Tesla stock has volatile week despite Bitcoin unicorn

Tesla has been known for as long as it has been in existence as a disruptor of its sector.

Its founder, Elon Musk, is a maverick and a free thinker and has risen to prominence as one of the world’s richest men via his methodology of disregarding the well-trodden path and finding ways to reinvent it.

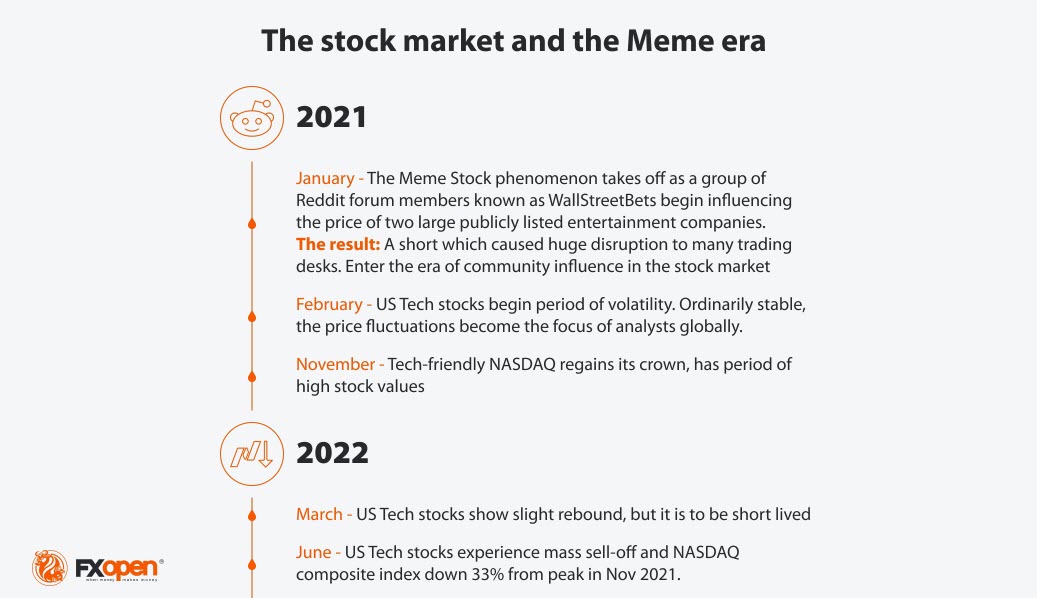

Thus, Elon Musk’s influential interest in cryptocurrency has been a well-covered subject over the past year and a half, and his own advocacy of cryptocurrencies ranging from Bitcoin to oddball meme currencies such as Dogecoin has been high profile.

It is fair to say that Elon Musk’s interest in cryptocurrency is not just an interest, it positions him as an influencer.

In May 2021, he was responsible for crashing the value of five popular cryptocurrencies by over $700 million, and then partially responsible for causing them to rise to a higher value than before his infamous Twitter post-orientated tumble.

It is therefore fitting that Elon Musk would bring cryptocurrency investment into his commercial portfolio, which he did with Tesla.

By the end of last year, Tesla could lay claim to being the most influential disrupting force in the automotive industry, as well as the only large cap publicly listed corporation which is a Bitcoin whale.

A Bitcoin whale is an entity or person which holds enough Bitcoin to be able to influence the market.

Now, as Tesla remains a major market force and all of the traditional car manufacturers have been rallying to make electric vehicles after over 100 years of not even considering moving away from internal combustion, and as a recent SEC filing showed that the company has made $64 million in gains from bitcoin sales, its own stock is volatile to say the least.

This week, prices are down to $804 per share after a rally last week.

Whether investors in high market cap publicly listed companies are still relatively conservative and don’t favor risky and avantgarde strategies such as the Bitcoin trading activities of Tesla is perhaps a matter for discussion, but despite these crypto-fueled gains being made public information, the value of Tesla stock has been declining during the course of this week.

On Friday last week, Tesla stock was trading at $840 per share, so today’s $804 is a definitive downturn.

Elon Musk, who is openly pro-free market, and has objected to government lockdowns across Europe and America has this week stated that Tesla’s factories in Germany and Texas are losing billions of dollars as supply-chain snags and battery-cell manufacturing hurdles limit production caused by the draconian lockdowns in 2020 and 2021.

Clearly, regardless of how well capitalized and how much of a market icon Tesla is, foresight, innovation and disruption still equals volatility.