Why Is the Czech Koruna So Strong Against the US Dollar?

Two decades ago, it was very much in vogue for the newly administered member states of the European Union to adopt the Euro currency.

Introduced in January 1999, just six years after the formation of the European Union, the Euro currency was a hot property among nations wishing to leverage their position in a continental common market, gain ‘major currency’ status overnight, and remove all borders when doing business with neighbouring countries.

Some nations, for reasons of their own choice or by virtue of their position in that they have been unable to join the single European currency due to admission criteria, have maintained their own sovereign currencies despite being fully subscribed members of the European Union.

Interestingly, whereas twenty years ago, those which did not adopt the Euro were considered outliers, now they have their heyday.

The Czech Republic is one such country. Located in Central Europe, with a strong manufacturing industry and diversified economy, it is a well-respected national economy which ranks well among the European benchmarks.

Whilst the Czech Republic has for some time admitted that it is preparing to adopt the Euro, this has not yet taken place, and there is no set date; therefore, it is still in the balance.

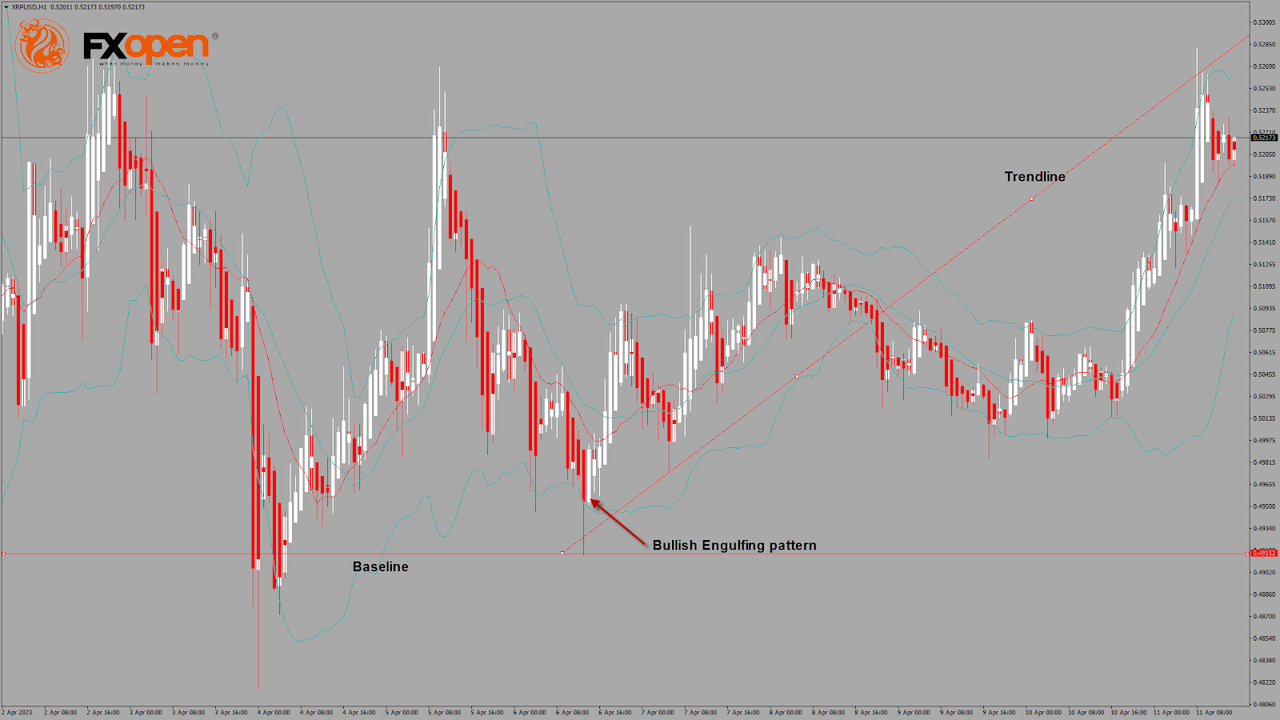

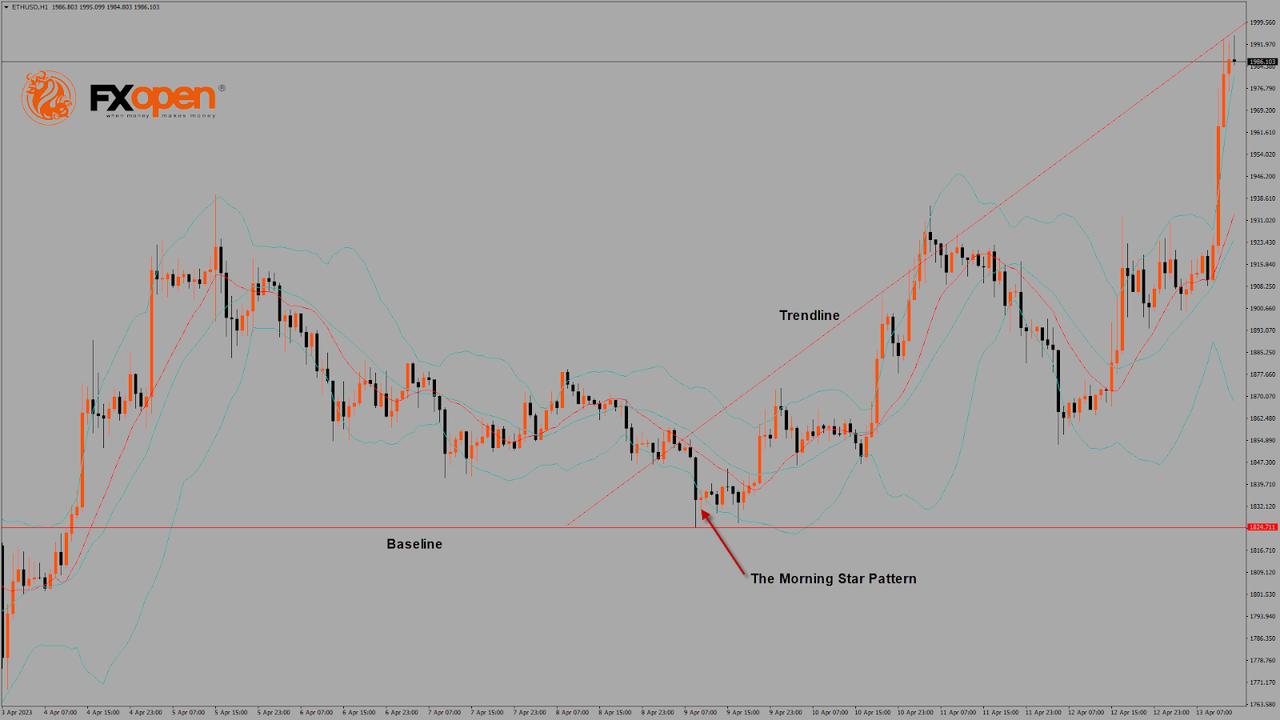

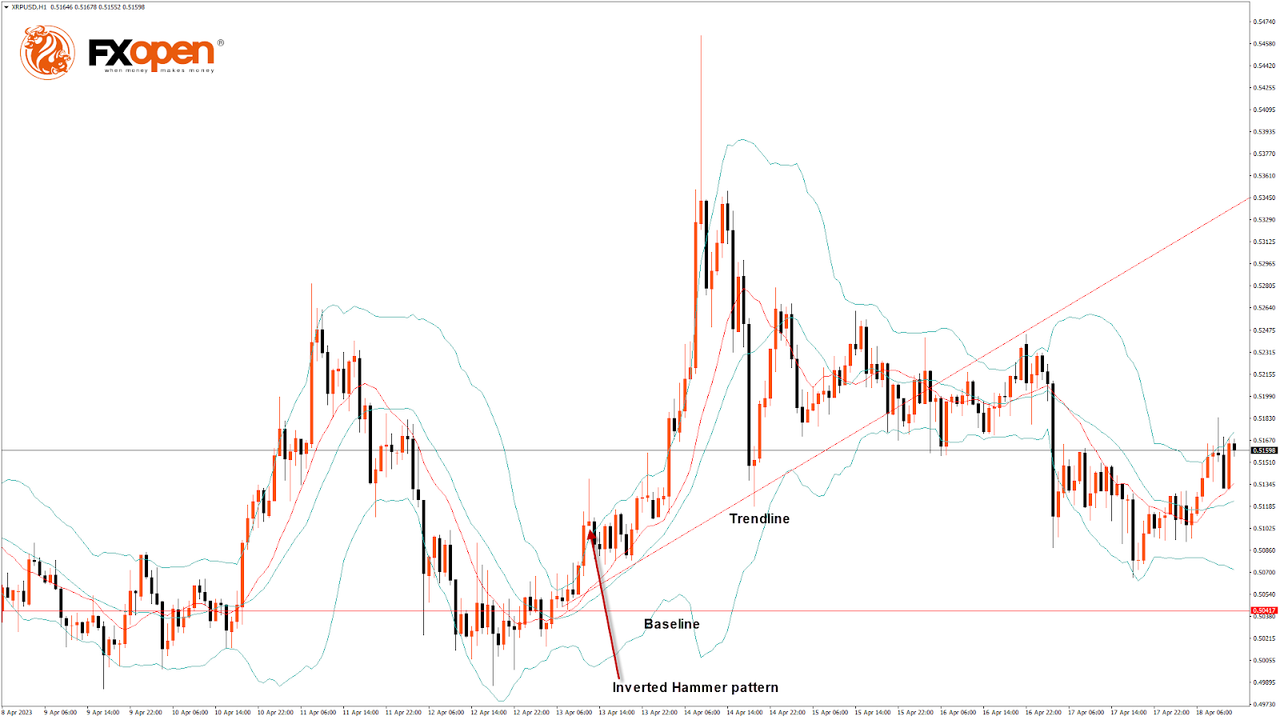

