BTCUSD, the growth potential of “digital gold” remains

All last week, the BTCUSD pair continued its upward trend and today reached the 47500 mark. The positions of “digital gold” are strengthening against the backdrop of the protracted Ukrainian crisis and the sanctions war, which is an additional incentive for the growth of global inflation and the depreciation of fiat currencies.

An additional driver of growth was the statement of representatives of the Russian authorities about the possibility of trading energy for cryptocurrency, which can lead to serious investments in the sector. No official decision has been made on this, but it is being worked out. Earlier it was reported that digital assets can become a base for payments for ordinary goods supplied, for example, from Turkey. Perhaps in the near future, access to the digital market will be facilitated for ordinary Russians, at least the chairman of the Russian government Mikhail Mishustin stated the need to integrate the mechanism of turnover of digital currencies into the financial system of the country. A number of experts believe that the short-term support for the market is also provided by the acquisition of 1.1B dollars worth of BTC by Luna Foundation Guard (LFG) to ensure the stability of the UST stablecoin.

Nevertheless, it cannot be ruled out that the entry of large Russian assets into the digital market will be able to meet obstacles from US and EU regulators, since they are not interested in circumventing the imposed economic restrictions. Thus, the US Congress continues to discuss a law allowing the National Ministry of Finance to block transactions of cryptocurrency exchanges from the addresses of persons included in the sanctions lists. US Treasury Secretary Janet Yellen once again confirmed that cryptocurrencies can pose a threat to financial stability and be an instrument of illegal activity, even though they occupy an increasing place in investment activities.

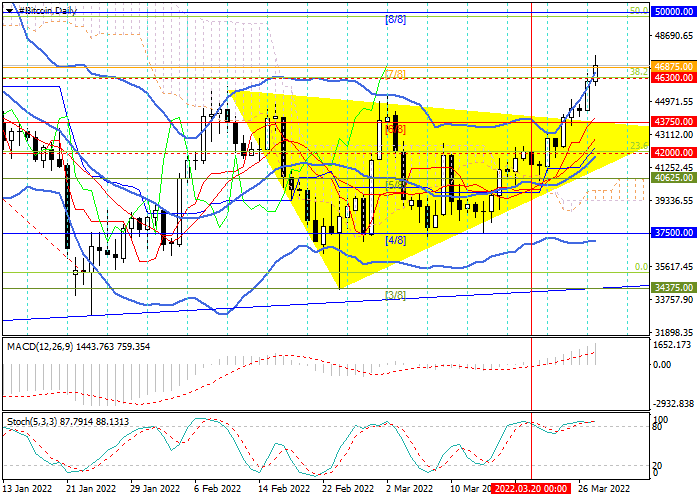

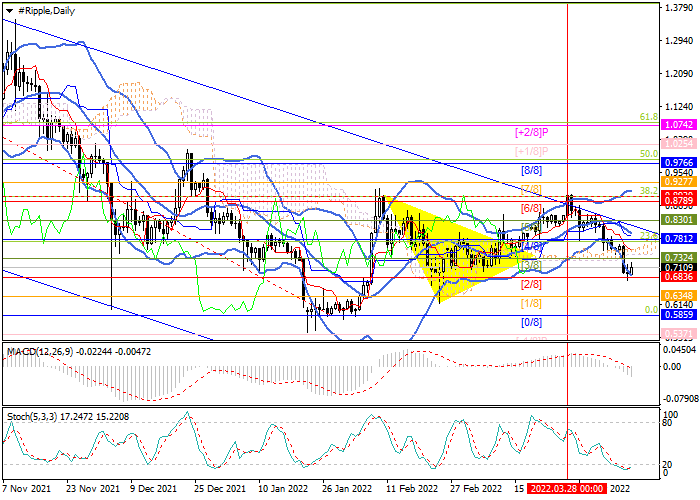

Technically, the price is testing the resistance zone 46300 - 46875. Consolidating above it will give the prospect of growth in the area of 50000. In case of a breakdown of the 43750 mark, the beginning of a decline to the levels of 42000 and 37500 is not excluded. The indicators point out the continuation of the upward trend: the Bollinger Bands are directed upwards, the MACD histogram is increasing in the positive zone, and the Stochastic is horizontal in the overbought zone.

Resistance levels: 46875, 50000.

Support levels: 43750, 41000, 37500.

Trade with a true ECN broker

Solid ECN Securities