Hi All,

Again another thread about Elliot Wave / EW.

As always, I just want to add more information about EW. I used EW before. I don’t use it now, only because I have my own method that I think easier and better for my personality. I’m not arguing, but only sharing. hopefully, it can help anyone who need the information more.

As I mentioned in other thread EW is another perspective of AMD. So we need to know the principle, core idea, behind EW.

When there are many EW traders give different analysis on an instrument, only 2 possible things: EW from different TF or they don’t know how to use EW at all.

If you read through EW, follow the instruction step by step, the specification to define Wave 1-5, we can hardly have two different analysis.

Example, when to look W1? The answer is during equilibrium. Outside this moment, no W1 will be eligible. The question is at how we interpret equilibrium.

When we can see W1, we anticipate W2, as long as W2 moves according to the rule of EW, we can expect W3. This is how EW’s traders can have the benefit from implementing EW.

During W3, it can continue to W4. Sometime, market has no enough momentum, W4 fails, then the cycle breaks here. This is the reality of EW, nothing is perfect. So EW’s trader wont expect there will always W1-5 and then a-b-c.

The principle is the same like AMD, these principles are actually market psychology, they are part of market dynamic, and generically come from Price Action.

We don’t need sophisticated terminology and technique to trade, when you look at the chart, price moves like stair up, that will be uptrend. We learn how to have benefit from this pattern. From this basic idea, comes out many concepts from scrutinizing the basic idea.

Have a good trade all

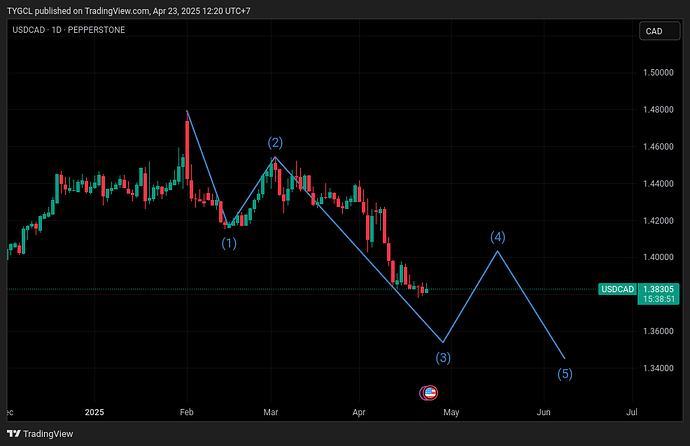

Example here, the incomplete EW … unarguable, no more pattern to play with.