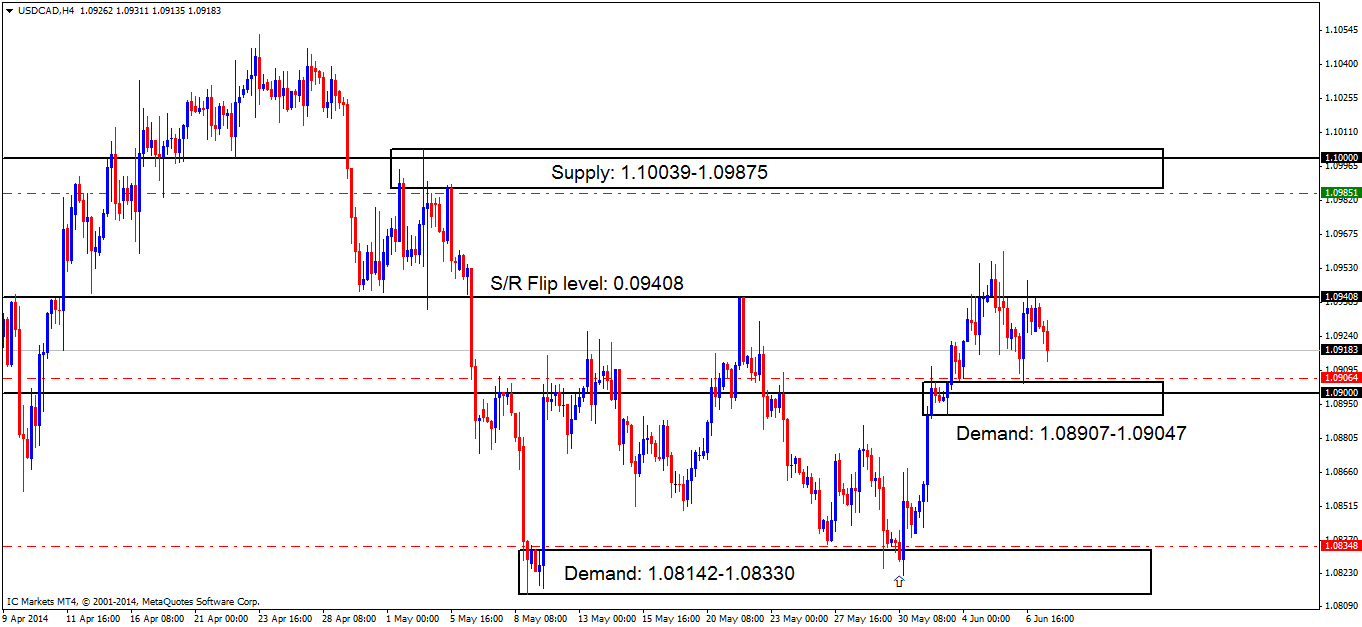

USD/CAD:

[B]Weekly TF.[/B]

The last weekly analysis reported price would possibly retrace all the way down to demand below at 1.05609-1.07372, however, price has found, what appears to be, strong support (S/R Flip level) at 1.08438 creating an S/R flip level. The bulls definitely took charge last week as the most recent weekly candle engulfed 3 prior weekly candles north.

[B]Daily TF.[/B]

The sellers do not seem to be interested in taking prices lower just yet, we have seen a few spikes (wicks) in and around supply at 1.10039-1.09356, but no positive lower closes have been seen yet. As per this timeframe, there is no clear direction; either the supply area just mentioned needs to be consumed, or the minor support below at 1.08142 needs to be consumed to give us some idea of where price may be heading next

[B]4hr TF.[/B]

The S/R flip level at 0.09408 has seen multiple spikes north, consuming the majority of sellers there, possibly clearing the path for more buying due to the confirmed support on the weekly at 1.08438 and with the sellers appearing to struggle at on the daily timeframe at supply (1.10039-1.09356), higher prices may be seen up to supply at 1.10039-1.09875.

[ul]

[li]At the time of writing there are no pending buy orders seen, there are, however, P.A confirmation orders (Red line) seen just above demand (1.08142-1.08330) at 1.08348 as there may be orders left unfilled here, a pending order is not wise here due to how deep price penetrated the level before (marked with an arrow). Near-term P.A confirmation orders at 1.09063 just above demand at 1.08907-1.09047 may still have unfilled orders lurking around this area. The reason a pending order may not be logical here, is because of the big figure 1.09000 within the demand area just mentioned may see a deep spike south which does happen regularly, so pro money can stop out traders with stops too close and collect lots of liquidity.[/li][li]Pending sell orders (Green line) just below supply (1.10039-1.09875) at 1.09851 will very likely see a nice reaction. However, we should remain aware of the big figure number 1.10000 is lurking within the top half of the supply area (levels above), so a bigger stop may be required![/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 1.08348 (SL: Likely to be set at 1.08127 TP: Decided if/when price ‘confirms’ the level) 1.09063 (SL: Likely to be set at 1.08882 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.09851 (SL: 1.10114 TP: [1] 1.09408 [2] 1.09047) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]Higher-timeframes indicate higher prices may be seen, so a retracement down to demand at 1.08907-1.09047 will likely happen. Price will likely trade in between the demand area just mentioned, and the S/R flip resistance area above at 1.09408, until volatility picks up, which may mean waiting until Tuesday.[/li][/ul]

USD/CHF:

[B]Weekly TF.[/B]

Stacked demand is seen at 0.85500-0.82750 and 0.85670 – 0.88360, whilst stacked supply is also seen above at 0.99190 – 1.00530 and 0.99710 – 0.97460.

Price formed a nice-looking bearish pin bar on this timeframe, indicating sellers were in control for the majority of the last trading week, with price closing near its lows at 0.89354.

[B]Daily TF.[/B]

A nice-looking engulfing bar was printed on Thursday indicating we may see lower prices very soon. Price is currently capped between demand (S/R flip level) at 0.88501 and supply above at 0.91563-0.90844, a visit to the supply area is more likely since we have recently seen price reacting off of weekly demand (above) at 0.85670-0.88360.

[B]4hr TF.[/B]

Price is currently trading between supply at 0.90381-0.90033 and demand below at 0.88973-0.89168.

A break above supply could see price test oncoming supply at 0.91339-0.91116 (not shown on chart –too far above), and, a break below demand could see price testing the daily S/R flip level at 0.88501.

[ul]

[li]There are no safe pending buy orders seen at the time of writing. P.A confirmation orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order. Near-term P.A confirmation buy orders are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders left on Friday.[/li][li]Pending sell orders (Green line) are seen at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063. Unfilled sell orders are likely lurking around this area due to the way price turned, it was a quick reaction possibly meaning not all pro money orders were filled. There are no P.A confirmation orders currently seen in the market.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 0.89029 (SL: Likely to be set at 0.88784 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.90063 (SL: 0.90412 TP: [1] 0.89168 [2] 0.88501) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]Price will likely stay trading within supply at 0.90381-0.90033 and demand at 0.88973-0.89168, If a break is seen below, watch for buyers to come into the market around the daily S/R flip level at 0.88501. Conversely, if a break above supply is seen this could see price testing oncoming supply at 0.91339-0.91116.[/li][/ul]

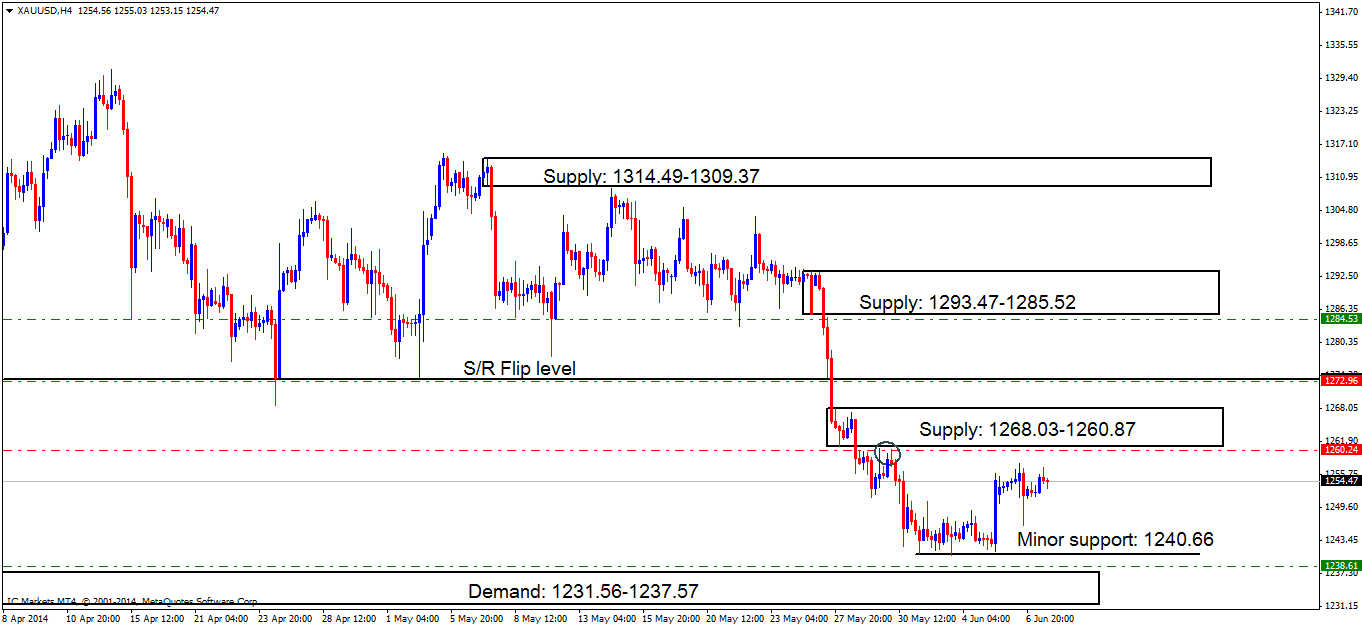

XAU/USD (GOLD)

[B]Weekly TF.[/B]

Gold is still currently trading within a range, supply being seen at 1495.00 – 1419.68, and demand at 1156.85 – 1194.53. Gold has been trading within this range since 2012 with a break of either area yet to be seen.

[B]Daily TF.[/B]

Price is trading within demand at 1238.51-1254.97; however, buyers are showing very little interest in taking price higher from this level up towards the S/R flip level at 1277.36. A break below the demand area just mentioned could see price drop hard, possibly testing support at 1182.01.

[B]4hr TF.[/B]

Gold on the higher timeframes produces clean price action, easily definable by zones and levels. Price is currently trading between minor support at 1240.66 and supply above at 1268.03-1260.87. The minor support level just mentioned is a great level to be faked into demand at 1231.56-1237.57. A break above supply (levels above) could see price testing either the S/R flip level at 1273.34 or supply above this level at 1293.47-1285.52.

[ul]

[li]Pending buy orders (Green line) seen above demand (1231.56-1237.57) at 1238.61 as pro money will likely fakeout the minor support level at 1240.66 into demand below (levels above). At the time of writing there are no P.A confirmation orders seen in the market.[/li][li]Pending sell orders (Green line) are seen just below supply (1293.47-1285.52) at 1284.53, as this level will likely see a reaction due to a serious supply/demand imbalance around this area. P.A confirmation orders (Red line) just below supply (1268.03-1260.87) at 1260.24 require confirmation to enter short here due to previous price action (circled) possibly consuming some of the sellers as it left the zone. P.A confirmation orders just under the S/R flip area (1273.34) at 1272.96 will likely see a reaction, be that as it may, there is no logical area for a stop, so confirmation is required.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1238.61 (SL: 1230.64 TP: 1260.87 P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1284.53 (SL: 1294.70 TP: [1] 1273.34 [2] 1268.03) P.A.C: 1272.96 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 1260.24 (SL: Will be likely set at 1269.04 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]Price will likely trade in between supply at 1268.03-1260.87 and demand at 1240.66 for much of today. One spot to watch out for is the demand area below the minor support (level above) at 1231.56-1237.57 as a fakeout south may be seen very soon.[/li][/ul]

[B]For the readers’ benefit:[/B]

