Traders dump British Pound en masse as BoE pulls plug on pension support

Will there be a run on pension funds? It was inevitable that the Bank of England would curtail its support somewhere when ‘support’ means literally printing money in order to keep fueling a collapsing economy.

Just a few weeks ago, at the point during which the British Pound was in absolute freefall against the Euro and US Dollar, the Bank of England introduced a £65 billion bond buying program which was aimed at preventing a market rout, which was viewed as a money printing exercise and raised many fears among investors.

Now, as the Pound has continued its downward slide, the Bank of England yesterday hinted at potentially ending its support by exiting its emergency gilt support program to pension companies on Friday, as planned.

Speaking in Washington DC yesterday, Bank of England Governor Andrew Bailey stated publicly that “The rebalancing must be done and my message to the funds involved and all the firms involved managing those funds: you’ve got three days left now. You’ve got to get this done.”

The result was a significant amount of fear among British investors and private pension contributors who began to raise concerns that their pension funds would become worthless, or that the companies responsible for managing them may face financial difficulties.

Commentary in mainstream news contained viewpoints such as people in their mid-fifties considering withdrawing their pension as a lump sum to protect it.

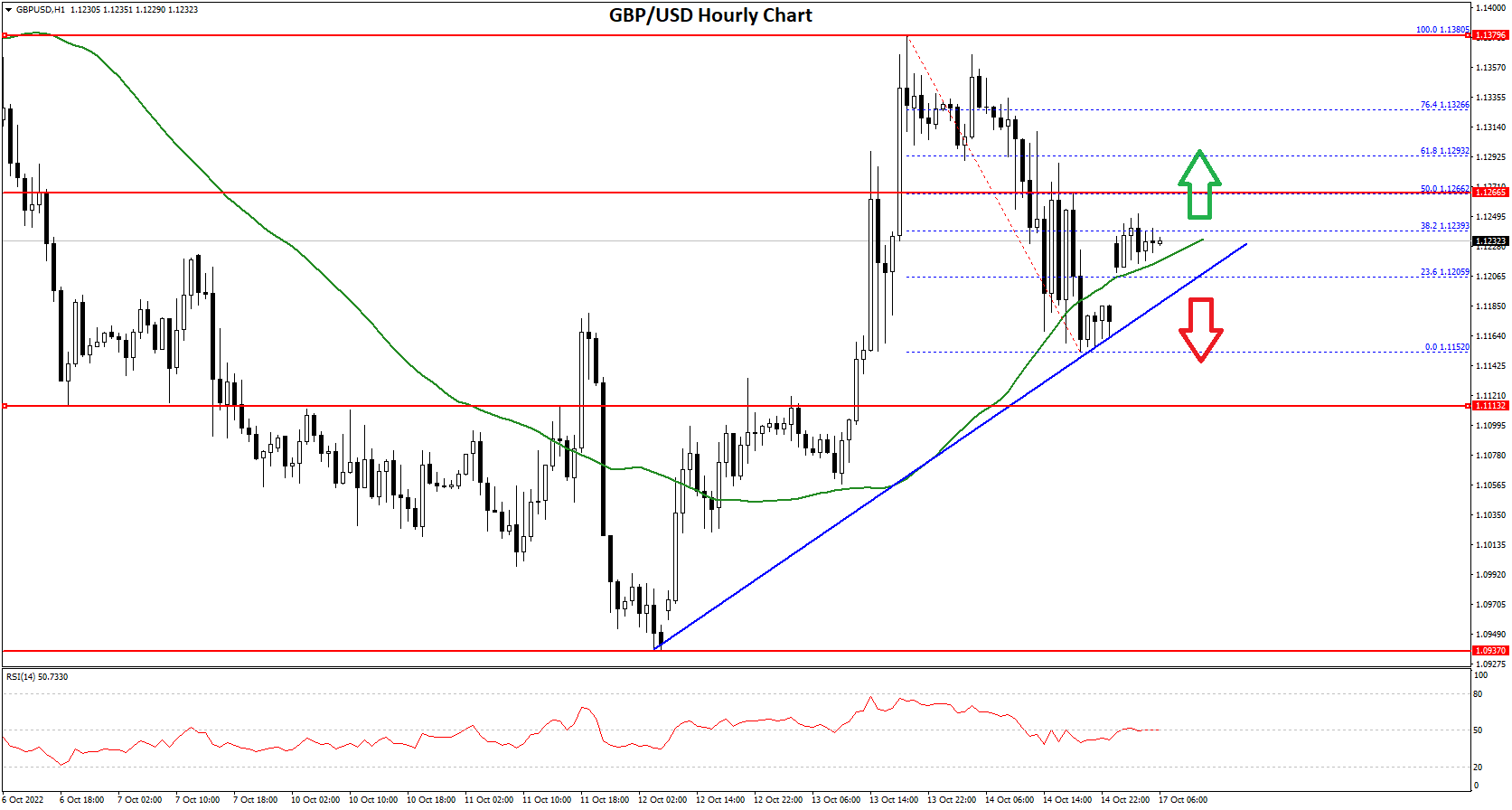

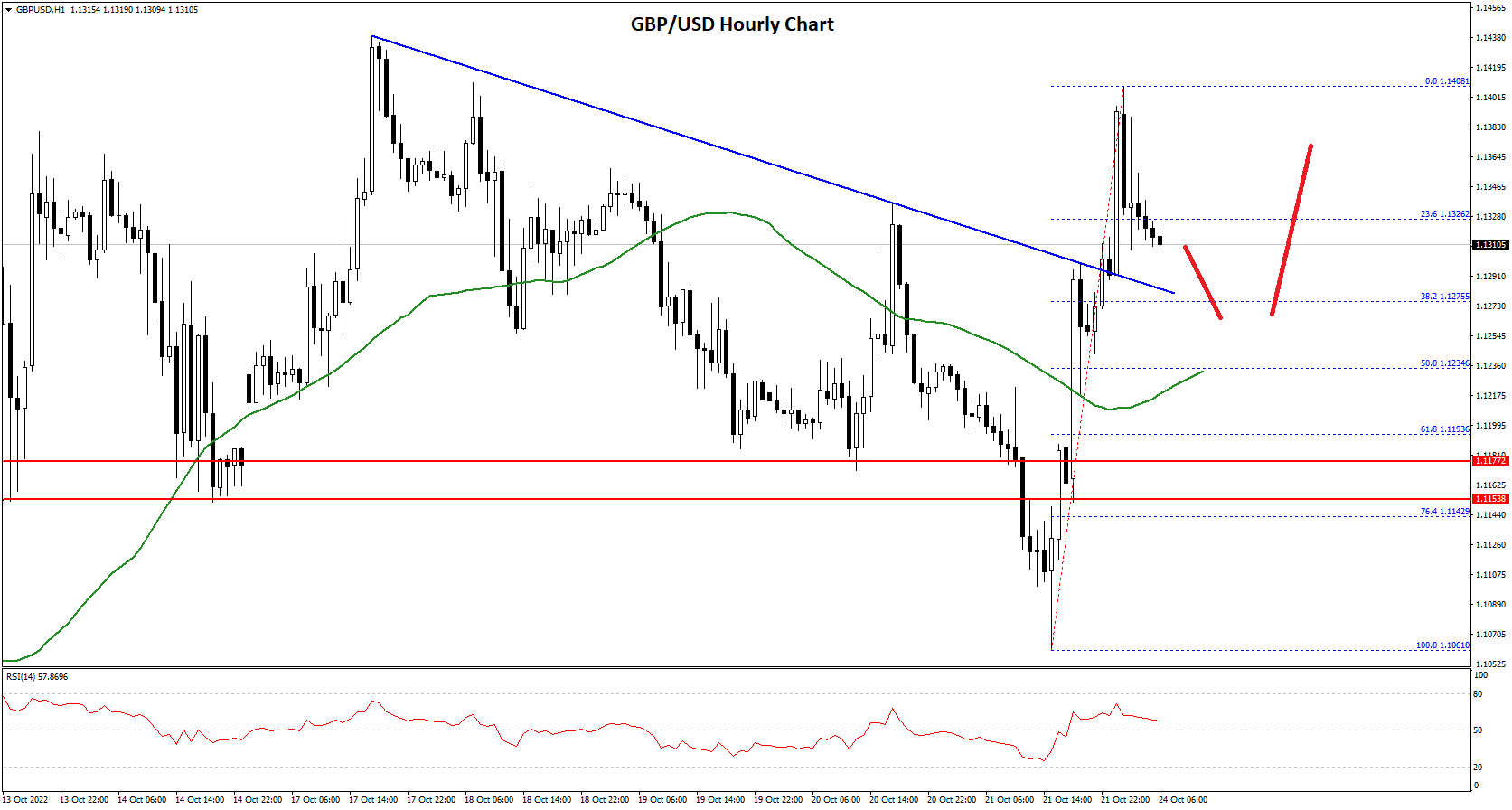

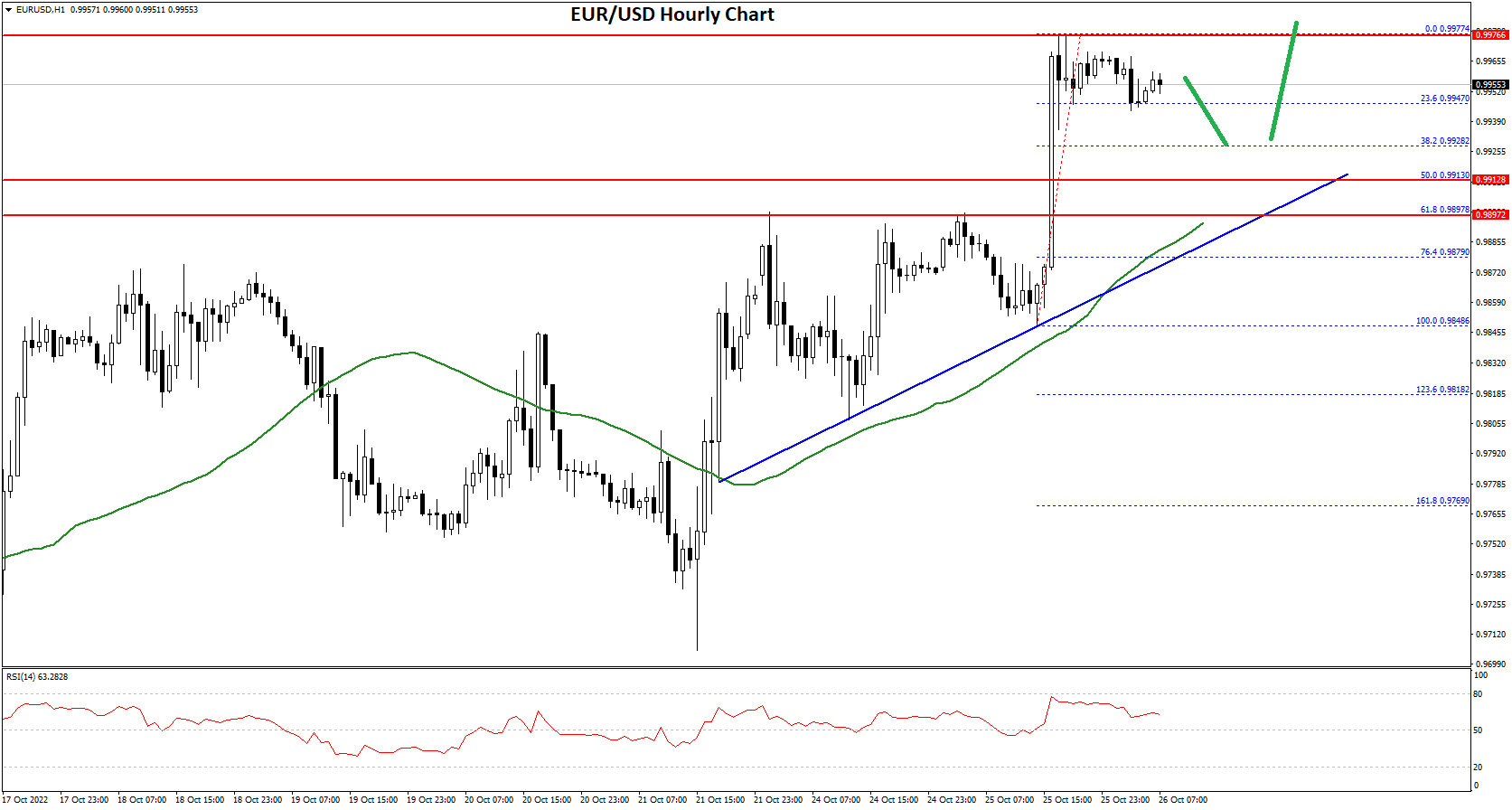

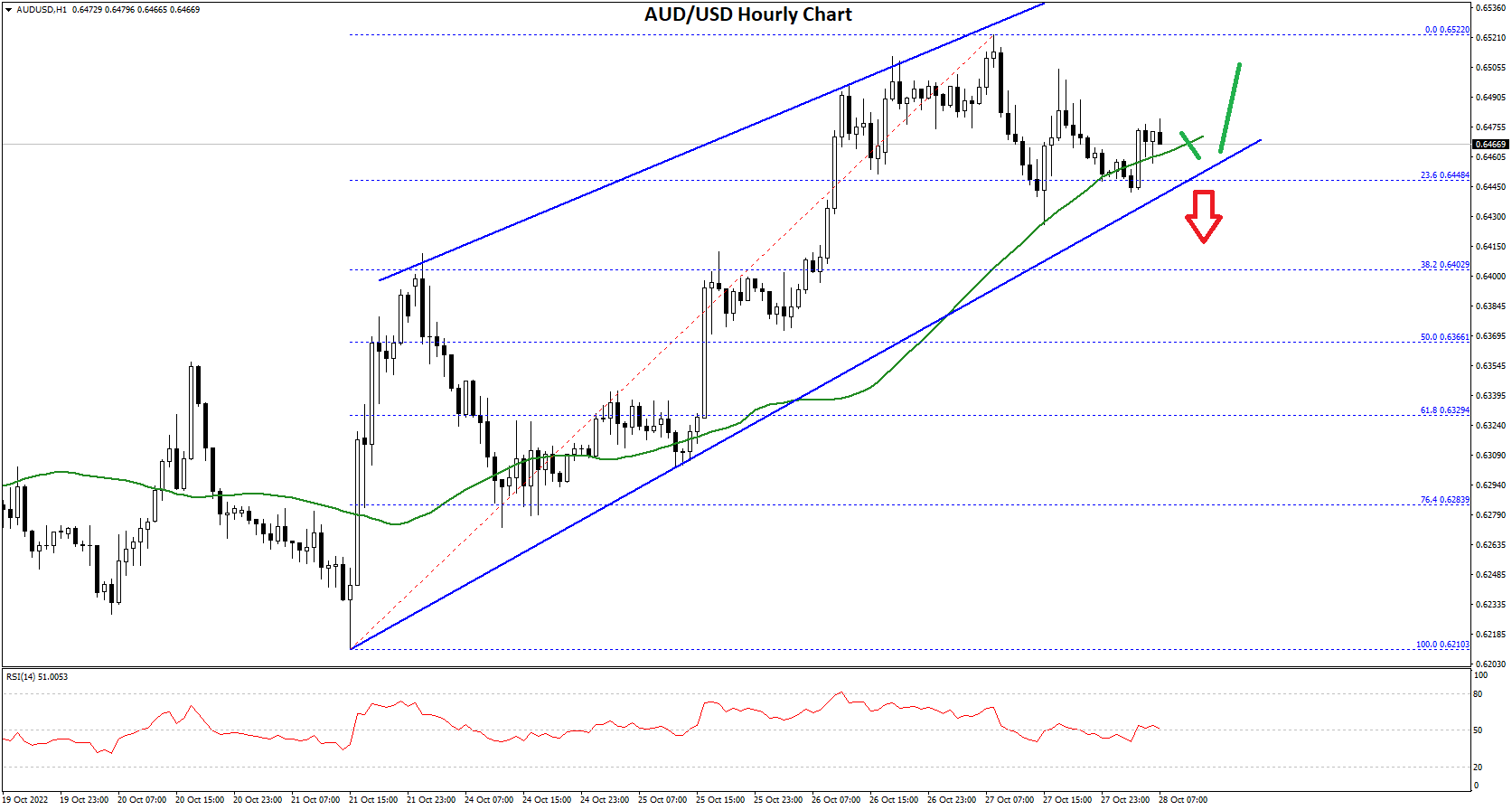

The market reacted as perhaps expected, with traders dumping the Pound and a further decline in value having taken place.

