[B]Forex Technical & Market Analysis FXCC May 06 2013

EUR/USD still searching for direction after busy week of economic data

After what was an extremely busy week of economic releases and central bank monetary policy meetings, the EUR/USD finished the week up 87 pips at 1.3116. The price action remains extremely choppy with neither side being able to sustain any follow through for a substantial amount of time. Many analysts are now wondering whether or not the “risk on” mentality which was boosted by the better than expected US Jobs data will have any follow through going into upcoming week and how will it influence the foreign exchange market.

According to Kathy Lien of BK Asset Management, “Investors put on their rose colored glasses today and drove currencies and equities sharply higher on the back of stronger job growth in the month of April. At a time when other central banks like the ECB and BoJ are kick starting a new round of easing, the better than expected labor market report will keep the Fed comfortably on hold. The question now is whether the payroll driven rally in FX (and stocks) will last. With far less important data on the calendar next week, we think investors will remain optimistic.”

Forex Technical & Market Analysis: May 06 2013

FOREX ECONOMIC CALENDAR :

2013-05-06 13:00 GMT | EU.ECB President Draghi’s Speech

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index (Apr)

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index s.a (Apr)

2013-05-06 23:30 GMT | AUD.AiG Performance of Construction Index (Apr)

FOREX NEWS :

2013-05-06 04:09 GMT | EUR/USD still searching for direction after busy week of economic data