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

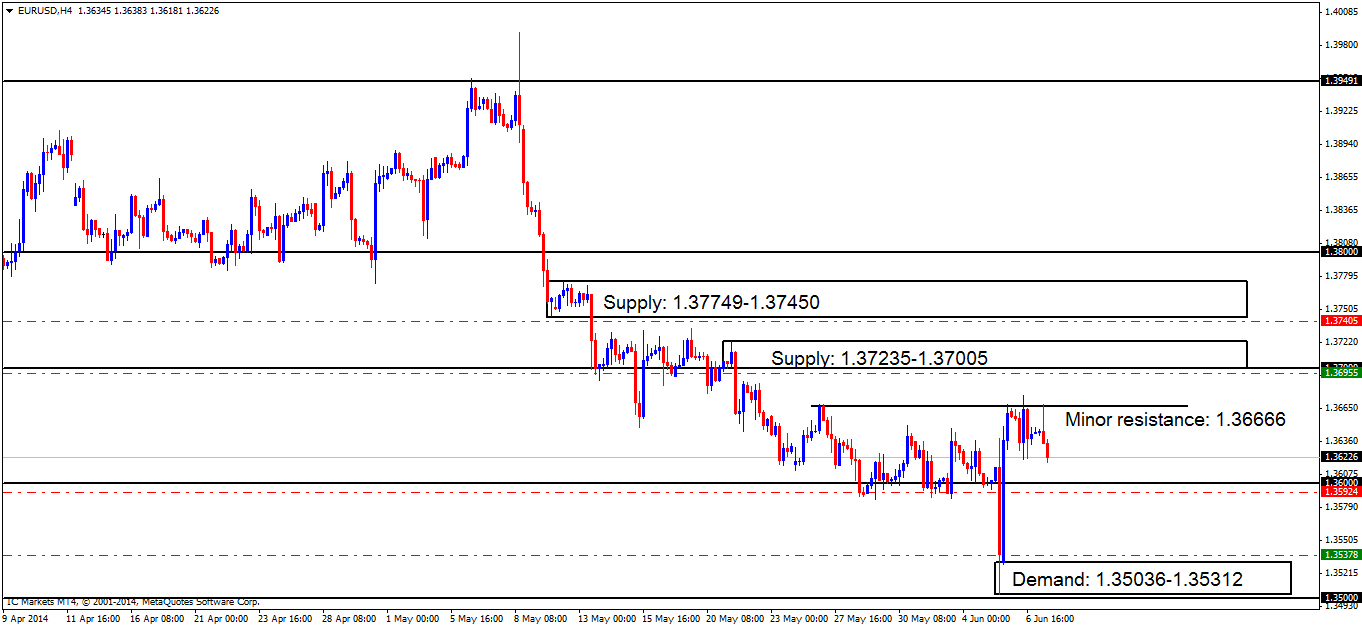

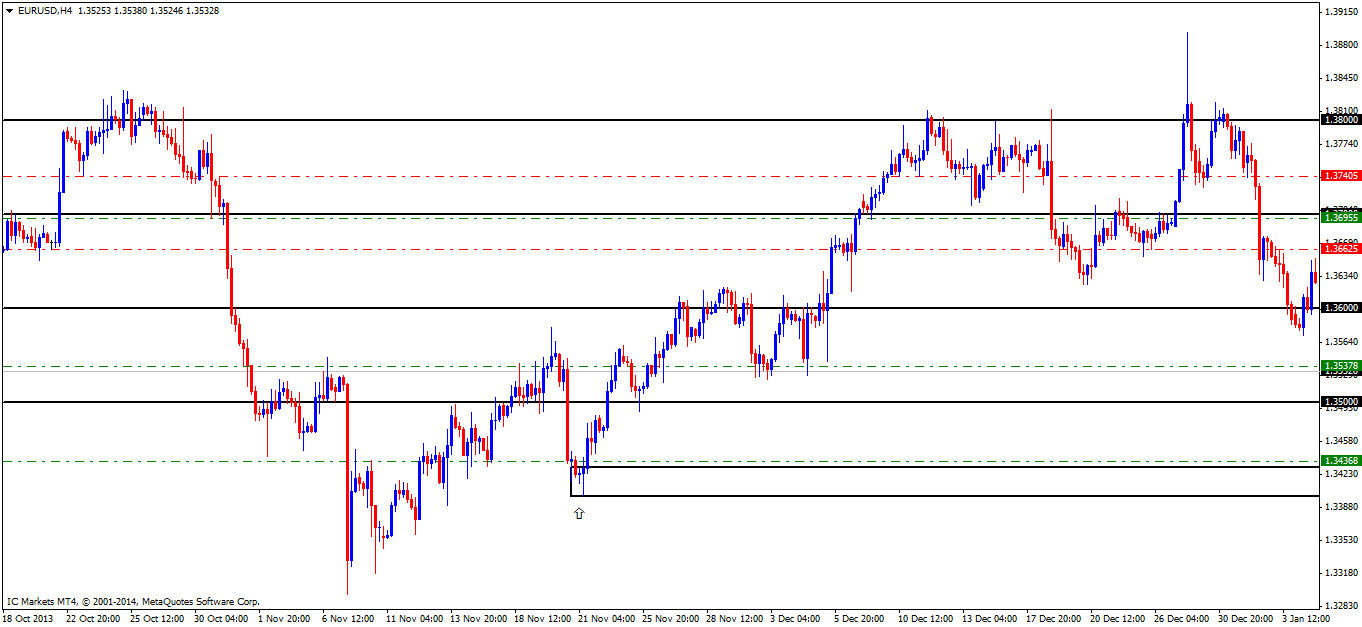

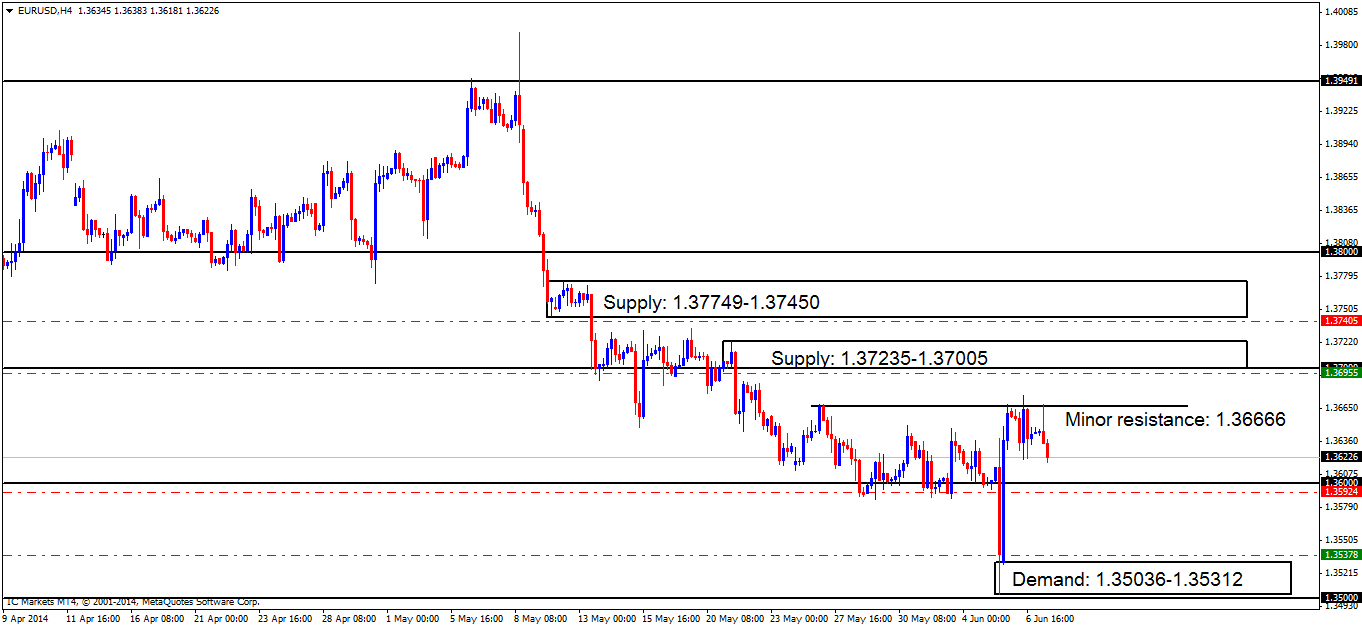

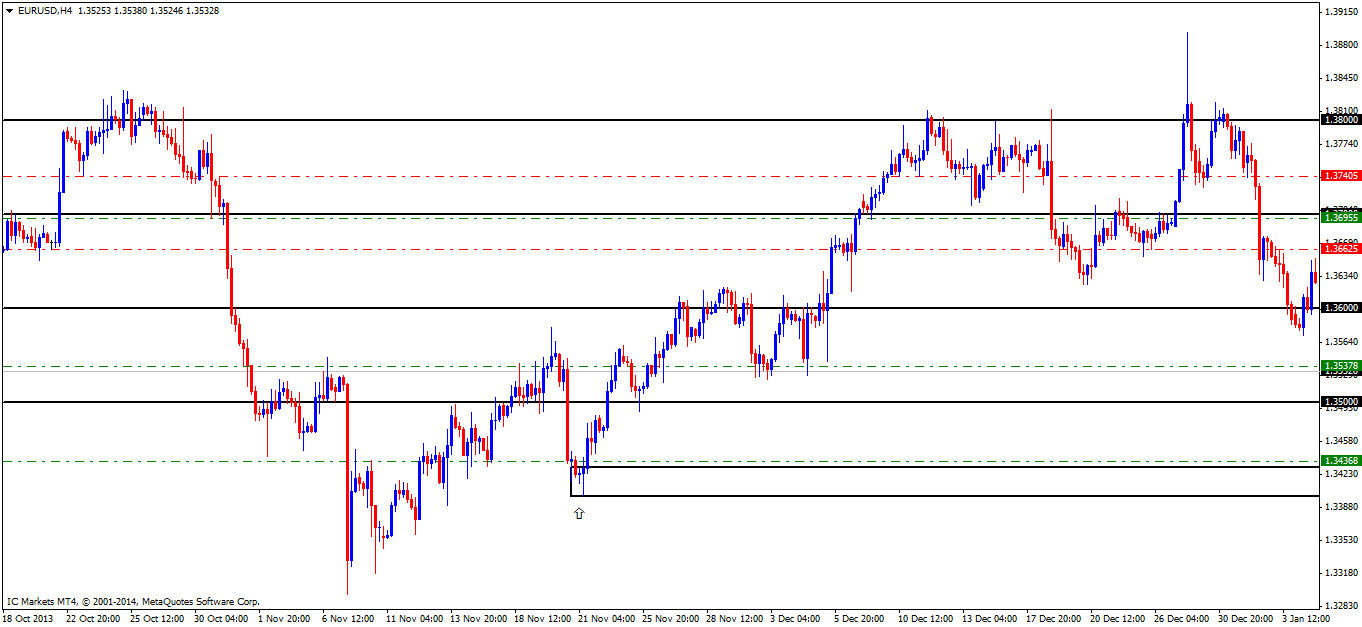

EUR/USD:

[B]4hr TF.[/B]

A reaction at minor resistance (1.36666) has been seen, and at the time of writing, intraday sellers appear in control meaning we may see a touch of the round number very soon. This down move could very well be traders closing their long positions from last week.

Although we are currently trading within weekly demand at 1.34770-1.36771, buyers still have to contend with daily supply at 1.37342-1.36890, so the retracement we are seeing is expected.

There has been no change to either pending, or P.A confirmation orders due to a very slow Monday, which was noted and expected in yesterday’s analysis.

Much the same as yesterday:

[ul]

[li]Pending buy orders (Green line) are seen at 1.35378 just above demand at 1.35036-1.35312 as there may be unfilled buy orders sitting there. P.A confirmation buy orders (Red line) are visible just below the round number 1.36000 at 1.35924. A pending order is not logical around this level because previous price action indicates there may be very few unfilled orders available here, making a reversal unlikely. Price is more likely to test the lower demand already mentioned at 1.35036-1.35312 for an overall bigger push up as indicated by the higher timeframes.[/li][li]Pending sell orders (Green line) are seen at 1.36955 just below supply at 1.37235-1.37005. Pending orders are set here since this level remains untouched, meaning unfilled orders are likely still around this area. P.A confirmation sell orders (Red line) are seen higher up at 1.37405 just below supply at 1.37749-1.37450. This level requires confirmation because of how close the supply areas (levels above) are together, thus making a logical target area unavailable. Do be on your guard with these orders; the higher-timeframes are indicating higher prices may be seen this week.[/li][/ul]

[B]  [/B]

[/B]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1.35378 (SL: 1.34971 TP: [1] 1.36000 [2] 1.36666) P.A.C: 1.35924 (SL: Decided if/when price ‘confirms’ the level T.P: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C: 1.37405 (SL: More than likely at 1.37791 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]Due to price recently seen trading below daily supply at 1.37342-1.36890, a retrace down to 4hr demand at 1.35036-1.35312 will possibly happen, triggering our pending buy order set at 1.35378 for an overall bigger push up, as do not forget we are still deep within weekly demand at 1.34770-1.36771.[/li][/ul]