The Czech economy’s stoic resilience has certainly displayed itself through the strength of the country’s sovereign currency, as the Koruna is trading today against the US Dollar at 21.29, which is its highest point in over a year, and one of its highest points over the past five years.

The Czech Koruna is not pegged against any other currency, and despite the Czech Republic’s status as a European Union member state, the Koruna does not have any pegging arrangement with the European Central Bank; therefore, economic conditions within the Czech Republic itself determine the value and demand for the national currency.

The US Dollar has been performing surprisingly well over recent months, but as with most majors, there is not much in the way of volatility and as the United States economy has managed to bring itself out of double-digit inflation some time ago and is now at 5%, which is the lowest it has been since 2021 compared to many European nations which are between 10 and 22%.

Therefore, the Czech Koruna’s performance against a very strong major, which has been further stabilised by the US Federal Reserve, considering no further interest rate rises for the foreseeable future, is of great interest.

Currently, according to Statistica, inflation in the Czech Republic is at around 11% but is forecast to drop to 5.82% in 2024. According to CEIC Data, the national debt was 44.1% of GDP by the end of 2022, whereas the United States had a 123.4% national debt to GDP ratio for the same period.

Thus, the Czech Republic’s steady output of good quality export products and a diversified domestic market with a stable backdrop set the Koruna in good stead.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.