2013-05-06 03:18 GMT | GBP/JPY notches highest close since August 2009

2013-05-06 01:44 GMT | AUD/USD edges lower after weak Aussie retail sales number

2013-05-06 01:02 GMT | NZD/USD edges higher in early Asia trade

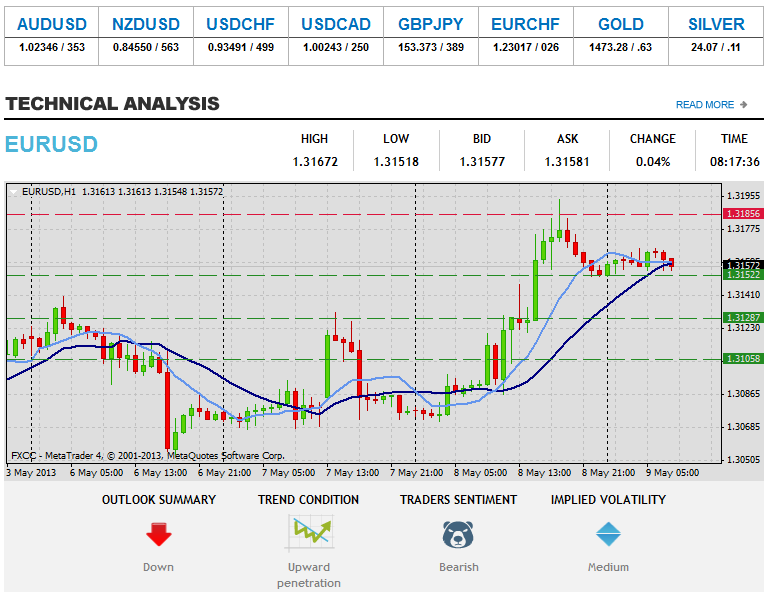

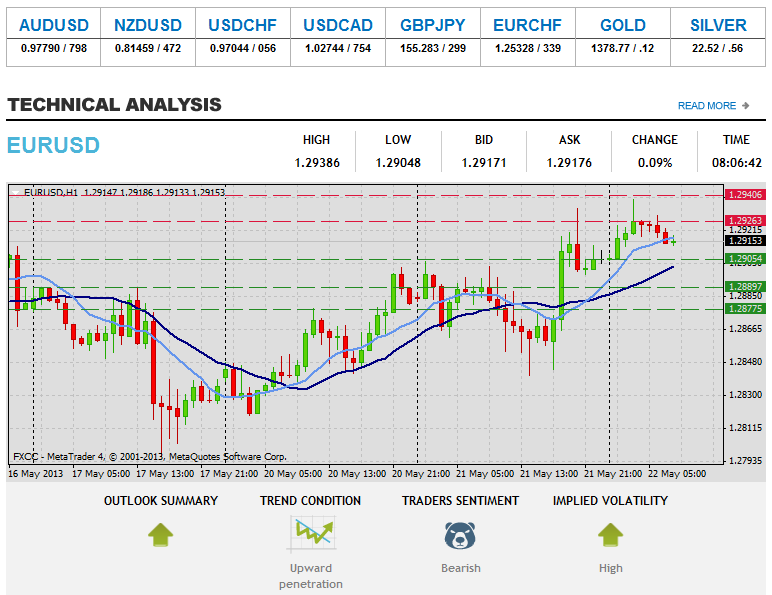

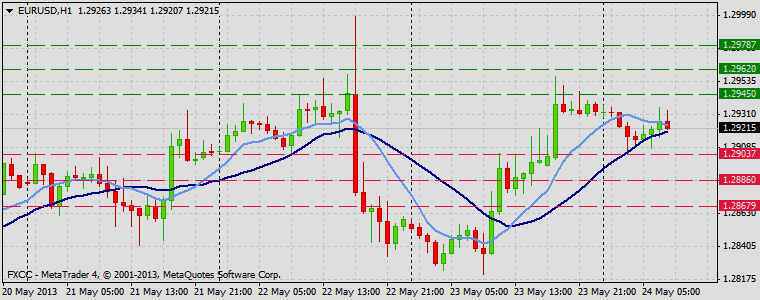

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3156 (R1). Clearance here is required to validate next interim target at 1.3185 (R2) and any further rise would then be targeting mark at 1.3219 (R3). Downwards scenario: On the other hand, instrument retests our next support level at 1.3117 (S1) today. Market decline below it would create a stronger bearish sentiment and enable our interim target at 1.3084 (S2). Final support for today locates at 1.3057 (S3).

Resistance Levels: 1.3156, 1.3185, 1.3219

Support Levels: 1.3117, 1.3084, 1.3057

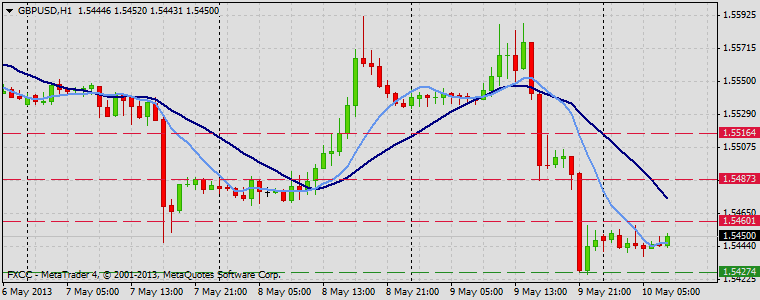

Forex Technical Analysis GBPUSD :

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5525 (R1). In such case we would suggest next target at 1.5546 (R2) and any further rise would then be limited to final resistance at 1.5571 (R3). Downwards scenario: Further correction development is limited now to 1.5481 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.5454 (S2) and 1.5426 (S3).

Resistance Levels: 1.5525, 1.5546, 1.5571

Support Levels: 1.5481, 1.5454, 1.5426

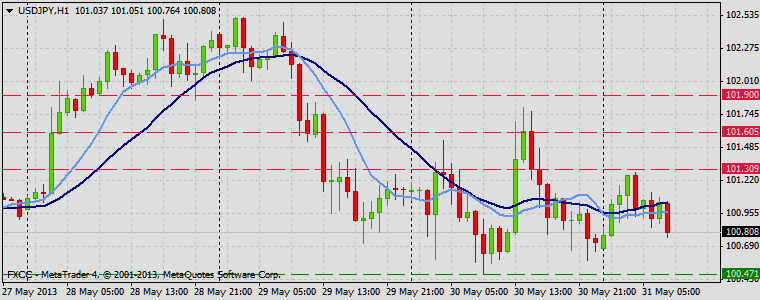

Forex Technical Analysis USDJPY :

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 92.02 (R1). Price extension above it is required to validate our next intraday targets at 98.16 (R2) and 98.30 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 97.59 (S1). Break here is required to open a route towards to next target at 97.42 (S2) and then any further easing would be targeting final support at 97.27 (S3).

Resistance Levels: 98.02, 98.16, 98.30

Support Levels: 97.59, 97.42, 97.27

Source: FX Central Clearing Ltd,( Learn Forex Training | ECN Forex Account | forex trader blog | FXCC )[/B]