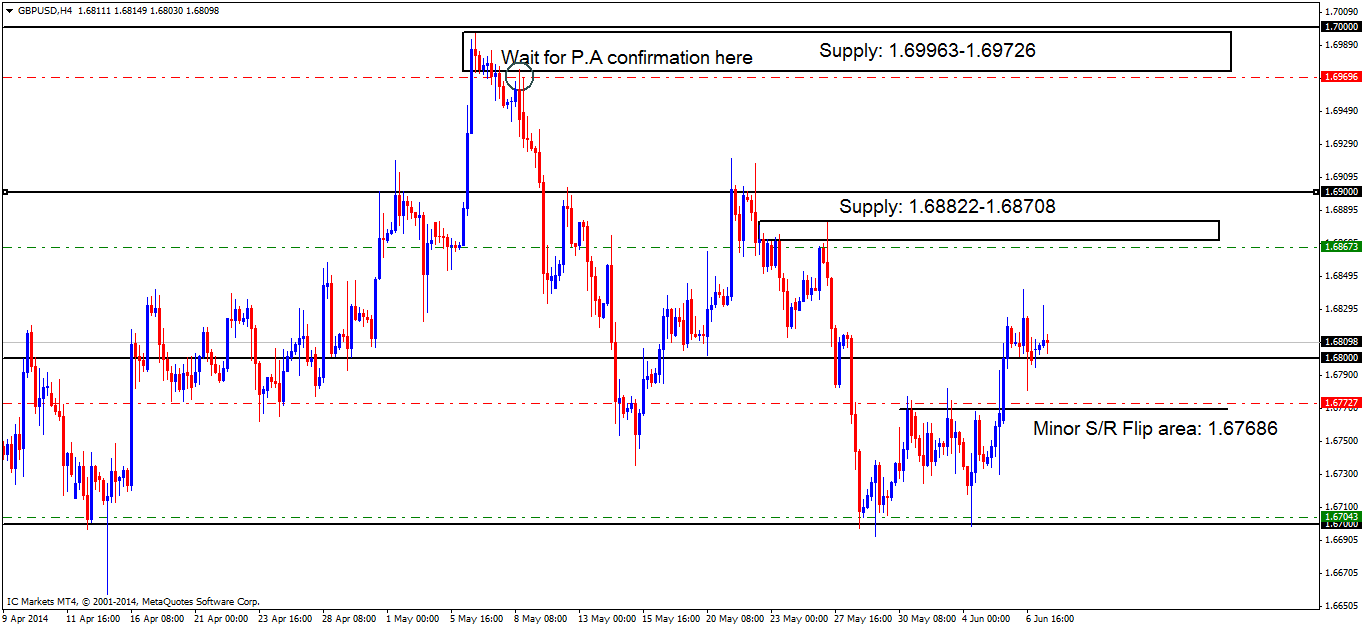

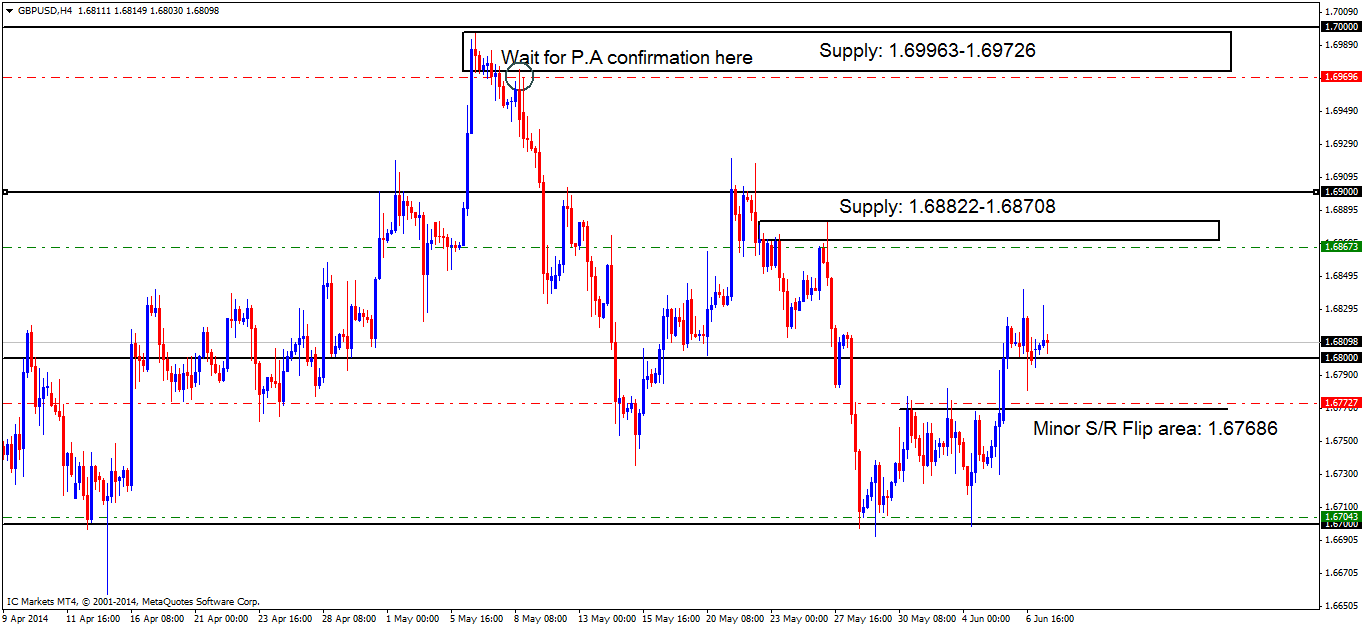

GBP/USD:

[B]4hr TF.

[/B]

Price has been seen dancing around the round number 1.68000 since late last week; a decision on direction has yet to be seen. Much the same as the Euro, the Pound had experienced little price movement yesterday, again, this was expected.

Price still remains capped between supply above at 1.68822-1.68708 and the round number below at 1.68000 acting as temporary demand.

Pending and P.A confirmation orders remain exactly the same as the market has seen little change since the last analysis.

[ul]

[li]Pending buy orders (Green line) are seen below at 1.65874 just above demand at 1.65518-1.65827 (not visible on the chart). This area shows great potential due to the momentum away from the base indicating unfilled orders may still be in play. The next pending buy orders (Green line) are seen just above the round number 1.67000 at 1.67043, this area will likely see a reaction due to the amount of credible touches this level has seen, making it an area to watch out for. Small P.A.confirmation buy orders (Red line) are seen below current price at 1.67727 just above the minor S/R flip level (1.67686), a pending order set here would be too risky, due to there being no logical area for a stop loss, that is why it is better to wait for price to ‘confirm’ this area beforehand.[/li][li]Pending sell orders (Green line) are visible below supply (1.68822-1.68708) at 1.68673 due to the nice-looking momentum away from this area indicating unfilled orders may still be hiding there. P.A confirmation sell orders (Red line) are seen at 1.69696 just below supply at 1.69963-1.69726. The reason this level requires confirmation is due to the wicks spiking the area as price left the base (circled) warning us sellers may have already been consumed.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1.65874 (SL: 1.65472 TP: Dependent on approaching price action nearer the time) 1.67043 (SL: 1.66527 TP: [1]1.67686 [2] 1.68000 [3] 1.68708) P.A.C: 1.67727 (SL: Decided if/when price ‘confirms’ the level T.P: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.68673 (SL: 1.68846 1 TP: [1] 1.68000 [2] 1.67686) P.A.C: 1.69696 (SL: More than likely will be at 1.70030 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]With major players in Europe and Australia back at their trading desks today, normal market volatility should be seen. Price will likely see a small retracement down to the minor S/R flip area at 1.67686, or if the sellers have the strength, a drop to the round number 1.67000 may happen, before any higher prices are seen.[/li][/ul]