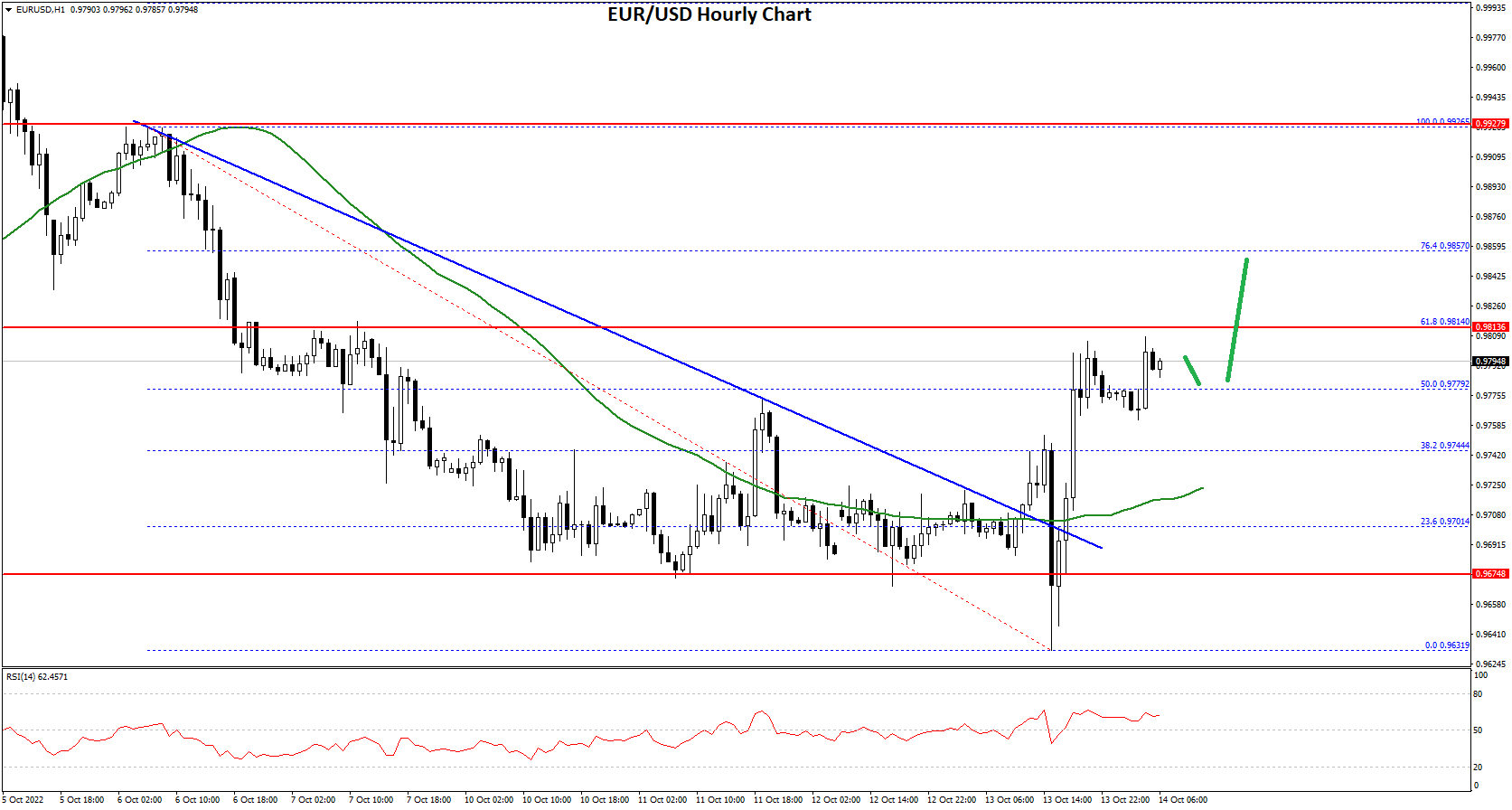

During the US trading session yesterday, the British Pound dropped to 1.09 against the Euro and further slid against the US Dollar.

