it is not working for you. An indicator is only as good as the user. No more no less. You will not get rich by selling a pair because your indicator says the pair is overbought. I will get rich off of you for doing that.

This post went in a different direction that I had intended but I like the end result. I have more to add but I am tired of typing so for now I am done. Please take this into consideration if you are learning to trade. Without the above there is no way to short a bull market and live to tell about it.

These are my thoughts as I continue my quest to short the aussie into extinction

Nice post bob. Between the lines there are sparks of a genius… Wise words… I enjoyed the whole post.

Like everything in forex, the longer you look at it, the more it will tell you.

The same goes to a trading plan and money management.

These things dont come through reading. Only way is to put in the hours. Practice. Look at the entire thing again. Repeat.

yep, thanks Bob, for sum things up. my mistake is moneymanagement and I know it for a month but couldn’t help myself yet. Not that I wouldn’t know aout it, it’s more became a habit. so I will force myself somehow not to do fx this way.

hey, and happy anniversary here in BP & in fx