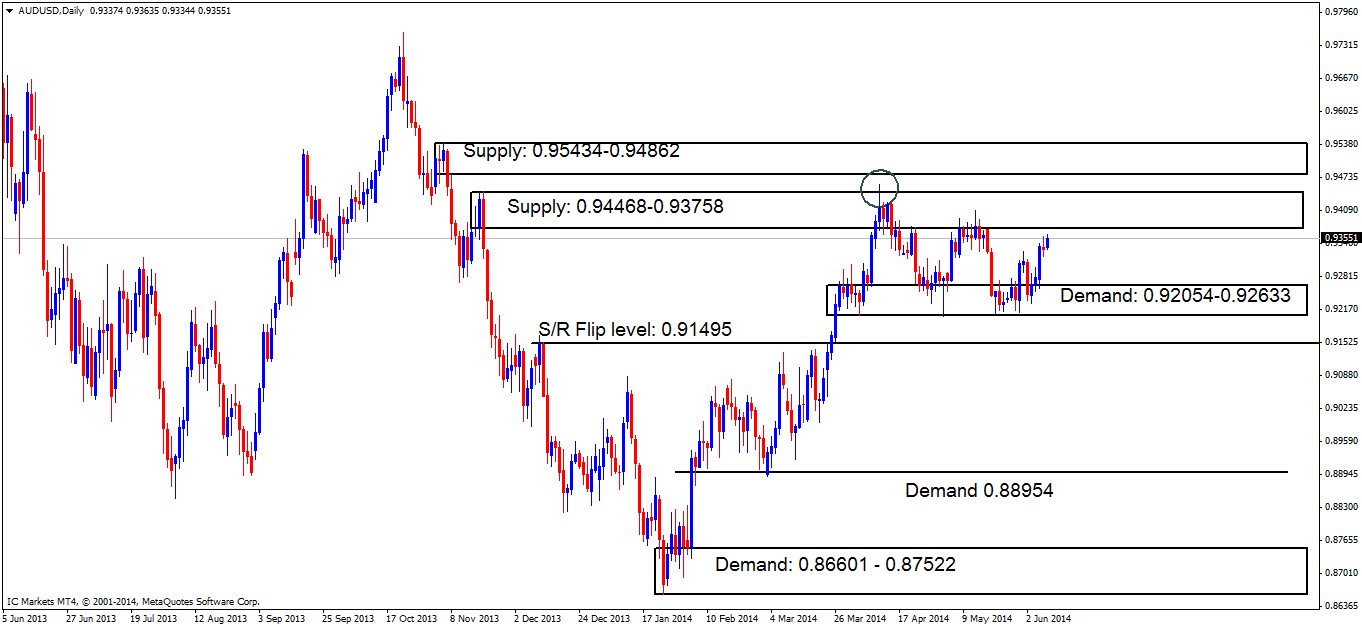

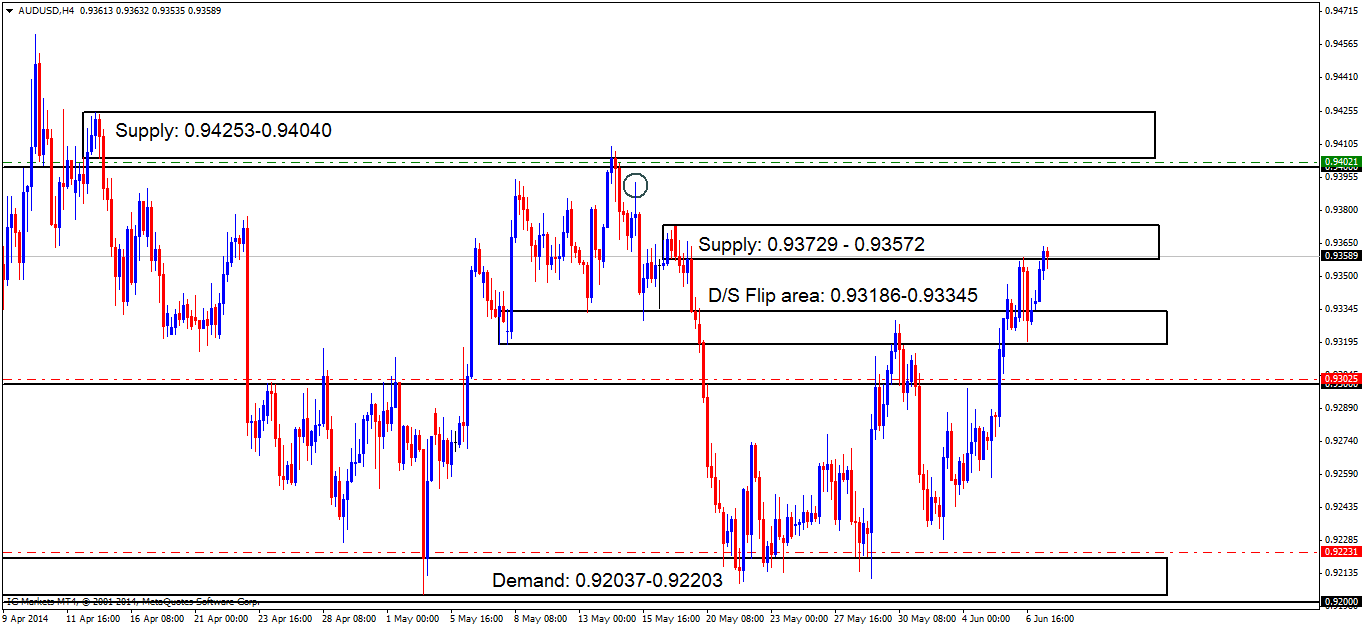

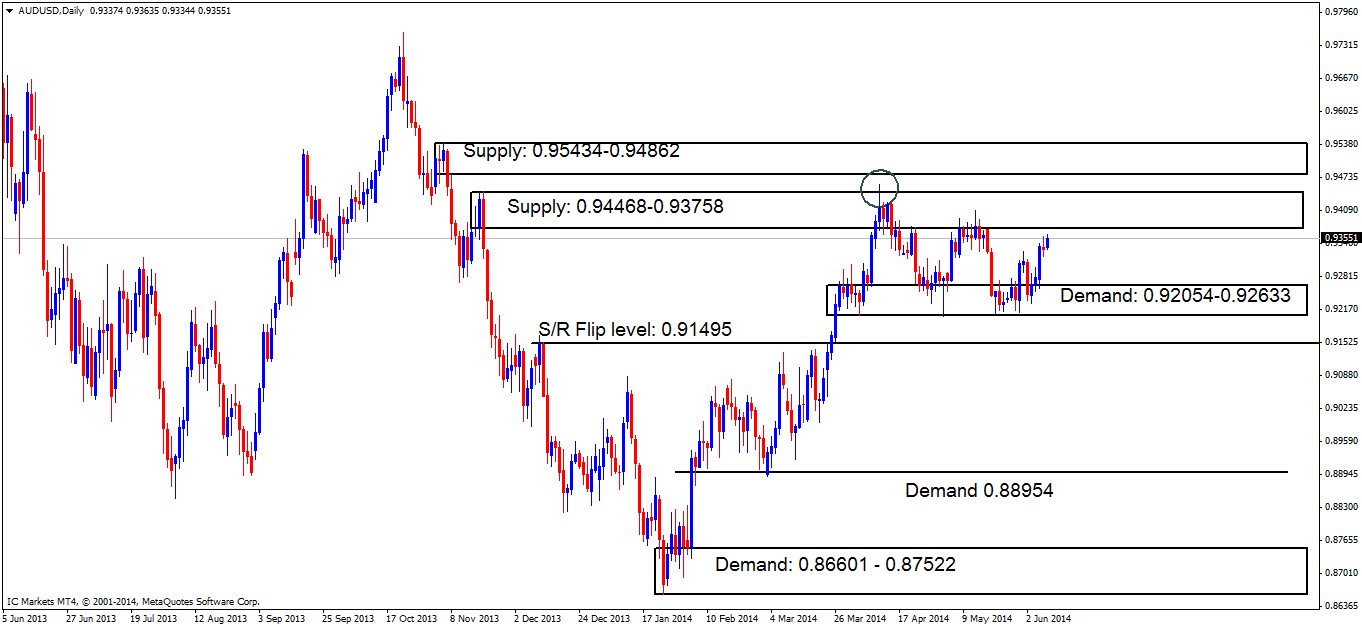

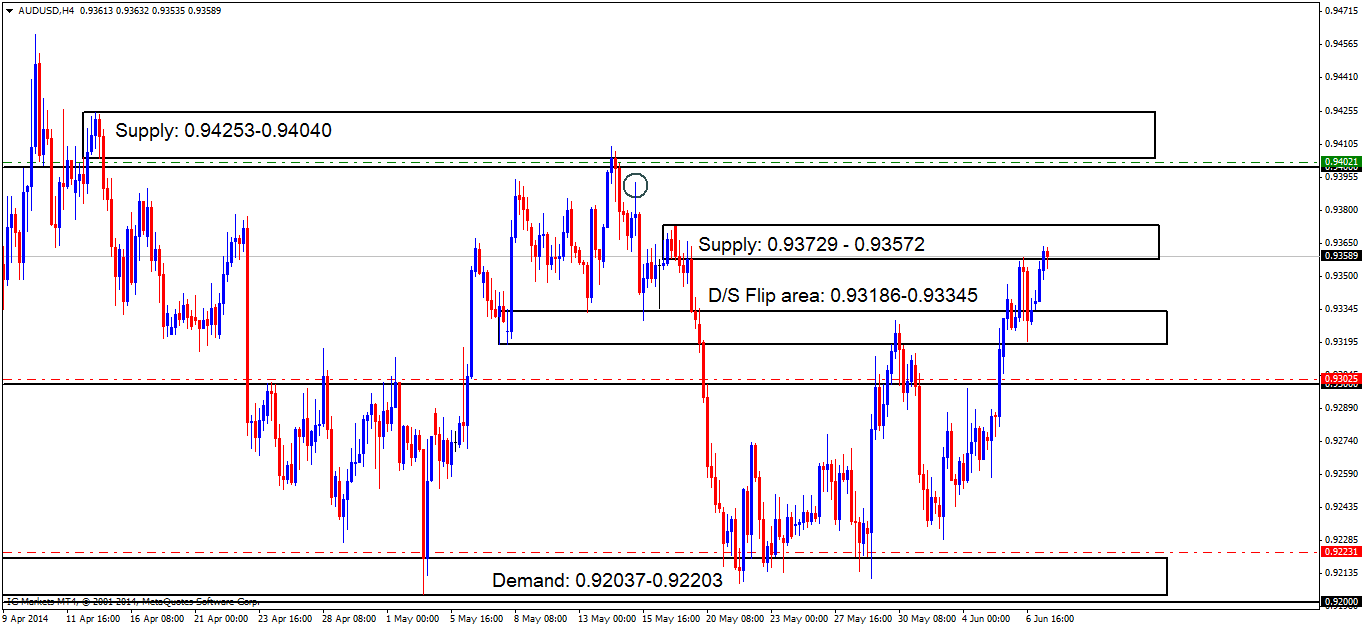

AUD/USD:

[B]Daily TF.[/B]

As reported in yesterday’s analysis, price still remains capped within medium-term consolidation between supply at 0.94468 – 0.93758 and demand below at 0.92054 – 0.92633. At the time of writing, price is trading near the upper limits of this consolidation.

The wick which has been purposely circled shows pro money clearing sellers’ stops out here weakening the supply area (levels above). Taking all of this in to consideration and remaining aware that the weekly time frame is trading around resistance at 0.93718, a fakeout north to collect liquidity may happen on the daily timeframe to bring prices south.

[B]4hr TF.[/B]

Price is currently trading within supply at 0.93729-0.93572 capping price to the upside, with demand below at 0.93186-0.93345 capping price to the downside. It was reported in the last analysis, retail buy and sell orders would likely be set between these two areas.

A break above supply (levels above) could force price to test the supply area above at 0.94253-0.94040, as most of the supply between this area is likely consumed due to the wick (circled) in between (levels above), allowing price to rally without meeting too many sellers. A break below demand (levels above) could see price testing the round number 0.93000.

Like the Euro and the Pound, the pending and P.A confirmation orders on the Aussie remain exactly the same too:

[ul]

[li]At the time of writing there are no pending buy orders available due to current price action. P.A confirmation buy orders (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order here, since there have been some deep spikes into this demand area (levels above), meaning there could be few buyers left here, so, it’s better to wait for confirmation. The next batch of P.A confirmation buy orders (Red line) are visible just above the round number 0.93000 at 0.93025, as previous price action has shown that this area is a magnet for deep tests (spikes); we want to avoid this happening to us by waiting for confirmation.[/li][li]Pending sell orders (Green line) are seen just below supply (0.94253-0.94040) at 0.94021. This supply area, although not fresh, has only seen a small test to the lower limit of the base meaning there are likely active sellers lurking deeper within, permitting pending orders to be set.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: No pending orders are seen with current price action. P.A.C: 0.92231 (SL: more than likely will be at 0.91984 TP: Decided if/when price ‘confirms’ the level) 0.93025 (SL: Dependent on where price ‘confirms’ the level TP: Dependent on where price ‘confirms’ the level)[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.94021 (SL: 0.94277 TP: [1] 0.93729 [2] 0.93345 [3] 0.93000) P.A.C: No P.A confirmation orders seen with current price action.[/li][li][B]Most likely scenario: [/B]With normal market volatility expected today, supply at 0.93729-0.93572 may be consumed, possibly clearing the path up to supply at 0.94253-0.94040. Before all of this happens though, do not totally rule out the possibility of price turning south towards the round number 0.93000, as the D/S flip area at 0.93186-0.93345 appears to be consumed and very weak at this point.[/li][/ul]

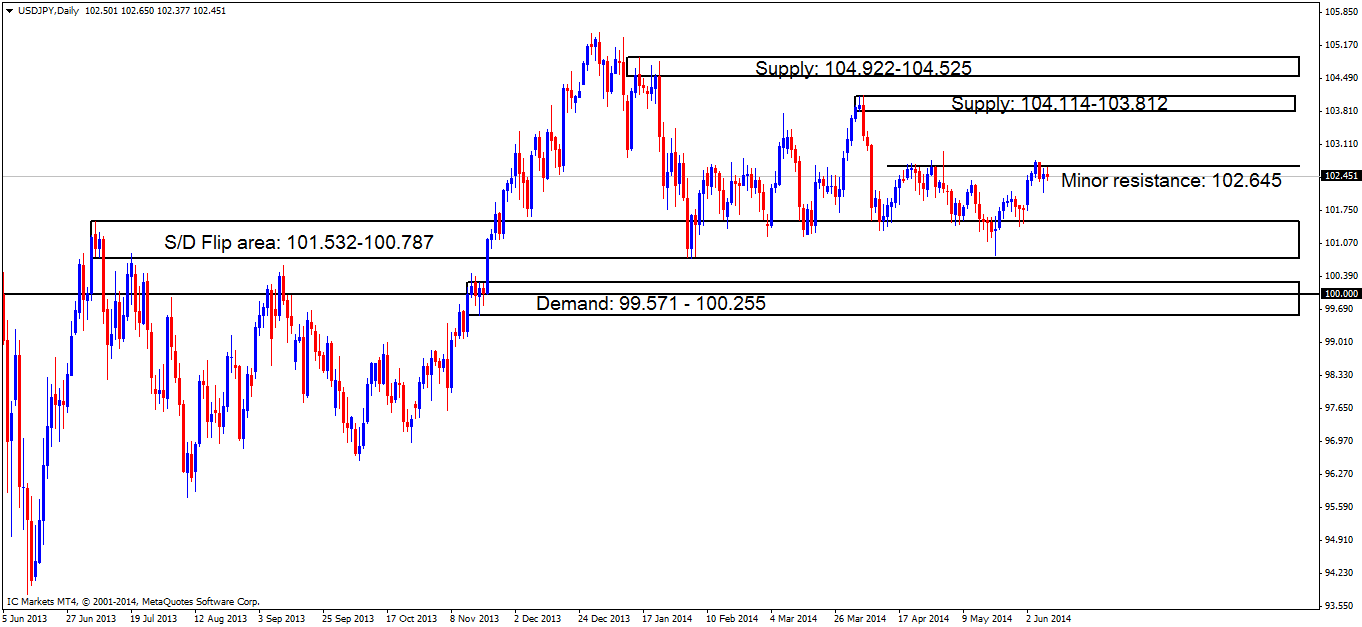

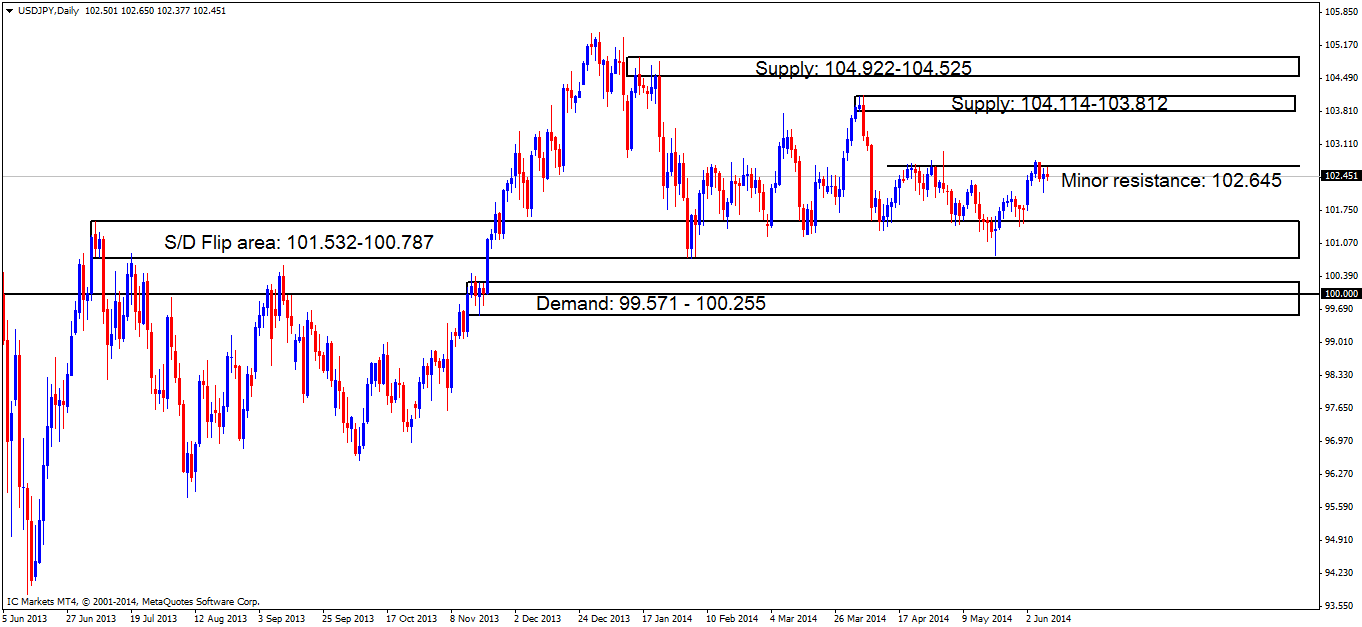

USD/JPY:

[B]Daily TF.[/B]

A quick reminder of what the higher timeframes are showing. The daily timeframe sees price holding below minor resistance at 102.645, but do not be fooled by this! A positive close above the minor resistance level has already been seen, meaning the buyers may still have strength.

A decline in price may yet be seen, but the overall likely direction is north on this pair, as do not forget, we have just seen a bullish reaction on the weekly timeframe at support (101.254).

