AUD/USD and NZD/USD Weekly Chart Outlook

AUD/USD struggled to stay above 0.7000 and corrected lower. Similarly, NZD/USD is facing strong resistance near 0.6540.

Important Takeaways for AUD/USD and NZD/USD Analysis

- The Aussie Dollar started a downside correction from the 0.7150 zone against the US Dollar.

- There is a crucial bearish trend line forming with resistance near 0.6900 on the weekly chart of AUD/USD at FXOpen.

- NZD/USD also started a steady increase above the 0.5750 and 0.6000 levels.

- There is a key bearish trend line forming with resistance near 0.6365 on the weekly chart at FXOpen.

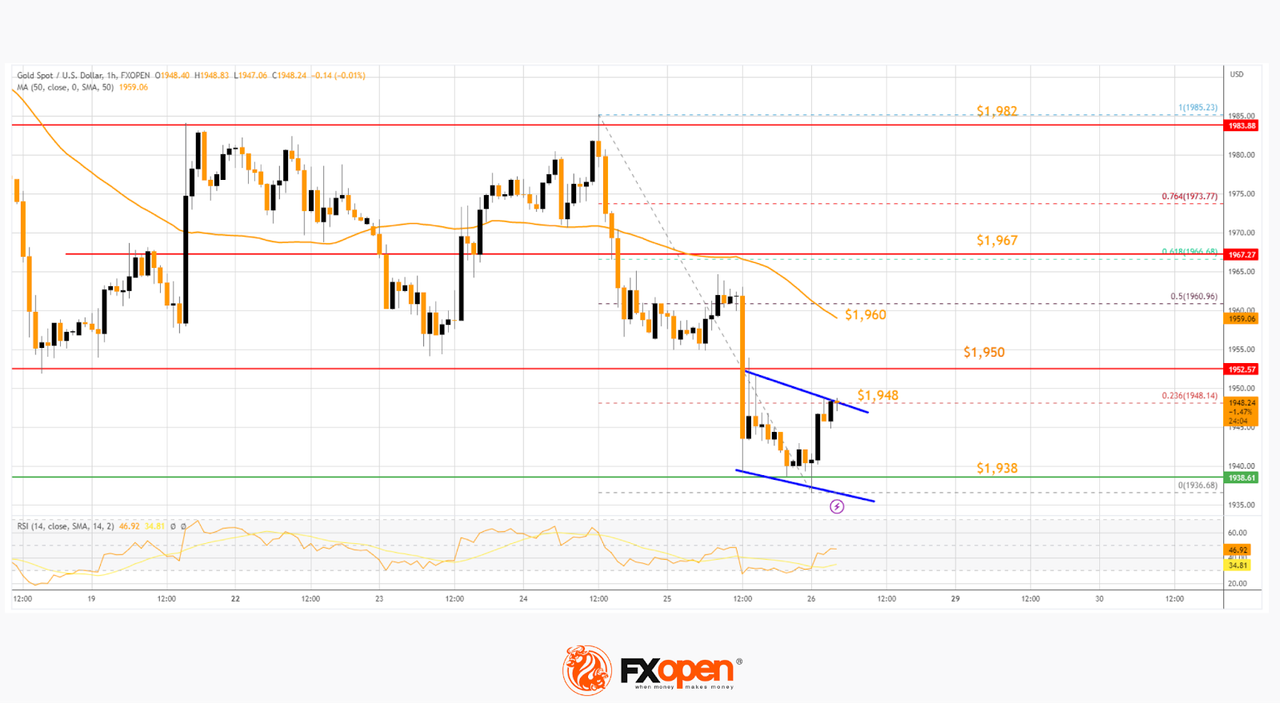

AUD/USD Technical Analysis

On the weekly chart of AUD/USD at FXOpen, the pair climbed higher above the 0.6540 and 0.6900 resistance levels. However, the Aussie Dollar failed to clear the 0.7150 zone against the US Dollar.

As a result, there was a bearish reaction from the 0.7150 zone. The pair corrected lower below the 0.6900 pivot level and the 50-week simple moving average. Besides, there was a spike below the 50% Fib retracement level of the upward move from the 0.6170 swing low to the 0.7157 high.

On the AUD/USD chart, the pair is now showing bearish signs below the 50-week simple moving average and a crucial bearish trend line with resistance near 0.6900. Only a successful daily close above 0.6900 might start a strong recovery toward the 0.7150 level.

Any more gains might send the pair toward the 0.7550 level. The next major resistance sits near the 0.8000 resistance. On the downside, the first major support is near the 61.8% Fib retracement level of the upward move from the 0.6170 swing low to the 0.7157 high at 0.6540.

The next major support is near the 0.6400 level, below which the pair may perhaps extend its decline toward the 0.6170 level. Any more losses might call for a move toward the 0.6000 level.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.