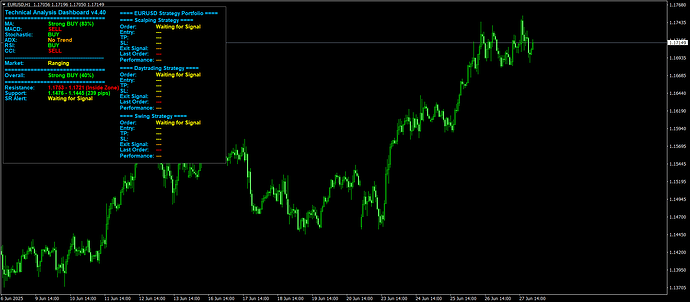

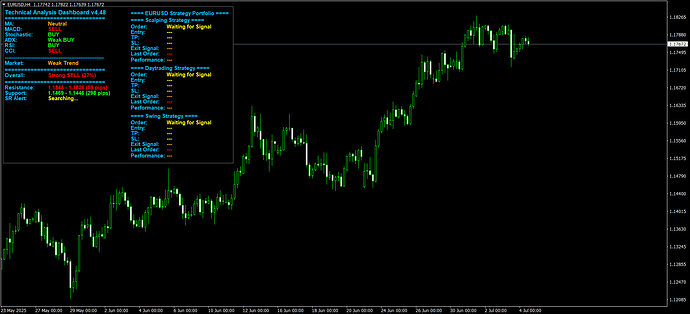

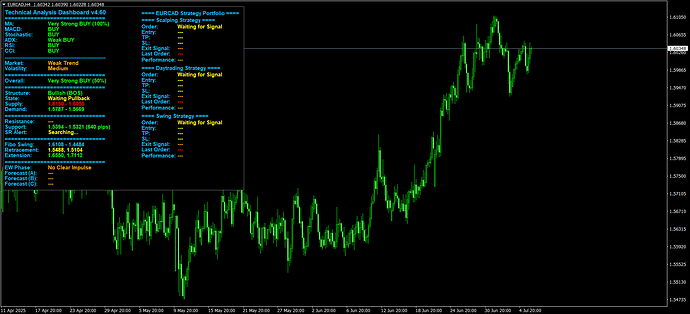

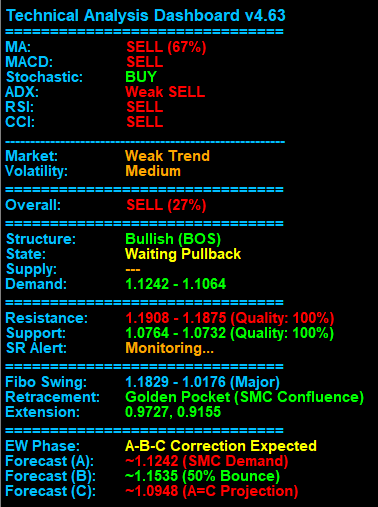

Currency pair: EURUSD

Date: June 29, 2025

Analysis: The H1 Dashboard indicates a Strong BUY (83%) signal from the Moving Averages, with MACD showing a BUY, RSI indicating a BUY, and ADX suggesting No Trend. Conversely, Stochastic and CCI are both signaling SELL. This mixed sentiment suggests that while trend-following indicators lean bullish, momentum and oscillating indicators are bearish, requiring careful consideration.

The “Overall” analysis across M5, M30, and H1 timeframes points to a Strong BUY (40%). While still indicating a bullish bias, the 40% strength suggests that the buying pressure might not be overwhelmingly strong across all analyzed timeframes, aligning with the mixed signals from individual H1 indicators.

Currently, the market condition for EURUSD is Ranging. The nearest Resistance zone is identified between 1.1753 - 1.1721 (Inside Zone), and the Support zone is at 1.1476 - 1.1445 (239 pips). The SR Alert is “Waiting for Signal.”

Given the ranging market condition and the proximity of the price to the resistance inside zone, a breakout above 1.1753 would confirm a stronger bullish move, while a move towards the 1.1476 support zone would indicate a potential reversal or continued consolidation within the range. The wide support zone of 239 pips suggests a significant potential downside if the current resistance holds.

All trading strategies (Scalping, Daytrading, and Swing) are currently Waiting for Signal.

Disclaimer: This analysis is based solely on data from the provided dashboard and is intended for educational purposes only. Trading involves risk, and by following this analysis or its signals, you may incur financial losses. Please exercise caution and make your own informed trading decisions.

Technical Analysis Dashboard v4.35.zip (495.7 KB)