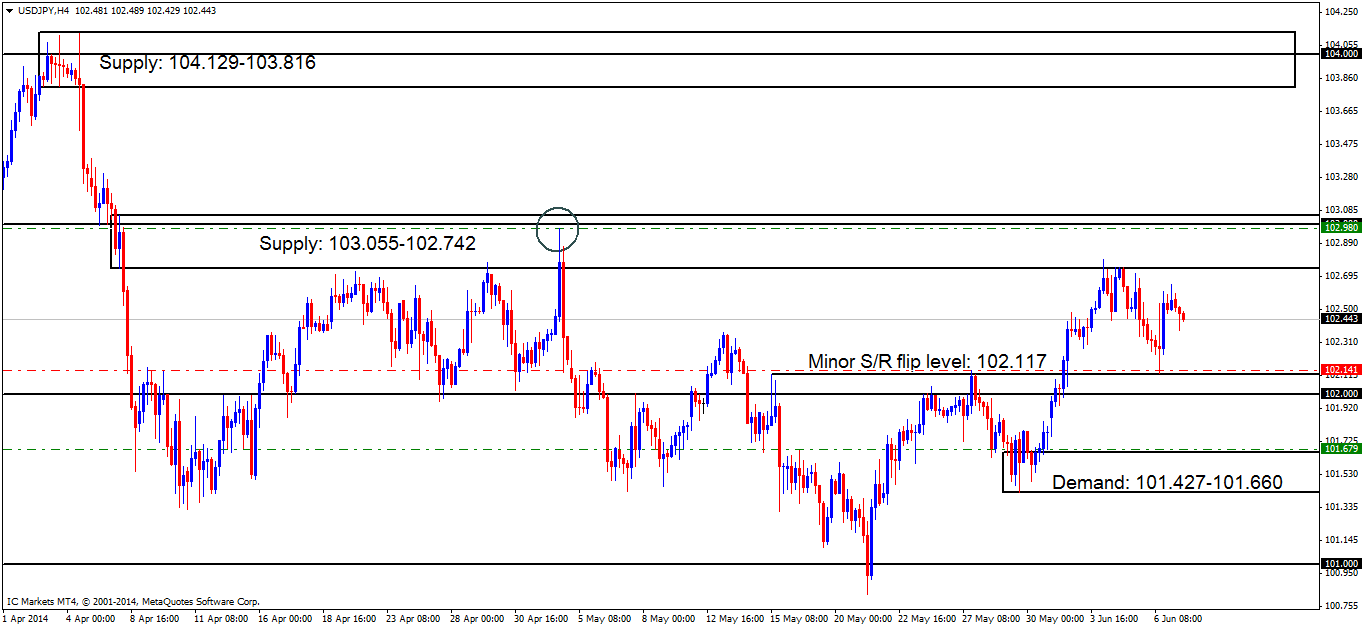

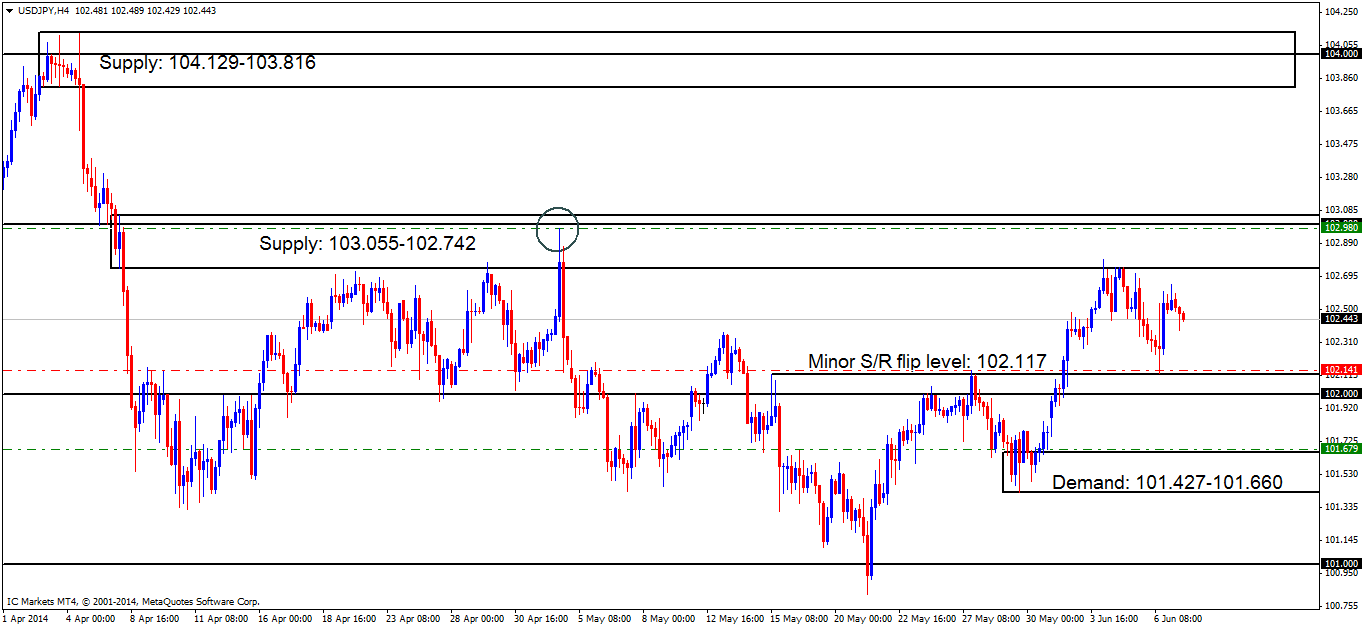

[B]4hr TF.[/B]

Price action was very quiet yesterday with very little movement seen in either direction. Technically nothing has changed and the analysis completed yesterday is still valid.

Price is currently capped between supply at 103.055-102.742 and demand (S/R flip level) at 102.117. A break above this supply could see price testing supply at 104.129-103.816; conversely, a break below the (demand) S/R flip level could see price testing demand at 101.427-101.660.

Pending and P.A confirmation orders remain exactly the same as yesterday’s analysis, as such, still remain valid:

[ul]

[li]Pending buy orders (Green line) are seen just above demand (101.427-101.660) at 101.679, as this demand remains fresh and likely still hold unfilled orders. P.A confirmation orders (Red line) are seen at 102.141 just above the S/R flip level (102.117). This area may well hold, but there is always the chance of a deep spike to the round number 102.000 below, which could stop us out, so best to wait for added confirmation.[/li][li]Pending sell orders (Green line) are visible at 102.980, deep within supply (103.055-102.742), and just below the round number 103.000. The supply area may well be weak now, but the way price reacted at the circled area indicates pro money activity, meaning sell orders may be left unfilled there.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O:101.679 (SL: 101.404 TP: [1] 102.000 [2] 102.742) P.A.C: 102.141 (SL: Likely to be set at 101.925 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 102.980 (SL: 103.108 TP: 102.117, but may well change if the market sees any developments). P.A.C: No P.A confirmation orders seen with current price action.[/li][li][B]Most likely scenario: [/B]Price will likely see more energy today as major players in Europe and Australia begin to return to their trading desks after the long weekend. A drop in price is expected and may only reach the minor S/R flip level at 102.117, or we may see a bigger drop to demand at 101.427-101.660, before any higher prices are seen, so do not these areas down.[/li][/ul]

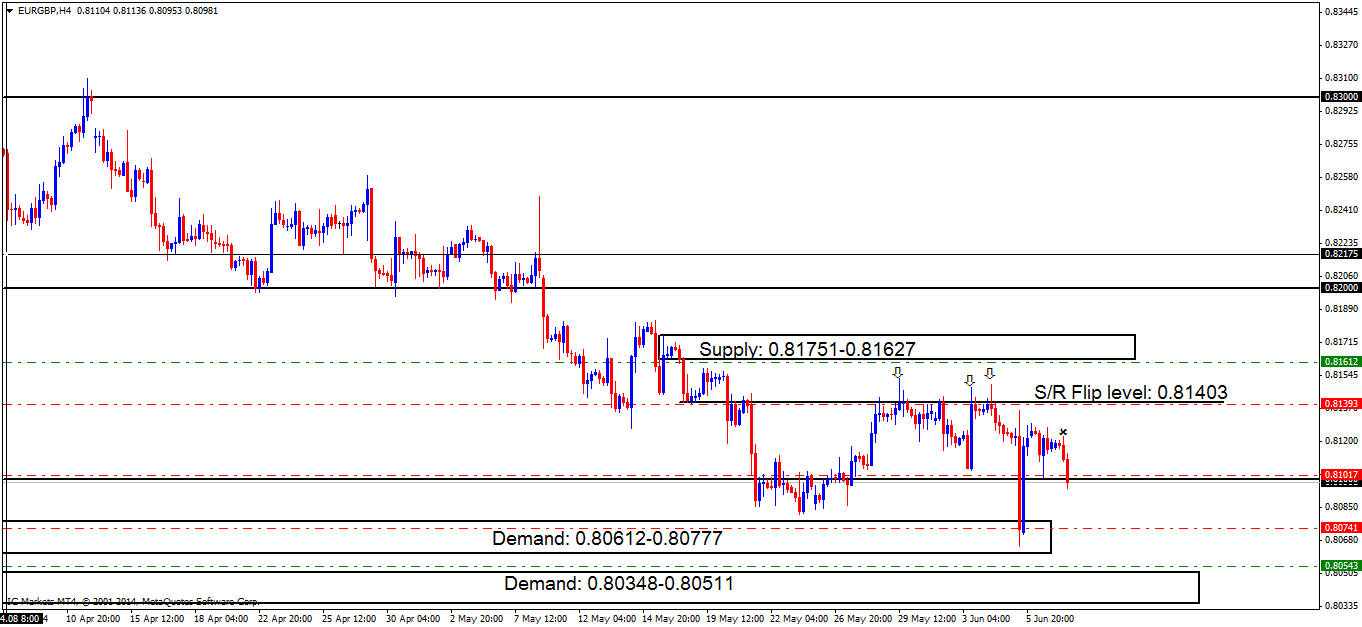

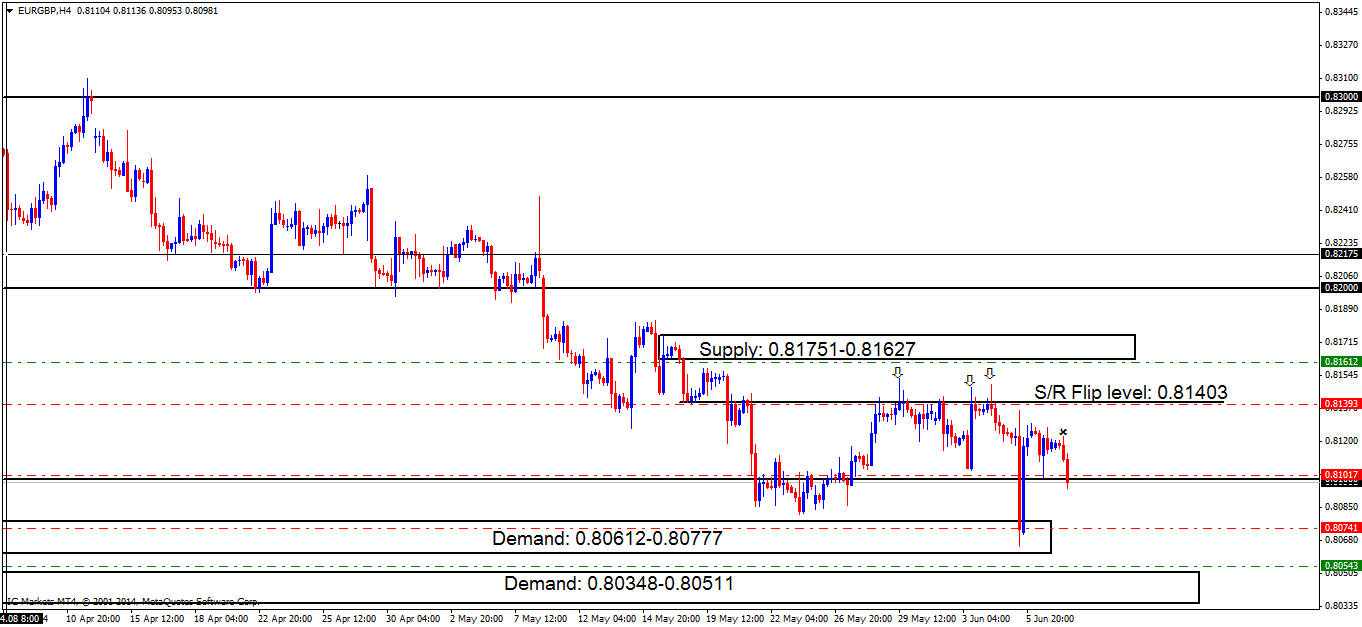

EUR/GBP:

[B]4hr TF.[/B]

The sellers really took control yesterday with price currently seen trading around the round number at 0.81000.,technically though, not a lot has changed since the last analysis yesterday.

Pending and P.A confirmation orders remain the same with a little more added information, due to price currently testing the P.A confirmation buy order at 0.81017.

