[B]Forex Technical & Market Analysis FXCC Mar 29 2013

The Cyprus moment

The euro zone could be slipping into a new period of turbulence even before it has had a chance to return to growth. And yet the improvement previously discussed in these pages has been confirmed: borrowing conditions for governments have improved and some, such as Ireland, have made a successful return to the markets. Ratings on sovereign debt have stabilised. One sign of an easing of financial tensions in the zone is that the internal balances in the Eurosystem, as reflected in Target 2 balances, have narrowed to a degree. These are encouraging but fragile signs that could be compromised by the difficulties in managing the Cypriot crisis or by the political uncertainty in Italy. Is there a new European crisis brewing in Cyprus? The country’s banking system needs to be recapitalised, failing which the European Central Bank (ECB) – which is not responsible for solvency issues – could cease to provide support. However, given the size of the banking sector (seven times GDP) the sums in play by far exceed the country’s repayment capacity. The EUR 17bn of total needs (of which EUR 10bn for banks) account for one year’s GDP for Cyprus, which is only the 26th biggest economy in European Union. A loan of this amount from the European Stability Mechanism (ESM) would push government debt up to the unsustainable level of around 200% of GDP. The main risk would then be the snuffing out of the Cypriot economy for many years, with no certainty that any financial aid would in fact be repaid.

https://support.fxcc.com/email/technical/29032013/

FOREX ECONOMIC CALENDAR :

2013-03-29 12:30 GMT | United States. US Core Personal Consumption Expenditure - Prices Index (YoY) (Feb)

2013-03-29 12:30 GMT | United States. US Personal Income (MoM) (Feb)

2013-03-29 12:30 GMT | United States. US Personal Spending (Feb)

2013-03-29 13:55 GMT | United States. Reuters/Michigan Consumer Sentiment Index (Mar)

FOREX NEWS :

2013-03-29 07:07 GMT | EUR/USD hovering around 1.2800

2013-03-29 06:00 GMT | GBP/USD holding around 1.5200

2013-03-29 05:36 GMT | Japan data disappoints; Yen advances a bit

2013-03-29 03:53 GMT | EUR/JPY gravitating around 120.70

EURUSD :

HIGH 1.28367 LOW 1.27934 BID 1.28082 ASK 1.28086 CHANGE -0.07% TIME 09 : 14:14

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: On the upside resistive structure at 1.2836 (R1) prevents further gains. Clearance here is required to open route towards to next target at 1.2859 (R2) and then final target could be triggered at 1.2884 (R3). Downwards scenario: On the other hand price could retest our next support level at 1.2787 (S1) later on today. Successful penetration below it would suggest next intraday targets at 1.2764 (S2) and 1.2740 (S3).

Resistance Levels: 1.2836, 1.2859, 1.2884

Support Levels: 1.2787, 1.2764, 1.2740

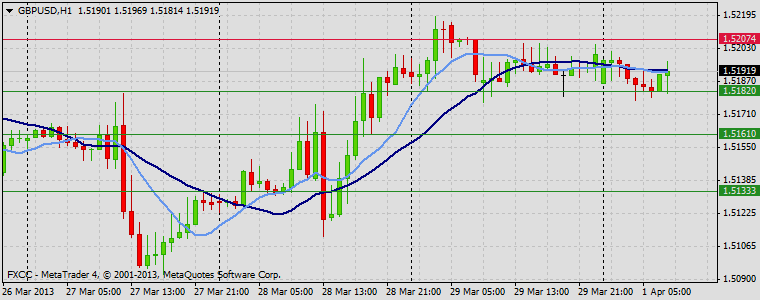

GBPUSD :

HIGH 1.52187 LOW 1.5177 BID 1.51814 ASK 1.51827 CHANGE -0.06% TIME 09 : 14:15

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Technically medium-term bias remains positive. Next resistive structure holds above the local high of the day - at 1.5218 (R1). Break here would suggest marks at 1.5231 (R2) and 1.5244 (R3) as next visible targets. Downwards scenario: Activation of bearish forces is possible below the support level at 1.5167 (S1). Clearance here would suggest next interim target at 1.5153 (S2) and if the price holds its momentum on the downside we would suggest final target for today at 1.5140 (S3).

Resistance Levels: 1.5218, 1.5231, 1.5244

Support Levels: 1.5167, 1.5153, 1.5140

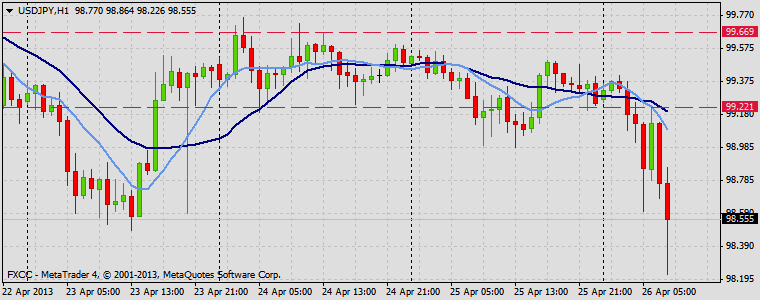

USDJPY :

HIGH 94.299 LOW 93.973 BID 94.046 ASK 94.061 CHANGE -0.1% TIME 09 : 14:16

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Any upside actions looks limited to resistance level at 94.25 (R1). Surpassing of this level might enable next target at 94.38 (R2) and any further gains would then be targeting final mark at 94.51 (R3) in potential. Downwards scenario: Fractal level accumulation on the 93.95 (S1) zone offers an important technical level. Discounted value of USDJPY might push through this mark and enable next visible target at 93.82 (S2) en route to support at 93.69 (S3).

Resistance Levels: 94.25, 94.38, 94.51

Support Levels: 93.95, 93.82, 93.69

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )[/B]