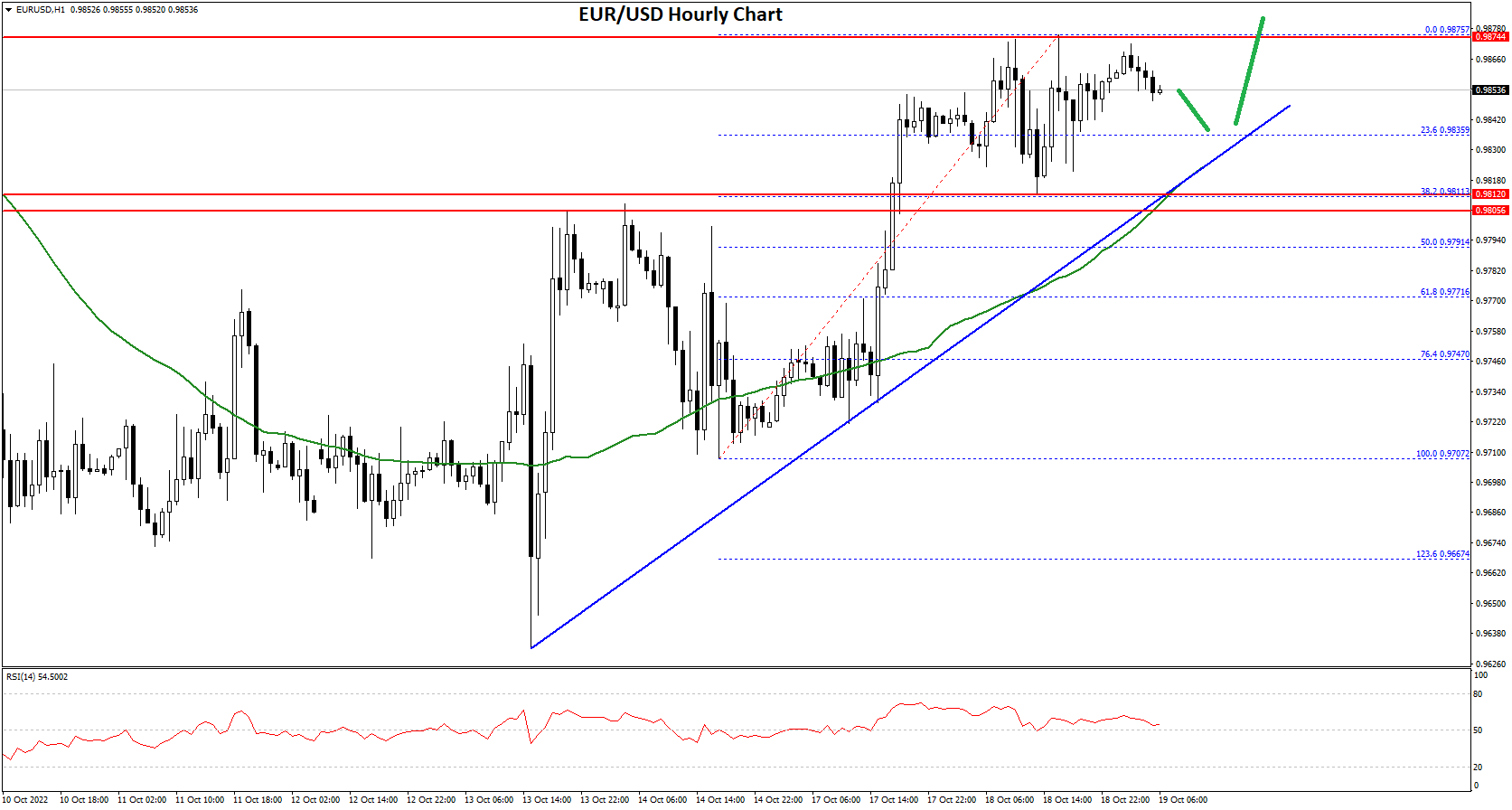

This morning, however, messages have become mixed as Bank of England Governor Andrew Bailey stated during private conversations with bank executives that the Bank of England may look at extending its emergency bond-buying program past this Friday’s deadline, according to people briefed on the discussions which made its way into the Financial Times this morning, despite Mr Bailey having already told pension funds that they “have three days left” before the support ends.