[ul]

[li]Pending buy orders (Green line) are seen at 0.80543 just above demand at 0.80348-0.80511 as this will be the likely level pro money pushes price down to if they want to collect more liquidity for a bigger push up. P.A confirmation orders (Red line) are seen at 0.80741 sitting within demand at 0.80612-0.80777, there will likely be orders left unfilled here, but with a great-looking demand area (levels above) lurking just below, it becomes too risky for a pending order, as price could very easily fake this demand area to the one below (0.80348-0.80511). The last P.A confirmation buy order is above the round number 0.81000 at 0.81017, this level has actually been hit at the time of writing. We now need price to confirm this level by consuming the high 0.81225 marked with an x. If price does consume this high, pending buy orders will likely be seen around the 0.81017 area.[/li][li]Pending sell orders (Green line) are spotted just under fresh supply (0.81751-0.81627) at 0.81612 due to the area being fresh giving the impression orders may still remain unfilled there. P.A confirmation orders (Red line) under the S/R flip level 0.81403 at 081393 is an area where a reaction is likely, however there were too many wicks north seen marked with arrows, indicating sellers are drying up, thus, the need to wait for more confirmation.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O:0.80543 (SL: 0.80328 TP: [1] 0.81000 [2] 0.81403) P.A.C: 0.80741 (SL: Likely to be set at 0.80586 TP: Decided if/when price ‘confirms’ the level) 0.81017 has been hit (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.81612 (SL: 0.81784 TP: [1] 0.81403 [2] 0.81000) P.A.C: 0.81393 (SL: Will be likely set at 0.81564 TP: Will be likely set at the round number 0.81000).[/li][li][B]Most likely scenario: [/B]Price will likely see more of a decline in value than we are currently seeing. Sellers are currently battling with the buyers around the round number 0.81000 level. Sellers will likely win this battle since pro money may wish to collect more liquidity lower down around the two demand areas (0.80348-0.80511/0.80612-0.80777) seen below for a possible push higher in prices, as the higher timeframes are suggesting.[/li][/ul]

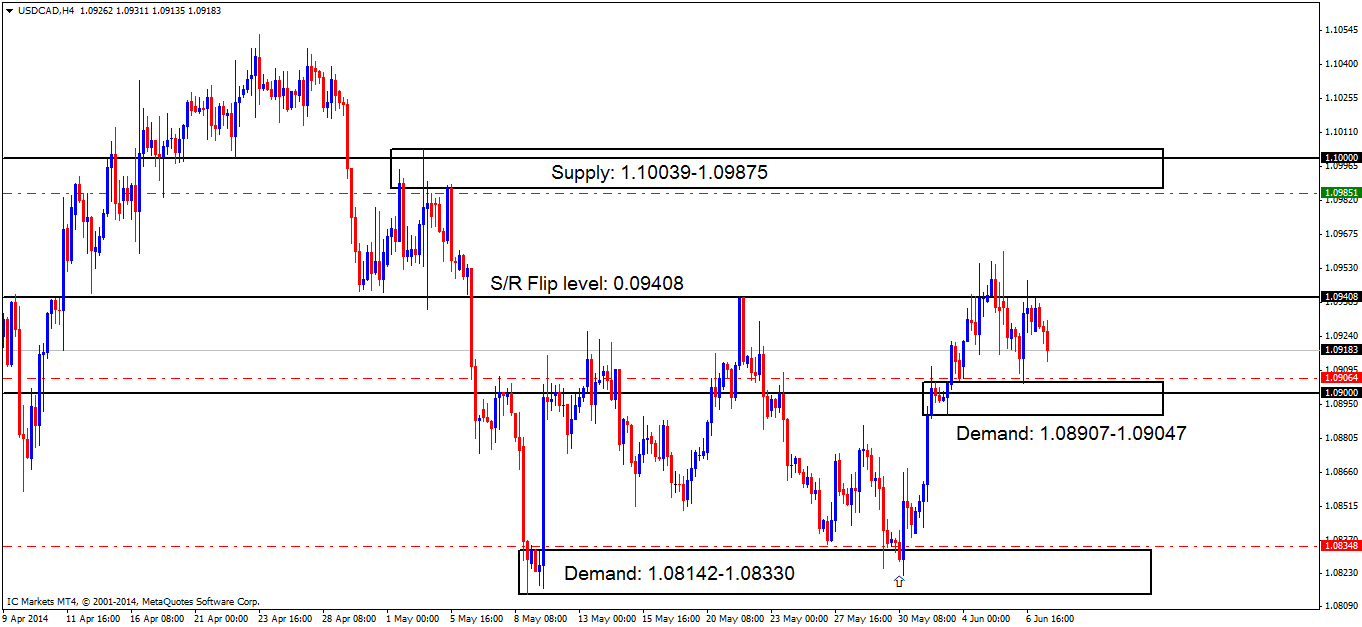

USD/CAD:

[B]4hr TF.[/B]

Like most of the pairs, technically no drastic changes have been seen. The sellers appear to have taken control, with little sign of buying interest shown from the bulls.

Price still remains capped between supply (S/R flip level) above at 0.09408, with demand being seen below at 1.08907-1.09047.

Pending and P.A confirmation orders remain exactly the same as yesterday’s analysis, as such, still remain valid:

[ul]

[li]At the time of writing there are no pending buy orders seen. There are, however, P.A confirmation orders (Red line) seen just above demand (1.08142-1.08330) at 1.08348. There may be orders left unfilled here, a pending order is not wise here due to how deep price penetrated the level before (marked with an arrow). Near-term P.A confirmation orders at 1.09064 just above demand at 1.08907-1.09047 may still have unfilled orders lurking around this area. The reason a pending order may not be logical here, is because of the big figure 1.09000 within the demand area just mentioned may see a deep spike south which does happen regularly, so pro money can stop out traders with stops too close and collect lots of liquidity.[/li][li]Pending sell orders (Green line) just below supply (1.10039-1.09875) at 1.09851 will very likely see a nice reaction. However, we should remain aware of the big figure number 1.10000 lurking within the top half of the supply area (levels above), so a bigger stop may be necessary![/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 1.08348 (SL: Likely to be set at 1.08127 TP: Decided if/when price ‘confirms’ the level) 1.09064 (SL: Likely to be set at 1.08882 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.09851 (SL: 1.10114 TP: [1] 1.09408 [2] 1.09047) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]With normal market conditions expected to be seen today, price will likely see a retracement south towards demand at 1.08907-1.09047. A reaction is very possible here, however do be prepared for price to consume this level and head deeper south towards demand below at 1.08142-1.08330 before a push higher happens.[/li][/ul]

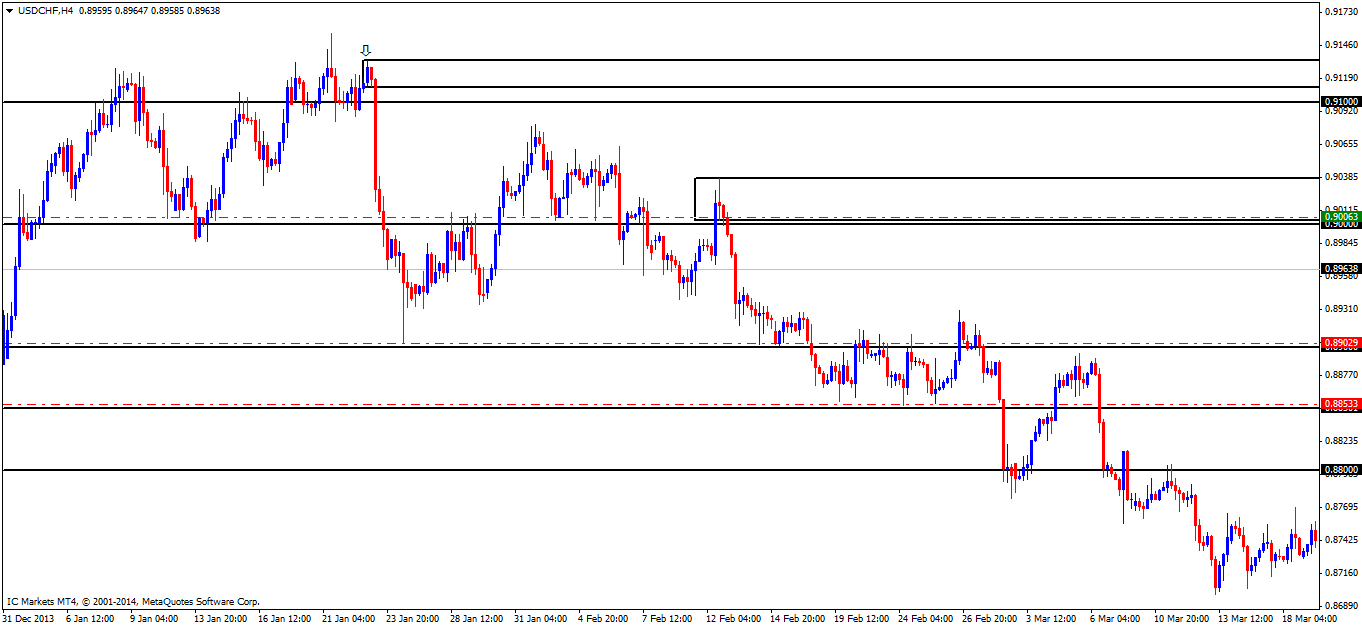

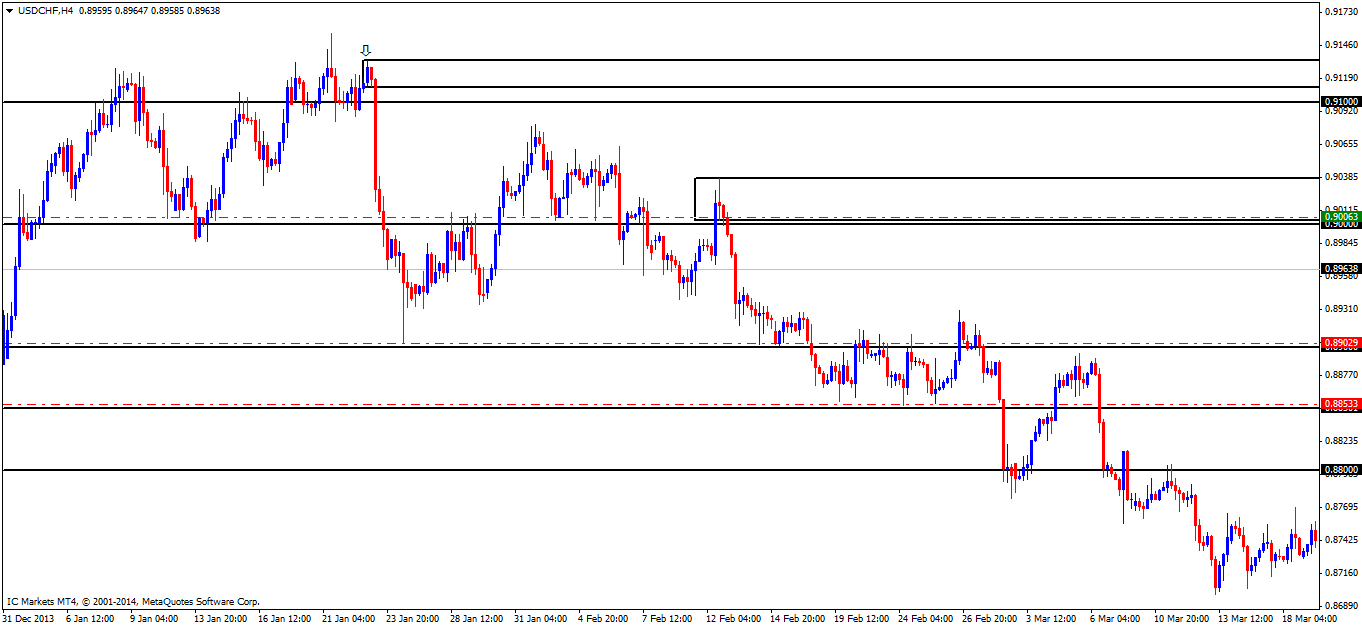

USD/CHF:

[B]4hr TF.[/B]

The sellers made an attempt on the demand area below at 0.88973-0.89168 just missing the upper base within a few pips or so. Following this, the buyers appeared to be in control (at the time of writing) for most of yesterday.

Price still remains trading between supply at 0.90381-0.90033 and demand below at 0.88973-0.89168.

A break above supply could see price test oncoming supply at 0.91339-0.91116 (shown on chart 1 below marked with an arrow) and, a break below demand could see price testing the daily S/R flip level at 0.88501.

