AUD/USD and NZD/USD Target Additional Gains

AUD/USD is moving higher and might climb further higher above 0.6740. NZD/USD is also rising and might rally above the 0.6310 resistance zone.

Important Takeaways for AUD USD and NZD USD Analysis Today

- The Aussie Dollar started a fresh increase above the 0.6670 and 0.6700 levels against the US Dollar.

- There was a break above a major contracting triangle with resistance near 0.6700 on the hourly chart of AUD/USD at FXOpen.

- NZD/USD is gaining bullish momentum above the 0.6260 support.

- There is a key bullish trend line forming with support near 0.6260 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

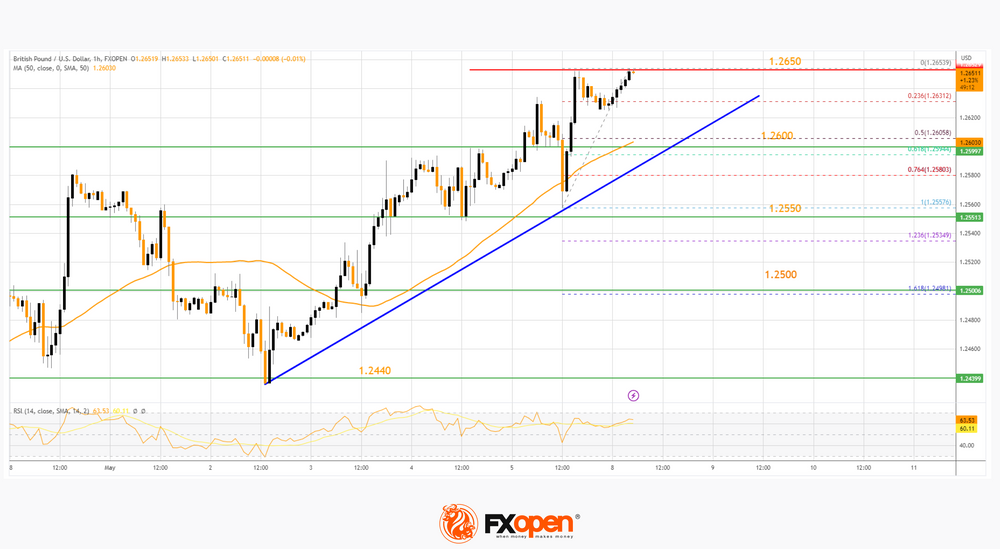

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6640 support. The Aussie Dollar was able to clear the 50-hour simple moving average to move into a positive zone against the US Dollar.

There was also a break above a major contracting triangle with resistance near 0.6700 and the 76.4% Fib retracement level of the downward move from the 0.6717 swing high to the 0.6641 low.

The AUD USD chart indicates that the pair is now consolidating near the 1.236 Fib extension of the downward move from the 0.6717 swing high to the 0.6641 low. On the upside, it is facing resistance near the 0.6740 level.

An upside break above the 0.6740 resistance might send the pair further higher. The next major resistance is near the 0.6780 level. Any more gains could open the doors for a move toward the 0.6840 resistance zone.

On the downside, initial support is near 0.6740. The next support could be the 0.6670 level and the 50-hour simple moving average. If there is a downside break below the 0.6670 support, the pair could extend its decline toward the 0.6640 level. Any more losses might signal a move toward 0.6580.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.