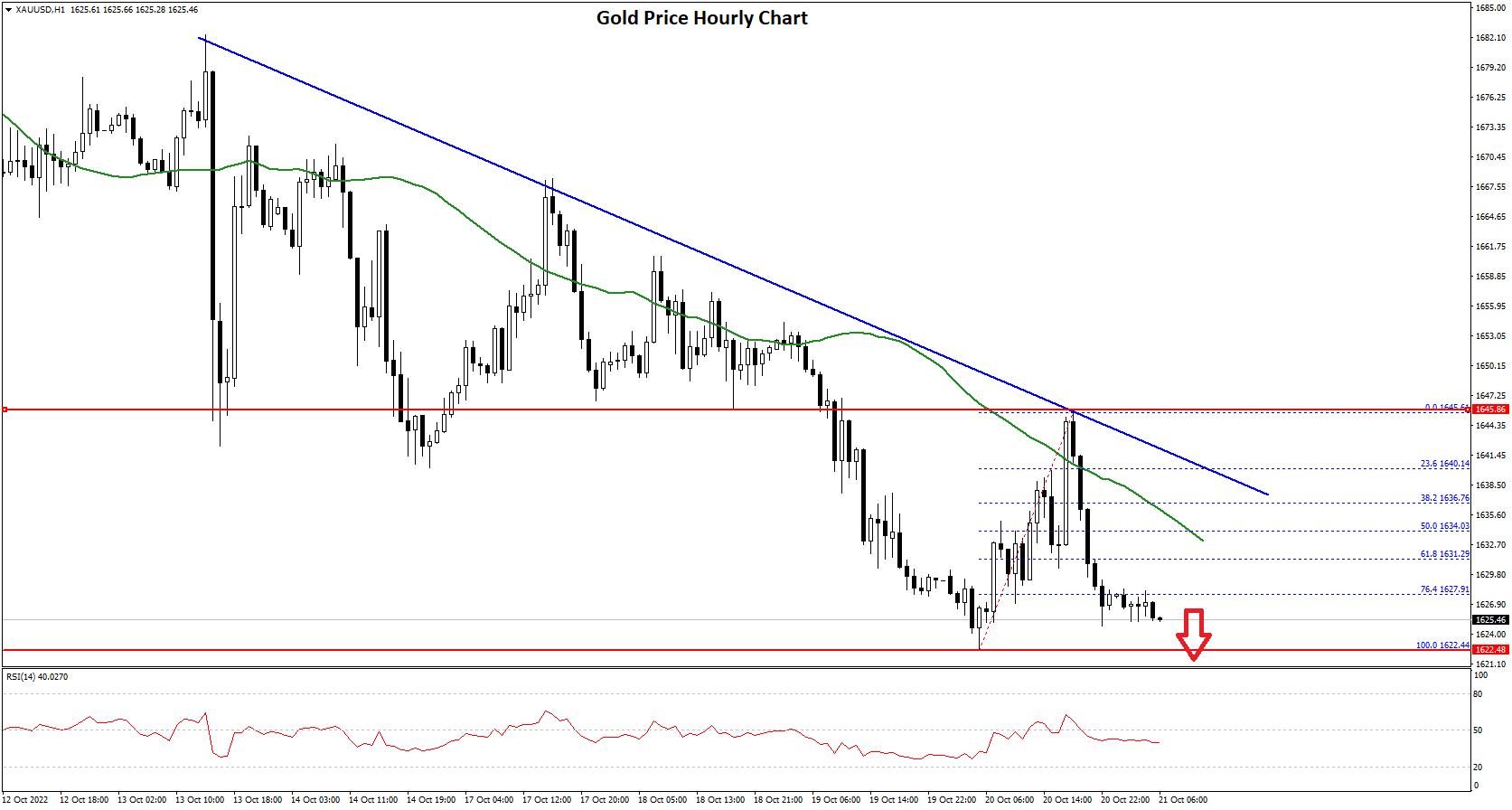

Pension funds are now in the process of redefining their investment strategies as the support is set to end in just three days time, however with the British Pound in turmoil, the economy tanking and inflation rampaging, interest rates set to reach between 5% and 6% by January 2023, there is a pinch to be felt for borrowers as well as those who are saving for their retirement.

This double-edged sword has not gone down well with investors and the overall outlook for the Pound is bleak indeed, especially considering that the UK Gilt market is not in the best shape, and internal reports have shown that the pensions industry is in no way ready for the Bank of England to withdraw its support.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.