Chart 1:

Pending and P.A confirmation orders remain exactly the same as yesterday’s analysis, as such, still remain valid:

[ul]

[li]There are no safe pending buy orders seen at the time of writing. P.A confirmation orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order. Near-term P.A confirmation buy orders are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders left on Friday.[/li][li]Pending sell orders (Green line) are seen at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063. Unfilled sell orders are likely lurking around this area due to the way price turned, it was a quick reaction possibly meaning not all pro money orders were filled. There are no P.A confirmation orders currently seen in the market.[/li][/ul]

Chart 2:

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 0.89029 (SL: Likely to be set at 0.88784 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.90063 (SL: 0.90412 TP: [1] 0.89168 [2] 0.88501) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]Even with normal market conditions expected to return to normal today, price will likely remain trading between supply at 0.90381-0.90033 and demand below at 0.88973-0.89168.[/li][/ul]

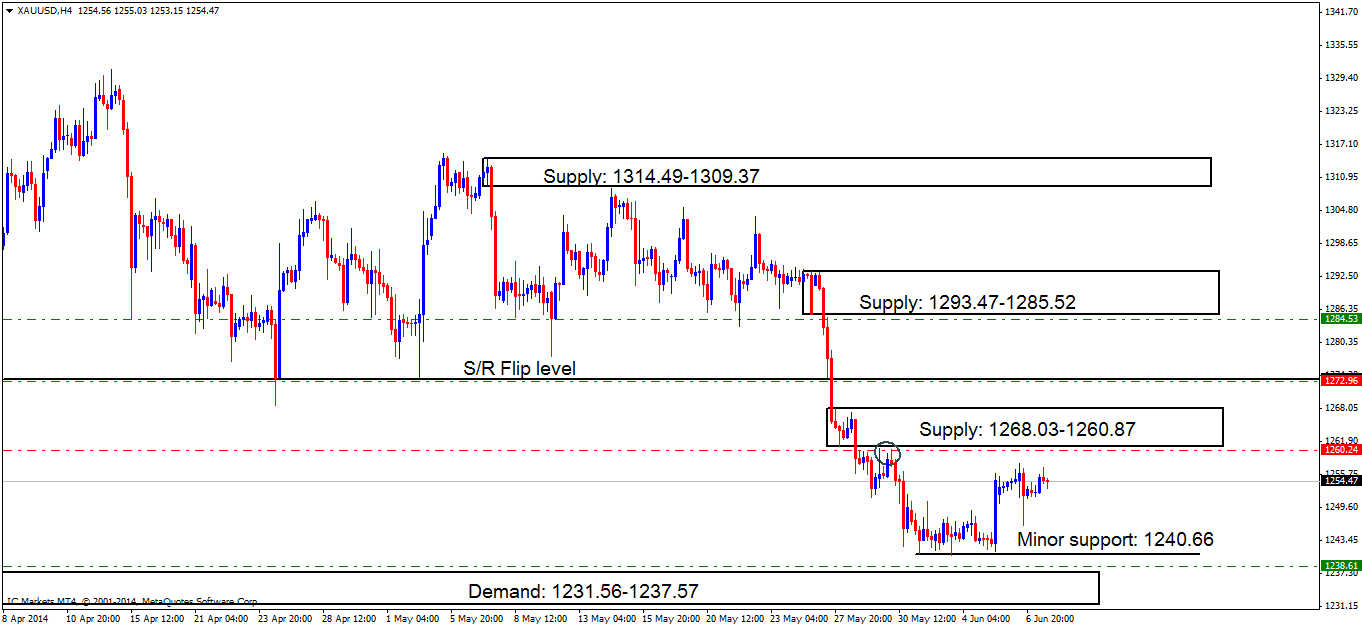

XAU/USD (GOLD)

[B]4hr TF.[/B]

Technically, very little has changed, price saw very slow movement yesterday.

Much of the last analysis still remains valid:

Price still remains trading between minor support at 1240.66 and supply above at 1268.03-1260.87. The minor support level just mentioned is a great level to be faked into demand at 1231.56-1237.57. A break above supply (levels above) could see price testing either the S/R flip level at 1273.34 or supply above this level at 1293.47-1285.52.

Pending and P.A confirmation orders remain exactly the same as yesterday’s analysis, as such, still remain valid:

[ul]

[li]Pending buy orders (Green line) are seen above demand (1231.56-1237.57) at 1238.61 as pro money will likely fakeout the minor support level at 1240.66 into demand below (levels above). At the time of writing there are no P.A confirmation orders seen in the market.[/li][li]Pending sell orders (Green line) are seen just below supply (1293.47-1285.52) at 1284.53, as this level will likely see a reaction due to a supply/demand imbalance around this area. P.A confirmation orders (Red line) just below supply (1268.03-1260.87) at 1260.24 require confirmation to enter short here due to previous price action (circled) possibly consuming some of the sellers as it left the zone. P.A confirmation orders just under the S/R flip area (1273.34) at 1272.96 will likely see a reaction; be that as it may, there is no logical area for a stop, resulting in confirmation being required at this level.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1238.61 (SL: 1230.64 TP: 1260.87 P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1284.53 (SL: 1294.70 TP: [1] 1273.34 [2] 1268.03) P.A.C: 1272.96 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 1260.24 (SL: Will be likely set at 1269.04 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]More volatility is expected today, however, price will still likely remain trading between supply at 1268.03-1260.87 and demand below at 1240.66, possibly seeing price touching either area just mentioned.[/li][/ul]

[B]For the readers’ benefit:

[/B]

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

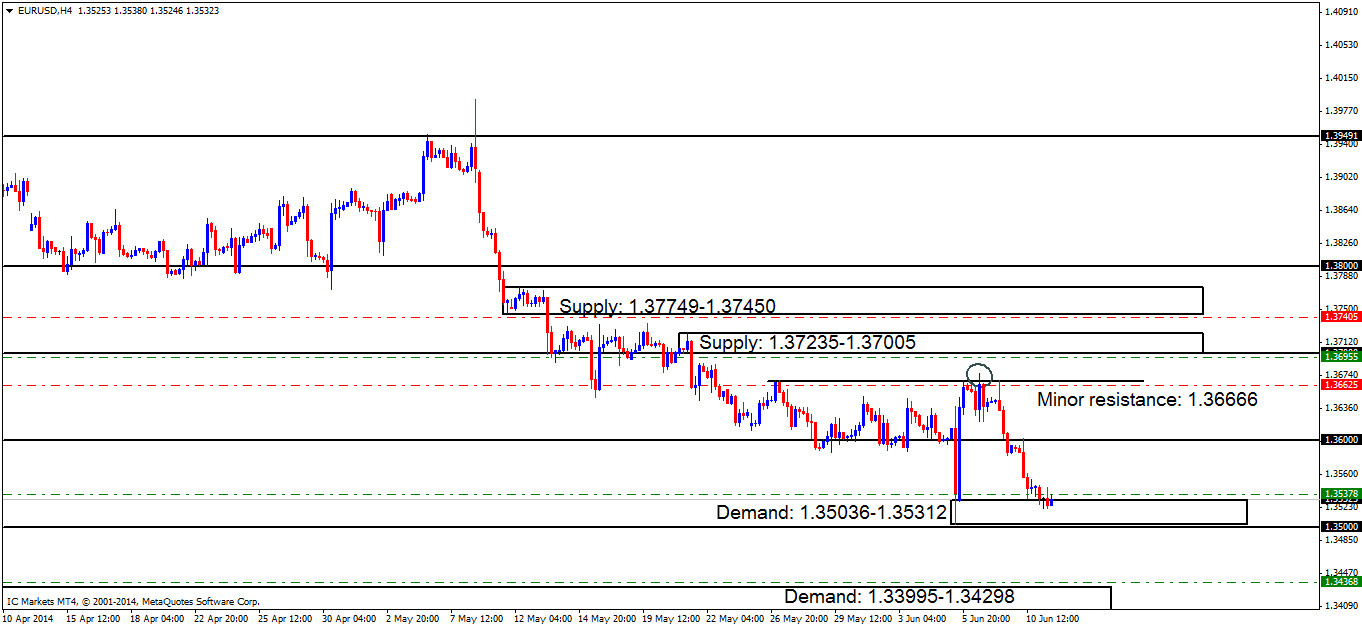

EUR/USD:

[B]Daily TF.[/B]

Sellers have taken full advantage of the available liquidity just under supply at 1.37342-1.36890, with buyers currently showing little interest .

[B]4hr TF.[/B]

Price is currently seen trading around demand at 1.35036-1.35312. The little time it took to form this demand area indicated strong buying pressure at that particular time. Pro money was no doubt involved in this move, so unfilled buy orders were likely left over.

Price is currently capped between demand (levels above) and (supply) minor resistance at 1.36666 with the round number 1.36000 seen in between.

[ul]

[li]The Pending buy order (Green line) seen at 1.35378 just above demand at 1.35036-1.35312 is currently active, so keep a close eye on the first target area. The P.A confirmation buy order (Red line) visible just below the round number 1.36000 at 1.35924 has been cancelled since price has dropped too far for this confirmation trade to remain valid.[/li][li]Pending sell orders (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still around this area. P.A confirmation sell orders (Red line) are seen higher up at 1.37405 just below supply at 1.37749-1.37450, this level requires confirmation because of how close the supply areas (levels above) are together, thus making a logical target area unavailable. New P.A confirmation sell orders are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid, but still needs to be confirmed due to a spike seen on Friday (circled) which may have consumed most of the sellers originally there. [B]Do be on your guard with these orders; the higher-timeframes are indicating that higher prices may be seen this week.[/B][/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: (Active) 1.35378 (SL: 1.34971 TP: [1] 1.36000 [2] 1.36666) P.A.C: No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C: 1.37405 (SL: More than likely at 1.37791 TP: Dependent on where price ‘confirms’ the level) 1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]Price will likely see higher prices from demand at 1.35036-1.35312 to at least the round number at 1.36000.[/li][/ul]

GBP/USD:

[B]4hr TF.

[/B]

The Pound, at the time of writing, remains relatively quiet comparing to the Euro. The minor S/R flip level at 1.67686 recently saw a touch, with buying pressure clearly being seen there.

Take a look at the mini trend line placed on the chart below; this may have been pro money consuming sell orders in lower-timeframe supply pockets. Whilst still allowing price to drop, ultimately, what this does is clear a path for the buyers to rally prices higher.

[ul]

[li]Pending buy orders (Green line) are seen below (1.65874) just above demand at 1.65518-1.65827 (not visible on the chart). This area shows great potential as the momentum away from the base indicates unfilled orders may still be in play. The next set of pending buy orders (Green line) are seen just above the round number 1.67000 at 1.67043, this area will likely see a reaction due to the amount of credible touches this level has seen, making it an area to watch out for. Small P.A confirmation buy orders (Red line) are visible at 1.67727 just above the minor S/R flip level (1.67686). This level is now active, if price consumes the high 1.68419 marked with an x, this would permit a pending order to be set at 1.67727 ready for a possible retracement.[/li][li]Pending sell orders (Green line) are visible below supply (1.68822-1.68708) at 1.68673 due to strong momentum away from this area, indicating unfilled orders may still be hiding there. P.A confirmation sell orders (Red line) are seen at 1.69696 just below supply at 1.69963-1.69726. The reason this level requires confirmation is due to the wicks spiking the area as price left the base (circled) warning us sellers may have already been consumed.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1.65874 (SL: 1.65472 TP: Dependent on approaching price action nearer the time) 1.67043 (SL: 1.66527 TP: [1]1.67686 [2] 1.68000 [3] 1.68708) P.A.C: (Active-awaiting confirmation) 1.67727 (SL: Decided if/when price ‘confirms’ the level T.P: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.68673 (SL: 1.68846 1 TP: [1] 1.68000 [2] 1.67686) P.A.C: 1.69696 (SL: More than likely will be at 1.70030 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]Price will likely trade in and around the minor S/R flip area at 1.67686, however do remain vigilant to the fact price could just as well decline further towards the round number below at 1.67000. This is why we do not set pending orders at level we are not confident with![/li][/ul]

AUD/USD:

[B]Daily TF.

[/B]

Price is currently seen trading at 0.93669 just under supply at 0.94468-0.93758.

[B]4hr TF.[/B]

Price action on this timeframe seems to have conflicting signals. The mini trend line shown on the 4hr chart below indicates that pro money are likely consuming lower timeframe demand pockets while still rallying price i.e. clearing the path south for their sell orders.

On the other hand, a wick/spike (marked with an arrow) has been seen above supply at 0.93729-0.93572 giving a signal that price may want to visit the upper supply at 0.94253-0.94040 since sellers in this area may have been consumed leaving the path clear for buyers.

Taking the points above into consideration, we will do well not to forget that we are presently trading at not only daily supply (0.94468-0.93758) as shown above, but also weekly-timeframe resistance at 0.93718 as well, so lower prices are more favorable at the moment.

Pending and P.A confirmation orders remain exactly the same as none of our existing orders have been triggered.

[ul]

[li]At the time of writing, there are no pending buy orders seen in the market. P.A confirmation buy orders (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order around this area, since deep spikes into this demand zone have been seen (levels above) possibly consuming the majority of buyers in the process. The next batch of P.A confirmation buy orders (Red line) are visible just above the round number 0.93000 at 0.93025. We require confirmation of this level because previous price action has warned us deep tests happen on a regular basis (seen on the chart below), hence the need to wait for confirmation rather than getting stopped out time after time through lack of patience.[/li][li]Pending sell orders (Green line) are seen just below supply (0.94253-0.94040) at 0.94021. This supply area, although not fresh, has only seen a small test to the lower limit of the base meaning there are likely active sellers lurking deeper within, permitting pending orders to be set.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: No pending orders are seen with current price action. P.A.C: 0.92231 (SL: more than likely will be at 0.91984 TP: Decided if/when price ‘confirms’ the level) 0.93025 (SL: Dependent on where price ‘confirms’ the level TP: Dependent on where price ‘confirms’ the level)[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.94021 (SL: 0.94277 TP: [1] 0.93729 [2] 0.93345 [3] 0.93000) P.A.C: No P.A confirmation orders seen with current price action.[/li][li][B]Most likely scenario: [/B]Due to price currently trading at higher-timeframe supply (Weekly/Daily), lower prices may be seen. Price will likely do one of two things, 1. Trade up to the round number 0.94000 before seeing a decline, or 2. Drop from where price is seen trading at (0.93708) as pro money has all the liquidity they need.[/li][/ul]

USD/JPY:

[B]4hr TF.

[/B]

Since the last analysis, price has seen a small decline in value making a low of 102.216 (at the time of writing) nearing ever so closer to our P.A confirmation order set at 102.141. Price still remains capped between supply at 103.055-102.742 and demand (S/R flip level) at 102.117. A break above this supply could see price testing supply at 104.129-103.816; conversely, a break below the (demand) S/R flip level could see price testing demand at 101.427-101.660.

Pending and P.A confirmation orders remain exactly the same as yesterday’s analysis, as such, still remain valid:

[ul]

[li]Pending buy orders (Green line) are seen just above demand (101.427-101.660) at 101.679, as this demand remains fresh and likely still hold unfilled orders. P.A confirmation orders (Red line) are seen at 102.141 just above the S/R flip level (102.117). This area may well hold, but there is always the chance of a deep spike to the round number 102.000 below, which could see a lot of traders getting stopped out, so, as always in these circumstances, it is best to wait for added confirmation.[/li][li]Pending sell orders (Green line) are visible at 102.980, deep within supply (103.055-102.742), this supply area may well be weak now, but the way price reacted at the circled area indicates pro money activity, meaning sell orders may be left unfilled there.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O:101.679 (SL: 101.404 TP: [1] 102.000 [2] 102.742) P.A.C: 102.141 (SL: Likely to be set at 101.925 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 102.980 (SL: 103.108 TP: 102.117, but may well change if the market sees any developments). P.A.C: No P.A confirmation orders seen with current price action.[/li][li][B]Most likely scenario: [/B]Price will likely see a drop in value with the possibility of only reaching the minor S/R flip area at 102.117[/li][/ul]

EUR/GBP:

[B]Weekly TF.

[/B]

Buyers around the weekly demand at 0.80848-0.81668 appear to be struggling with the onslaught of selling presently seen.

[B]Daily TF.[/B]

Will there be strong enough buyers around the daily demand area at 0.80348-0.80576 to consumes the selling pressure? Only time will tell.

[B]4hr TF.[/B]

The round number 0.81000 has seen buyers well and truly consumed, with buyers standing no chance. Buyers on this timeframe seem to be showing some interest around the demand area at 0.80612-0.80777. However, traders should be prepared for price to possibly fake this demand area south to demand below at 0.80348-0.80511, hence the use of a confirmation order at 0.80741.

[ul]

[li]Pending buy orders (Green line) are seen at 0.80543 just above demand at 0.80348-0.80511 as this will be the likely level pro money pushes price down to if they want to collect more liquidity for a bigger push up. The P.A confirmation order (Red line) set at 0.80741 sitting within demand at 0.80612-0.80777 is now active. If buyers can prove this level by consuming sellers at the round number marked with a tick sign, a pending order is permitted to be set at 0.80741 awaiting a possible retracement. The last P.A confirmation buy order above the round number 0.81000 at 0.81017 has been cancelled since price was unable to consume the high marked with a an x at 0.81225.[/li][li]Pending sell orders (Green line) are spotted just under fresh supply (0.81751-0.81627) at 0.81612 due to the area being fresh giving the impression orders may still remain unfilled there. P.A confirmation orders (Red line) under the S/R flip level 0.81403 at 081393 is an area where a reaction is likely, however there were too many wicks north seen marked with arrows, indicating sellers are drying up, thus, the need to wait for more confirmation.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O:0.80543 (SL: 0.80328 TP: [1] 0.81000 [2] 0.81403) P.A.C: (Active-awaiting confirmation) 0.80741 (SL: Likely to be set at 0.80586 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.81612 (SL: 0.81784 TP: [1] 0.81403 [2] 0.81000) P.A.C: 0.81393 (SL: Will be likely set at 0.81564 TP: Will be likely set at the round number 0.81000).[/li][li][B]Most likely scenario: [/B] Price will likely do one of two things; 1. Price will confirm our confirmation order set at 0.80741 within demand (0.80612-0.80777), or 2. Consume the demand area just mentioned, and fill our pending order set just above demand (0.80348-0.80511) at 0.80543, it is very difficult to tell as the weekly timeframe demand area at 0.80848-0.81668 seems to be very weak, whilst oncoming daily demand (0.80348-0.80576) may produce a nice bullish reaction. Only time will tell.[/li][/ul]

USD/CAD:

[B]4hr TF.

[/B]

Price has seen a little more action since the last analysis. Sellers have temporarily taken control of the market driving price deep into demand at 1.08907-1.09047 triggering our P.A confirmation buy order at 1.09064.

Supply at 1.09408 is presently capping the market to the upside, whilst demand at 1.089071.09047 is capping market to the downside.

A quick reminder of the higher-timeframe picture: the weekly timeframe is showing confirmed support at 1.08438, while the daily timeframe is trading in and around supply at 1.10039-1.09356. Which area will prevail, best bet is the weekly timeframe, as the higher timeframes usually overrule the lower timeframes.

[ul]

[li]At the time of writing there are no pending buy orders seen. There are, however, P.A confirmation orders (Red line) seen just above demand (1.08142-1.08330) at 1.08348. There may be orders left unfilled here, however, a pending order is not wise due to how deep price penetrated the level before (marked with an arrow).The near-term P.A confirmation order at 1.09064 just above demand at 1.08907-1.09047 is now active. Buyers will need to prove this area by consuming the high 1.09480; a pending order will then be set at 1.09064 awaiting a possible retracement.[/li][li]Pending sell orders (Green line) just below supply (1.10039-1.09875) at 1.09851 will very likely see a nice reaction. However, we should remain aware of the big figure number 1.10000 lurking within the top half of the supply area (levels above), so a bigger stop may be necessary! There are currently no P.A confirmation orders seen on this pair.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 1.08348 (SL: Likely to be set at 1.08127 TP: Decided if/when price ‘confirms’ the level) 1.09064 (Active-awaiting confirmation) (SL: Likely to be set at 1.08882 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.09851 (SL: 1.10114 TP: [1] 1.09408 [2] 1.09047) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]The demand area at 1.08907-1.09047 will likely not hold. Once volume picks up, price will likely break this demand area along with the round number 1.09000, seeing a drop towards demand below at 1.08142-1.08330.[/li][/ul]

USD/CHF:

[B]4hr TF

[/B]

The buyers really took control over the past few days. Sellers seem to be coming into the market around supply at 0.90381-0.90033 where our pending sell order (0.90063) has been filled. The base formed just below supply marked with an arrow is quite concerning since this could essentially cause trouble for the sellers attempting to reach their targets.

At the time of writing, price still remains capped between supply at 0.90381-0.90033 and demand below at 0.88973-0.89168.

[ul]

[li]There are no safe pending buy orders seen at the time of writing. P.A confirmation buy orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order. Near-term P.A confirmation buy orders are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders left on Friday.[/li][li]The pending sell order (Green line) visible at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063 is now active, so keep a close eye on the first target area. There are no P.A confirmation orders currently seen in the market.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 0.89029 (SL: Likely to be set at 0.88784 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: (Active) 0.90063 (SL: 0.90412 TP: [1] 0.89168 [2] 0.88501) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]Price will likely see a decline in value from supply at 0.90381-0.90033 at least to 0.89747 marked with an arrow, if price consumes this area, look for buyers to come into the market around demand at 0.88973-0.89168.[/li][/ul]

XAU/USD (GOLD)

[B]4hr TF.[/B]

Gold has seen frustrating price action over the past few days with little action to report. Price has rallied into supply at 1268.03-1260.87 triggering our P.A confirmation order set at 1260.24.

If price breaks above this supply area, expect sellers to be lurking at either the S/R flip level at 1273.34 or supply above this level at 1293.47-1285.52.

[ul]

[li]Pending buy orders (Green line) are seen above demand (1231.56-1237.57) at 1238.61 as pro money will likely fakeout the minor support level at 1240.66 into demand below (levels above). At the time of writing there are no P.A confirmation orders seen in the market.[/li][li]Pending sell orders (Green line) are seen just below supply (1293.47-1285.52) at 1284.53, as this level will likely see a reaction due to a supply/demand imbalance around this area. The P.A confirmation order (Red line) set just below supply (1268.03-1260.87) at 1260.24 is now active. Sellers will need to confirm this supply area by consuming the low 1250.17 marked with an arrow. If/when this happens; a pending order can be set at 1260.24, awaiting a possible retracement. P.A confirmation orders just under the S/R flip area (1273.34) at 1272.96 will likely see a reaction; be that as it may, there is no logical area for a stop, resulting in confirmation being required at this level.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1238.61 (SL: 1230.64 TP: 1260.87 P.A.C: There are currently no P.A confirmation orders seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1284.53 (SL: 1294.70 TP: [1] 1273.34 [2] 1268.03) P.A.C: 1272.96 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 1260.24 (Active-awaiting confirmation) (SL: Will be likely set at 1269.04 TP: Decided if/when price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]Seeing selling pressure around supply at 1268.03-1260.87 is unlikely since the higher timeframes are currently indicating longs as the daily timeframe is currently seen trading within demand at 1238.51-1254.97, hence the need for confirmation orders.[/li][/ul]

[B]For the readers’ benefit:[/B]

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

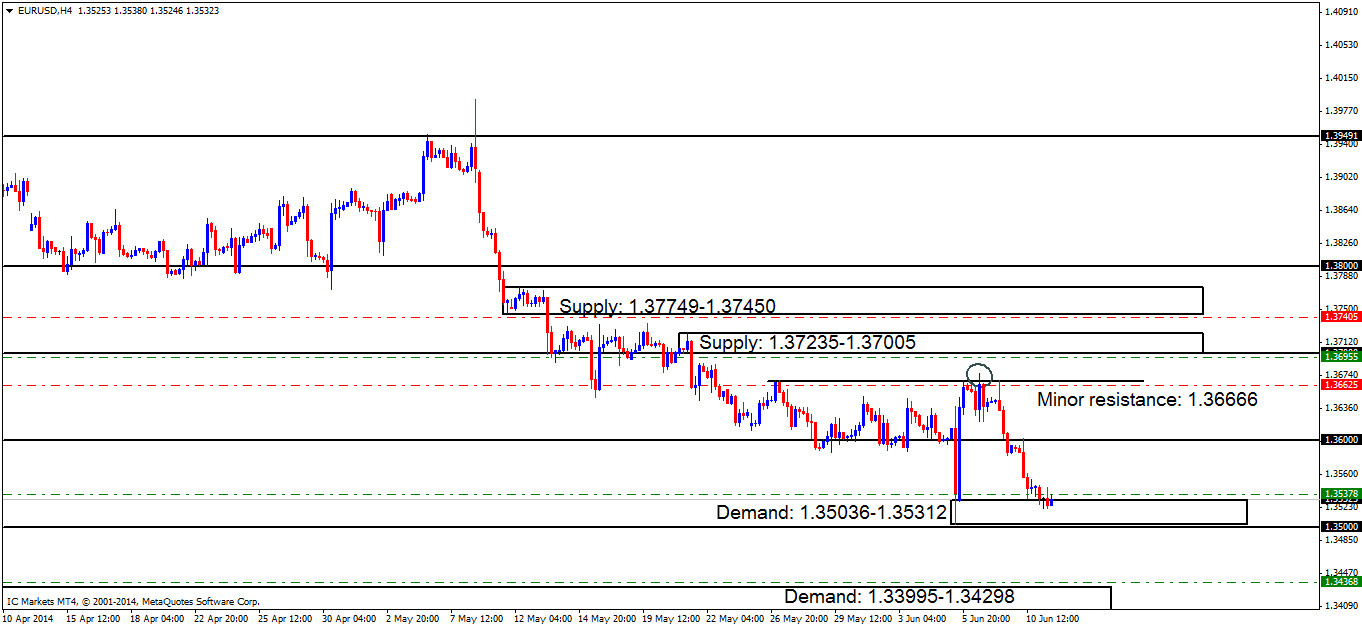

EUR/USD:

[B]4hr TF.[/B]

Demand at 1.35036-1.35312 is currently holding. Buyers are yet to show any convincing interest in taking prices higher which is a little concerning. If a break below is seen here, the next fresh demand area is at 1.33995-1.34298 [B](Chart 2).[/B]

Consuming 4hr demand at 1.35036-1.35312 would not be a good sign for buyers, as this is the last logical demand area left within weekly timeframe demand at 1.34770-1.36771.

[ul]

[li][B]The Pending buy order[/B] (Green line) seen at 1.35378 just above demand at 1.35036-1.35312 is currently active, so keep a close eye on the first target area (reported below).[/li][li][B]New pending buy orders [/B]are seen around demand (1.33995-1.34298) at 1.34368. This demand area will more than likely see some sort of reaction due to its location seen to the left, marked with an arrow[B] (Chart 1).[/B][/li][li][B]Pending sell orders[/B] (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still set around this area.[/li][li][B]P.A confirmation sell orders[/B] (Red line) are seen higher up at 1.37405 just below supply at 1.37749-1.37450, this level requires confirmation because of how close the supply areas (levels above) are together, thus making a logical target area unavailable.[/li][li][B]P.A confirmation sell orders [/B]are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid, but still needs to be confirmed due to a spike seen on Friday (circled) which may have consumed most of the sellers originally there. [B]Do be on your guard with these sell orders; the higher-timeframes are indicating that higher prices may be seen this week.[/B][/li][/ul]

Chart 1:

Chart 2:

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: (Active) 1.35378 (SL: 1.34971 TP: [1] 1.36000 [2] 1.36666) 1.34368 (SL: 1.33926 TP: Dependent on how price action approaches the zone). P.A.C: No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C: 1.37405 (SL: More than likely at 1.37791 TP: Dependent on where price ‘confirms’ the level) 1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]The demand area at 1.35036-1.35312 will likely still see a bullish reaction, nevertheless, a spike lower may be seen first to the round number at 1.35000.[/li][/ul]